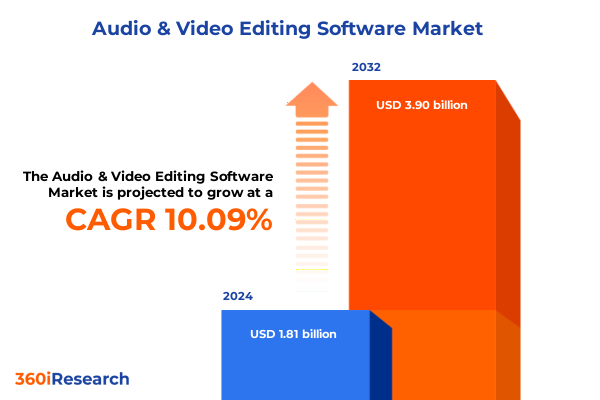

The Audio & Video Editing Software Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.11 billion in 2026, at a CAGR of 10.38% to reach USD 3.90 billion by 2032.

Navigating the Dynamic Convergence of Audio and Video Editing Innovations and Technological Advancements Reshaping the Modern Content Creation Ecosystem

The audio and video editing software sector is experiencing unprecedented growth fueled by the proliferation of short-form content across social media platforms and the rising demand for polished, professional-grade productions. Cloud-based editing platforms saw a 36% adoption increase among content creators in 2023, while AI-driven automation features achieved a 59% uptake among freelancers and influencers, significantly reducing manual workloads and turnaround times. Subscription-based licensing models have overtaken perpetual licenses, accounting for over 62% of software purchases as vendors shift toward recurring revenue streams that enable continuous feature deployments and tighter customer engagement.

Industry showcases have underscored how artificial intelligence has evolved from an experimental add-on to a foundational component of editing workflows. At the 2025 NAB Show, Tiered Generative AI Adoption and Agentic AI emerged as critical imperatives, automating functions ranging from audio calibration and color grading to complex indexing and contextual localization, thereby slashing time-to-market and broadening global distribution capabilities.

Simultaneously, mobile editing applications are empowering creators to produce broadcast-quality audio and video directly from smartphones, while immersive technologies like 360° video and VR editing tools are unlocking new narrative possibilities within interactive 3D environments. These developments herald an era of accessible, efficient, and creatively expansive editing solutions that cater to a diverse spectrum of professional and amateur users.

Embracing Revolutionary Shifts Driven by AI Automation Cloud Collaboration and Immersive Technologies Transforming the Audio and Video Editing Landscape

In recent years, artificial intelligence has transcended its role as a niche enhancement to become a strategic cornerstone of modern editing environments. Tiered AI tools now autonomously perform tasks such as scene detection, noise removal, and audio leveling, while Agentic AI systems can independently manage end-to-end workflows like post-production indexing and culturally nuanced localization, accelerating global content rollouts with minimal human intervention.

Cloud-based collaborative platforms have dismantled geographical and infrastructural barriers, enabling multiple stakeholders to co-edit projects in real time. These environments support concurrent versioning, integrated annotation, and centralized asset management, streamlining feedback loops and ensuring cohesive creative outcomes even when team members span different time zones.

The rapid ascendancy of mobile editing applications, combined with cross-platform compatibility across desktop, web, and mobile interfaces, has democratized content creation. This seamless integration ensures that user projects and assets remain synchronized across devices, empowering editors to maintain momentum and creative continuity regardless of location or hardware constraints.

Pricing paradigms have shifted decisively from one-time perpetual licenses toward subscription-based models that bundle continuous updates, cloud storage, and modular feature sets. This evolution aligns vendor and customer incentives, encouraging ongoing innovation and ensuring that the latest AI enhancements, collaboration tools, and immersive editing capabilities remain accessible as part of a unified service.

Assaying the Broad Ripple Effects of 2025 Section 301 Tariff Measures on Audio and Video Editing Infrastructure and Supply Chain Resilience

Effective January 1, 2025, the Office of the United States Trade Representative implemented a substantive increase in Section 301 tariff rates, elevating duties on solar wafers and polysilicon to 50% and raising tariffs on certain tungsten products to 25%. These measures, part of a broader strategy to counteract unfair trade practices, have implications for the production and procurement of critical hardware components used in audio and video editing systems.

Concurrently, tariffs on semiconductor components under HTS headings 8541 and 8542 were increased from 25% to 50%, significantly impacting the cost structure of processors, memory modules, and integrated circuits that underpin high-performance editing workstations and recording interfaces. In response, several stakeholders have begun evaluating onshore assembly options and forging partnerships with domestic manufacturers to mitigate exposure to elevated import duties and supply chain disruptions.

To balance the need for protection with the imperative of maintaining competitive access to essential technologies, the USTR extended certain product exclusions through August 31, 2025. This temporary relief cushions the immediate impact on equipment costs and affords companies additional time to adapt procurement and production strategies, underscoring the nuanced interplay between trade policy objectives and industry resilience.

Uncovering Multidimensional Segmentation Insights Across Product Types Deployment Modes Platforms Pricing Models End Users and Application Domains

The market structure bifurcates along product type, examining audio editing solutions-encompassing specialized restoration tools alongside full-featured digital audio workstations-and video editing platforms, which range from consumer-aimed applications to professional-grade suites equipped for complex post production. This delineation reveals that audio restoration utilities are increasingly integrated within more expansive editing ecosystems, while demand for high-throughput professional video software underscores a clear divide between consumer-level ease of use and enterprise-grade performance.

Deployment modes also play a pivotal role, from on premise installations that guarantee maximum security and minimal latency to public cloud services that facilitate real-time collaboration and global access. In turn, private cloud configurations and hybrid arrangements offer a balanced blend of control and scalability, enabling organizations to optimize resource allocation according to project criticality and data sensitivity.

Platform segmentation highlights the expanding influence of mobile and web-based editors alongside traditional desktop environments. On mobile, Android and iOS applications are steadily closing the feature gap with desktop counterparts, empowering creators to edit on the move. Web interfaces offer lightweight editing capabilities for quick turnarounds and remote reviews, whereas Windows-based solutions-augmented by Mac and Linux environments-continue to dominate resource-intensive workflows that demand robust hardware acceleration.

Pricing frameworks are equally diverse, encompassing freemium approaches-with ad-supported or feature-limited tiers that lower entry barriers-alongside perpetual license offerings for one-time acquisitions and subscription plans available on annual or monthly terms. This multiplicity allows software providers to cater to both individual hobbyists seeking no-cost entry points and enterprise clients requiring predictable budgeting for comprehensive toolsets.

The end-user landscape stretches from educational institutions, addressing both higher education and K–12 needs for multimedia content creation, to enterprise environments such as healthcare and retail that leverage video and audio editing for training and marketing. At the pinnacle, media entertainment verticals-including broadcast studios and film production houses-drive demand for advanced editing functionalities and compliance with stringent regulatory standards.

Finally, application-based segmentation distinguishes between consumer use cases, where podcasting and vlogging dominate, and professional scenarios like color grading and high-end post production. This contrast illuminates how simplified interfaces and templated workflows serve newcomers, while seasoned professionals rely on granular controls and extensibility to meet exacting project requirements.

This comprehensive research report categorizes the Audio & Video Editing Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Platform

- Deployment Mode

- Application

- End User

Illuminating Regional Variations in Demand and Innovation Across the Americas Europe Middle East Africa and Asia Pacific Markets

The Americas region, led by the United States-which accounted for more than 29% of professional-grade editing software downloads in 2023-continues to embrace cloud-based subscription models and AI-driven features, supported by a mature ecosystem of creative agencies, broadcast networks, and independent studios. Canada has mirrored these trends, with a particular emphasis on remote collaboration tools that accommodate a geographically dispersed workforce.

In Europe, Middle East, and Africa, data sovereignty concerns and regulatory frameworks around content localization have elevated private cloud and hybrid deployment strategies. European studios are pioneering agentic AI applications that automate subtitle generation and multilingual voiceovers, while Middle Eastern and African markets are seeing accelerated investment in localized editing solutions designed to serve diverse linguistic and cultural narratives.

Asia-Pacific represents the fastest-growing cluster, driven by mobile-first economies and burgeoning creative sectors in markets such as India, South Korea, and Japan. Indian content creators have gravitated toward freemium and subscription-based mobile apps to produce short-form videos for social platforms, while professional studios in East Asia are investing heavily in high-resolution post production capabilities. In China, domestic regulations and platform preferences continue to shape unique demand patterns for locally developed editing software.

This comprehensive research report examines key regions that drive the evolution of the Audio & Video Editing Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Innovations from Leading Software Providers Shaping the Future of Audio and Video Editing Solutions

Leading software providers are deploying diverse strategies to maintain competitive positioning. Adobe continues to expand its Sensei AI portfolio across Premiere Pro and Audition, integrating predictive analytics and generative capabilities that streamline editing tasks and accelerate creative experimentation. Blackmagic Design’s DaVinci Resolve leverages its renowned color grading heritage to attract post production professionals, while integrating audio editing modules to foster end-to-end project workflows within a single application.

Simultaneously, Apple’s Final Cut Pro remains the go-to choice for Mac-centric studios seeking optimized performance on proprietary hardware, while Avid’s Media Composer sustains its stronghold in broadcast environments through robust asset management and compliance features. Challenger brands such as CyberLink and Corel are carving out niches by offering cost-effective solutions that emphasize ease of use and rapid onboarding, addressing the needs of emerging creators and small enterprises.

This comprehensive research report delivers an in-depth overview of the principal market players in the Audio & Video Editing Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acon AS

- Adobe, Inc.

- Animoto Inc.

- Apple, Inc.

- ArcSoft, Inc.

- Autodesk, Inc.

- Avid Technology, Inc.

- Banuba Limited

- Blackmagic Design Pty. Ltd.

- Corel Corporation

- Corel Corporation

- CyberLink Corporation

- HairerSoft

- iZotope, Inc.

- MAGIX Software GmbH

- MAXON Computer GmbH

- Microsoft Corporation

- Movavi Software Limited

- Side Effects Software Inc.

- Sony Corporation

- Video Caddy

Actionable Recommendations for Industry Leaders to Capitalize on Emerging Technologies Navigate Tariff Challenges and Drive Collaborative Growth

Industry leaders should prioritize the integration of advanced AI and machine learning capabilities to automate repetitive editing processes, allocate resources toward enhancing agentic AI functionalities for global localization, and develop modular cloud architectures that support hybrid workflows. Concurrently, diversifying platform support to ensure seamless experiences across mobile, web, and desktop environments will be critical to capturing the growing segment of on-the-go content creators.

Organizations must also navigate the evolving tariff landscape by establishing partnerships with domestic hardware manufacturers, exploring localized assembly options for critical components, and leveraging temporary tariff exclusions to minimize cost impacts. Embracing flexible pricing models-ranging from freemium tiers that drive user acquisition to subscription offerings that deliver sustained value-can optimize revenue streams for both enterprise and consumer segments. Finally, fostering strategic alliances with regional distributors and content platforms can accelerate market entry, ensure regulatory compliance, and deliver tailored solutions that resonate with localized user preferences.

Detailing Our Rigorous Research Methodology Leveraging Primary Interviews Secondary Data and Analytical Triangulation for Unbiased Insights

This analysis is grounded in a comprehensive research framework that combines qualitative and quantitative approaches. Primary interviews with senior executives from leading software vendors, production studios, and hardware manufacturers provided nuanced perspectives on strategic priorities, technology roadmaps, and regulatory considerations.

Secondary data was gathered from reputable industry publications, government trade releases, and peer-reviewed studies to validate market dynamics and emerging trends. Analytical triangulation was employed to cross-verify findings across multiple sources, ensuring the reliability and objectivity of insights. The methodology also incorporated expert validation sessions, where independent consultants in media technology and supply chain management reviewed and refined key conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Audio & Video Editing Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Audio & Video Editing Software Market, by Product Type

- Audio & Video Editing Software Market, by Platform

- Audio & Video Editing Software Market, by Deployment Mode

- Audio & Video Editing Software Market, by Application

- Audio & Video Editing Software Market, by End User

- Audio & Video Editing Software Market, by Region

- Audio & Video Editing Software Market, by Group

- Audio & Video Editing Software Market, by Country

- United States Audio & Video Editing Software Market

- China Audio & Video Editing Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Reflections on How Technological Advancements Shifting Market Forces and Regulatory Dynamics Define the Audio and Video Editing Frontier

As audio and video editing software continues its rapid evolution, the interplay of artificial intelligence, cloud collaboration, and mobile democratization is redefining creative workflows. The strategic implications of trade policies-particularly tariff fluctuations-and regional preferences underscore the necessity for agile operational models and diversified deployment methods.

Looking ahead, the convergence of immersive technologies with real-time editing features and subscription-based innovation will shape competitive dynamics, compelling stakeholders to invest in scalable architectures and customer-centric monetization strategies. By balancing technological innovation with regulatory awareness and regional customization, industry participants can navigate market complexities and harness emerging opportunities in the global content creation ecosystem.

Engaging with Ketan Rohom to Secure Comprehensive Market Intelligence and Empower Your Strategic Decisions in Audio Video Editing Software

To explore the full breadth of audio and video editing software market intelligence and gain tailored insights for your organization, reach out directly to Ketan Rohom. As Associate Director of Sales & Marketing, he can provide a detailed consultation and facilitate access to the complete research report. Contact Ketan to secure your strategic advantage and empower decision-making with the most comprehensive data and analysis available in today’s rapidly evolving content creation landscape

- How big is the Audio & Video Editing Software Market?

- What is the Audio & Video Editing Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?