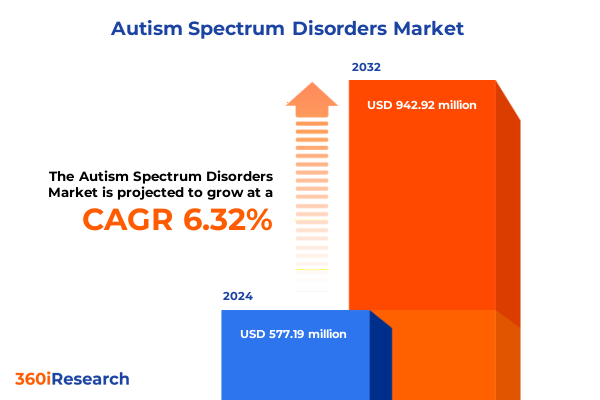

The Autism Spectrum Disorders Market size was estimated at USD 611.79 million in 2025 and expected to reach USD 651.36 million in 2026, at a CAGR of 6.37% to reach USD 942.92 million by 2032.

Unveiling the Complexity and Urgency in Understanding Autism Spectrum Disorders and Emerging Treatment Paradigms in Modern Healthcare Environments

Autism spectrum disorders encompass a range of neurodevelopmental variations characterized by differences in social communication, restrictive behaviors, and sensory processing. These differences manifest across a broad continuum of cognitive and functional capacities, challenging clinicians, caregivers, and policymakers to adopt a nuanced understanding that transcends one-size-fits-all frameworks. As awareness expands among medical professionals and the public, the imperative for precision in diagnosis and individualized care has become more pronounced.

Over the past decade, strides in genetics and neurobiology have deepened our understanding of the biological mechanisms underlying autism, illuminating pathways for tailored interventions. Regulatory bodies and advocacy groups have shifted priorities toward early screening and inclusive education, recognizing that timely support can significantly enhance developmental trajectories. This evolving context mandates a holistic approach that integrates clinical best practices with technological innovations and policy support to address the full spectrum of needs. Transitional collaboration between researchers, practitioners, and families is critical, as emerging evidence continues to reshape clinical guidelines and influence resource allocation across the healthcare ecosystem.

Exploring the Paradigm Shifts Driving Innovation and Inclusive Care for Individuals with Autism Spectrum Disorders in a Transforming Healthcare Landscape

Recent years have witnessed transformative shifts reshaping the landscape of autism spectrum disorder care, driven by technological breakthroughs, policy evolution, and shifting societal expectations. Digital therapeutics and telehealth platforms have surged to the forefront, extending the reach of behavioral therapies and specialist consultations beyond traditional clinic walls. Coupled with advances in artificial intelligence, machine learning algorithms now support early detection efforts by analyzing speech patterns, eye movements, and social engagement metrics, facilitating interventions at earlier developmental stages.

Concurrently, policy frameworks have adapted to prioritize accessibility and inclusivity, with updated guidelines emphasizing person-centered care and evidence-based practices. Insurance reforms and public funding initiatives have broadened reimbursement pathways for applied behavior analysis and supportive services, while advocacy coalitions continue to influence legislative agendas to ensure equitable access across socioeconomic strata. At the same time, research into the gut-brain axis, genetic markers, and novel pharmacological targets is accelerating, opening avenues for integrated treatment models that combine behavioral therapies with biomedical interventions. Together, these paradigm shifts are converging to create a more responsive and resilient ecosystem that addresses the diverse needs of individuals on the autism spectrum.

Assessing How Recent United States Tariff Measures Have Escalated Costs and Altered Supply Dynamics in Autism Assistive Technologies and Therapeutic Devices

The cumulative impact of recent United States tariff measures has introduced significant challenges for importing critical assistive technologies and therapeutic devices that support individuals with autism spectrum disorders. Notably, the increased Section 301 tariffs on medical devices originating from China have raised duties by up to 100 percent on consumable supplies such as syringes, gloves, and respiratory masks, while appliances that incorporate steel and aluminum components now face an additional 25 percent tariff since January 2025. These policies, enacted to protect domestic manufacturing, have inadvertently heightened production costs for manufacturers of communication devices and sensory aids, many of which rely on global supply chains to source electronic components from Asia-Pacific hubs.

Deriving Deep Market Insights Through Multifaceted Segmentation That Reveals Critical Patterns in Autism Spectrum Disorder Treatment and Care Modalities

A nuanced analysis of the autism spectrum disorder market emerges when viewed through four critical segmentation frameworks, each revealing unique drivers of demand and barriers to access. By age group, the continuum from early childhood through adolescence and into adulthood highlights evolving therapeutic priorities, with early childhood interventions emphasizing developmental milestones, school-age support focusing on social integration, and adult services addressing vocational and independent living outcomes. Treatment type segmentation underscores the interplay between assistive technologies-spanning communication devices and sensory aids-and behavior therapy modalities such as applied behavior analysis, cognitive behavioral therapy, occupational therapy, and speech therapy, alongside pharmacological therapies targeting antipsychotics, selective serotonin reuptake inhibitors, and stimulants. Severity level distinctions from Level 1 through Level 3 bring into focus the intensities of support required, guiding resource allocation from standard behavioral programs to intensive multidisciplinary care. The end-user segmentation-from multi-specialty and specialty clinics to home-based in-home services and parental care, government and private hospitals, and both public and private special education centers-highlights the necessity of tailoring service delivery models to organizational capabilities and caregiver preferences. Finally, distribution channel segmentation exposes the dynamics of hospital, online, and retail pharmacies, each with subchannels ranging from company-operated websites and third-party platforms to chain and independent pharmacies, shaping access, pricing, and inventory management strategies across ecosystem stakeholders.

This comprehensive research report categorizes the Autism Spectrum Disorders market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Age Group

- Treatment Type

- Severity Level

- End User

- Distribution Channel

Gaining Strategic Perspectives Through Regional Analysis Highlighting Unique Adoption Trends and Policy Environments in the Americas, EMEA, and Asia-Pacific

Regional dynamics play a critical role in shaping the availability, adoption, and reimbursement of autism spectrum disorder services and products. In the Americas, policy agendas have increasingly prioritized early intervention programs and inclusive education mandates, supported by dynamic innovation ecosystems in telehealth and digital therapeutics. Public–private partnerships and philanthropic initiatives further supplement government funding, driving diverse service models. Moving across Europe, the Middle East, and Africa, heterogeneity in healthcare infrastructure and regulatory environments creates a tapestry of best practices, from standardized national screening protocols in Western Europe to emerging advocacy movements and capacity-building efforts across the Middle East and Africa, where diagnostic access remains a key challenge. In the Asia-Pacific region, rapid economic development and expanding private healthcare sectors coexist with variable public health investment, resulting in accelerated adoption of mobile health platforms and assistive technology imports, tempered by complex import regulations and localized manufacturing strategies. These regional distinctions underscore the imperative for tailored market entry strategies and partnerships that align with local policy, reimbursement frameworks, and cultural contexts.

This comprehensive research report examines key regions that drive the evolution of the Autism Spectrum Disorders market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Industry Stakeholders and Their Strategic Contributions to the Evolving Autism Spectrum Disorder Treatment Ecosystem and Innovation Landscape

Key companies within the autism spectrum disorder treatment and support ecosystem are advancing innovation along distinct trajectories. Technology firms specializing in augmentative and alternative communication devices are integrating AI-driven personalization features to enhance real-time social interaction support. Concurrently, leading behavior therapy providers are scaling remote service delivery via secure telehealth platforms, expanding clinician networks to meet rising demand for applied behavior analysis and speech therapy. Pharmaceutical companies are investing in research targeting core social impairments, with clinical-stage compounds exploring modulators of neural connectivity and synaptic signaling pathways, although no breakthrough pharmacotherapy has yet achieved regulatory approval for core ASD symptoms. Additionally, multispecialty clinics and integrated care networks are forging collaborations with educational institutions to deliver blended in-school and at-home interventions, leveraging data analytics to optimize treatment pathways. Together, these diverse players-ranging from medtech innovators to dedicated therapy organizations and biotech researchers-shape a competitive ecosystem where partnerships and acquisitions are driving consolidation and scaling capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autism Spectrum Disorders market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aeglea BioTherapeutics Inc.

- Aelis Farma SAS

- Alembic Pharmaceuticals Limited

- Aurobindo Pharma Ltd.

- Axial Therapeutics Inc.

- Curemark LLC

- DeFloria, Inc.

- Eli Lilly and Company

- F. Hoffmann‑La Roche Ltd.

- H. Lundbeck A/S

- Harmony Biosciences Inc.

- Janssen Pharmaceuticals, Inc.

- Jazz Pharmaceuticals Plc

- Johnson & Johnson Services, Inc.

- NeuroRx Inc.

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd.

- PaxMedica Inc.

- Pfizer Inc.

- Q BioMed Inc.

- STALICLA SA

- Teva Pharmaceutical Industries Ltd.

- Yamo Pharmaceuticals LLC

- Zynerba Pharmaceuticals Inc.

Formulating Actionable Strategic Pathways for Industry Leaders to Navigate the Evolving Autism Spectrum Disorder Treatment Arena and Drive Sustainable Impact

Industry leaders can capitalize on emerging opportunities by adopting an integrated strategic framework that emphasizes collaboration across technology developers, clinical providers, and policy advocates. First, strengthening supply chain resilience through diversified sourcing and strategic inventory management will mitigate exposure to tariff fluctuations and component shortages. Next, investing in interoperable digital platforms that seamlessly connect electronic health records, teletherapy systems, and caregiver-facing applications will create holistic care pathways and drive adherence to evidence-based protocols. Stakeholder engagement efforts should prioritize building robust partnerships with advocacy organizations, insurers, and educational bodies to expand reimbursement models and secure long-term funding for comprehensive services. Furthermore, embedding real-world data collection and outcome measurement into service delivery will provide actionable insights to refine therapeutic protocols and demonstrate value to payers and policymakers. By adopting these actionable steps, industry leaders can drive sustainable growth, enhance care quality, and foster inclusive outcomes for individuals along the autism spectrum.

Illuminating the Rigorous Research Methodology Underpinning Robust Market Insights in Autism Spectrum Disorder Studies and Industry Analysis

This research employs a rigorous mixed-methods approach designed to capture both breadth and depth in market insights. Primary research consisted of structured interviews with clinicians, technology developers, payers, and caregivers, facilitating firsthand perspectives on current service models, unmet needs, and investment priorities. Concurrently, secondary research encompassed a systematic review of peer-reviewed journals, regulatory filings, policy whitepapers, and public health databases, ensuring alignment with the latest evidence and policy developments. Quantitative analyses synthesized data on treatment utilization patterns, adoption of digital therapeutics, and regional service capacities, whereas qualitative thematic analysis of stakeholder interviews informed the identification of emerging trends and pain points. Triangulation across these methods, complemented by expert panel validation sessions, underpins the robustness and reliability of the findings, providing a comprehensive foundation for strategic decision making and policy formulation in the autism spectrum disorder landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autism Spectrum Disorders market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autism Spectrum Disorders Market, by Age Group

- Autism Spectrum Disorders Market, by Treatment Type

- Autism Spectrum Disorders Market, by Severity Level

- Autism Spectrum Disorders Market, by End User

- Autism Spectrum Disorders Market, by Distribution Channel

- Autism Spectrum Disorders Market, by Region

- Autism Spectrum Disorders Market, by Group

- Autism Spectrum Disorders Market, by Country

- United States Autism Spectrum Disorders Market

- China Autism Spectrum Disorders Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Comprehensive Findings to Illuminate Opportunities and Propel Collaborative Efforts in Advancing Autism Spectrum Disorder Care and Support

The confluence of technological innovation, policy evolution, and growing societal awareness has ushered in a new era of opportunity for advancing autism spectrum disorder care and support. By synthesizing insights across segmentation frameworks, regional dynamics, and competitive landscapes, this analysis illuminates the multifaceted drivers shaping market trajectories. From the promise of AI-enabled diagnostics to the resilience imperative spurred by tariff-driven supply chain complexities, stakeholders are positioned at a pivotal juncture where strategic collaboration can unlock tangible improvements in outcomes and access. As the landscape continues to evolve, embracing data-driven decision making, advocating for inclusive policy reforms, and fostering cross-sector partnerships will be essential to sustaining momentum. Ultimately, the collective efforts of technology innovators, clinical providers, policymakers, and caregivers will determine the pace at which meaningful progress is realized, reinforcing a shared commitment to empowering individuals on the autism spectrum.

Engaging with Associate Director of Sales and Marketing to Unlock Comprehensive Autism Spectrum Disorder Market Research Insights and Drive Informed Decision Making

For tailored guidance on navigating the complex landscape of autism spectrum disorder research and market dynamics, connect with Ketan Rohom, whose expertise as Associate Director, Sales & Marketing ensures direct access to comprehensive insights and strategic support. Engaging with this report presents an opportunity to strengthen your organization’s decision making with data-driven analysis and expert recommendations tailored to the evolving needs of individuals on the spectrum and their care ecosystems. Reach out now to secure your competitive advantage and catalyze growth through precisely curated market intelligence and actionable strategies.

- How big is the Autism Spectrum Disorders Market?

- What is the Autism Spectrum Disorders Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?