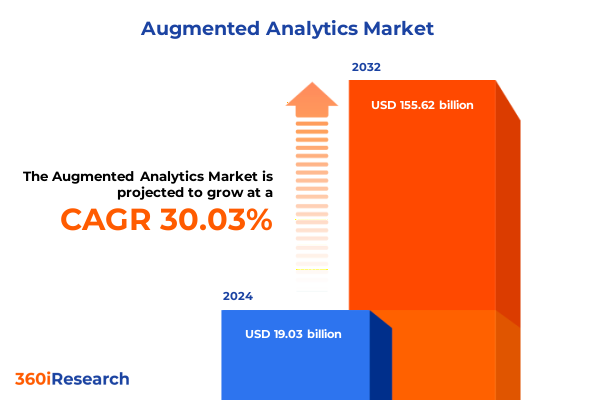

The Augmented Analytics Market size was estimated at USD 24.27 billion in 2025 and expected to reach USD 31.19 billion in 2026, at a CAGR of 30.40% to reach USD 155.62 billion by 2032.

Embracing AI-Powered Augmented Analytics to Propel Data-Driven Decision-Making and Transform Business Intelligence in an Era of Rapid Technological Evolution

As organizations grapple with an ever-expanding universe of data, augmented analytics has emerged as a critical lever for transforming raw information into actionable intelligence. By embedding artificial intelligence and machine learning directly into analytics workflows, this approach helps surface patterns and trends that traditionally required extensive manual effort by data scientists. Consequently, business leaders can focus on strategic interpretation rather than time-consuming data preparation and exploration.

Driven by advances in natural language processing and automated machine learning, augmented analytics platforms democratize the ability to generate insights across functions and skill levels. Rather than relying on a centralized analytics team, frontline users in finance, marketing, sales, and operations can now interrogate data conversationally, receive automated recommendations, and visualize complex scenarios in real time. This shift not only accelerates decision cycles but also elevates overall data literacy.

With the convergence of cloud-native architectures and agentic AI frameworks, the boundary between human reasoning and machine-driven analysis is increasingly blurred. Organizations adopting these solutions find themselves better equipped to respond to market volatility, optimize resource allocation, and innovate at scale. As we look ahead, the integration of embedded AI assistants and autonomous agents will redefine the role of analytics, enabling truly intelligent enterprises to outpace their peers.

Navigating the Dynamic Transformation of Analytics: How Augmented Capabilities Are Redefining Data Processing, User Interaction and Strategic Insights

The analytics landscape is undergoing a profound metamorphosis as machine learning, generative AI, and edge computing reshape how data is collected, processed, and interpreted. No longer confined to static dashboards, analytics now delivers dynamic, context-aware narratives that adapt to the user’s question and the evolving data environment. This paradigm shift is driven by breakthroughs in natural language generation, which enable systems to explain key drivers behind trends without the need for specialized coding skills.

In tandem, edge computing is decentralizing analytics, bringing near-instantaneous insights to IoT devices and remote sensors. Industries such as manufacturing and logistics are harnessing on-site data processing capabilities to respond to events in milliseconds, whether that involves recalibrating production lines or rerouting shipments in real time. As a result, organizations can embed analytics into operational workflows, stretching from shop floor control to predictive maintenance.

Moreover, the rise of agentic AI frameworks has introduced autonomous assistants capable of executing multi-step analytics tasks, collaborating with human experts to drive continuous improvement. These intelligent agents can proactively identify anomalies, recommend next-best actions, and even initiate data collection pipelines without explicit user instruction. The cumulative effect is a transition from reactive reporting to proactive, goal-oriented analytics that anticipates business needs.

Assessing the Broad Economic Ripples of 2025 U.S. Tariff Policies on Pricing Structures, Supply Chain Resilience and Corporate Financial Health

The United States’ tariff policies enacted throughout 2025 have generated a wide array of economic repercussions that ripple through supply chains, consumer pricing, and corporate profitability. Early in the year, the effective tariff rate climbed to 22.5 percent-the highest level recorded since 1909-prompting immediate cost pressures on imported raw materials and finished goods. Analysts observed short-term consumer price inflation rising by approximately 2.3 percent, translating into an average household expense increase near $3,800 in 2024 dollars.

By midyear, subsequent court decisions had narrowed the scope of enforceable tariffs to those under Section 232 authority, including steel, aluminum, and autos. This recalibration lowered the average rate to 14.7 percent but maintained the highest tariff burden seen since the late 1930s. In the short run, these measures still produced a 1.5 percent uptick in consumer prices, equating to about a $2,000 loss per household in 2025 dollars. While businesses initially absorbed much of the increased costs into margins, pressure on profit pools intensified across sectors such as automotive manufacturing and specialty chemicals.

Despite stable headline inflation through June, economists warn that the deferred impact on consumers may materialize in late 2025 as companies exhaust existing inventory buffers. Treasury data indicates tariff revenues could reach $300 billion by year’s end, further influencing fiscal considerations. In the long run, sustained elevated tariffs risk suppressing real GDP growth by up to 0.7 percentage points and reducing payrolls by more than half a million positions, underscoring the profound and multifaceted impact of these trade measures.

Gaining Deep Market Intelligence by Unpacking Component, Deployment, User, Application and Industry Vertical Differentiators

Understanding market dynamics requires a nuanced view of how different components, deployment modes, user segments, application areas, and industry verticals interact to shape demand for augmented analytics. From a component standpoint, platforms that integrate AI-driven visualization, natural language querying, and automated insights are rapidly eclipsing standalone services, which focus on ad hoc modeling and consulting support.

When considering deployment, cloud-based solutions offer unparalleled scalability and continuous delivery of the latest AI enhancements, while on-premises installations appeal to organizations with stringent data sovereignty or latency requirements. These divergent approaches reflect varying priorities around security, customization and total cost of ownership.

End users span the full enterprise spectrum. Large corporations leverage augmented analytics to orchestrate complex, cross-border data initiatives, embedding AI assistants into global decision workflows. Meanwhile, small and midsize businesses capitalize on self-service tools to accelerate time to insight and foster data-driven cultures without the need for extensive IT resources.

Applications extend across functions. In finance, performance analytics and risk analytics frameworks help CFOs simulate scenarios and satisfy regulatory mandates. Human resources teams deploy talent analytics and workforce planning modules to optimize headcount and reduce turnover. Marketing uses campaign analytics and customer analytics to personalize outreach and measure attribution, while sales organizations rely on customer analytics, forecasting and performance management to drive quotas and accelerate revenue. Supply chain professionals harness demand forecasting and inventory optimization to reduce stockouts and lower carrying costs.

Finally, industry verticals impose unique requirements. Financial services institutions require rigorous governance and audit trails, government and defense agencies prioritize secure, mission-critical deployments, and healthcare organizations demand compliant, privacy-preserving analytics. Meanwhile, IT and telecom, manufacturing, retail and e-commerce, and transportation and logistics each impose specialized data integration and real-time decisioning imperatives.

This comprehensive research report categorizes the Augmented Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment Mode

- End User

- Application

- End-use

Exploring Regional Nuances in Adoption and Innovation Across the Americas, Europe Middle East & Africa and Asia-Pacific Markets

Geographic context plays a pivotal role in the adoption trajectory and innovation intensity of augmented analytics solutions. In the Americas, maturity levels are highest, driven by widespread cloud infrastructure and robust venture funding for AI startups. North American enterprises lead in embedding natural language query interfaces and generative AI assistants in customer-facing applications, while Latin American businesses are increasingly adopting self-service analytics to bridge insight gaps amid resource constraints.

Across Europe, the Middle East and Africa, regulatory frameworks such as GDPR inform stringent data governance practices, spurring the rise of privacy-preserving analytics and federated learning models. Western Europe demonstrates steady uptake of cloud-centric augmented analytics, whereas emerging markets in the Middle East and Africa capitalize on cloud-based plug-and-play solutions to overcome legacy infrastructure challenges and accelerate digital transformation.

The Asia-Pacific region exhibits the fastest growth in both adoption and vendor innovation. Government-driven initiatives, particularly in China, Singapore and Australia, prioritize AI-driven analytics for public health, smart cities and manufacturing excellence. Local vendors blend generative AI with domain-specific expertise to tailor solutions for retail giants, financial conglomerates, and high-volume logistics providers. Cross-border consortia further catalyze shared innovation, leveraging pooled data assets to refine machine learning models for regional benchmarks and emerging use cases.

This comprehensive research report examines key regions that drive the evolution of the Augmented Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Technology Providers Driving the Evolution of Augmented Analytics with AI Integration and Enterprise-Grade Innovation

The competitive landscape for augmented analytics is anchored by a blend of established enterprise software titans and specialized AI-driven challengers. Microsoft’s Power BI, enhanced by Copilot capabilities and seamless integration with the Fabric ecosystem, continues to set the benchmark for cross-functional analytics with strong adoption among existing Microsoft 365 customers. Salesforce’s Tableau platform, underpinned by Einstein Discovery and the new Tableau Next architecture, excels in visual storytelling and community-driven innovation, solidifying its position among large-scale enterprises.

IBM’s Cognos Analytics has steadily integrated watsonx BI Assistant, delivering governed metrics catalogs and natural language generation to enable sophisticated decision support across regulated industries. SAP Analytics Cloud differentiates through its Joule copilot and industry-specific planning modules, appealing to organizations seeking tight integration between analytics and enterprise resource planning workflows.

Qlik distinguishes itself with its associative engine and Qlik AutoML suite, delivering automated machine learning and natural language interaction for cloud- and application-agnostic deployments. SAS Viya’s decision-intelligence framework and Viya Copilot reflect its depth in regulated industries, adding bias detection and governance controls to autonomous analytics agents. Oracle Analytics Cloud, with its embedded generative AI services and enterprise-grade data modeling, addresses the needs of large cloud-centric deployments, while Alteryx remains a leader in low-code automation and data preparation workflows that complement full-stack analytics platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Augmented Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actian Corporation

- Aible, Inc.

- Altair Engineering Inc.

- Alteryx, Inc.

- AtScale, Inc.

- Databricks, Inc.

- DataRobot, Inc.

- Domo, Inc.

- DotData, Inc.

- GoodData Corporation

- Infor Equity Holdings, LLC

- International Business Machines Corporation

- KNIME AG

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- QlikTech International AB

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Sisense, Inc.

- Tellius, Inc.

- ThoughtSpot, Inc.

- Yellowfin BI

- Zoho Corporation

Strategic Roadmap for Industry Leaders to Implement Augmented Analytics, Foster Data Literacy and Accelerate AI-Driven Decision Excellence

Industry leaders seeking to capitalize on augmented analytics should first establish a clear strategic vision anchored in concrete business outcomes. By defining high-priority use cases-such as predictive maintenance, dynamic pricing or talent retention analytics-organizations can focus investments on solutions that promise rapid time to value. Subsequently, aligning stakeholder expectations across IT, analytics and business units ensures that governance models support agile deployment without compromising compliance or security.

Cultivating data literacy is equally critical. Structured training programs, embedded AI mentors and in-context guidance within analytics interfaces empower users at all levels to interpret automated insights confidently. Such programs not only boost user adoption but also foster a culture of continuous improvement, where feedback loops between frontline teams and data scientists refine algorithmic models over time.

From a technical standpoint, adopting a microservices-based analytics architecture facilitates incremental integration of AI agents and modular analytics components. This approach enables seamless scaling across cloud and on-premises environments, while minimizing disruption to existing workflows. Organizations should also invest in unified semantic layers and metadata catalogs to ensure consistent data definitions and accelerate model governance.

Finally, forging strategic partnerships with leading vendors and specialized service providers can hasten implementation and unlock advanced capabilities such as agentic AI pilots and federated learning. Regularly benchmarking solution performance and user satisfaction against industry peers provides actionable insights for iterative enhancements, ensuring that augmented analytics initiatives deliver sustained competitive advantage.

Transparent Overview of Research Framework Incorporating Data Collection, Expert Engagement, Modeling Techniques and Analytical Rigor

Our research methodology combined rigorous secondary research, expert interviews, and quantitative analysis to deliver a comprehensive market perspective. Initially, we conducted an extensive review of publicly available resources, including vendor documentation, industry white papers and academic studies, to map the evolving technology landscape and identify key innovation trends.

We then engaged with over twenty senior analytics practitioners, IT leaders and domain experts through structured interviews to validate our hypotheses and uncover real-world deployment challenges. Insights gleaned from these discussions informed the development of use case frameworks and vendor evaluation criteria.

On the quantitative side, we synthesized data from financial reports, patent filings and technology adoption surveys to assess vendor positioning and regional growth differentials. This triangulation approach ensured that our findings reflect both market sentiment and empirical performance metrics.

Throughout the study, we maintained strict quality controls, including peer reviews and consistency checks across data points, to uphold the analytical rigor and credibility of our conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Augmented Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Augmented Analytics Market, by Component

- Augmented Analytics Market, by Technology

- Augmented Analytics Market, by Deployment Mode

- Augmented Analytics Market, by End User

- Augmented Analytics Market, by Application

- Augmented Analytics Market, by End-use

- Augmented Analytics Market, by Region

- Augmented Analytics Market, by Group

- Augmented Analytics Market, by Country

- United States Augmented Analytics Market

- China Augmented Analytics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Perspectives to Illuminate the Path Forward in Augmented Analytics Adoption and Impact

Augmented analytics represents a watershed in the evolution of business intelligence, bridging the gap between advanced AI capabilities and everyday decision-making. By embedding machine learning and natural language interfaces directly into analytics workflows, organizations can accelerate insight generation, democratize data access and foster a culture of continuous learning.

The transformative shifts in user empowerment, cloud-native deployment and autonomous AI agents underscore the strategic imperative for enterprises to modernize their analytics infrastructures. Meanwhile, the cumulative economic impact of trade policies in 2025 highlights the importance of real-time insights to navigate macroeconomic volatility and protect profitability.

Segmentation insights reveal that tailored solutions-whether focused on platforms, deployment modes or industry-specific applications-are essential for maximizing the value of augmented analytics investments. Regional nuances further illustrate that a one-size-fits-all approach is no longer sufficient; successful adopters align their strategies with local market dynamics and regulatory environments.

As leading vendors continue to innovate, industry leaders must adopt a structured roadmap encompassing clear use case prioritization, data literacy cultivation and modular architecture design. By doing so, organizations will be well-positioned to harness the full potential of augmented analytics and drive sustainable competitive differentiation.

Connect with Ketan Rohom to Secure Exclusive Augmented Analytics Insights and Accelerate Your Competitive Advantage Through Our Comprehensive Research

For tailored insights and to secure the full market research report on the augmented analytics landscape, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan is ready to guide you through our comprehensive findings and help you translate data-driven intelligence into strategic advantage. Reach out to schedule a personalized consultation and learn how these insights can accelerate your organization’s journey toward AI-driven decision excellence.

- How big is the Augmented Analytics Market?

- What is the Augmented Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?