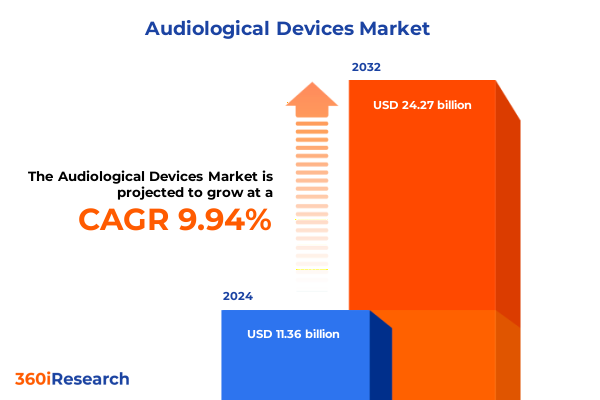

The Audiological Devices Market size was estimated at USD 12.31 billion in 2025 and expected to reach USD 13.34 billion in 2026, at a CAGR of 10.18% to reach USD 24.27 billion by 2032.

Exploring the Critical Role of Modern Hearing Technologies in Enhancing Quality of Life and Addressing Emerging Demographic and Clinical Demands within Audio Health

The audiological devices industry has undergone a remarkable transformation in recent years, propelled by advancements in sensor technology, signal processing algorithms and miniaturization techniques. Rapid demographic shifts, driven by an aging global population and rising awareness of hearing health, have elevated the demand for sophisticated hearing solutions. Consequently, stakeholders across the value chain are investing heavily in research and development to deliver devices that not only enhance auditory experiences but also integrate seamlessly with digital health ecosystems. By leveraging innovations such as machine-learning-powered noise cancellation, wireless connectivity and app-based user interfaces, manufacturers are redefining what it means to provide compassionate and comprehensive care for individuals with hearing impairment.

Furthermore, the convergence of audiological devices with telehealth platforms has created new avenues for remote diagnostics and real-time fitting adjustments. As a result, clinical professionals can extend their reach beyond traditional brick-and-mortar settings, delivering more accessible services to underserved and remote populations. This democratization of hearing healthcare has significant social and economic implications, fostering inclusive communities and reducing long-term care costs. As such, the introduction of connected hearing solutions represents a paradigm shift from mere amplification toward holistic auditory wellness. Looking ahead, the trajectory of audiological devices will be determined by the ability of market participants to blend scientific rigor with empathetic design principles that prioritize both user comfort and clinical efficacy.

Uncovering the Transformative Forces Redefining the Audiological Landscape through Regulatory Shifts Clinical Innovations and Changing Consumer Expectations

The landscape of audiological devices is being reshaped by a confluence of transformative forces that span regulatory, technological and consumer domains. On the regulatory front, authorities in key markets have introduced more stringent standards for device safety, electromagnetic compatibility and data privacy. These updated requirements, while ensuring higher levels of patient protection, have prompted manufacturers to accelerate compliance efforts and certify next-generation solutions under revised protocols. In parallel, technological breakthroughs in microelectromechanical systems have enabled the integration of advanced sensors that detect environmental cues and adapt amplification profiles in real time, enhancing speech comprehension in complex acoustic environments.

Consumer expectations are also evolving, with users demanding personalized experiences and seamless interoperability between devices and smartphones. This trend has encouraged alliances with leading consumer electronics brands and spurred the development of open-platform architectures. As a result, forward-thinking companies are deploying over-the-air software updates to enhance device functionality post-purchase, fostering ongoing engagement and loyalty. Taken together, these shifts underscore a broader movement toward patient-centric innovation, in which audiological devices are no longer static instruments but dynamic companions that continuously learn and adjust to individual lifestyles.

Assessing the Cumulative Impact of 2025 United States Trade Tariffs on Supply Chains Component Costs and Pricing Dynamics within the Audiological Device Sector

The cumulative impact of United States tariffs implemented in 2025 is exerting upward pressure on component costs and complicating global supply chain logistics for audiological device manufacturers. Tariffs on microchips, digital signal processors and specialized metals have increased the landed cost of frontline components, compelling procurement teams to seek alternative sources and renegotiate supplier contracts. To mitigate margin erosion, several vendors have turned to strategic inventory buffering and regional assembly hubs, albeit at the expense of elevated working capital requirements.

Subsequently, these cost adjustments have manifested in modest price hikes for end users, particularly in premium hearing aid categories where high-precision parts are integral to performance. Nonetheless, sustained demand driven by demographic imperatives has tempered market resistance to these increases. In fact, some manufacturers have redirected tariff-related cost impacts toward value-added services, such as extended warranties and digital health subscriptions, thereby preserving their competitive positioning. Ultimately, the 2025 tariff environment underscores the importance of agile supply chain design and underscores the strategic value of near-shore manufacturing partnerships.

Revealing Key Market Segmentation Insights Across Product Typology Distribution Channels and User Demographics Shaping the Audiological Devices Landscape

A nuanced segmentation analysis reveals the complexity and diversity of the audiological devices market. Based on product type, offerings span assistive listening devices, bone anchored hearing systems, cochlear implants and middle ear implants alongside a robust hearing aid category that encompasses behind the ear, completely in canal, in the canal, in the ear and receiver in canal models. Distribution channels range from hospitals and clinics to online retail platforms and traditional retail pharmacies, reflecting both clinical procurement pathways and growing digital marketplaces. End users include ENT clinics, home healthcare providers and hospital networks, each with distinct purchasing criteria and service requirements.

Meanwhile, the evolution from analog to digital technology types has driven improvements in sound fidelity and enabled advanced features such as feedback cancellation and adaptive directional microphones. Battery preferences also segment the market between disposable cells, prized for ease of replacement, and rechargeable units, valued for their sustainability and total cost of ownership benefits. Finally, age group segmentation-adult, geriatric and pediatric-captures diverse usage patterns and clinical protocols, highlighting the need for age-specific fitting software and service models. By integrating these segmentation dimensions, decision makers can tailor product roadmaps, align distribution investments and refine user engagement strategies.

This comprehensive research report categorizes the Audiological Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology Type

- Battery Type

- Age Group

- Distribution Channel

- End User

Analyzing Regional Market Dynamics in the Americas EMEA and Asia Pacific to Identify Growth Drivers Barriers and Strategic Opportunities in Audiological Devices

Regional dynamics are shaping distinct contours of growth, innovation and competitive intensity in the audiological devices market. In the Americas, North American penetration remains robust due to widespread insurance coverage, high consumer awareness and the presence of leading research institutions. Latin American markets, while still nascent, are experiencing gradual expansion fueled by public health initiatives and partnerships aimed at improving rural access to hearing care.

Conversely, Europe, the Middle East and Africa present a tapestry of heterogeneous regulatory environments and reimbursement schemes. Western Europe maintains a mature ecosystem where bundled service and device contracts are common, whereas in parts of Eastern Europe and the Middle East, infrastructure constraints and variable insurance coverage present both challenges and opportunities for localized market entrants. Turning to Asia Pacific, expedited urbanization and increasing per capita healthcare spending are driving demand, with countries such as China, Japan and Australia leading adoption of digital and rechargeable technologies. Simultaneously, rapidly growing populations in Southeast Asia and India offer a vast, underserved patient base, prompting manufacturers to adapt channel strategies and leverage tele-audiology solutions for remote fitting and support.

This comprehensive research report examines key regions that drive the evolution of the Audiological Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborations Driving Competitive Advantage and Technological Leadership in the Global Audiological Devices Market

Leading companies in the audiological devices sector are leveraging proprietary research, strategic alliances and targeted investments to fortify their market positions. Innovative players have made significant strides in the intersection of auditory health and digital ecosystems, launching smartphone-integrated hearing solutions and cloud-based analytics platforms that deliver real-time usage insights. Collaborative ventures between device manufacturers and telehealth providers are expanding access, particularly in rural and underserved regions, while partnerships with academic institutions are accelerating breakthroughs in gene therapy approaches for hearing restoration.

At the same time, a wave of acquisitions and joint ventures is reshaping competitive dynamics. Established hearing aid providers are acquiring niche technology startups to bolster portfolios with advanced sensor arrays and biometric monitoring features. Meanwhile, prominent cochlear implant manufacturers are broadening their service offerings to include ongoing auditory training applications and remote audiologist support. Together, these strategic initiatives reflect a broader trend toward vertically integrated business models that combine device hardware, software services and clinical care pathways into unified value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Audiological Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amplifon Hearing Health Care, Corp.

- Arphi Electronics Private Limited

- Audifon GmbH & Co. KG

- Beltone Group

- Cochlear Limited

- Eargo Inc.

- Earlens Corp.

- GN Store Nord A/S

- Horentek Hearing Diagnostics

- IN4 Technology Corporation

- Interacoustics A/S

- INVENTIS NORTH AMERICA INC.

- MED-EL Medical Electronics GmbH

- Rion Co., Ltd.

- SeboTek Hearing Systems, LLC

- Sonova Holding AG

- Starkey Hearing Technologies, Inc.

- Unitron

- William Demant Holding A/S

- WS Audiology A/S

Outlining Actionable Strategic Recommendations for Industry Leaders to Navigate Regulatory Challenges Disruptive Technologies and Evolving Consumer Preferences

Industry leaders must adopt a multi-pronged strategy to thrive amid regulatory complexity, technological disruption and shifting patient expectations. First, investing in modular product architectures and scalable manufacturing platforms will enhance supply chain resilience and cost efficiency, enabling rapid adaptation to evolving tariff environments and component shortages. Second, deepening engagement with digital health stakeholders-such as telehealth providers, EMR platforms and data analytics firms-will unlock new revenue streams and foster stickier customer relationships through recurring service models.

Moreover, manufacturers should prioritize inclusive design principles that address the needs of pediatric, adult and geriatric users alike, incorporating user feedback loops into product development lifecycles. This, in turn, will reinforce brand loyalty and support premium pricing strategies. Finally, proactive regulatory intelligence and advocacy efforts are critical; by collaborating with standards bodies and participating in public-private working groups, companies can influence emerging guidelines, accelerate approval timelines and ensure that patient safety remains paramount.

Detailing the Rigorous Research Methodology Employed to Deliver Comprehensive and Reliable Insights into the Audiological Devices Market Space

This research leverages a multi-method approach to ensure both breadth and depth in its findings. A comprehensive review of public regulatory documents, patent filings and clinical trial registries was conducted to map the innovation landscape and identify key technological inflection points. Primary qualitative interviews with audiologists, procurement specialists and patient advocacy groups were supplemented by quantitative analysis of device shipment data, component pricing trends and reimbursement claims statistics.

Additionally, regional market experts were engaged to contextualize growth drivers and operational constraints across the Americas, EMEA and Asia Pacific. Segmentation analyses across product type, distribution channel, end user, technology type, battery preference and age group were performed to delineate discrete customer needs and competitive intensity. Rigorous data triangulation and validation processes were applied at each stage to reconcile discrepancies and ensure the reliability of insights. The result is a robust, actionable framework designed to support strategic decision making across the audiological devices value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Audiological Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Audiological Devices Market, by Product Type

- Audiological Devices Market, by Technology Type

- Audiological Devices Market, by Battery Type

- Audiological Devices Market, by Age Group

- Audiological Devices Market, by Distribution Channel

- Audiological Devices Market, by End User

- Audiological Devices Market, by Region

- Audiological Devices Market, by Group

- Audiological Devices Market, by Country

- United States Audiological Devices Market

- China Audiological Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Future Trajectory of Audiological Devices Emphasizing Innovation Adoption Regulatory Adaptation and Market Resilience

In conclusion, the audiological devices market stands at a pivotal juncture defined by demographic imperatives, technological maturation and evolving regulatory landscapes. Companies that invest in connected ecosystems, modular product platforms and inclusive design will be best positioned to capture the expanding base of hearing health consumers. Meanwhile, the 2025 tariff environment underscores the importance of supply chain agility and near-shore manufacturing partnerships to mitigate cost headwinds.

Looking forward, continued convergence between digital health and audiological care is expected to unlock new models of remote diagnostics, personalized therapy and subscription-based service offerings. Organizations that remain proactive in regulatory engagement and leverage advanced data analytics will emerge as the market’s most resilient and innovative leaders. Ultimately, success will hinge on the ability to align scientific rigor with empathetic user experiences, ensuring that hearing solutions not only restore sound but also enhance quality of life across all demographics.

Engage with Ketan Rohom for Exclusive Audiological Devices Market Intelligence and Customized Insights to Accelerate Strategic Decision Making

If you are seeking to harness the strategic insights and market intelligence necessary to stay ahead in the rapidly evolving audiological devices industry, reach out to Ketan Rohom. As Associate Director, Sales & Marketing, he can provide you with a tailored market research report that delivers in-depth analysis of industry trends, tariff impacts, segmentation dynamics and competitive benchmarking. Engage with him to unlock actionable data, customized competitive landscapes and expert recommendations designed to support your strategic planning, product development and go-to-market initiatives. Invest in comprehensive research today to empower your organization with the insights needed to make confident, data-driven decisions and maximize market opportunities.

- How big is the Audiological Devices Market?

- What is the Audiological Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?