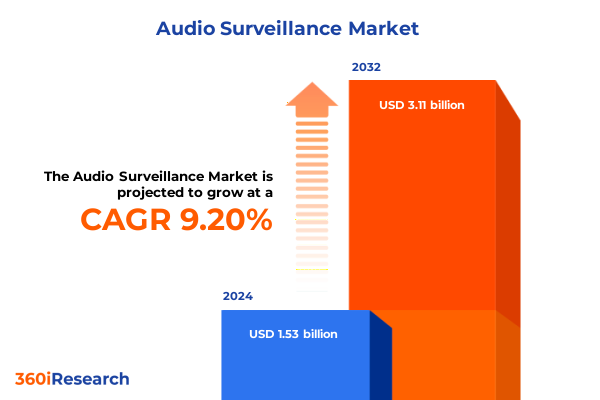

The Audio Surveillance Market size was estimated at USD 1.67 billion in 2025 and expected to reach USD 1.82 billion in 2026, at a CAGR of 9.26% to reach USD 3.11 billion by 2032.

Strategic executive overview of the evolving global audio surveillance ecosystem for security, intelligence, and operational awareness

Audio surveillance has moved from a niche adjunct to video monitoring into a central pillar of modern security and operational intelligence architectures. Across public spaces, transportation hubs, mission‑critical facilities, and connected homes, networked microphones, recorders, and smart speakers now act as pervasive acoustic sensors. These systems enrich situational awareness by capturing not only spoken conversations but also environmental cues such as alarms, glass breakage, crowd noise, and machinery anomalies.

At the same time, the technology stack underpinning audio surveillance is undergoing rapid transformation. Legacy analog installations are steadily giving way to IP‑based and software‑defined systems that integrate tightly with video management platforms, access control, and broader Internet of Things ecosystems. Artificial intelligence and edge analytics are enabling capabilities such as keyword spotting, anomaly and aggression detection, gunshot and incident recognition, and advanced forensics, often in real time. This evolution is intersecting with rising concerns over privacy, data protection, and cybersecurity, forcing stakeholders to rethink how and where they deploy microphones and recording infrastructure.

Within this context, the executive summary provides a structured view of the audio surveillance landscape. It highlights how component categories such as hardware, software, and services interact; how different connectivity types and frequency ranges support varied applications; and how regional regulatory regimes shape adoption patterns. It also explains how cumulative United States tariff actions through 2025 are reshaping supply chains and cost structures, and it distills the strategic responses of leading solution providers. Collectively, these insights are designed to support informed decision‑making by security leaders, technology strategists, investors, and policymakers.

Transformative technology, regulatory, and risk dynamics reshaping audio surveillance architectures and deployment models across sectors

Across the industry, one of the most consequential shifts has been the migration from closed analog architectures toward IP‑based and cloud‑enabled audio surveillance systems. Network microphones, speakers, and recorders now connect directly to Ethernet or wireless infrastructure, exposing standard application programming interfaces and supporting centralized management alongside video and access control. Vendors are emphasizing open platforms and interoperability, allowing operators to mix components from different manufacturers and to integrate audio feeds into broader command‑and‑control and incident management environments.

Parallel to this connectivity transition, artificial intelligence and signal processing advances are transforming what organizations expect from audio data. Edge devices equipped with embedded processors now perform local noise reduction, beamforming, and event detection, sending only relevant segments to central servers or cloud analytics engines. Research into acoustic cyber‑attacks and voice spoofing has highlighted the risks of maliciously injected commands and deepfake audio, prompting new interest in liveness detection, anti‑spoofing models, and acoustic anomaly detection tailored to smart speakers and IoT devices. These trends are pushing solution providers to embed security and resilience directly into microphones and audio processing pipelines.

Regulatory and societal expectations are also reshaping deployment practices. Heightened awareness of privacy rights, amplified by data protection regimes and litigation around unauthorized recording, is driving more explicit consent, stricter retention policies, and privacy‑by‑design architectures. In parallel, the expansion of voice‑activated systems and virtual assistants in homes, vehicles, and workplaces is blurring the boundary between consumer convenience and security‑grade surveillance. As a result, many institutions are moving from ad hoc microphone deployments to formal governance frameworks that specify which spaces are monitored, under what conditions, with what transparency, and for which analytic purposes.

Finally, the risk landscape itself is evolving. Mass‑casualty incidents, workplace violence, and critical infrastructure threats are compelling authorities and enterprises to seek earlier and richer detection signals. Audio offers complementary coverage where cameras may be obstructed or lighting is poor, and it can detect events before they become visually apparent. This growing recognition of audio’s unique value is driving investment in multi‑sensor, context‑aware systems that fuse sound, video, access control, and environmental data into cohesive operational awareness platforms.

Cumulative impact of United States trade policy and 2025 tariffs on audio surveillance supply chains, cost structures, and innovation agendas

Current United States tariff policy has its roots in the Section 301 measures first applied to Chinese goods in 2018 and subsequently reviewed and adjusted by the present administration. In 2024, the government completed a statutory review of these actions and opted not only to maintain existing tariffs but also to raise duties on a set of strategic product categories, notably including steel, aluminum, semiconductors, electric vehicles, batteries, and certain critical minerals. While audio surveillance hardware is not singled out as a category, many of its core components depend heavily on those upstream inputs.

By 2025, the tariff rate on semiconductors imported from China is scheduled to rise from twenty‑five percent to fifty percent, reinforcing a policy thrust that seeks to reduce dependence on Chinese foundries and promote domestic and allied production. Microphone arrays, digital signal processors, network controllers, and storage subsystems all rely on such chips, so higher duties on these components or on finished boards can translate into increased bill‑of‑materials costs for audio recorders, IP microphones, and smart speakers. Similar considerations apply to tariff hikes on steel and aluminum, which are key materials in enclosures, mounts, and brackets used in ruggedized or vandal‑resistant installations, as well as to any future action involving magnets and other elements used in transducers.

In parallel with tariffs, regulatory actions targeting security risks posed by certain Chinese electronics manufacturers and testing laboratories are reshaping the supplier landscape. The Federal Communications Commission has already restricted equipment authorizations for several Chinese telecom and surveillance companies and, in 2025, voted to bar laboratories associated with entities deemed security risks from testing devices for the domestic market. While these measures are technically distinct from tariffs, they have a similar effect of pushing integrators and end users toward alternative supply sources.

The cumulative impact through 2025 is multifaceted. On the cost side, integrators and original equipment manufacturers are contending with higher input prices and are exploring design changes, multi‑sourcing strategies, and near‑shoring or friend‑shoring of production to mitigate exposure. On the innovation side, policies such as the CHIPS and Science Act and clean manufacturing incentives, which accompany tariff measures, are catalyzing investment in domestic semiconductor and advanced manufacturing capabilities that will ultimately benefit audio surveillance vendors able to tap these ecosystems. Strategically, companies that proactively adjust their supply chains, diversify beyond single‑country dependencies, and redesign products with flexible component options are better positioned to preserve margins and maintain delivery reliability in this evolving trade environment.

Component, connectivity, frequency, application, and channel segmentation insights revealing nuanced opportunity patterns in audio surveillance

From a component standpoint, audio surveillance remains anchored in hardware, yet value is increasingly shaped by software and services. Core hardware elements such as microphones, recorders, speakers, cables, and connectors still determine baseline capture quality, durability, and coverage. Directional and array microphones, high‑fidelity loudspeakers for networked public address, and robust connectors capable of withstanding harsh environments are critical in transportation hubs, industrial plants, and outdoor city surveillance. At the same time, hardware commoditization in some tiers is pushing vendors to differentiate through software features and lifecycle services rather than purely through device specifications.

Software layers now provide the intelligence that transforms captured sound into operational insight. Audio codecs, encryption, acoustic event detection, speech analytics, and integration middleware link edge devices to video management and incident response systems. Vendors increasingly bundle analytics modules that perform tasks such as keyword spotting, aggression detection, and environment classification, often employing machine learning models tuned to specific customer environments. This software orientation is complemented by services focused on installation and setup, as well as maintenance and support. Professional design and installation services are particularly important for complex projects such as airports, hospitals, and large campuses, where acoustic modeling, network design, and regulatory compliance must be coordinated. Ongoing support services, including health monitoring, firmware updates, and periodic tuning, help maintain performance and security over time.

Connectivity and system type segmentation reveal another layer of strategic nuance. Traditional wired systems remain widely deployed because of their reliability, electromagnetic resilience, and predictable latency. Within this space, analog wired configurations continue to serve legacy installations and budget‑constrained environments, while digital wired architectures offer improved signal quality, simplified cabling, and easier integration with IP networks. In contrast, IP‑based and predominantly wireless systems are expanding rapidly where flexibility and scalability matter most. Wireless implementations leveraging Bluetooth, radio‑frequency links, and Wi‑Fi enable rapid deployment in temporary installations, historical buildings, and retrofit scenarios, though they demand careful design to manage interference, security, and battery life.

Frequency range segmentation reflects differing performance requirements. Low‑frequency capture is useful for detecting mechanical vibrations, heavy machinery anomalies, and certain types of structural impacts, supporting industrial safety and predictive maintenance use cases. Mid‑frequency performance underpins intelligible speech capture in environments such as offices, schools, and transportation hubs. High‑frequency response becomes important for accurately reproducing consonants and subtle acoustic cues, which enhances transcription quality and forensic analysis. Product portfolios that span low, mid, and high frequency performance bands can therefore be tailored to distinct application profiles rather than relying on one‑size‑fits‑all designs.

Application segmentation provides perhaps the clearest illustration of how diverse and specialized demand has become. In commercial settings, such as hotels, restaurants, offices, corporate campuses, and retail stores, audio surveillance is used for loss prevention, dispute resolution, service quality monitoring, and emergency messaging. Consumer deployments revolve around home security and smart home integration, with microphones embedded in video doorbells, indoor and outdoor cameras, and smart speakers connected to virtual assistants. Healthcare environments, including clinics and hospitals, emphasize patient and staff safety, fall detection, and incident documentation while managing stringent confidentiality requirements.

Industrial sites such as construction projects, manufacturing plants, warehouses, and distribution centers rely on audio monitoring to detect equipment malfunctions, collisions, and unsafe behaviors in noisy environments where visual coverage may be constrained. Institutional users, including schools, colleges, and research laboratories, deploy audio systems for early detection of threats, monitoring of restricted areas, and coordination during drills or actual emergencies. Law enforcement and military and defense stakeholders use tactical and fixed audio sensors for evidence collection, perimeter monitoring, and situational awareness in high‑risk operations. Transportation operators across airports, bus and freight terminals, railways, and metro systems integrate audio with public address and emergency communication systems to manage crowd flow, respond to incidents, and coordinate with first responders.

Distribution channel dynamics round out the segmentation picture. Offline channels dominated by security integrators, value‑added resellers, and specialized distributors remain central for complex, mission‑critical deployments that require design expertise and integration with broader security architectures. At the same time, online channels, including e‑commerce platforms and vendor‑operated portals, are gaining importance for standardized components and smaller systems, especially in the consumer and small‑to‑medium enterprise segments. Vendors that balance robust channel partnerships with intuitive online procurement and configuration tools are better positioned to capture demand across this spectrum of buyers.

This comprehensive research report categorizes the Audio Surveillance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Frequency Range

- Application

- Distribution Channel

Regional perspectives on audio surveillance adoption, regulation, and technology maturity across the Americas, EMEA, and Asia Pacific landscapes

Regional dynamics in audio surveillance are shaped by differences in security priorities, infrastructure investment, regulatory regimes, and technology maturity. In the Americas, particularly in the United States, there is a strong focus on integrating audio with existing video surveillance, access control, and emergency communication systems. Public safety initiatives, school security programs, and transportation infrastructure upgrades continue to drive deployments of networked microphones, intercoms, and IP speakers in city centers, campuses, and transit networks. At the same time, an active litigation environment and varying state‑level privacy statutes encourage organizations to adopt explicit policies for consent, signage, and data retention, pushing solution providers to embed robust governance features into their platforms.

Across Europe, the Middle East, and Africa, adoption patterns are heavily influenced by stringent privacy and data protection laws, as well as by diverse economic and political contexts. In many European countries, audio surveillance in workplaces, retail spaces, and public areas is subject to strict proportionality and transparency requirements. This has catalyzed interest in designs that emphasize event‑triggered recording, local processing with minimal data retention, and strong encryption. In the Middle East, large‑scale infrastructure and smart city projects, together with critical energy facilities, are significant adopters of integrated audio and video systems, often with strong government sponsorship. In parts of Africa, deployment is accelerating in high‑growth urban centers and transportation corridors, although variability in broadband connectivity and power infrastructure shapes the balance between cloud‑centric and edge‑heavy designs.

In the Asia‑Pacific region, the landscape ranges from highly saturated markets with substantial installed bases to emerging economies undergoing rapid urbanization and digitization. Advanced economies such as Japan, South Korea, Singapore, and Australia are investing in next‑generation IP‑based audio systems with sophisticated analytics for transportation, retail, and corporate environments. Meanwhile, countries with expanding manufacturing and logistics footprints are turning to audio surveillance to enhance industrial safety and supply chain resilience. The widespread adoption of smart home devices and voice‑activated assistants across several Asia‑Pacific markets is also normalizing the presence of microphones in residential settings, which in turn influences expectations for consumer‑grade security products.

Taken together, these regional perspectives underscore that no single deployment model or product mix suits all markets. Vendors and integrators must calibrate their offerings to local regulatory expectations, infrastructure realities, and cultural attitudes toward surveillance. Organizations planning cross‑regional rollouts need flexible architectures that can support centralized policy frameworks while allowing for local configuration of data handling, analytics features, and integration with national or municipal emergency systems.

This comprehensive research report examines key regions that drive the evolution of the Audio Surveillance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic positioning and innovation priorities of leading audio surveillance solution providers across hardware, software, and services domains

The competitive landscape in audio surveillance spans traditional professional audio manufacturers, specialized security vendors, and diversified technology groups. Companies with roots in professional audio, such as those producing microphones, loudspeakers, and amplifiers for broadcast, live sound, and installed systems, have leveraged their acoustic engineering expertise to supply components and subsystems used in surveillance and public safety applications. Electro‑Voice, for example, offers microphones and speakers deployed in commercial and institutional installations, including retail environments and houses of worship, which overlap significantly with venues that also require surveillance and emergency communication capabilities.

Specialist security vendors have moved aggressively into networked audio, treating it as a natural extension of video surveillance and access control portfolios. Axis Communications, a pioneer in network video, now also develops network audio devices such as IP speakers and audio management software designed for physical security and public address. By integrating audio devices natively into their video management ecosystems, such providers enable unified configuration, synchronized recording, and coordinated analytics, simplifying deployment for integrators and end users.

Global audio brands recognized for high‑fidelity microphones and headsets, including Sennheiser and Audio‑Technica, contribute critical components for surveillance‑grade capture, especially in applications where speech intelligibility and low noise are paramount. Their research and development investments in transducer design, wireless transmission, and spatial audio also inform specialized solutions used in law enforcement, broadcast monitoring, and mission‑critical communications.

Across this ecosystem, strategic themes are converging. Vendors are prioritizing cybersecurity hardening for networked audio devices, incorporating secure boot, signed firmware, and encrypted media transport to counter growing threats of device compromise and stream interception. Many are opening their platforms through well‑documented APIs and software development kits to enable third‑party analytics and custom integrations, positioning audio endpoints as intelligent sensors within broader IoT frameworks. There is also a strong emphasis on sustainability and lifecycle management: manufacturers are optimizing power consumption, extending device lifetimes with software updates, and improving recyclability of materials in response to corporate and regulatory environmental objectives.

Partnerships and acquisitions continue to shape the landscape as companies seek to combine strengths in acoustics, networking, and analytics. Collaboration between professional audio manufacturers and security platform providers is becoming more common, enabling turnkey solutions that address complex verticals such as healthcare, transportation, and education. Providers that can offer end‑to‑end solutions-from high‑performance hardware through analytics software to managed services-are particularly well positioned to serve large enterprises and public sector customers with multi‑site deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Audio Surveillance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avigilon Corporation

- AVTRON Technologies LLC

- AXIS Communications AB

- Becker Avionics GmbH

- BrickHouse Security

- Dahua Technology Co., Ltd

- ETS Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hanwha Vision Co., Ltd.

- Honeywell International Inc.

- KJB Security Products

- LG Corporation

- Louroe Electronics, Inc

- MG Electronics

- Mobotix AG

- Ovation Systems Limited

- Panasonic Corporation

- Robert Bosch GmbH

- S. Siedle & Söhne Telefon- und Telegrafenwerke OHG

- Shenzhen Enster Electronics Co., Ltd.

- Shenzhen LS VISION Technology Co., Ltd.

- Smart Cabling & Transmission Corp.

- Sony Group Corporation

- Speco Technologies

- Vivotek Inc

Actionable strategic recommendations to navigate technological disruption, regulatory scrutiny, and tariff headwinds in the audio surveillance market

For industry leaders, translating these structural shifts into competitive advantage begins with a clear technology roadmap. Organizations responsible for product strategy should accelerate the transition toward IP‑based and software‑defined audio architectures that can be continuously updated with new analytics, encryption protocols, and integrations. Designing devices and platforms with sufficient processing headroom at the edge allows for deployment of more sophisticated AI models over time, including advanced noise suppression, context‑aware event detection, and localized decision‑making that reduces bandwidth and latency.

At the same time, security and privacy must be treated as design imperatives rather than afterthoughts. The increasing feasibility of voice‑based cyber‑attacks and spoofing, demonstrated in recent academic work, highlights the need for liveness detection, robust authentication, and anomaly monitoring in voice‑controlled and audio‑monitored environments. Vendors should invest in security‑by‑design practices, including threat modeling for acoustic attack vectors, regular penetration testing of networked audio devices, and secure firmware lifecycle management. End users, in turn, should adopt comprehensive policies that cover access control to recordings, encryption of data in transit and at rest, and clear retention and deletion schedules aligned with applicable regulations.

Tariff‑driven supply chain shifts call for deliberate diversification strategies. Product and procurement teams should map the origin of critical components such as semiconductors, transducers, and metal enclosures, and then identify alternative suppliers or manufacturing locations capable of mitigating cost spikes or export restrictions. Modular designs that can accommodate functionally equivalent components from multiple sources can reduce dependency on any single geography. Leaders should also monitor industrial policy developments, including incentives for domestic semiconductor and electronics manufacturing, to align sourcing and partnership decisions with emerging regional ecosystems.

Another priority is verticalization. Rather than relying solely on generic audio products, vendors and integrators can create tailored solutions for priority sectors such as healthcare, education, transportation, and industrial safety. This involves codifying best practices for microphone placement, analytics tuning, and workflow integration in each environment, and then packaging them as reference architectures or pre‑configured bundles. Such vertical focus can shorten deployment times, improve outcomes, and differentiate offerings in a crowded market.

Finally, stakeholder engagement and transparency will be crucial for sustaining social license to operate. Clear communication with employees, customers, and the public about where and why audio surveillance is used, how data is protected, and what oversight mechanisms exist can reduce resistance and legal risk. Industry leaders who combine technical excellence with ethical deployment frameworks will be better positioned to influence regulatory debates, participate in standards development, and secure long‑term customer trust.

Comprehensive research methodology integrating primary intelligence, secondary sources, and rigorous validation to inform audio surveillance insights

The insights summarized in this executive overview are grounded in a multifaceted research methodology designed to capture both the technological and policy complexity of the audio surveillance landscape. The research team began by conducting an extensive review of secondary sources, including government policy documents, regulatory filings, technical standards, patent databases, academic publications, and public disclosures from equipment manufacturers and service providers. This desk research focused on developments in networked audio technology, AI‑driven analytics, information security, and trade policy affecting electronic components and finished systems.

To complement this foundational work, the study incorporated structured and semi‑structured interviews with stakeholders across the value chain, including system integrators, product managers, security architects, compliance officers, and end users in sectors such as transportation, healthcare, retail, and critical infrastructure. These conversations helped validate technology adoption patterns, uncover practical challenges encountered in real deployments, and identify emerging use cases that are not yet widely documented. Insights from industry conferences, technical workshops, and standards committee proceedings were also synthesized to capture forward‑looking perspectives on interoperability and governance.

Analytical rigor was maintained through systematic triangulation. Quantitative indicators from publicly available financial reports, trade data, and policy impact assessments were cross‑checked against qualitative feedback from industry practitioners to reduce the risk of bias or over‑reliance on any single viewpoint. Where academic research highlighted specific vulnerabilities-such as acoustic attacks on voice assistants or limitations in current anti‑spoofing systems-these findings were interpreted in the context of practical deployment constraints and commercially available mitigations.

Throughout the process, particular care was taken to avoid dependence on any one commercial data provider and to respect the limitations of each source type. Rather than focusing on precise numerical projections or market share estimates, the methodology emphasized structural trends, technology trajectories, regulatory inflection points, and strategic responses by leading actors. The outcome is a body of analysis that aims to be both technically robust and directly usable by decision‑makers tasked with shaping future audio surveillance strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Audio Surveillance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Audio Surveillance Market, by Component

- Audio Surveillance Market, by Type

- Audio Surveillance Market, by Frequency Range

- Audio Surveillance Market, by Application

- Audio Surveillance Market, by Distribution Channel

- Audio Surveillance Market, by Region

- Audio Surveillance Market, by Group

- Audio Surveillance Market, by Country

- United States Audio Surveillance Market

- China Audio Surveillance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing the strategic implications of technology trends, policy shifts, and competitive dynamics shaping the future of audio surveillance

The analysis of audio surveillance reveals a sector in the midst of profound transformation. What once revolved around relatively simple microphones and recorders has become an ecosystem of networked, software‑defined, and analytics‑rich devices that function as distributed acoustic sensors. These systems are increasingly valued not only for forensic evidence after an incident, but also for their ability to enhance real‑time situational awareness, support proactive risk mitigation, and streamline everyday operations in environments ranging from public transit to smart homes.

At the same time, the sector is navigating a complex interplay of geopolitical and regulatory forces. United States tariffs through 2025, together with allied policy initiatives, are reshaping where and how key components such as semiconductors and metal enclosures are manufactured, while restrictions on certain foreign suppliers and testing laboratories are altering competitive dynamics and supply relationships. Privacy and data protection laws, especially in Europe and parts of the Americas, impose demanding requirements on how audio is captured, processed, and stored, pushing solution providers toward privacy‑by‑design architectures and transparent governance frameworks.

Technological innovation and risk evolution proceed in parallel. Advances in AI, edge computing, and signal processing are opening the door to more sophisticated analytics, from aggression and gunshot detection to liveness verification and deepfake‑resistant authentication. Yet the same research also highlights new classes of threats, including acoustic cyber‑attacks and replay‑based compromises of voice‑controlled systems. This duality underscores the need for continuous security engineering and responsible deployment practices.

Across regions and segments, a consistent theme emerges: organizations that treat audio surveillance as a strategic, integrated capability-rather than as a stand‑alone add‑on to video-are achieving richer coverage and more agile response capabilities. Success increasingly depends on aligning technology choices with specific application needs, regulatory contexts, and long‑term supply considerations. Vendors that build open, secure, and upgradeable platforms, and end users that invest in governance, training, and stakeholder engagement, will be best positioned to harness the full potential of audio surveillance while managing its risks.

In sum, audio surveillance is evolving into a critical layer of the broader security and operational intelligence stack. As this evolution continues, the decisions made today about architectures, partnerships, and governance will shape not only organizational resilience but also public trust in how acoustic monitoring technologies are used.

Engage with Ketan Rohom to access deeper audio surveillance intelligence and unlock the full strategic value of this market research report

Modern audio surveillance decisions are no longer about purchasing isolated microphones or recorders; they are about orchestrating a secure, compliant, and future‑proof acoustic intelligence capability. The full market research report goes far beyond this executive overview, delivering detailed vendor benchmarking, technology roadmaps, regulatory scenario analysis, and granular segmentation views that cannot be captured in a summary.

To translate these insights into decisive action, it is essential to work closely with someone who understands both the technical and commercial dimensions of the market. Engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, creates a dedicated pathway for aligning the report’s findings with your organization’s specific strategic questions, whether they relate to supply chain resilience, AI‑enabled analytics, or regional expansion.

By initiating a conversation with Ketan, decision‑makers can explore tailored purchase options, discuss license structures for broader internal use, and identify which sections of the report are most critical for their immediate planning cycle. This focused engagement helps ensure that investment in the report rapidly converts into practical initiatives, from portfolio realignment and partnership strategies to compliance programs and go‑to‑market refinement.

Now is a pivotal moment for organizations active in security, public safety, defense, and connected devices. Acting today to secure comprehensive intelligence on the audio surveillance landscape will position your team to anticipate regulatory changes, navigate tariff‑driven cost pressures, and capitalize on emerging demand in high‑value applications. Connecting with Ketan to purchase and implement the full report is an actionable step toward building a more informed, resilient, and competitive strategy.

- How big is the Audio Surveillance Market?

- What is the Audio Surveillance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?