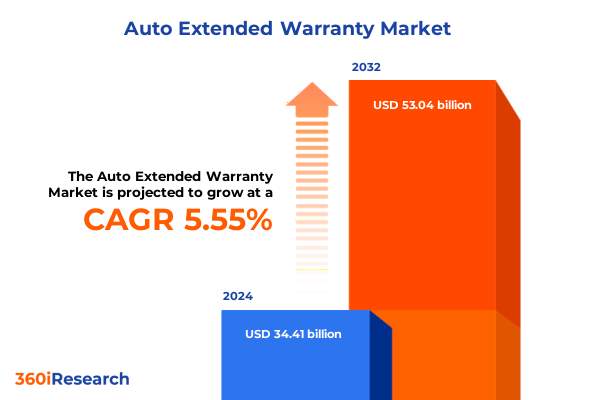

The Auto Extended Warranty Market size was estimated at USD 36.22 billion in 2025 and expected to reach USD 38.14 billion in 2026, at a CAGR of 5.60% to reach USD 53.04 billion by 2032.

Unveiling the Strategic Role of Auto Extended Warranties in Enhancing Vehicle Longevity and Consumer Confidence in a Dynamic Market Environment

The automotive warranty paradigm has undergone profound evolution over the past decade, reshaping how consumers perceive vehicle ownership and how providers structure their service offerings. With rising vehicle complexity and the growing average age of cars on the road, extended warranties have emerged as a critical instrument for managing repair costs and driving customer loyalty. In the current economic climate, where supply chain constraints and chip shortages have driven repair lead times upward, the assurance offered by extended coverage programs has never been more valuable. Industry stakeholders recognize that these warranty products do more than mitigate financial risk; they foster brand trust and unlock recurring revenue opportunities through cross-sell and upsell initiatives.

Moreover, the competitive landscape has intensified as traditional automakers, aftermarket specialists, and fintech disruptors vie for market share. Technological advancements in telematics, predictive analytics, and digital claims processing have elevated customer expectations for seamless onboarding and real-time service tracking. Against this backdrop, a sophisticated understanding of consumer drivers-ranging from plan duration preferences to coverage scope-is indispensable for crafting differentiated offerings that resonate with diverse customer profiles. This executive summary sets the stage for a deep dive into the transformative shifts, segmentation dynamics, regional nuances, and actionable strategies that define the Auto Extended Warranty market today.

Analyzing How Digital Personalization and Proactive Maintenance Partnerships Are Shaping the Future of Vehicle Protection Solutions

Amid rising complexity in vehicle design and unprecedented supply chain volatility, the Auto Extended Warranty market is experiencing a seismic shift in both product design and consumer engagement. Providers are transitioning from one-size-fits-all plans toward modular coverage architectures that allow drivers to tailor protection based on their specific usage patterns and risk tolerance. For instance, digital platforms now enable customers to add or remove electrical systems or drivetrain components with a few clicks, creating a more personalized experience.

Simultaneously, partnerships between warranty issuers and roadside assistance networks have deepened, fueling integrated service bundles that extend beyond traditional repair coverage into proactive maintenance alerts. These alliances leverage telematics data to predict potential failures, reducing downtime and reinforcing customer satisfaction. Furthermore, the growing emphasis on sustainability has prompted some brands to introduce eco-friendly maintenance packages, where customers can access green parts and certified repair shops committed to reducing carbon footprints.

Collectively, these transformative trends underscore a shift toward proactive, data-driven warranty solutions that blend preventive care with flexible coverage. As the market continues to adapt, providers that harness analytics for preemptive service recommendations and seamless digital experiences will set the benchmark for value creation.

Evaluating the Broad Implications of 2025 Import Tariff Revisions on Warranty Premiums and Claims Cost Management Strategies

The reintroduction of targeted tariffs on imported automotive components in early 2025 has reverberated across the extended warranty landscape, altering cost structures and reshaping provider strategies. As assembly plants adjusted to higher input costs for engines, transmissions, and electronics, warranty underwriters faced elevated claims expense assumptions. To maintain margin integrity, many issuers revised their pricing algorithms, leading to modest increases in premium levels across certain coverage tiers. Meanwhile, premium plan durations extending beyond three years saw a more pronounced recalibration to offset long-term exposure to volatile parts costs.

In response, some forward-looking providers have reengineered their supply chain relationships, securing guaranteed rates from domestic parts suppliers and forging strategic alliances with independent service centers to mitigate tariff-induced price inflations. This realignment has not only stabilized claims expenses but has also accelerated the adoption of remanufactured components where permissible by plan terms. While consumers initially expressed concern over premium adjustments, transparent communication about the direct link between tariffs and repair costs has softened backlash and preserved customer retention rates.

Ultimately, the cumulative impact of 2025 tariffs underscores the necessity for adaptive pricing frameworks and agile supply chain management. Warranty providers that integrate dynamic cost forecasting with robust supplier networks will be best positioned to navigate ongoing trade policy fluctuations without compromising service quality or customer satisfaction.

Delving into Consumer Preferences Across Coverage Scopes, Durations, Vehicle Profiles, and Purchase Channels to Inform Granular Product Differentiation

An in-depth look at coverage typologies reveals that bumper-to-bumper plans, which encompass electrical systems, mechanical systems, and safety features, continue to command a premium positioning among buyers seeking comprehensive protection. Conversely, exclusionary policies are gaining traction with cost-conscious customers who prioritize core system coverage while accepting certain repair categories as out-of-scope risks. Powertrain agreements focused on drive axle, engine components, and transmissions are also witnessing a resurgence, particularly among high-mileage drivers who view drivetrain failures as the most significant financial risk.

When examining plan duration, multi-year agreements extending beyond three years have become increasingly popular among owners of vehicles aged three years or more, offering predictable budget planning and enhanced peace of mind. Short-term plans of up to three years retain appeal for drivers who rotate vehicles frequently or who prefer lower upfront premiums. Vehicle age segmentation further underscores this trend: new vehicle buyers often opt for exclusionary or bumper-to-bumper packages as part of dealer-recommended bundles, while used vehicle owners gravitate toward powertrain and stated component plans that align with the greater variability in maintenance history.

The type of vehicle also influences coverage selection. Commercial operators of heavy-duty trucks and light commercial vehicles leverage robust powertrain warranties to minimize operational downtime, whereas sedan and SUV owners focus on bundled safety-feature coverage given shifting regulatory standards around active driver assistance systems. The choice of purchase channel is equally instructive: dealership-facilitated offerings command immediate post-sale conversions, while banks and credit unions deliver extended tenure plans bundled with financing solutions. Online platforms, by contrast, attract tech-savvy customers who value on-demand plan customization and instant digital fulfillment. Finally, corporate clients increasingly negotiate portfolio-wide agreements to standardize coverage for fleet vehicles, while individual customers prefer à la carte plans that align with personal usage profiles.

This comprehensive research report categorizes the Auto Extended Warranty market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coverage Type

- Plan Duration

- Vehicle Age

- Vehicle Type

- Purchase Channel

- Customer Type

Comparing Regional Variations in Distribution Channels, Regulatory Frameworks, and Consumer Appetite Shaping Warranty Adoption Globally

North American operators benefit from a mature dealership network and integrated financial services ecosystem that simplifies extended warranty distribution, with an extensive service center infrastructure supporting efficient claims resolution. In the United States and Canada, rising vehicle prices and extended ownership cycles have further fueled demand for longer-term protection plans, while telematics adoption promotes usage-based pricing models that enhance underwriting precision.

The Europe, Middle East & Africa landscape presents a diverse tableau of regulatory regimes and consumer expectations. In Western Europe, stringent consumer protection laws mandate clear plan disclosures, encouraging issuers to refine contract language and elevate service transparency. Meanwhile, emerging markets in the Middle East exhibit growing appetite for comprehensive bumper-to-bumper coverage, driven by expanding new vehicle sales and infrastructural investments in franchise dealership networks. In Africa, independent providers carve out niches by bundling roadside assistance with component plans to address lower service center density.

Asia-Pacific markets demonstrate a dichotomy between advanced economies, where digital claims processing and OEM-backed programs dominate, and developing nations, which are rapidly adopting online platforms to bridge gaps in traditional distribution channels. In China and India, the proliferation of mobile-first consumers has accelerated uptake of flexible, subscription-style warranty offerings, while in Australia, long-standing relationships between insurers and mechanical workshops reinforce the prevalence of powertrain-focused plans. Across all regions, local regulatory frameworks, vehicle parc composition, and consumer risk tolerance coalesce to shape nuanced regional strategies.

This comprehensive research report examines key regions that drive the evolution of the Auto Extended Warranty market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Market Leaders Are Leveraging Technology, Partnerships, and Strategic Acquisitions to Gain Competitive Advantage

Leading issuers are redefining market standards through strategic partnerships, digital enablement, and vertically integrated service networks. For example, a prominent automotive finance company has launched an AI-driven claims portal that reduces average resolution times by leveraging machine learning to triage repair requests. Another key player has doubled down on joint ventures with OEM franchised dealers, embedding extended warranty offers into new vehicle sale processes to capture higher attach rates on day one. Meanwhile, an aftermarket specialist has expanded its footprint through acquisitions of regional warranty underwriters, broadening its service network and standardizing customer experiences across multiple geographies.

Insurtech disruptors wield technology to offer on-demand coverage, enabling policyholders to pause, upgrade, or cancel plans via mobile applications without long-term commitments. This flexibility appeals to a growing demographic of gig-economy drivers and urban dwellers who require short-duration protection. Established insurers, in turn, are responding by embedding telematics devices in existing plans to unlock usage-based pricing and proactive maintenance alerts. Collectively, these initiatives reflect a broader competitive dynamic where scale players leverage distribution muscle and capital, while innovators focus on customer experience differentiation through digital-first capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Auto Extended Warranty market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A-protect Warranty Corp.

- AA Auto Protection

- Allstate Corporation

- Ally Financial Inc.

- AmTrust Financial Services, Inc.

- Assurant, Inc.

- Auto Shield Canada

- Autopair Warranty Inc.

- Berkshire Hathaway Inc.

- Canada General Warranty

- Canada-West Assurance

- CARCHEX, LLC

- CARS Protection Plus, Inc.

- CarShield, LLC

- Concord Auto Ventures LLC

- Cornerstone United

- CoverageOne by Motors Insurance Corporation

- EasyCare by APCO Holdings, LLC

- Endurance Warranty Services, LLC

- Ensurall

- First Canadian Financial Group

- Ford Motor Company

- Fortegra Group, Inc.

- General Motor Company

- Global Warranty Corporation

- GWC Warranty Corporation

- Hendrick Automotive Group

- Honda Motor Co., Ltd.

- iA Financial Group

- Jim Moran & Associates, Inc.

- Kia Corporation

- LGM Financial Services Inc.

- Liberty Bell Insurance

- Lubrico Warranty Inc.

- NationWide Auto Warranty Corporation

- Obvi Inc.

- Olive by Repair Ventures, LLC

- Omega Auto Care, LLC

- Ox Warranty Group

- Protect My Car

- Steele & Jones, LLC

- Tata Motors Limited

- Toco Warranty Corp.

- Toyota Financial Services

Strategic Imperatives for Leveraging Digital Automation, Supplier Alliances, and Modular Offerings to Drive Sustained Growth in Extended Warranties

To thrive amid intensifying competition and evolving consumer expectations, industry leaders must prioritize digital transformation across the warranty lifecycle. This entails investing in end-to-end claims automation platforms that harness real-time vehicle data for faster adjudication and enhanced transparency. Concurrently, establishing strategic alliances with domestic parts suppliers can mitigate exposure to tariff fluctuations and secure preferential pricing for high-volume components.

Product modularity should remain a focal point: enabling policyholders to tailor coverage by selecting specific systems, durations, and service add-ons will boost perceived value and allow for more accurate risk segmentation. Marketing efforts must be finely tuned to highlight the tangible cost savings associated with preventive maintenance collaborations and green repair options. In regions with complex regulatory landscapes, providers should streamline contract language and bolster consumer education initiatives to foster trust.

Finally, a dual distribution strategy that balances traditional dealership channels with direct-to-consumer online platforms will capture both high-trust buyers and digitally native segments. For fleet operators, designing portfolio agreements with volume-based incentives and performance-based service level agreements will deepen client relationships and reduce churn. By embracing agility, data-driven insights, and customer-centric innovation, leaders can secure sustainable growth in the dynamic extended warranty ecosystem.

Overview of Integrated Primary Research, Comprehensive Secondary Analysis, and Robust Data Triangulation Ensuring Actionable Market Insights

This report is grounded in a rigorous research framework that integrates qualitative and quantitative methodologies. Primary insights were gathered through in-depth interviews with senior executives from OEMs, warranty issuers, service network managers, and consumer advocacy groups, ensuring a 360-degree perspective on market dynamics. Complementary surveys of end users provided statistical validation of emerging preferences around coverage scope, plan duration, and purchase channels.

Secondary research encompassed analysis of industry association publications, regulatory filings, and company disclosures to map tariff developments, competitive landscapes, and regulatory constraints. Data triangulation was employed to reconcile discrepancies between proprietary survey results and publicly available information. Market validation workshops convened cross-functional experts to stress-test key findings and refine narrative interpretations.

Synthesizing these inputs, the research team applied advanced data modeling techniques to identify correlations between vehicle age cohorts, claim frequencies, and customer satisfaction metrics. Geographic segmentation was informed by regional vehicle parc data and service network density analyses. The final research deliverable was subject to a multi-stage quality review process to ensure accuracy, reliability, and actionable relevance for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Auto Extended Warranty market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Auto Extended Warranty Market, by Coverage Type

- Auto Extended Warranty Market, by Plan Duration

- Auto Extended Warranty Market, by Vehicle Age

- Auto Extended Warranty Market, by Vehicle Type

- Auto Extended Warranty Market, by Purchase Channel

- Auto Extended Warranty Market, by Customer Type

- Auto Extended Warranty Market, by Region

- Auto Extended Warranty Market, by Group

- Auto Extended Warranty Market, by Country

- United States Auto Extended Warranty Market

- China Auto Extended Warranty Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing the Convergence of Digital Innovation, Supply Chain Realignments, and Segment-Specific Strategies Driving the Next Phase of Warranty Growth

As the automotive landscape continues its rapid transformation, extended warranties have solidified their role as a vital component of the vehicle ownership experience. The convergence of digital innovation, supply chain realignments, and shifting consumer demographics has propelled the market into a new era defined by personalization, transparency, and resilience against macroeconomic headwinds.

Providers that cultivate agile pricing frameworks, embrace telematics-enabled service models, and sustain partnerships with parts suppliers will navigate tariff uncertainties with greater confidence. Tailoring coverage across diverse customer segments-from new vehicle buyers seeking all-inclusive protection to gig-economy drivers requiring short-term agreements-will unlock new revenue streams and strengthen brand loyalty. Moreover, regional adaptation of distribution strategies will be paramount as regulatory environments and consumer expectations diverge across geographies.

By synthesizing these insights, this executive summary offers a strategic blueprint for stakeholders aiming to capitalize on emerging opportunities and mitigate potential risks. The extended warranty domain stands at a pivotal juncture, and embracing a data-driven, customer-centric approach will differentiate industry leaders and define the next wave of market growth.

Engage with Our Senior Sales Leader to Unlock the Comprehensive Auto Extended Warranty Market Intelligence Tailored to Your Strategic Needs

Thank you for exploring this comprehensive analysis of the Auto Extended Warranty market. To access the full depth of insights, in-depth data tables, and proprietary forecasts that will empower your strategic roadmap, we invite you to connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan can guide you through tailored packages, answer any specific inquiries about the report scope, and facilitate immediate delivery of the research tailored to your organizational needs. Reach out today to secure your competitive edge through a complete, expertly curated market research report.

- How big is the Auto Extended Warranty Market?

- What is the Auto Extended Warranty Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?