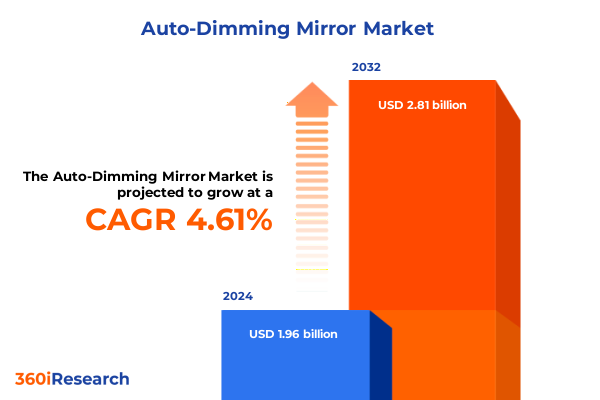

The Auto-Dimming Mirror Market size was estimated at USD 2.04 billion in 2025 and expected to reach USD 2.13 billion in 2026, at a CAGR of 4.68% to reach USD 2.81 billion by 2032.

Exploring How Auto-Dimming Mirror Innovations Are Shaping Vehicle Safety, Comfort, and Adaptive Technology Integration Across Segments

Over the past decade, auto-dimming mirrors have emerged as a pivotal safety and comfort feature in passenger and commercial vehicles alike. Originally conceived to reduce glare from trailing headlights, these mirrors now integrate sophisticated sensor and electrochromic technologies that enhance driver visibility under varying light conditions. Adoption has accelerated as regulatory bodies and original equipment manufacturers (OEMs) recognize the necessity of minimizing driver distraction and fatigue during night-time operation.

Innovation in mirror technologies has coincided with the rise of advanced driver assistance systems (ADAS), creating an environment in which adaptive rearview solutions are considered a baseline expectation rather than a luxury upgrade. As a result, many leading vehicle platforms today incorporate auto-dimming functionality as standard equipment. This shift underscores how consumer demand for safety features and OEM commitments to comprehensive ADAS suites are driving rapid enhancements across sensor accuracy, dimming response times, and integration with digital rear view camera displays.

While electrochromic and liquid crystal approaches represent the dominant technological pathways, ongoing research focuses on improving power efficiency, reducing component thickness, and seamlessly embedding sensors for ambient light and proximity detection. Consequently, what began as a reactive glare-reduction mechanism has evolved into an integrated component of broader vehicle intelligence systems, foreshadowing continual performance improvements and expanded applications beyond traditional rearview configurations.

Understanding the Transformative Shifts in Automotive Mirror Technology Driven by Safety Regulations and Advanced Driver Assistance Systems Integration

The landscape of automotive mirror systems has undergone transformative shifts fueled by regulatory mandates, electrification trends, and the proliferation of advanced sensor networks. In recent years, safety regulations in key markets have compelled automakers to strengthen crash avoidance and night-driving protections, elevating auto-dimming mirrors from optional extras to recommended equipment. Concurrently, rapid advancements in electrochromic materials and liquid crystal compounds have delivered faster response times and finer gradations of tint, enabling mirrors to adjust seamlessly across a broad range of lighting scenarios.

Moreover, the advent of high-voltage electrical architectures in electric vehicles (EVs) has provided designers with greater flexibility in energy allocation for accessory subsystems, allowing power-hungry electrochromic coatings to benefit from more robust and stable current sources. As automakers push for lighter, more aerodynamic exteriors, mirror housings are being redesigned to accommodate dual sensor integration, coupling ambient light sensing with camera-based optical assistance. This integration forms an essential interface between traditional reflective components and digital imaging systems that augment situational awareness.

Furthermore, consumer expectations have expanded alongside smartphone-like user experiences in vehicle cabins. Real-time connectivity and over-the-air updates now enable mirror firmware to be calibrated remotely, adjusting tint protocols to new environmental conditions or integrating with in-cabin camera feeds. These transformative shifts underscore how auto-dimming mirrors are becoming intelligent nodes within the vehicle ecosystem rather than standalone glare-control devices.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Auto-Dimming Mirror Supply Chains and Cost Structures in Automotive Manufacturing

Throughout 2025, a tiered structure of United States tariffs has reshaped the cost dynamics for auto-dimming mirror components and assemblies. Key inputs-such as electrochromic coatings, specialized glass substrates, and precision sensor modules-have faced duties under both Section 301 measures targeting certain foreign electronics and Section 232 levies on steel and aluminum substrates. These combined duties have imposed incremental manufacturing costs, prompting many suppliers to revisit sourcing strategies to mitigate exposure to elevated import fees.

As a result, original equipment manufacturers and Tier 1 suppliers have accelerated efforts to localize production of critical mirror elements. Investments in North American electrochromic coating facilities and sensor integration lines have notably increased, reflecting a strategic shift toward supply chain resilience. Simultaneously, companies are exploring tariff engineering techniques, such as redesigning mirror assemblies to qualify for lower-duty classifications and partnering with domestic glass fabricators to bypass higher aluminum surcharge categories.

Consequently, while upfront capital expenditures have grown in response to tariff pressures, long-term benefits include reduced exposure to geopolitical volatility and shorter lead times from production to assembly. In conjunction with these adjustments, some manufacturers have negotiated hybrid supply agreements that blend offshore cost advantages with onshore value-add processes, ensuring compliance with regulatory frameworks and sustaining price competitiveness in an inflationary environment.

Gaining Key Segmentation Insights into Auto-Dimming Mirror Adoption Across Product Types Applications Vehicle Configurations and Sales Channels

Insight into auto-dimming mirror adoption reveals a landscape defined by nuanced distinctions across product, application, vehicle, and sales channels. Electrochromic technology leads market penetration, with configurations differentiated by sensor capabilities; dual sensor integration seamlessly combines ambient light detection with rear proximity alerts, whereas single sensor systems focus solely on glare control. Liquid crystal variants, while less prevalent, offer rapid tint transitions and are favored for specialized use cases where power efficiency and thin-form factor take precedence.

Application-based segmentation underscores divergent design priorities: exterior mirror installations emphasize robust sealing against environmental extremes and anti-corrosion treatments, while interior units must balance low-profile aesthetics with unobtrusive integration of glue-bound sensor arrays. Within vehicle types, commercial categories necessitate heavy-duty configurations for fleet trucks, alongside lighter solutions optimized for delivery vans and transit shuttles. Passenger vehicles exhibit broader stylistic preferences, with demand concentrated in hatchbacks, sedans, and SUVs-each requiring tailored housing shapes, mounting systems, and electronic interfaces.

Sales channel dynamics further influence market approaches, as offline distribution remains dominant for OEM fitments, enabling direct integration into assembly lines, while aftermarket upgrades increasingly leverage online platforms to reach end consumers seeking retrofit solutions. The interplay of these segmentation factors drives differentiated product roadmaps, ensuring that suppliers align technological offerings with the precise demands of diverse vehicle and channel ecosystems.

This comprehensive research report categorizes the Auto-Dimming Mirror market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Application

- Sales Channel

Uncovering Regional Variations in Auto-Dimming Mirror Adoption Fueled by Regulatory Compulsions and Consumer Comfort Demands Across Key Territories

Regional trends in auto-dimming mirror adoption vary considerably, shaped by regulatory frameworks, consumer preferences, and regional manufacturing footprints. In the Americas, stringent safety standards and high consumer expectations for comfort features have driven widespread deployment of both interior and exterior auto-dimming mirrors. The United States leads in aftermarket customization, with retrofit kits readily available for light commercial and passenger segments, while Canada and Mexico exhibit strong OEM adoption driven by transnational supply chains.

Across Europe, the Middle East & Africa, stringent vehicle safety directives and aggressive emissions targets have reinforced demand for lightweight electrochromic mirrors that complement aerodynamic design and contribute to fuel efficiency. European automakers prioritize dual sensor integration to satisfy rigorous night-driving performance tests, whereas markets in the Middle East and Africa often select robust single sensor units to withstand extreme temperature fluctuations and dust-laden environments.

In Asia-Pacific, a dynamic mix of established automotive hubs and emerging economies shapes diverse demand patterns. Japan and South Korea continue to innovate with liquid crystal-based solutions, integrating mirror functionality into broader smart cabin initiatives. China’s rapidly expanding EV market fuels large-scale production of both interior and exterior systems, while Southeast Asian markets demonstrate growing appetite for retrofit offerings via online channels. These regional insights highlight the importance of tailoring technology roadmaps and distribution strategies to local market nuances and regulatory priorities.

This comprehensive research report examines key regions that drive the evolution of the Auto-Dimming Mirror market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Shaping Competitive Dynamics Through Innovation Partnerships and Manufacturing Excellence in Auto-Dimming Mirror Solutions

The competitive landscape of auto-dimming mirrors is governed by a few leading suppliers that combine deep materials expertise with extensive automotive partnerships. Gentex Corporation has long set the pace for electrochromic mirror innovation through proprietary coating technologies and strategic OEM alliances. Around the same time, Magna International expanded its rearview systems portfolio by integrating camera-based digital mirrors and forging joint ventures with sensor specialists to enhance ADAS compatibility.

Gentherm and Murakami Corporation have distinguished themselves by optimizing manufacturing efficiencies, deploying modular production lines in key automotive clusters to serve global Tier 1 contracts. Meanwhile, SEI Industries emphasizes value-added services, offering customizable mirror assemblies that cater to niche vehicle variants and aftermarket retrofit applications. Each of these players leverages differentiated R&D pathways-ranging from next-generation polymer-dispersed liquid crystal modules to ultra-thin glass laminates-to capture share within both original equipment and aftermarket sectors.

As consolidation accelerates, newer entrants focusing on specialized sensor fusion and low-power electrochromic chemistries are forging collaborations with established mirror manufacturers. This trend underscores a broader industry dynamic in which traditional glass-and-coating businesses partner with electronics innovators to deliver holistic reflective and digital vision solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Auto-Dimming Mirror market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Continental AG

- Denso Corporation

- Ficosa International S.A.

- FLABEG Automotive Holding GmbH

- Gentex Corporation

- Honda Lock Mfg. Co., Ltd.

- Ichikoh Industries, Ltd.

- Konview Electronics Corporation Limited

- Kyocera Corporation

- Magna International Inc.

- Murakami Corporation

- Samvardhana Motherson Group

- SL Corporation

- Tokai Rika Co., Ltd.

- Valeo SA

Actionable Strategies for Industry Executives to Elevate Auto-Dimming Mirror Performance Diversify Supply Chains and Capitalize on Aftermarket Opportunities

To maintain a competitive edge, industry leaders should prioritize end-to-end sensor integration that aligns mirror dimming protocols with broader vehicle safety systems. Collaborating proactively with camera and LiDAR module suppliers can enable more holistic glare mitigation strategies tied to real-time environmental analysis. Furthermore, investing in advanced electrochromic materials with reduced power draw will support greater adoption in electric and hybrid platforms, bolstering both energy efficiency and user experience.

Supply chain diversification is equally critical. Companies are advised to augment offshore sourcing with regional manufacturing hubs to navigate fluctuating tariff regimes and minimize logistical disruptions. Establishing joint ventures with local glass fabricators and electronics assemblers can accelerate time to market while ensuring compliance with regional trade policies. Concurrently, enhancing online sales channels and direct-to-consumer platforms will capture aftermarket growth, particularly among fleet operators and commercial vehicle managers seeking turnkey retrofit options.

Finally, adopting a data-driven approach to product development-leveraging telematics feedback and user behavior analytics-will refine dimming algorithms and sensor calibration protocols. By integrating over-the-air update capabilities, mirror systems can evolve post-deployment, enabling continuous performance improvements and alignment with emerging regulatory requirements.

Defining the Rigorous Research Methodology Underpinning the Analysis of Auto-Dimming Mirror Industry Insights Through Triangulated Data Collection

This analysis is grounded in a rigorous research methodology combining primary and secondary data sources. Primary research involved structured interviews with OEM product managers, Tier 1 supplier executives, and industry subject-matter experts to ascertain technology preferences, procurement strategies, and integration timelines. Complementing these insights, surveys of aftermarket distributors and fleet maintenance specialists provided perspective on retrofit adoption patterns and channel-specific demand drivers.

Secondary research encompassed a comprehensive review of regulatory databases, patent filings, and technical papers on electrochromic and liquid crystal innovations. Trade association publications and government customs data were analyzed to map tariff classifications and supply chain flows, while white papers from materials science institutes informed evaluations of emerging coating chemistries.

Data triangulation techniques ensured consistency and reliability, integrating qualitative findings with quantitative shipment and adoption statistics. Segmentation criteria were defined across product type, application, vehicle type, and sales channel, enabling granular analysis of market dynamics. Geographical coverage spanned the Americas, Europe, Middle East & Africa, and Asia-Pacific, reflecting regional regulatory contexts and consumer preferences. This structured approach provides a transparent and replicable framework for assessing auto-dimming mirror industry trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Auto-Dimming Mirror market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Auto-Dimming Mirror Market, by Product Type

- Auto-Dimming Mirror Market, by Vehicle Type

- Auto-Dimming Mirror Market, by Application

- Auto-Dimming Mirror Market, by Sales Channel

- Auto-Dimming Mirror Market, by Region

- Auto-Dimming Mirror Market, by Group

- Auto-Dimming Mirror Market, by Country

- United States Auto-Dimming Mirror Market

- China Auto-Dimming Mirror Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Strategic Imperatives from Advanced Technology Integration Tariff Management and Segmentation Dynamics to Guide Stakeholder Decision Making

In synthesizing the analysis, several strategic imperatives stand out. Technological convergence between sensor integration and electrochromic coating advancements will dictate the next generation of auto-dimming mirror solutions. As safety regulations and ADAS requirements evolve, industry participants must accelerate R&D investments in lower-power, faster-response materials and integrated sensor-housing architectures.

Tariff-driven cost pressures underscore the importance of balanced global sourcing strategies and tariff engineering to maintain margin resilience. Segmentation insights highlight that product differentiation-whether through dual sensor integration or specialized liquid crystal modules-remains a key lever for targeting distinct vehicle platforms and sales channels. Region-specific adoption patterns further emphasize the need for localized manufacturing footprints and tailored go-to-market approaches.

Collectively, these findings equip stakeholders with a nuanced understanding of competitive dynamics and growth opportunities. By aligning product portfolios with regulatory expectations and consumer comfort demands, mirror suppliers and OEMs can forge ahead in delivering safer, more intuitive driving experiences. The intersection of technological innovation, supply chain optimization, and strategic partnerships will define market leadership in the coming years.

Engage Directly with Ketan Rohom to Secure Comprehensive Auto-Dimming Mirror Market Intelligence and Drive Strategic Growth

To obtain the comprehensive auto-dimming mirror market insights and leverage them for strategic growth, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Whether you are refining product roadmaps, exploring new partnership opportunities, or assessing supply chain resilience, Ketan can guide you through tailored data and expert analysis. Secure your copy of the detailed market research report today to gain an unparalleled understanding of technology trends, tariff impacts, segmentation dynamics, and regional growth drivers. Engage with Ketan to schedule a personalized briefing, discuss bespoke consulting options, and make informed decisions that will accelerate innovation in your organization. Don’t miss the opportunity to transform strategic planning with data-driven intelligence at your fingertips

- How big is the Auto-Dimming Mirror Market?

- What is the Auto-Dimming Mirror Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?