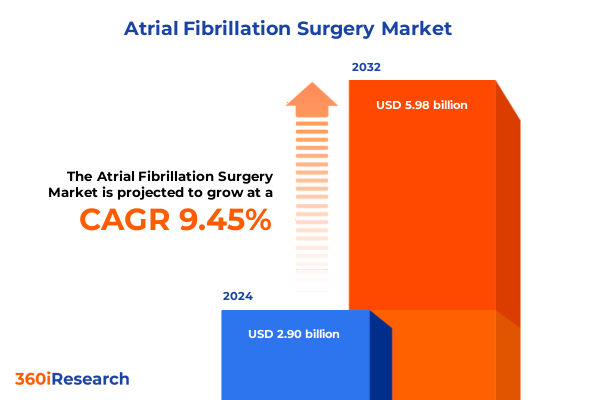

The Atrial Fibrillation Surgery Market size was estimated at USD 3.15 billion in 2025 and expected to reach USD 3.43 billion in 2026, at a CAGR of 9.56% to reach USD 5.98 billion by 2032.

Defining the Critical Landscape of Atrial Fibrillation Surgery Amid Rising Prevalence and Evolving Clinical Imperatives

Atrial fibrillation represents the most prevalent sustained cardiac arrhythmia, affecting an estimated 5.2 million individuals in the United States as of 2010 and projected to exceed 12 million by 2030 according to joint ACC/AHA assessments. This arrhythmia’s prevalence amplifies with an aging population and rising rates of comorbidities such as hypertension and obesity, underpinning a significant burden on healthcare systems and patient quality of life. The irregular atrial contractions inherent to this condition elevate stroke risk fivefold and double all-cause mortality, while contributing to heart failure and cognitive decline.

In response to these trends, the landscape of atrial fibrillation management has evolved to include advanced interventional strategies beyond pharmacotherapy. Catheter-based ablation techniques and minimally invasive surgical procedures have emerged as pivotal options for patients with symptomatic or refractory atrial fibrillation. Contemporary clinical guidelines now emphasize early rhythm control and early integration of ablation procedures, reflecting evidence that timely intervention may improve long-term outcomes and reduce the need for repeated interventions. As practice patterns shift, understanding the nuances of surgical approaches and their place within a comprehensive care continuum is essential for healthcare leaders and decision-makers.

Unveiling Transformative Technological and Procedural Innovations That Are Reshaping the Future of Atrial Fibrillation Surgery

Technological breakthroughs have redefined the intervention spectrum for atrial fibrillation surgery, propelling a shift from traditional open-chest procedures to hybrid and minimally invasive strategies. Hybrid ablation combines epicardial and endocardial lesion sets in a coordinated approach, harnessing the strengths of surgical visualization and catheter precision; this synergy has demonstrated favorable rhythm control outcomes of up to 79 percent at 19 months follow-up in persistent and long-standing persistent atrial fibrillation cohorts. Parallel advancements in pulsed field ablation technology, characterized by shorter procedure duration and reduced collateral tissue damage, are gaining rapid adoption, with multiple U.S. FDA approvals granted since 2023.

Beyond ablation modalities, artificial intelligence and high-definition mapping systems are augmenting procedural planning and real-time lesion assessment. Electroanatomical mapping platforms now integrate machine learning algorithms that predict arrhythmogenic substrates, enhancing target identification and potentially improving single-procedure success rates. Robotic navigation systems and endoscopic visualization tools further refine surgical accessibility, enabling complex lesion sets with smaller incisions and reduced convalescence. Together, these transformative shifts underscore a trajectory toward precision-driven, patient-centric atrial fibrillation care.

Assessing the Broad Financial and Operational Effects of the 2025 U.S. Tariff Regime on Atrial Fibrillation Surgical Device Supply Chains

The reinstatement of Section 301 tariffs in April 2025 introduced a baseline 10 percent import duty on Class I and II medical devices, with higher rates applied to specific trading partners, escalating cost pressures across the atrial fibrillation surgery supply chain. Companies such as Zimmer Biomet forecast profit impacts of up to USD 80 million in 2025, prompting firms to reassess sourcing strategies and accelerate regional manufacturing investments. Tariff-induced cost shifts have reverberated through hospital procurement budgets, potentially constraining access to advanced ablation catheters and mapping systems in the near term.

In anticipation of sustained tariff exposure, leading medical device manufacturers have pursued supply chain realignment by expanding U.S.-based production and forging long-term procurement agreements with domestic suppliers. Boston Scientific’s new manufacturing site in Georgia and Abbott’s R&D investments in Illinois exemplify this strategic pivot to mitigate levy-driven cost escalations and ensure continuity of device availability. While these measures may entail short-term capital allocation shifts, they are critical to preserving patient access to essential atrial fibrillation surgical technologies amid a dynamically evolving trade policy landscape.

Elucidating Core Market Segmentation Dimensions That Highlight the Diverse Procedural, Technological, and End-User Pathways in Atrial Fibrillation Surgery

Insight into market segmentation illuminates the varied pathways through which atrial fibrillation surgery is delivered and experienced. Procedures span from catheter ablation modalities-encompassing radiofrequency, cryoablation, laser, and high-intensity focused ultrasound-to hybrid convergent approaches and traditional surgical Maze operations, each offering distinct efficacy, safety, and procedural footprint profiles. Substrate mapping and navigation platforms integral to catheter-based workflows bifurcate into electroanatomical and magnetic mapping systems, complemented by navigation solutions that range from magnetic guidance to robotic arm assistance, underscoring the intricate ecosystem of device-enabled precision.

Beyond procedure differentiation, energy sources classify ablation techniques into thermal modalities such as radiofrequency and laser, alongside non-thermal approaches like pulsed field and ultrasound ablation. Indication-based stratification distinguishes paroxysmal, persistent, and permanent atrial fibrillation cohorts, with long-standing persistent cases often necessitating hybrid or surgical Maze interventions due to atrial remodeling complexity. End user environments, spanning hospital electrophysiology labs to ambulatory surgical centers-both hospital-affiliated and independent-reflect the shifting site-of-care paradigm as same-day discharge models gain traction, emphasizing the importance of case complexity and patient acuity in driving channel preference.

This comprehensive research report categorizes the Atrial Fibrillation Surgery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Procedure Type

- Energy Source

- Device Type

- Indication

- End User

Highlighting the Distinct Interplay of Demographics, Reimbursement, and Technological Adoption Driving Atrial Fibrillation Surgery Across Global Regions

Regional dynamics in atrial fibrillation surgery are shaped by healthcare infrastructure, regulatory environments, and demographic trends. In the Americas, robust reimbursement frameworks and a high prevalence of atrial fibrillation have propelled widespread adoption of advanced ablation and mapping systems. Health systems across the United States and Canada continue to expand electrophysiology program offerings, supported by favorable coverage policies that recognize the long-term value of early rhythm control interventions.

Europe, the Middle East, and Africa present a mosaic of market drivers where Western European nations lead in procedural uptake owing to established clinical guidelines and significant healthcare R&D investments. Conversely, emerging economies within EMEA are witnessing accelerated growth fueled by rising healthcare expenditures, expanded public insurance schemes, and growing clinician proficiency in electrophysiology procedures. Localization of manufacturing and targeted training initiatives are further catalyzing access to both catheter-based and hybrid surgical solutions.

Asia-Pacific stands out for its rapid expansion trajectory, reflecting large patient pools, increasing health awareness, and strategic government support for domestic medical device production. Countries such as Japan and Australia are early adopters of pulsed field ablation and AI-driven mapping platforms, while China and India are focusing on scaling procedural capacity through public–private partnerships and investment in specialist training, laying the groundwork for substantial procedural volume growth.

This comprehensive research report examines key regions that drive the evolution of the Atrial Fibrillation Surgery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives and Competitive Differentiators Among Leading MedTech Companies in the Atrial Fibrillation Surgery Arena

Major device manufacturers are intensifying competition through strategic product launches, portfolio expansions, and capacity enhancements. Medtronic has positioned its PulseSelect pulsed field ablation system as a frontrunner in non-thermal lesion creation, recently resolving supply constraints to sustain hospital demand and achieving double-digit revenue growth in its cardiac rhythm segment. The company’s commitment to integrated mapping solutions, including its forthcoming Affera Sphere-9 catheter, underscores a trend toward bundled electrophysiology platforms that streamline procedural workflows and data integration.

Boston Scientific continues to leverage its expertise in contact force sensing catheters and high-density mapping to fortify its electrophysiology franchise. The opening of new manufacturing sites in Georgia and Minnesota demonstrates its strategic pivot toward supply resilience amid trade challenges. Abbott has introduced the TactiFlex Ablation Catheter featuring a flexible tip and contact force technology to enhance lesion durability and procedural safety, reflecting an industry focus on precision delivery systems. Meanwhile, Johnson & Johnson’s MedTech arm integrates its acquired V-Wave platform to explore synergistic heart failure and arrhythmia therapies, and companies like AtriCure are advancing minimally invasive surgical ablation adjuncts for hybrid OR suites.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atrial Fibrillation Surgery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Acutus Medical, Inc.

- AtriCure, Inc.

- Baylis Medical Company Inc.

- Biosense Webster, Inc.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- CardioFocus, Inc.

- CathRx Ltd.

- Japan Lifeline Co., Ltd.

- Johnson & Johnson Services, Inc.

- Kardium Inc.

- Koninklijke Philips N.V.

- Lepu Medical Technology (Beijing) Co., Ltd.

- LivaNova plc

- Medtronic plc

- MicroPort EP MedTech (Co., Ltd.)

- Osypka AG

- Pulse Biosciences, Inc.

- Stereotaxis Inc.

- Synaptic Medical B.V.

Driving Operational Excellence and Clinical Adoption Through Strategic Supply Chain, Training, and Data Integration Initiatives

Industry leaders must chart proactive strategies to navigate evolving clinical, regulatory, and trade environments. Prioritizing supply chain agility is critical; organizations should evaluate onshore manufacturing partnerships and diversified sourcing to mitigate tariff volatility and secure timely access to essential ablation and mapping technologies. Concurrently, investment in clinician training programs on novel modalities-such as pulsed field and hybrid ablation-will accelerate adoption and optimize procedural outcomes.

Stakeholders should also champion cross-functional data integration by adopting interoperable platforms that consolidate electrophysiological mapping, procedural metrics, and long-term patient follow-up data. This holistic approach can enhance decision support, facilitate real-world evidence generation, and empower value-based contracting discussions with payers. Finally, engaging with regulatory bodies to shape reimbursement pathways for advanced surgical interventions will ensure sustainable market access and support the translation of technological innovation into widespread clinical practice.

Aligning Robust Mixed-Method Research Protocols With Expert Validation to Uncover Actionable Insights in Atrial Fibrillation Surgery

This research encompasses a mixed-methodology framework combining primary interviews with electrophysiologists, cardiac surgeons, and healthcare procurement leaders, alongside secondary data analysis of peer-reviewed clinical guidelines, regulatory filings, and industry publications. Market dynamics were evaluated using top-down and bottom-up approaches, validating segmentation insights through cross-referencing device utilization data from hospital registries and procedural volume forecasts from independent analytics firms.

Qualitative inputs were solicited via structured expert panels to capture evolving clinical preferences, while quantitative analyses leveraged company reports, trade association data, and publicly available patent landscapes. Regional demand assessments incorporated health expenditure trends and demographic projections from government databases. Rigorous triangulation and data cleaning processes ensured robustness, while iterative stakeholder reviews refined the final insights to align with real-world clinical and operational contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atrial Fibrillation Surgery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atrial Fibrillation Surgery Market, by Procedure Type

- Atrial Fibrillation Surgery Market, by Energy Source

- Atrial Fibrillation Surgery Market, by Device Type

- Atrial Fibrillation Surgery Market, by Indication

- Atrial Fibrillation Surgery Market, by End User

- Atrial Fibrillation Surgery Market, by Region

- Atrial Fibrillation Surgery Market, by Group

- Atrial Fibrillation Surgery Market, by Country

- United States Atrial Fibrillation Surgery Market

- China Atrial Fibrillation Surgery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Consolidating the Dynamic Convergence of Innovation, Policy, and Clinical Practice in Atrial Fibrillation Surgery to Illuminate Future Pathways

Atrial fibrillation surgery is undergoing a period of unprecedented innovation, driven by the convergence of novel energy modalities, advanced mapping technologies, and strategic industry investments. As clinical guidelines evolve toward earlier and more definitive rhythm control, the roles of catheter ablation, hybrid procedures, and minimally invasive surgical strategies have become integral to comprehensive care pathways.

Navigating the implications of external factors-such as trade policy shifts and regional reimbursement landscapes-remains vital for stakeholders aiming to sustain access, control costs, and deliver optimal patient outcomes. By leveraging segmentation clarity, regional intelligence, and competitive benchmarking, healthcare leaders can make informed decisions that position their organizations at the forefront of this dynamic therapeutic domain.

Seize Strategic Advantages in Atrial Fibrillation Surgery Through Personalized Consultation and Data-Driven Market Insights

Empowering transformation in atrial fibrillation care begins with informed decision-making. To explore deeper insights, advanced data models, and strategic analyses that can drive your organization forward, reach out today to Ketan Rohom, Associate Director of Sales & Marketing. Engage with an expert who can tailor solutions to your unique challenges and help you leverage cutting-edge research for competitive advantage. Take the next step toward optimizing patient outcomes and operational excellence by securing your comprehensive atrial fibrillation surgery market research report now.

- How big is the Atrial Fibrillation Surgery Market?

- What is the Atrial Fibrillation Surgery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?