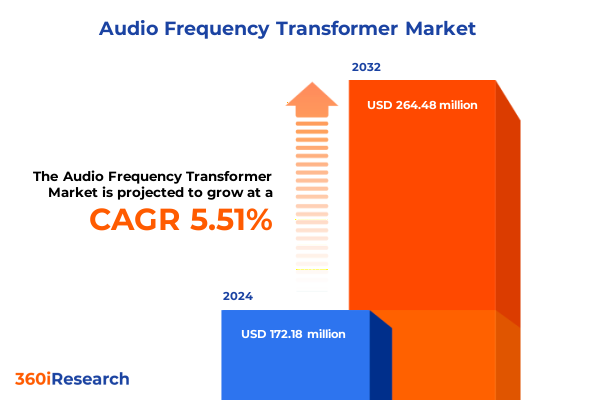

The Audio Frequency Transformer Market size was estimated at USD 181.51 million in 2025 and expected to reach USD 190.63 million in 2026, at a CAGR of 5.52% to reach USD 264.48 million by 2032.

Foundations And Innovations In Audio Frequency Transformers Shaping The Future Landscape Of Precision Signal Control And Power Management

Audio frequency transformers stand at the nexus of signal fidelity and power management, serving as indispensable components in a vast array of electronic and electrical systems. By ensuring smooth impedance matching and isolation between circuits, these transformers underpin the reliability of high-resolution audio equipment, precision measurement instruments, and industrial control systems. In a landscape where demand for crystal-clear sound and robust power delivery is intensifying, their role has never been more central to both analog and digital signal pathways. Furthermore, the relentless drive towards miniaturization in consumer electronics and the push for more efficient power conversion in industrial applications elevate these components from mere passive elements to strategic assets within design architectures.

Transitioning from historical usage in legacy audio amplifiers to modern applications in electric vehicles and renewable energy inverters, audio frequency transformers increasingly integrate advanced materials and manufacturing techniques. Their ability to suppress electromagnetic interference and accommodate variable load conditions makes them vital to maintaining system stability and regulatory compliance. As industries evolve, the emphasis on lightweight, thermally efficient, and high-precision designs has accelerated innovation in core materials and winding methods. Consequently, decision makers and engineers alike must develop a comprehensive understanding of these transformers’ capabilities and limitations to harness their full potential in next-generation electronics.

Emerging Technological And Market Dynamics That Are Redefining Audio Frequency Transformer Deployment Across Evolving Industrial And Consumer Application Domains

Recent years have witnessed a sweeping transformation in how audio frequency transformers are designed, manufactured, and deployed. The convergence of digital signal processing, IoT-enabled monitoring, and smart grid integration is driving unprecedented demand for transformers that combine high-fidelity performance with real-time diagnostics. Modern designs increasingly incorporate embedded sensors and wireless connectivity to provide continuous health monitoring, enabling predictive maintenance and minimizing unplanned downtime. As a result, the technology is no longer confined to passive energy conversion but is evolving into an intelligent node within broader automation and control networks.

Meanwhile, the ascent of electric vehicles and renewable energy systems has placed new pressures on transformer manufacturers to deliver customized solutions that can handle wide load fluctuations, rapid cycling, and resistance to environmental stressors. Materials science innovations, such as amorphous alloys and advanced composite laminations, are enabling cores that reduce hysteresis losses and improve thermal conductivity. At the same time, miniaturization trends inspired by consumer demand for portable audio and wearable devices are prompting compact transformer architectures with optimized winding geometries. In tandem, regulatory frameworks aimed at enhancing energy efficiency and reducing carbon footprints are shaping design priorities and fostering cross-industry collaboration on next-generation transformer standards.

Analyzing The Aggregate Repercussions Of The 2025 United States Tariff Measures On Supply Chains Component Costs And Strategic Procurement Practices In Audio Frequency Transformers

The imposition of new tariff measures by the United States in early 2025 has introduced a layer of complexity to the procurement and cost structure of audio frequency transformers. Increased duties on critical raw materials such as silicon steel and copper foil have elevated component costs, prompting manufacturers to explore alternative sourcing strategies and negotiate long‐term supply agreements. As a result, engineering teams are reassessing their design portfolios to identify substitute materials or to optimize core geometries in order to maintain performance while mitigating cost escalations.

Moreover, the ripple effects of these tariff adjustments extend beyond material expenses. Enhanced customs scrutiny and longer lead times have underscored the importance of supply chain resilience and inventory agility. Many organizations have responded by diversifying supplier bases, nearshoring production facilities, and adopting just-in-time inventory models reinforced by digital tracking tools. In parallel, collaborative partnerships between transformer specialists and logistics providers have emerged to streamline customs clearance and reduce exposure to tariff volatility. This strategic realignment, while initially resource intensive, is laying the groundwork for more flexible and responsive supply networks that can better absorb future regulatory shifts.

InDepth Perspective On How Phase Type Core Configuration EndUser Verticals Power Ratings Winding Materials Cooling Methods And Sales Channels Shape Audio Frequency Transformer Strategies

In examining how audio frequency transformers are categorized for market analysis, a multi-dimensional segmentation framework emerges that illuminates distinct performance criteria and customer requirements. The first segmentation axis distinguishes between single phase and three phase configurations, reflecting the foundational power delivery needs of residential audio amplifiers versus industrial signal processing systems. Parallel to this, core composition serves as another critical dimension, as the choice between laminated cores and toroidal cores drives trade-offs between magnetic flux density, electromagnetic interference suppression, and footprint efficiency.

Transitioning to usage contexts, transformer applications span diverse end user verticals such as aerospace and defense, automotive, consumer electronics, industrial manufacturing, renewable energy and power, and telecommunications, each with unique reliability mandates, environmental standards, and form factor constraints. Further granularity is achieved through power rating classifications, which segment products into high (>1000 VA), medium (250–1000 VA), and low (≤250 VA) tiers, guiding designers in balancing thermal performance and size requirements. Winding material selection, whether aluminum or copper, then informs considerations around conductivity, weight, and cost, while the choice of cooling method-dry type or oil immersed-dictates maintenance protocols and environmental safety measures. Lastly, the sales channel classification into aftermarket and OEM channels highlights divergent go-to-market strategies, with aftermarket players emphasizing modular upgrades and OEM partners focusing on design-integrated offerings. Collectively, these segmentation layers provide a nuanced blueprint for product development and strategic positioning in the audio frequency transformer arena.

This comprehensive research report categorizes the Audio Frequency Transformer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Phase Type

- Core Type

- Power Rating

- Winding Material

- Cooling Method

- End User

- Sales Channel

Regional Market Dynamics And GrowthCatalysts Across The Americas Europe Middle East Africa And AsiaPacific Illustrating Diverse DemandPatterns And Operational Priorities

Regional dynamics in the audio frequency transformer domain reveal marked variations in demand drivers, regulatory environments, and technological readiness. In the Americas, the confluence of robust industrial manufacturing, burgeoning renewable energy infrastructure, and thriving automotive innovation hubs fosters sustained interest in ruggedized, high-efficiency transformers. This region’s emphasis on reducing carbon emissions and meeting stringent safety standards accelerates the adoption of oil immersed cooling for heavy-duty applications and dry type designs for consumer-grade equipment. Furthermore, North American and South American markets exhibit divergent supply chain preferences, with near-shore manufacturing gaining momentum in the United States and Brazil, while Mexico continues to solidify its position as a strategic export base for both industrial and consumer electronics.

In contrast, the Europe, Middle East & Africa region presents a tapestry of market conditions shaped by aggressive energy-efficiency mandates, heterogeneous infrastructure maturity, and evolving defense procurement practices. European Union directives on electromagnetic compatibility and sustainable materials spur innovative core formulations and advanced winding techniques. Meanwhile, Gulf Cooperation Council nations and North African economies are investing heavily in power transmission and telecommunications upgrades, leading to increased demand for both laminated core and toroidal core solutions that meet harsh environmental requirements. Simultaneously, African manufacturing clusters are gradually embracing local assembly capabilities, enhancing responsiveness to market fluctuations.

Finally, the Asia-Pacific marketplace stands as the preeminent engine of growth, driven by a thriving consumer electronics industry in East Asia, expansive renewable energy projects in Southeast Asia, and electrification initiatives in countries such as India and Australia. High production volumes of single phase transformers cater to home audio system manufacturers, while three phase solutions underpin expanding industrial parks and telecommunications infrastructure. The region’s well-established supply networks for aluminum and copper winding materials, coupled with cost-competitive assembly facilities, enable rapid product iterations and scale-up, positioning Asia-Pacific as a bellwether for emerging transformer technologies.

This comprehensive research report examines key regions that drive the evolution of the Audio Frequency Transformer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles And InnovationTrajectories Of Leading Manufacturers Highlighting Their Technological Advancements Partnerships And Market Positioning In Audio Frequency Transformers

Leading participants in the audio frequency transformer market are distinguished by their commitment to continuous innovation, strategic collaborations, and differentiated service offerings. Established multinational corporations have been bolstering their R&D pipelines to integrate next-generation core materials such as nanocrystalline alloys, which deliver superior permeability and lower losses under variable load conditions. Concurrently, partnerships with specialist component suppliers and academic research centers have accelerated the development of lighter, more compact enclosures and advanced cooling architectures that enhance thermal stability in both dry type and oil immersed variants.

Alongside these incumbents, a cohort of agile engineering firms has emerged with a focus on highly customized solutions tailored to niche applications. By leveraging modular design platforms, they offer bespoke transformer assemblies that can be rapidly prototyped and validated to meet stringent aerospace and defense standards or automotive vibration resistance requirements. These firms often differentiate themselves through integrated digital services, embedding sensors for real-time temperature and flux monitoring, as well as providing cloud-based analytics dashboards for predictive maintenance. In parallel, after-market specialists are forging alliances with major OEMs to deliver upgrade kits that extend the lifecycle of existing systems while minimizing installation disruption, thereby reinforcing the strategic value proposition of audio frequency transformers across their entire operational arc.

This comprehensive research report delivers an in-depth overview of the principal market players in the Audio Frequency Transformer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- HALO Electronics

- Jensen Transformers

- Legrand SA

- MACOM Technology Solutions

- Murata Manufacturing Co., Ltd.

- Neutrik AG

- OXFORD ELECTRICAL PRODUCTS

- PICO Electronics, Inc.

- Pro-Ject Audio

- Pulse Electronics

- Rupert Neve Designs, LLC

- Solar Electronics Company.

- STMicroelectronics N.V.

- Tamura Corporation

- TDK Corporation

- Texas Instruments Incorporated

- Triad Magnetics

- Vigortronix Ltd

- Würth Elektronik eiSos GmbH & Co. KG

ActionOriented Strategic Recommendations Empowering Industry Leaders To Optimize Supply Chains Advance Technology Adoption And Navigate Regulatory AndTradeChallenges In Audio Frequency Transformer Markets

To navigate the evolving landscape effectively, industry leaders should prioritize a multifaceted supply chain strategy that balances cost efficiency with resilience. By diversifying supplier networks across geographies and forging long-term procurement agreements, organizations can mitigate the impact of material tariff fluctuations and lead time uncertainties. Simultaneously, implementing digital twin simulations for transformer designs enables rapid validation of alternative core materials and winding configurations, accelerating time-to-market while safeguarding performance benchmarks.

In tandem, companies are encouraged to invest in modular product platforms that accommodate both single phase and three phase configurations, reducing the engineering overhead associated with bespoke solutions. Embracing additive manufacturing techniques for core prototypes and custom enclosures can further shorten development cycles and unlock novel geometries for enhanced thermal management. To address end user expectations, embedding real-time monitoring capabilities and leveraging cloud-based analytics will bolster predictive maintenance offerings and foster customer loyalty. Finally, aligning innovation roadmaps with regional regulatory roadmaps and sustainability objectives can position organizations as preferred partners for large-scale renewable energy and industrial automation projects, unlocking long-term growth potential without overreliance on volatile segments.

Transparent Research Approach Integrating Rigorous Primary Interviews Comprehensive Secondary Analysis And Methodical Triangulation To Ensure Robust Insights And Credibility

This research initiative employed a robust methodology that integrates qualitative expert interviews, secondary data synthesis, and rigorous triangulation to ensure comprehensive coverage and credibility. Primary insights were obtained through discussions with transformer design engineers, procurement specialists, and regulatory advisors, providing firsthand perspectives on technology adoption challenges, material selection criteria, and evolving quality standards. These interviews were conducted under confidentiality agreements, allowing participants to share candid assessments of supplier performance and innovation priorities.

Complementing the primary research, a thorough review of industry publications, patent filings, technical standards, and publicly available financial statements enabled cross-verification of emerging trends and strategic imperatives. Data points were systematically compared and validated across multiple independent sources to minimize bias and enhance reliability. Throughout the process, analytical frameworks were applied to dissect segmentation drivers, regional dynamics, and competitive landscapes, ensuring that conclusions rest on a balanced, methodical foundation. By maintaining transparency in research steps and upholding stringent data validation protocols, the study delivers actionable insights that reflect the current state of audio frequency transformer markets and anticipate near-term shifts in technology and regulation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Audio Frequency Transformer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Audio Frequency Transformer Market, by Phase Type

- Audio Frequency Transformer Market, by Core Type

- Audio Frequency Transformer Market, by Power Rating

- Audio Frequency Transformer Market, by Winding Material

- Audio Frequency Transformer Market, by Cooling Method

- Audio Frequency Transformer Market, by End User

- Audio Frequency Transformer Market, by Sales Channel

- Audio Frequency Transformer Market, by Region

- Audio Frequency Transformer Market, by Group

- Audio Frequency Transformer Market, by Country

- United States Audio Frequency Transformer Market

- China Audio Frequency Transformer Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesized Conclusions Illuminating Core Trends Opportunities And Strategic Imperatives To Guide DecisionMakers In Maximizing Value From Audio Frequency Transformer Innovations

Drawing together the insights from technological evolution, tariff impacts, segmentation analysis, and regional dynamics illuminates the multifaceted nature of the audio frequency transformer market. The convergence of advanced materials research, digital integration for real-time monitoring, and a renewed focus on supply chain resiliency underscores the dual imperatives of performance optimization and operational flexibility. Key segmentation drivers expose areas where targeted innovations-such as high-efficiency toroidal cores or compact dry type units-can address specific end user requirements across aerospace, automotive, and renewable energy sectors.

Strategically, organizations that embrace modular design platforms, invest in predictive maintenance services, and align their procurement strategies with emerging tariff regulations will be best positioned to capitalize on future growth opportunities. Regional nuances, from the Americas’ renewable energy focus to Europe, Middle East & Africa’s stringent efficiency mandates and Asia-Pacific’s manufacturing prowess, further highlight the need for tailored market approaches. Ultimately, success in this domain will hinge on the ability to balance cutting-edge technological advancements with pragmatic supply chain and commercial strategies, ensuring that audio frequency transformers continue to underpin next-generation applications with reliability and precision.

Engaging CallToAction To Connect With Associate Director Sales And Marketing For Personalized Insights Premium Research Access And Strategic Partnership Opportunities Within The Audio Frequency Transformer Domain

For tailored exploration of these strategic insights and to access the comprehensive market research report on audio frequency transformers, industry leaders and decision makers are encouraged to reach out directly to Ketan Rohom. As Associate Director of Sales and Marketing, he brings deep expertise in guiding organizations through complex technology evaluations and procurement strategies. Engaging with Ketan will open a direct channel for personalized consultations where specific operational challenges, customization requirements, and long-term innovation roadmaps can be discussed in detail. By collaborating with him, organizations gain early visibility into additional updates and sector-specific briefings, empowering them to stay ahead of regulatory changes and supply chain shifts. Contacting Ketan ensures that your team receives priority support, bespoke package options, and exclusive access to ongoing analysis, enabling you to maximize the strategic value of your investment and accelerate growth in the audio frequency transformer domain.

- How big is the Audio Frequency Transformer Market?

- What is the Audio Frequency Transformer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?