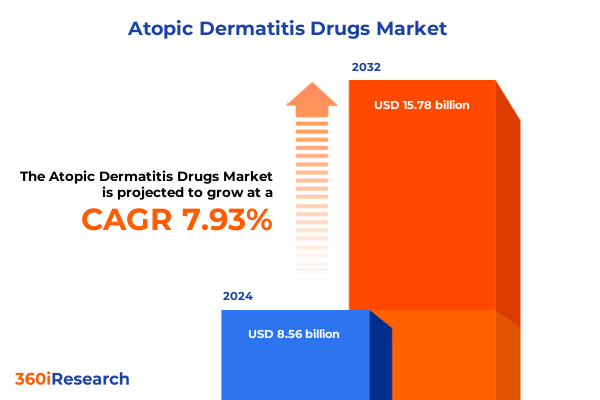

The Atopic Dermatitis Drugs Market size was estimated at USD 9.18 billion in 2025 and expected to reach USD 9.84 billion in 2026, at a CAGR of 8.04% to reach USD 15.78 billion by 2032.

Understanding the Rising Burden of Atopic Dermatitis and the Imperative Shift Toward Next-Generation Therapeutic Approaches to Unmet Needs

Atopic dermatitis, a chronic inflammatory skin condition characterized by intense itching, redness, and recurrent flare-ups, presents a profound and growing public health challenge. In the United States alone, approximately 16.5 million adults and nearly 9.6 million children live with this condition, with one-third of pediatric patients experiencing moderate to severe symptoms that significantly impair daily functioning and quality of life. Epidemiological studies indicate that prevalence has nearly tripled over the past four decades in developed nations, underscoring both environmental and genetic contributions to disease onset and persistence. These statistics underscore an urgent need for more effective management strategies that address not only the physical manifestations of the disease, but also the broader psycho-social burdens borne by patients.

Disease manifestations extend far beyond the skin, with atopic dermatitis exerting a documented toll on emotional well-being, self-image, and social interactions. Individuals with severe disease report heightened levels of anxiety, depression, and sleep disturbances, often linked to relentless itching and visible lesions that undermine self-esteem and interpersonal relationships. Children encounter unique challenges, including school absenteeism and social stigmatization, while adults face workplace discrimination and disrupted intimate relationships, emphasizing the necessity of holistic care models that integrate psychological support with dermatological treatment.

Traditional topical therapies, including corticosteroids and calcineurin inhibitors, have long served as first-line interventions, yet they frequently fall short in delivering sustained disease control for moderate to severe cases. As a result, clinicians and researchers have embarked on a quest for transformative solutions, exploring novel pathways and immunological targets to mitigate chronic inflammation more effectively. This quest has catalyzed a new era of precision dermatology, where insights into cytokine signaling and molecular pathogenesis are being leveraged to develop next-generation therapies poised to redefine standard of care.

Transformative Shifts in Atopic Dermatitis Treatment Landscape Driven by Precision Medicine and Advanced Immunomodulatory Therapies

The atopic dermatitis treatment paradigm is rapidly evolving as a result of breakthroughs in targeted immunotherapy and molecularly tailored approaches. Biologic agents that inhibit interleukin-4 and interleukin-13 signaling, such as dupilumab, have revolutionized the management of moderate to severe disease by delivering sustained clinical remission and substantial improvements in patient-reported outcomes. Expansions of these indications to include adolescents and young children have further underscored their versatility, with emerging real-world evidence reinforcing the safety profiles observed in pivotal trials.

Moreover, small molecule inhibitors of the Janus kinase family have emerged as formidable contenders in the therapeutic arsenal. Baricitinib, a selective JAK1/JAK2 inhibitor approved by the European Medicines Agency in 2020, has demonstrated rapid alleviation of cutaneous inflammation and pruritus, prompting investigations into pediatric applications and combination regimens that could further enhance outcomes. Parallel efforts with abrocitinib and upadacitinib are yielding promising results in adult populations, shaping a competitive landscape where oral administration and dosing flexibility converge to meet diverse patient preferences.

In addition to these systemic advances, the topical pipeline is invigorated by novel phosphodiesterase-4 inhibitors and next-generation immunomodulators. Crisaborole established its clinical utility in mild to moderate disease, paving the way for newer agents like difamilast in Japan and roflumilast in late-stage development, each aimed at reducing inflammatory cascades with minimal systemic exposure. Furthermore, innovative modalities such as neurokinin receptor antagonists and OX40/OX40L pathway blockers are progressing through phase III trials, promising to address unmet needs in refractory patient subsets. Collectively, these transformative shifts signal a transition from broad-spectrum anti-inflammatory approaches to finely tuned interventions that align with the heterogeneous nature of atopic dermatitis.

Assessing the Cumulative Impact of 2025 United States Pharmaceutical Tariffs on Atopic Dermatitis Drug Supply Chains and Costs

In early 2025, the United States implemented sweeping tariff measures that introduced a 10 percent global levy on nearly all imported goods, including critical active pharmaceutical ingredients (APIs) and medical devices relevant to atopic dermatitis treatment. Notably, tariffs on Chinese-sourced APIs peaked at 245 percent, while imports from Canada and Mexico faced levies of 25 percent unless aligned with USMCA provisions, creating unprecedented cost pressures across the pharmaceutical supply chain.

These tariffs have triggered a cascade of operational challenges for drug developers and contract manufacturers alike. Supply routes for key immunosuppressants and biologic excipients have been disrupted, forcing companies to reevaluate sourcing strategies and consider domestic production alternatives. AstraZeneca’s announcement of a $50 billion U.S. investment plan reflects this trend, as organizations seek to hedge against policy uncertainties by expanding R&D and manufacturing footprints domestically. Despite these commitments, the transition to onshore production remains a complex, time-intensive endeavor requiring regulatory approvals and specialized infrastructure.

Consequently, the cost of bringing new therapies to market and maintaining existing product lines has escalated, creating downstream implications for pricing strategies and patient access initiatives. While temporary exemptions for certain pharmaceuticals have provided short-term relief, the specter of reinstated duties and potential sector-specific tariffs under Section 232 investigations looms large. Industry leaders are therefore focused on building resilient, diversified supply networks and negotiating tariff carve-outs to safeguard the affordability and availability of atopic dermatitis therapies.

Key Segmentation Insights Revealing How Drug Classifications, Administration Routes, and Distribution Channels Shape Atopic Dermatitis Treatment Dynamics

Insights into the atopic dermatitis drug landscape reveal a nuanced interplay between therapeutic classification, administration pathways, and delivery mechanisms. Systemic treatments encompass both biologic agents and small molecule immunosuppressants, with biologics targeting specific cytokine receptors and small molecules offering oral dosing flexibility. Topical therapies span multiple modalities, from calcineurin inhibitors and corticosteroids to phosphodiesterase-4 inhibitors and vitamin D analogues, each tailored to distinct severity profiles and patient tolerability considerations.

Route of administration further shapes treatment adoption, as formulations such as creams, gels, lotions, and ointments address diverse patient preferences and lesion characteristics. Injectable modes of delivery include pre-filled syringes and vials, enabling consistent dosing and optimized storage conditions, while oral systemic therapies provide convenience for those seeking to minimize clinic visits. Distribution channels encompass hospital pharmacies-both private and public-online platforms across digital health and e-commerce, as well as chain and independent retail pharmacies, each offering unique advantages in terms of access, patient support, and inventory management.

Patient demographics also influence therapeutic pathways, with adult, geriatric, and pediatric cohorts exhibiting varied disease phenotypes, comorbidity profiles, and treatment goals. Tailoring interventions to these segments demands a comprehensive understanding of age-related pharmacokinetics, adherence patterns, and the psychosocial context of disease management. By interpreting these segmentation dimensions holistically, stakeholders can devise targeted strategies that optimize clinical outcomes and operational efficiency.

This comprehensive research report categorizes the Atopic Dermatitis Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Mode Of Administration

- Patient Age Group

- Distribution Channel

Key Regional Insights Highlighting Distinct Opportunities and Challenges Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

The Americas region, led by the United States, represents the epicenter of atopic dermatitis therapeutic innovation, buoyed by robust clinical trial networks and early adoption of biologic agents. The 2025 American Academy of Dermatology meeting in Orlando showcased the latest real-world data on interleukin inhibitors and JAK blockers, reinforcing the region’s leadership in evidence generation and guideline evolution. However, in Latin America, fragmented reimbursement frameworks and supply chain constraints have slowed the uptake of high-cost therapies, highlighting opportunities for stakeholder collaboration to improve patient access and formulary inclusion.

In Europe, Middle East, and Africa, regulatory harmonization across the European Medicines Agency has facilitated timely approvals of agents like baricitinib for moderate to severe disease, while national reimbursement negotiations in key markets such as Germany and France create a patchwork of access landscapes. Emerging markets in the Middle East and Africa exhibit growing demand for cost-effective topical therapies, driven by a rising prevalence linked to urbanization and environmental factors, yet limited local manufacturing capacity often necessitates reliance on imported formulations.

Asia-Pacific demonstrates a dual dynamic of advanced research in developed economies alongside rapid market expansion in emerging nations. Japan’s approval of topical PDE4 inhibitors such as difamilast underscores the region’s commitment to diversified therapeutic options, while China’s burgeoning clinical trial ecosystem accelerates the development of novel biologics and biosimilars. Smaller markets across Southeast Asia are beginning to integrate digital health platforms to support patient education and remote monitoring, signaling a shift toward technology-enabled care models.

This comprehensive research report examines key regions that drive the evolution of the Atopic Dermatitis Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Exploring Competitive Dynamics, Strategic Partnerships, and Innovation Leadership in Atopic Dermatitis Drug Development

Regeneron and Sanofi have cemented their leadership in atopic dermatitis through dupilumab, the first interleukin-4 receptor alpha antagonist approved for both adult and pediatric populations. This collaboration has yielded sustained revenue streams and extensive real-world safety data, reinforcing the value of strategic partnerships between biotechnology innovators and global pharmaceutical firms. The expansion of dupilumab’s label to include children as young as six months underscores its broad applicability and sets a benchmark for subsequent biologics.

Pfizer’s nonsteroidal topical agent crisaborole occupies a distinct niche in the mild to moderate segment, offering a corticosteroid-sparing option that mitigates concerns around skin atrophy and barrier disruption. AbbVie’s launch of upadacitinib further intensifies competitive dynamics, with its oral JAK1 selectivity positioning it as an attractive alternative for patients seeking convenience and rapid symptomatic relief. Concurrently, Eli Lilly’s baricitinib introduction in Europe and Asia expands the JAK inhibitor class footprint, demonstrating how geographic regulatory strategies can drive incremental penetration across diverse markets.

Emerging biotechnology companies and platform innovators are also reshaping the competitive landscape. Late-stage pipelines featuring OX40/OX40L pathway modulators, neurokinin receptor antagonists, and mesenchymal stem cell therapies signal a shift toward mechanistic diversification. Strategic alliances between clinical research organizations and localized manufacturers are accelerating late-stage trials and bolstering capacity for commercial-scale biologic production, highlighting the critical role of cross-sector collaboration in bringing novel treatments to patients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atopic Dermatitis Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Almirall, S.A.

- Amgen Inc.

- Arcutis Biotherapeutics, Inc.

- Bausch Health Companies Inc.

- BiomX Inc.

- Bristol‑Myers Squibb Company

- Dermavant Sciences Inc.

- Eli Lilly and Company

- Galderma Group AG

- Glenmark Pharmaceuticals Ltd.

- Incyte Corporation

- Intas Pharmaceuticals Ltd.

- Kiniksa Pharmaceuticals, Ltd.

- Kyowa Hakkō Kirin Co., Ltd.

- LEO Pharma A/S

- Novartis AG

- Otsuka Holdings Co., Ltd.

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.

- Vanda Pharmaceuticals, Inc.

Actionable Recommendations for Industry Leaders to Navigate Tariff Challenges, Accelerate Pipeline Innovation, and Enhance Patient-Centric Strategies

To mitigate the complexities introduced by tariffs and trade policies, industry leaders should prioritize the diversification of active pharmaceutical ingredient sourcing and expand domestic manufacturing capabilities. By forging alliances with U.S.-based contract development and manufacturing organizations, companies can reduce exposure to import duties and ensure continuity of supply. Leveraging government incentives and tariff carve-outs, stakeholders can optimize cost structures and safeguard the affordability of atopic dermatitis therapies.

Accelerating pipeline innovation requires a balanced investment in both biologics and small molecule platforms. Organizations should continue to fund advanced clinical trials for emerging targets such as OX40/OX40L inhibitors and neurokinin-1 antagonists, while also enhancing patient stratification through biomarker-driven approaches. Collaborations with academic institutions and patient advocacy groups can enrich trial design and facilitate access to diverse patient cohorts, expediting time-to-market for novel agents.

Enhancing patient-centric strategies involves integrating digital health tools and real-world evidence frameworks into product development. Implementing mobile applications for symptom tracking and adherence monitoring can provide invaluable longitudinal data, informing post-launch optimizations and payor discussions. Moreover, designing comprehensive patient support programs-encompassing educational resources, telehealth consultations, and financial assistance-will elevate patient engagement and retention, ultimately improving therapeutic outcomes.

Comprehensive Research Methodology Detailing Data Sources, Analytical Frameworks, and Validation Processes for In-Depth Atopic Dermatitis Insights

This research employed a multi-tiered methodology, beginning with an extensive review of peer-reviewed literature, regulatory filings, and clinical trial registries. Authoritative sources such as PubMed, ClinicalTrials.gov, and regulatory agency databases were systematically analyzed to capture the latest approvals, pipeline progress, and therapeutic class developments. Secondary research was complemented by industry white papers and conference abstracts to ensure comprehensive coverage of emerging modalities.

Primary insights were derived from qualitative interviews with key opinion leaders, including dermatologists, pharmacoeconomists, and patient advocacy representatives. These discussions provided context on prescribing behaviors, market access hurdles, and real-world treatment experiences. Triangulation of secondary and primary data enabled robust validation of trends and helped identify critical inflection points within the atopic dermatitis therapeutic landscape.

Quantitative analysis incorporated data segmentation across drug classes, routes of administration, and geographies to delineate competitive positioning and growth drivers. Analytical frameworks such as SWOT and Porter’s Five Forces were applied to assess market dynamics and strategic viability. All findings underwent peer review by subject matter experts to ensure accuracy and relevance for both industry executives and clinical stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atopic Dermatitis Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atopic Dermatitis Drugs Market, by Drug Class

- Atopic Dermatitis Drugs Market, by Route Of Administration

- Atopic Dermatitis Drugs Market, by Mode Of Administration

- Atopic Dermatitis Drugs Market, by Patient Age Group

- Atopic Dermatitis Drugs Market, by Distribution Channel

- Atopic Dermatitis Drugs Market, by Region

- Atopic Dermatitis Drugs Market, by Group

- Atopic Dermatitis Drugs Market, by Country

- United States Atopic Dermatitis Drugs Market

- China Atopic Dermatitis Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Conclusive Insights Emphasizing the Strategic Imperatives and Future Trajectories Shaping the Atopic Dermatitis Therapeutic Landscape

The atopic dermatitis landscape is poised for further transformation as next-generation therapies gain traction and supply chain resiliency becomes paramount. Biologic agents targeting interleukin pathways have set new standards for efficacy and safety, while the emergence of JAK inhibitors and novel small molecules promises to broaden treatment choices for patients. Concurrently, geopolitical factors and tariff regimes underscore the importance of proactive supply diversification and strategic manufacturing investments.

Segmented approaches to treatment, informed by patient age, disease severity, and administration preferences, will be critical in delivering personalized care and maximizing therapeutic value. Regional dynamics further shape access paradigms, with each territory presenting unique regulatory, reimbursement, and infrastructure challenges that necessitate tailored market entry strategies.

Looking ahead, collaboration between pharmaceutical innovators, healthcare providers, and patient communities will drive the co-creation of holistic care models that extend beyond pharmacotherapy. By embracing digital health, real-world evidence, and patient support frameworks, the industry can ensure that advancements in atopic dermatitis therapies translate into meaningful improvements in patient quality of life and long-term disease control.

Take Immediate Action to Secure the Comprehensive Atopic Dermatitis Market Research Report Through a Direct Conversation with Ketan Rohom

To explore these comprehensive insights further and obtain the full market research report on atopic dermatitis drugs, readers are encouraged to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide tailored guidance on report content, scope, and customization options, ensuring that each organization’s unique strategic requirements are addressed. By engaging with Ketan, prospective clients gain immediate access to in-depth analyses, primary data sets, and expert commentary, all designed to inform high-stakes decision-making within the atopic dermatitis therapeutics space. Don’t miss the opportunity to leverage this critical research for competitive advantage and long-term planning.

- How big is the Atopic Dermatitis Drugs Market?

- What is the Atopic Dermatitis Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?