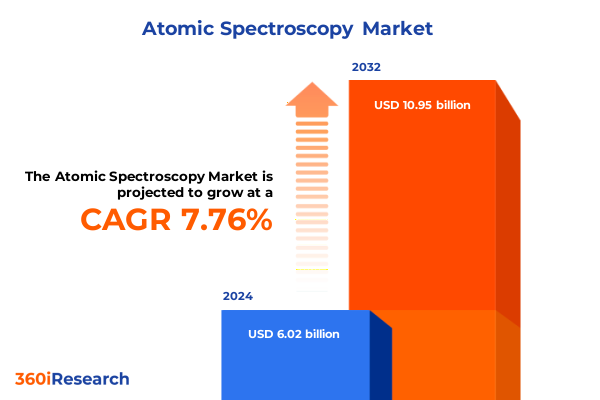

The Atomic Spectroscopy Market size was estimated at USD 6.43 billion in 2025 and expected to reach USD 6.86 billion in 2026, at a CAGR of 7.91% to reach USD 10.95 billion by 2032.

Establishing the Foundation of Modern Atomic Spectroscopy through Technological Breakthroughs, Evolving Analytical Requirements, and Industrial Drivers

The field of atomic spectroscopy has emerged as a cornerstone of analytical science, enabling precise elemental analysis across an array of industries from pharmaceuticals to environmental monitoring. Technological advances over the last decade have driven instruments toward greater sensitivity, enhanced accuracy, and streamlined workflows, underscoring the critical role that spectroscopic techniques play in ensuring regulatory compliance, quality assurance, and scientific innovation.

Against this backdrop, the introduction of miniaturized platforms, coupled with the integration of artificial intelligence and machine learning, has accelerated the capacity for real-time data interpretation and decision making. These developments have not only optimized laboratory throughput but have also expanded the potential for in-situ analysis and portable instrumentation. Consequently, laboratories and field operations are positioned to leverage atomic spectroscopy technologies with unprecedented efficiency.

As organizations pursue deeper insights into material composition and trace elemental detection, a thorough understanding of the market dynamics, evolving application needs, and technological trajectories becomes imperative. This introduction lays the groundwork for an executive summary that examines transformative shifts, regulatory influences, segmentation drivers, and strategic imperatives shaping the atomic spectroscopy domain.

Uncovering the Transformational Forces Redefining Atomic Spectroscopy by Harnessing Automation, Miniaturization, and Data-Driven Insights

The landscape of atomic spectroscopy is undergoing a profound transformation driven by automation, digital convergence, and sustainability imperatives. Instrumentation has evolved from standalone systems to interconnected platforms that harness cloud-based analytics, facilitating seamless data sharing and remote monitoring. Laboratories are increasingly adopting automated sample handling and robotics to reduce manual intervention, improve reproducibility, and accelerate throughput across diverse analytical workflows.

Moreover, the emergence of hyperspectral imaging and coupling spectroscopy with complementary techniques has redefined the boundaries of element-specific analysis. These hybrid configurations provide multidimensional insights, enabling researchers and engineers to correlate spatial distribution with elemental composition. In parallel, advancements in microplasma and low-power excitation sources have contributed to the development of portable spectrometers for in-field diagnostics, enhancing flexibility and responsiveness in applications such as environmental testing and process control.

Environmental sustainability has also catalyzed change, as vendors strive to reduce consumable waste and lower energy consumption through more efficient excitation sources and greener reagents. Consequently, organizations are balancing performance demands with lifecycle impact, leading to a holistic reappraisal of analytical workflows. The convergence of digitalization, automation, and eco-friendly design marks a transformative shift in how atomic spectroscopy is harnessed across industries.

Evaluating the Comprehensive Effects of 2025 United States Tariffs on Atomic Spectroscopy Supply Chains, Cost Structures, and Competitive Strategies

The implementation of 2025 tariff measures by the United States has introduced a new layer of complexity for providers and end users of atomic spectroscopy instrumentation and consumables. In March 2025, the imposition of a 25% duty on laboratory supplies imported from major trading partners including China, Canada, and Mexico has exerted upward pressure on procurement costs and supply chain logistics, compelling laboratories to reassess sourcing strategies and inventory management practices.

Following this, an April 2025 update enacted a universal 10% tariff on most imported goods, with certain lab-related items from China facing cumulative duty rates as high as 145%. This unprecedented tariff escalation has accelerated efforts to localize procurement, expand relationships with domestic distributors, and explore alternative regional suppliers to mitigate exposure to elevated import costs. As a result, instrument manufacturers are revisiting component sourcing, while service partners are adapting maintenance and calibration schedules to align with longer lead times and fluctuating availability.

Looking ahead, the cumulative impact of these trade policies underscores the necessity for agile supply chain frameworks and collaborative vendor partnerships. By anticipating potential disruptions and embedding tariff risk assessments into procurement planning, stakeholders can preserve operational continuity and uphold analytical rigor, even amidst evolving trade dynamics.

Deriving Strategic Insights from Technique and Application Segmentation to Navigate Complex Market Dynamics in Atomic Spectroscopy Platforms

In navigating the atomic spectroscopy landscape, an appreciation for technique-specific and application-driven drivers is essential for strategic positioning. The spectrum of analytical platforms-ranging from atomic absorption spectroscopy and elemental analyzers to advanced inductively coupled plasma-mass spectrometry and optical emission spectroscopy, as well as X-ray diffraction and fluorescence systems-each addresses distinct sensitivity, throughput, and sample matrix requirements. For instance, elemental analyzers provide rapid bulk composition data for process control, whereas ICP-MS affords ultra-trace detection for life science and environmental monitoring. This diversity necessitates a tailored approach to instrument selection, service models, and workflow integration that aligns with specific laboratory objectives.

Similarly, application domains such as environmental testing, food and beverage analysis, geochemical and mining exploration, industrial chemistry, petrochemical processing, and pharmaceutical and biotechnology quality assurance impose unique regulatory, throughput, and precision requirements. Environmental laboratories prioritize detection limits and regulatory compliance for contaminants, while food and beverage testing demands robust sample throughput and matrix tolerance. In geochemical surveys, portable or ruggedized systems facilitate on-site analysis, and petrochemical applications call for high-temperature plasma sources to handle viscous samples. By synthesizing insights from both technique and application standpoints, organizations can craft business strategies that optimize capital investments, streamline workflows, and enhance analytical capabilities in alignment with market needs.

This comprehensive research report categorizes the Atomic Spectroscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technique

- Application

Illuminating Regional Trends Shaping Atomic Spectroscopy Adoption across the Americas, Europe Middle East Africa, and Asia Pacific Landscapes

Geographic factors play a pivotal role in shaping demand patterns and strategic priorities within atomic spectroscopy. In the Americas, established research institutions and a regulatory environment emphasizing environmental safety drive sustained demand for high-precision analytical systems. This region also benefits from a robust service and distribution network, enabling rapid response times and localized technical support for end users.

Across Europe, the Middle East, and Africa, stringent environmental directives and food safety regulations are propelling investments in advanced spectroscopic platforms. Concurrently, efforts to modernize mining and petrochemical operations in emerging economies within this region are creating new opportunities for portable and high-throughput instrumentation. Vendors that tailor solutions to accommodate language diversity, regional compliance standards, and financing structures are finding success in penetrating EMEA markets.

In the Asia-Pacific region, rapid industrialization, expansion of pharmaceutical manufacturing hubs, and growing environmental monitoring initiatives are fueling demand for both bench-top and portable atomic spectroscopy solutions. Strong growth in research funding and collaborations between academic institutions and industrial partners further amplifies adoption. As a result, stakeholders must navigate complex regulatory frameworks and capital expenditure cycles to capitalize on the Asia-Pacific landscape.

This comprehensive research report examines key regions that drive the evolution of the Atomic Spectroscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Driving Innovation, Strategic Alliances, and Market Positioning within the Atomic Spectroscopy Ecosystem

Within the atomic spectroscopy ecosystem, certain industry leaders have distinguished themselves through sustained innovation, strategic partnerships, and comprehensive service offerings. Prominent instrument manufacturers have focused on embedding digital connectivity and predictive maintenance capabilities, enabling remote diagnostics and reducing instrument downtime. Collaborative ventures between established spectroscopy vendors and emerging software developers have yielded integrated platforms that leverage cloud computing and data analytics to deliver actionable insights at scale.

Moreover, mergers and acquisitions have reshaped competitive positioning, as companies seek to augment their portfolios with complementary technologies ranging from sample preparation modules to advanced detector systems. These consolidation activities not only expand product offerings but also create synergies in global distribution networks and technical support infrastructures. Meanwhile, agile specialized firms are carving niches by targeting applications such as elemental imaging, real-time process monitoring, and portable field analysis, challenging larger players to continuously evolve their roadmaps.

Service providers have also elevated their importance, offering comprehensive maintenance contracts, remote training modules, and consumable management solutions. By adopting subscription-based models and outcome-based service agreements, these entities are forging deeper relationships with end users, ensuring sustained instrument performance and fostering long-term loyalty in a highly competitive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atomic Spectroscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Analytik Jena GmbH+Co. KG by Endress+Hauser AG

- Anhui Wanyi Science and Technology Co., Ltd.

- Aurora Biomed Inc

- Avantor, Inc.

- Bruker Corporation

- Buck Scientific Instruments LLC

- Danaher Corporation

- GBC Scientific Equipment Pty Ltd

- Hitachi Ltd.

- HORIBA, Ltd.

- JEOL Ltd.

- LabGeni by LABFREEZ INSTRUMENTS GROUP & RAYSKY INSTRUMENTS

- Malvern analytical Ltd by Spectris plc

- Merck KGaA

- Oxford Instruments

- PerkinElmer Inc.

- Rigaku Holdings Corporation

- SAFAS Corporation

- Shimadzu Corporation

- Skyray Instruments USA, Inc.

- Teledyne Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- Wuxi Jiebo Instrument Technology Co.,Ltd.

- Xiangyi Instrument (Xiangtan) Limited

Formulating Actionable Industry Recommendations to Optimize Technology Investments, Enhance Service Offerings, and Strengthen Competitive Advantage

To thrive in the evolving atomic spectroscopy arena, organizations should prioritize strategic initiatives that align technology investments with operational goals, risk mitigation, and customer expectations. First, integrating automation and artificial intelligence-driven data processing can enhance laboratory productivity while reducing error rates and manual intervention. Deploying predictive maintenance frameworks based on instrument telemetry allows for proactive servicing and minimizes unplanned downtime.

Second, diversification of the supply chain through partnerships with regional distributors and qualified domestic fabricators can alleviate tariff-related pressures and foster greater resilience. Establishing dual-sourcing arrangements and maintaining buffer inventories of critical components further strengthens procurement strategies. Third, expanding service offerings beyond instrument sales-such as delivering consumables management, application support, and training workshops-can create new revenue streams and bolster client retention.

Finally, investing in sustainable product design, from energy-efficient excitation sources to recyclable consumables, not only addresses regulatory and corporate responsibility goals but also resonates with increasingly eco-conscious stakeholders. By implementing these actionable measures, industry leaders can secure competitive advantage and position themselves for long-term success in a dynamic market environment.

Detailing a Robust Research Methodology Incorporating Primary Interviews, Secondary Data Sources, and Rigorous Validation for Atomic Spectroscopy Analysis

This analysis is underpinned by a rigorous research methodology that combines expert primary interviews, comprehensive secondary data review, and systematic validation processes. Primary research involved in-depth discussions with laboratory managers, procurement specialists, and technical leaders across academia, industry, and contract research organizations to capture firsthand perspectives on technology adoption, pain points, and future requirements. Secondary research encompassed a review of peer-reviewed journals, patent filings, regulatory publications, and vendor white papers to establish a factual baseline for technological trends and market drivers.

Data triangulation was conducted by cross-referencing findings from multiple sources and reconciling discrepancies through follow-up interviews and focused workshops. Quality checks, including consistency audits and statistical validation tests, were applied to ensure the integrity of qualitative and quantitative insights. Additionally, a continuous feedback mechanism with select key stakeholders was integrated throughout the research process, enabling iterative refinement of conclusions and recommendations. This comprehensive approach ensures the analysis remains robust, reliable, and reflective of real-world industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atomic Spectroscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atomic Spectroscopy Market, by Product Type

- Atomic Spectroscopy Market, by Technique

- Atomic Spectroscopy Market, by Application

- Atomic Spectroscopy Market, by Region

- Atomic Spectroscopy Market, by Group

- Atomic Spectroscopy Market, by Country

- United States Atomic Spectroscopy Market

- China Atomic Spectroscopy Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesizing Key Findings and Future Outlook to Navigate Opportunities and Challenges in the Evolving Atomic Spectroscopy Landscape

In summary, the atomic spectroscopy landscape is characterized by rapid innovation in instrumentation, digitalization of workflows, and heightened attention to sustainability and operational resilience. Automation and connectivity are redefining how laboratories function, while evolving regulatory standards and application-specific demands underscore the importance of targeted segmentation strategies. Trade policy developments, notably the 2025 U.S. tariff measures, have amplified supply chain complexities and cost considerations, prompting stakeholders to adopt agile sourcing and partnership models.

Leading industry players are responding through strategic consolidations, integrated solution offerings, and data-driven service models, reshaping competitive dynamics and customer expectations. Regional differences in regulatory frameworks, infrastructure maturity, and funding priorities create both challenges and opportunities for end users and vendors alike. By synthesizing these insights and embracing a proactive, sustainability-focused mindset, organizations can harness the full potential of atomic spectroscopy to drive scientific discovery, ensure compliance, and deliver operational excellence.

Ultimately, the industry is poised for continued expansion, underpinned by technological breakthroughs, cross-sector collaboration, and strategic agility. Stakeholders who align their investments with emerging trends and fortify supply chains against policy uncertainties will be best positioned to capitalize on the transformative power of atomic spectroscopy.

Empowering Decision Makers with Targeted Industry Research and Direct Engagement Opportunities for Securing Comprehensive Atomic Spectroscopy Insights

To explore an in-depth analysis of the atomic spectroscopy marketplace, gain comprehensive segmentation insights, and uncover strategic opportunities across techniques, applications, and regions, connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure your customized research package and ensure your organization stays ahead in this rapidly evolving landscape.

- How big is the Atomic Spectroscopy Market?

- What is the Atomic Spectroscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?