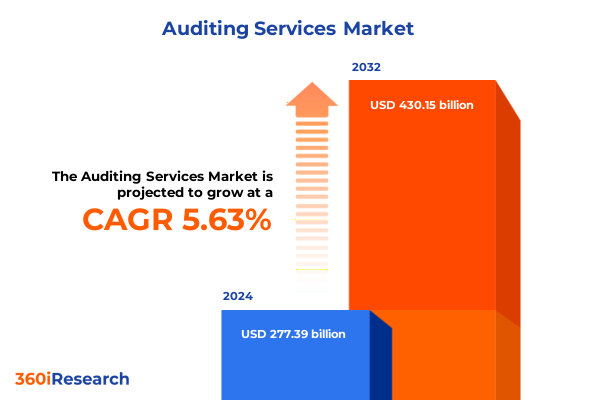

The Auditing Services Market size was estimated at USD 292.26 billion in 2025 and expected to reach USD 308.13 billion in 2026, at a CAGR of 5.67% to reach USD 430.15 billion by 2032.

Setting the Stage for Comprehensive Auditing Services Insights to Empower Decision Makers and Drive Operational Excellence

In an increasingly complex corporate landscape, auditing services serve as a critical backbone for organizations striving to uphold the highest standards of governance, transparency, and operational integrity. The introduction of stringent regulatory requirements, coupled with evolving stakeholder expectations, has heightened the role of auditing from a routine compliance exercise to a strategic lever that drives trust and long-term sustainability. This executive summary offers a panoramic view of the auditing services domain, showcasing how advanced methodologies and specialized expertise converge to deliver robust risk management and strategic foresight.

The rapid integration of digital technologies into audit processes has reshaped traditional paradigms, propelling data analytics, continuous monitoring, and real-time reporting from aspirational capabilities to foundational components of contemporary audit practice. As organizations navigate this shift, the need for a comprehensive understanding of service types, delivery models, and sector-specific requirements becomes paramount. Decision makers must appreciate the nuanced interplay between financial scrutiny, operational assessment, and social responsibility to harness the full potential of auditing as more than a mere checkbox exercise.

By illuminating key transformation drivers, regional nuances, and competitive dynamics, this section lays the groundwork for an in-depth exploration of how auditing services are evolving to meet the demands of the modern enterprise. Whether you are considering the deployment of advanced data analytics or evaluating the balance between in-house and outsourced audit capabilities, the insights provided herein will equip you to make informed strategic decisions.

Navigating Rapid Transformations in Auditing Practices Amidst Technological Advances, Evolving Regulatory Demands, and Global Market Dynamics

The auditing services landscape has undergone a radical metamorphosis driven by rapid technological advancements, heightened regulatory scrutiny, and the emergence of environmental, social, and governance (ESG) imperatives. Traditional audit engagements, once centered primarily on financial verification, have expanded to encompass a broader spectrum of compliance, operational efficiency, and risk mitigation services. This transformation reflects a fundamental shift in the role of auditors from scorekeepers to strategic advisors, collaborating closely with leadership teams to fortify resilience and foster sustainable growth.

One of the most significant shifts is the widespread adoption of data analytics and artificial intelligence, enabling audit professionals to sift through vast volumes of transactional and operational data with unprecedented speed and precision. Machine learning algorithms now identify anomalies, predict risk patterns, and prioritize high-impact areas for in‐depth examination. Consequently, the audit cycle has accelerated, facilitating more timely insights that drive continuous improvement. As a result, clients increasingly view auditing as an iterative process rather than a periodic obligation, heightening the value proposition of firms that can deliver agile, tech-enabled solutions.

Simultaneously, regulators and stakeholders demand greater transparency and accountability in areas such as sustainability reporting and cyber risk management. Firms are now expected to validate environmental and social data with the same rigor as financial statements, integrating frameworks such as the Task Force on Climate‐Related Financial Disclosures (TCFD) into audit protocols. This convergence of financial, operational, and ESG assurance underscores the necessity for multidisciplinary expertise and seamless collaboration across audit teams and organizational functions.

Moreover, global economic volatility and supply chain disruptions have elevated the importance of forensic and operational audits, as organizations seek to safeguard assets and ensure business continuity. The proliferation of regulatory changes, from data privacy laws to international trade policies, demands a dynamic approach that can adapt to shifting requirements and real-time developments. In this environment, audit providers that can anticipate emerging risks and craft bespoke frameworks will distinguish themselves as indispensable partners in the journey toward operational excellence and regulatory compliance.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Auditing Service Providers and Stakeholder Ecosystems

The implementation of new United States tariff measures in early 2025 has injected additional complexity into the auditing services marketplace, particularly for organizations with extensive import‐export activities. Higher duties on critical raw materials and capital goods have led to disrupted cost structures and altered risk profiles across industries such as manufacturing, technology, and retail. Audit professionals must now incorporate tariff compliance checks into standard financial and operational assessments to ensure that clients remain aligned with shifting import regulations and avoid inadvertent exposures.

Furthermore, these tariffs have prompted a reassessment of global supply chain strategies, driving many firms to diversify suppliers or localize production closer to end markets. This strategic pivot introduces fresh auditing requirements, from verifying the authenticity of locally sourced components to evaluating the financial viability of alternative production models. In turn, audit teams must broaden their scope to include scenario analysis and stress testing that account for fluctuating tariff regimes and geopolitical uncertainties.

From a risk management perspective, the cumulative impact of these tariff adjustments extends to cash flow forecasting and working capital optimization. Auditors are increasingly tasked with scrutinizing the effects of duty recalibrations on import ledgers, ensuring that reserve calculations and liquidity management practices reflect the latest tariff schedules. This expanded audit remit has elevated the importance of specialized expertise in international trade compliance, necessitating partnerships with customs law specialists and supply chain risk consultants.

As the U.S. government signals potential further measures in response to global trade dynamics, audit engagements must remain agile. Firms that integrate real-time trade data and leverage predictive analytics can anticipate tariff fluctuations and proactively adjust their audit frameworks. By embedding tariff analysis into core assurance processes, auditors transform a complex regulatory challenge into an opportunity to guide clients toward more resilient, cost-efficient operations.

Unveiling Deep-Dive Segmentation Perspectives Across Audit Types, Delivery Modes, End-Uses, and Organizational Scales to Illuminate Strategic Opportunities

A nuanced understanding of market segmentation is essential for audit firms seeking to tailor their services and address the diverse needs of clients across sectors and operational scales. When examining service offerings based on type, it becomes clear that each specialized audit category-from compliance and environmental assessments to simulation-driven financial reviews and advanced information system evaluations-demands unique technical skills and customized methodologies. This diversity underscores the imperative for continuous talent development and cross-disciplinary knowledge sharing within audit teams.

Mode of delivery represents another critical dimension of segmentation. Organizations often face the choice between leveraging internal resources and engaging external experts, with in-house audits offering deeper enterprise knowledge and outsourced engagements providing access to specialized tools and broader market insights. The decision hinges on factors such as regulatory complexity, cost optimization goals, and the desired level of independence in assurance processes.

End-use segmentation further refines market approaches, as sectors such as energy and utilities confront unique environmental and safety regulations, while financial services providers adhere to stringent capital adequacy and anti-money laundering standards. Government and public sector entities require transparency in budget allocations, whereas healthcare organizations must balance compliance with patient privacy considerations. Manufacturing and retail businesses focus on supply chain integrity and loss prevention, and technology and telecom clients emphasize cybersecurity and intellectual property safeguards.

Organizational size adds a final layer of strategic nuance. Large enterprises often pursue integrated audit programs that encompass multiple service types and geographies, supported by dedicated internal audit departments and global provider networks. In contrast, small and medium enterprises prioritize cost-effective, high-impact engagements that can be rapidly deployed to address immediate compliance or operational challenges. By aligning audit offerings with these segmentation insights, service providers can craft differentiated propositions that resonate with the specific requirements and risk appetites of each client segment.

This comprehensive research report categorizes the Auditing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Mode

- End-use

- Organization Size

Exploring Regional Nuances and Growth Catalysts in the Americas, Europe Middle East and Africa, and Asia-Pacific Audit Markets

Regional dynamics exert a profound influence on the adoption and evolution of auditing services, shaped by regulatory frameworks, economic growth patterns, and cultural attitudes toward governance. In the Americas, established economies with mature capital markets drive demand for sophisticated financial and forensic audits, leveraging advanced data analytics to optimize internal controls and meet high investor scrutiny. At the same time, emerging markets within the region fuel growth in environmental and social audits, as corporations and regulators alike emphasize sustainability and community impact.

Across Europe, the Middle East, and Africa, regulatory harmonization initiatives such as those under the European Union foster a rigorous compliance landscape that prioritizes data privacy, anti-corruption controls, and ESG disclosures. Firms operating in this region must navigate a complex mosaic of national statutes while also aligning with pan-regional directives, creating robust demand for cross-border audit capabilities and multilingual expert teams. In the Middle East and Africa, rapid infrastructure development and public sector modernization initiatives drive an increased reliance on both internal and external assurance services.

In the Asia-Pacific region, dynamic economic expansion and digital transformation have propelled a surge in information system audits and cybersecurity assessments. Regulatory bodies across jurisdictions are rapidly codifying data protection standards, while multinational corporations seek to harmonize reporting practices across diverse legal regimes. Meanwhile, the burgeoning manufacturing and telecom sectors in Asia-Pacific present unique operational risks, from supply chain disruptions to intellectual property compliance, that require specialized audit frameworks.

Taken together, these regional variations highlight the necessity for audit service providers to cultivate local expertise while maintaining global best practices. By blending deep regional insights with standardized methodologies, firms can deliver consistent quality and actionable recommendations that resonate with stakeholders across the Americas, EMEA, and Asia-Pacific markets.

This comprehensive research report examines key regions that drive the evolution of the Auditing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Auditing Service Providers and Their Strategic Initiatives Shaping the Competitive Landscape and Innovation Trajectories

A close examination of leading audit providers reveals a competitive landscape defined by both scale and specialization. Large, global firms have leveraged their broad resource pools and established reputations to expand service portfolios, integrating advanced analytics platforms and proprietary methodologies into their engagements. These organizations maintain extensive networks of industry specialists and regulatory experts, enabling them to handle complex, cross-border assignments with agility and precision.

At the same time, agile mid-tier and boutique firms capitalize on their ability to offer highly tailored services and rapid response times. By focusing on niche segments-such as environmental and social assurance or forensic and fraud investigations-these providers differentiate themselves through deep domain expertise and flexible delivery models. Their client-centric approach often features dedicated engagement teams, bespoke reporting frameworks, and direct access to senior leadership in each project.

Innovation is also reshaping competitive dynamics, as providers integrate cutting-edge technologies such as robotic process automation and natural language processing to streamline routine audit tasks and enhance error detection. Partnerships with technology vendors and research institutions have become instrumental in developing next-generation audit tools that can correlate disparate data sets, automate control testing, and deliver predictive risk insights.

Finally, strategic alliances and joint ventures are emerging as key growth strategies. By collaborating with consulting firms and niche specialists, audit providers can deliver end-to-end solutions that encompass everything from initial risk assessment and internal control design to post-implementation reviews and continuous monitoring. These collaborative models offer clients a unified advisory experience while allowing each firm to leverage its core competencies effectively.

This comprehensive research report delivers an in-depth overview of the principal market players in the Auditing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armanino LLP

- Baker Tilly US, LLP

- BDO International Limited

- Caonweb Pvt. Ltd.

- CBIZ CPAs P.C.

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- FORVIS, LLP

- Friedman LLP

- Grant Thornton LLP

- Healy Consultants Group PLC

- KPMG International Limited

- Ledoux, Petruska & Co., Inc.

- Marcum LLP

- Maxim Audit and Consultants

- Mayer Hoffman McCann P.C.

- Moore Global Network Limited

- Nexia International Limited

- PricewaterhouseCoopers LLP

- Protiviti Inc.

- RSM International Ltd.

- Schooley Mitchell

- SGS SA

- Steven Sewald & Co., CPAs & Consultants

Delivering Tactical Recommendations for Auditing Service Leaders to Strengthen Governance, Embrace Innovation, and Enhance Client Value

To maintain a leadership position in the dynamic auditing services arena, firms must embrace a multifaceted strategy that prioritizes innovation, operational excellence, and proactive client engagement. First, investing in advanced data analytics capabilities is essential. By deploying machine learning algorithms and predictive modeling, audit teams can identify emerging risk patterns and allocate resources to high-risk areas, thereby delivering deeper insights and faster cycle times.

Second, cultivating multidisciplinary talent is critical. Beyond traditional accounting and audit skills, professionals with expertise in ESG metrics, cybersecurity assessment, and international trade compliance will become invaluable assets. Structured training programs, cross-functional rotations, and partnerships with academic institutions can help build this specialized workforce.

Third, forging strategic partnerships can amplify service offerings. Collaborations with technology vendors, supply chain consultants, and legal experts enable comprehensive audit solutions that address clients’ evolving needs. These alliances also facilitate the integration of external data sources and niche expertise into audit methodologies, enhancing the depth and relevance of assurance reports.

Additionally, firms should refine their client engagement models by adopting continuous auditing approaches. Real-time reporting dashboards and automated control monitoring can transform periodic audits into ongoing assurance services, providing clients with immediate visibility into risk indicators and compliance gaps. This proactive model not only strengthens client relationships but also creates new revenue opportunities through subscription-based service offerings.

Finally, enhancing communication and thought leadership will reinforce market positioning. Publishing insightful white papers, hosting industry webinars, and participating in regulatory development forums demonstrate a commitment to advancing the profession. By articulating a clear vision for how auditing services will evolve in a digital and sustainable economy, firms can attract forward-thinking clients and set the agenda for industry best practices.

Detailing Rigorous Research Approaches, Analytical Frameworks, and Quality Assurance Protocols Underpinning the Auditing Services Market Study

A rigorous research methodology underlies every reliable market analysis, ensuring that insights are grounded in robust data and objective evaluation. The process begins with comprehensive secondary research, where regulatory filings, industry publications, and thought leadership papers are systematically reviewed to map out the market landscape and identify prevailing trends. This desk research sets the stage for targeted primary research activities.

In the primary phase, qualitative interviews with key industry stakeholders-such as audit firm partners, compliance officers, and corporate financial executives-provide firsthand perspectives on emerging challenges and strategic imperatives. These discussions are complemented by structured surveys that quantify the adoption rates of various service types and capture buyer preferences across different organizational sizes and regions.

Data triangulation serves as the cornerstone of analytical integrity. By cross-verifying information from multiple sources, the research team mitigates bias and validates critical findings. Advanced statistical tools and thematic analysis techniques are employed to synthesize quantitative and qualitative inputs into coherent narratives that reveal underlying market dynamics.

Quality assurance protocols further enhance the credibility of the study. Intermediate deliverables undergo multiple rounds of fact-checking and peer review, with revisions incorporated based on feedback from subject-matter experts. Final outputs are scrutinized for consistency, logical coherence, and alignment with the research objectives.

By combining systematic data gathering with rigorous analytical frameworks and stringent validation processes, this methodology ensures that the resulting insights are both comprehensive and actionable. Stakeholders can have confidence that the conclusions drawn reflect a multidimensional understanding of the auditing services market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Auditing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Auditing Services Market, by Type

- Auditing Services Market, by Mode

- Auditing Services Market, by End-use

- Auditing Services Market, by Organization Size

- Auditing Services Market, by Region

- Auditing Services Market, by Group

- Auditing Services Market, by Country

- United States Auditing Services Market

- China Auditing Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Strategic Takeaways and Forward-Looking Perspectives to Guide Stakeholders in the Evolving Auditing Services Ecosystem

In conclusion, the auditing services market stands at a pivotal juncture where technological innovation, regulatory evolution, and strategic imperatives converge to reshape industry standards. As data analytics and AI become integral to audit methodologies, firms that embrace these tools will unlock new dimensions of insight and operational efficiency. Simultaneously, the growing emphasis on ESG assurance and international trade compliance presents both challenges and opportunities for service providers to expand their advisory capabilities.

Segmentation analysis underscores the importance of tailored approaches, whether through specialized audit types, flexible delivery modes, or sector-specific expertise. Regional variations further highlight the need for local knowledge fused with global best practices, from the Americas’ mature financial markets to the Asia-Pacific’s rapid digital transformation.

Competitive dynamics continue to evolve, driven by the entry of agile boutiques, strategic alliances, and technology partnerships. To thrive in this environment, audit firms must focus on talent development, continuous process innovation, and proactive client engagement models. By doing so, they will not only meet the rigorous demands of regulators and stakeholders but also elevate auditing from a compliance function to a strategic catalyst for sustainable growth.

Ultimately, the insights and recommendations presented in this summary offer a roadmap for organizations seeking to harness the full potential of auditing services. Stakeholders who leverage these perspectives will be best positioned to navigate uncertainty, seize emerging opportunities, and fortify their governance frameworks for the challenges and possibilities that lie ahead.

Engage with Ketan Rohom to Unlock Comprehensive Auditing Services Insights and Accelerate Informed Decision-Making Through Premium Market Reports

To explore how these strategic insights can directly benefit your organization and secure access to the complete market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage with Ketan to discuss tailored solutions, unlock detailed data analyses across audit segments, and receive expert guidance for implementing best practices derived from our comprehensive study. Take advantage of this opportunity to leverage in-depth perspectives that will elevate your auditing service strategies and inform critical investment decisions. Begin your journey toward enhanced operational resilience and competitive advantage by contacting Ketan Rohom today.

- How big is the Auditing Services Market?

- What is the Auditing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?