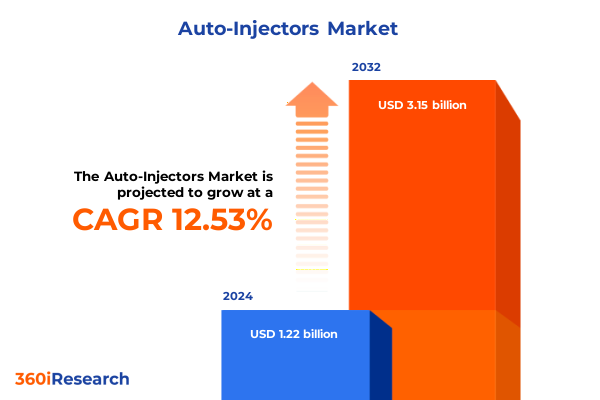

The Auto-Injectors Market size was estimated at USD 1.37 billion in 2025 and expected to reach USD 1.54 billion in 2026, at a CAGR of 12.60% to reach USD 3.15 billion by 2032.

Understanding the Emergence of Auto-Injectors as a Cornerstone of Patient-Centric Drug Delivery in Acute and Chronic Care Settings

The landscape of medical device delivery has been irrevocably transformed by the emergence of auto-injectors, which have rapidly evolved from niche tools into essential components of patient-centric therapy regimens. As self-administration gains prominence across both acute and chronic care pathways, stakeholders ranging from pharmaceutical developers to healthcare providers now prioritize devices that combine ease of use, safety, and reliability. This convergence of clinical necessity and patient empowerment has catalyzed a broader reevaluation of traditional administration methods, positioning auto-injectors as a linchpin in modern therapeutic strategies.

Underpinning this evolution is a growing emphasis on decentralizing care away from institutional settings toward at-home or ambulatory scenarios. The shift reflects broader healthcare paradigms that focus on cost containment, patient convenience, and adherence enhancement. In this context, auto-injectors have transcended their original role in emergency interventions to serve as critical delivery platforms for biologics and other complex therapies. As the industry continues to innovate, the strategic value of insights into design ergonomics, drug compatibility, and user training protocols has never been greater.

Identifying Transformational Dynamics Reshaping the Auto-Injector Landscape Through Digital Integration and Patient-Driven Innovations

Over the past several years, a series of transformational dynamics have reshaped the auto-injector landscape, driving both competitive intensity and collaborative opportunity. Advances in device engineering have enabled the integration of digital connectivity features, facilitating real-time monitoring of adherence and injection technique. This digital metamorphosis enhances patient outcomes by delivering actionable data to clinicians, while also creating new service layers around remote care management.

Simultaneously, regulatory frameworks have adapted to prioritize user safety and sterility assurance, prompting manufacturers to adopt novel materials and sterilization methodologies. The rise of patient advocacy movements has further intensified focus on human-factors design, accelerating development cycles for devices that minimize injection pain and reduce operational complexity. In parallel, strategic partnerships between pharmaceutical firms and device specialists have proliferated, creating ecosystems that align drug formulation with tailored injection mechanisms. Collectively, these shifts underscore a broader industry transformation toward integrated solutions that blend technology, patient experience, and therapeutic efficacy.

Assessing the Compounded Effects of 2025 United States Tariff Policies on Global Auto-Injector Manufacturing and Distribution

In 2025, United States tariff policies targeting certain medical device components and finished products have introduced a multilayered impact across the auto-injector value chain. By imposing additional duties on imported delivery system parts, these tariffs have triggered a realignment of supplier relationships, compelling many original equipment manufacturers to explore domestic sourcing alternatives. This recalibration has, in turn, generated fresh investment in stateside injection device assembly and packaging facilities, as companies seek to mitigate exposure to trade-related cost volatility.

However, the increased cost burdens associated with tariff-induced supply chain adjustments are not absorbed uniformly. Some suppliers have passed incremental expenses downstream, prompting device producers to reevaluate contract terms and negotiate shared responsibility for landed cost increases. Consequently, pricing strategies have evolved to incorporate total cost of ownership analyses, with a heightened focus on long-term supplier collaborations that can deliver consistent quality and lower risk of duty fluctuations. This cumulative impact has instigated a strategic imperative: balancing cost containment with supply chain resilience, all while safeguarding device availability for time-sensitive therapies.

Unveiling Targeted Segmentation Perspectives That Illuminate Consumer, Clinical and Commercial Drivers in the Auto-Injector Market

The auto-injector market is intricately segmented across multiple dimensions, each revealing distinct value drivers and clinical imperatives. When differentiating by type, the choice between disposable and reusable formats hinges on factors such as product lifecycle costs, sterilization protocols, and environmental considerations. Intramuscular and subcutaneous modes of administration represent divergent engineering challenges, with intramuscular designs optimized for deep-tissue delivery and subcutaneous configurations tailored for viscous biologic formulations.

Indication-specific segmentation further illuminates priorities: devices targeting anaphylaxis emphasize rapid-deploy mechanisms and transparent carrier housing for clear status indication; those for diabetes integrate dose adjustment features and connectivity to glucose monitoring platforms; injectors for multiple sclerosis focus on reduced injection force and ergonomic handling to support patients with compromised dexterity, and rheumatoid arthritis applications often include larger grip surfaces to accommodate joint pain and swelling. Distribution channels encompass a broad array of touchpoints, from hospital pharmacies supplying devices alongside inpatient therapy regimens to retail pharmacies serving at-home patients, as well as direct-to-patient online platforms that leverage digital ordering and home delivery. Finally, end-use environments-ambulatory care centers focused on outpatient procedures, homecare settings designed for self-administration by caregivers or patients, and hospitals & clinics requiring integration into centralized medication management systems-each impose unique requirements on device specifications and service support models.

This comprehensive research report categorizes the Auto-Injectors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Mode of Administration

- Indication

- Distribution Channel

- End Use

Analyzing Regional Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Decode Auto-Injector Industry Trends

Regional dynamics in the auto-injector industry reflect varied regulatory regimes, infrastructure maturity, and patient population profiles. In the Americas, established reimbursement frameworks and a robust ecosystem of specialty pharmacies accelerate adoption of connected injection technologies, while the prevalence of chronic disease management programs underscores demand for home-use solutions. The Americas also exhibit strong venture capital activity backing novel device startups, catalyzing rapid prototyping and pilot launches.

Across Europe, the Middle East & Africa, regulatory harmonization efforts coupled with country-specific health technology assessment bodies create a complex environment for market entry. Manufacturers must navigate diverse approval pathways, from CE marking in Europe to Gulf Cooperation Council standards in the Middle East and evolving regulatory capacity in African markets. Nevertheless, regional initiatives aimed at bolstering local manufacturing capabilities and public-private partnerships are paving the way for broader access to advanced auto-injector therapies.

In Asia-Pacific, the confluence of rising healthcare expenditures, expanding insurance coverage, and growing prevalence of conditions such as diabetes and autoimmune diseases fuels strong demand for both primary and secondary auto-injector applications. Cost-sensitive markets are driving interest in cost-effective disposable solutions, while more advanced markets invest heavily in reusable devices with integrated digital monitoring. Strategic partnerships between local OEMs and multinational pharmaceutical companies continue to shape distribution models and drive innovation tailored to regional patient needs.

This comprehensive research report examines key regions that drive the evolution of the Auto-Injectors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Strategic Collaborations Driving Competitive Advantage in the Global Auto-Injector Sector

The competitive landscape of the auto-injector sector is characterized by a mix of established medical device conglomerates and specialized innovators. Major players have fortified their portfolios through targeted acquisitions of niche injection device developers, while dedicating significant R&D budgets to incremental design improvements and novel material applications. At the same time, specialist firms with deep expertise in ergonomic design are leveraging collaborative agreements with large pharmaceutical companies to co-develop branded injection platforms that align precisely with drug characteristics and regulatory demands.

Partnership models range from co-licensing arrangements that share intellectual property and commercialization responsibilities to joint ventures focused on manufacturing scale-up for high-volume therapy programs. Companies are increasingly investing in digital health capabilities, integrating sensor technology and cloud-based analytics to differentiate their offerings. This strategic diversification allows organizations to deliver end-to-end solutions, encompassing device hardware, software platforms, and value-added services such as patient education and adherence support. The interplay between scale-driven incumbents and nimble innovators continues to shape the trajectory of competitive advantage in the auto-injector domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Auto-Injectors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Aktiv Medical Systems

- Amgen Inc.

- Amneal Pharmaceuticals, Inc.

- AptarGroup, Inc.

- Bayer AG

- Becton, Dickinson and Company

- Biogen Inc.

- Eli Lilly and Company

- Gerresheimer AG

- GlaxoSmithKline PLC

- Halozyme Therapeutics, Inc.

- Johnson & Johnson Services, Inc.

- Medeca Pharma AB

- Merck KGaA

- Mylan N.V. by Viatris Inc.

- NEMERA Group

- Novartis AG

- Pfizer, Inc.

- Ravimed Sp. z o.o.

- Recipharm AB

- Sanofi S.A.

- SHL Medical AG

- Stevanato Group

- Teva Pharmaceutical Industries Ltd.

- West Pharmaceutical Services, Inc.

- Ypsomed Holding AG

Strategic Imperatives for Industry Leaders to Enhance Resilience, Innovation and Market Penetration in Auto-Injector Solutions

To thrive within the complex auto-injector marketplace, industry leaders must prioritize resilience and adaptability across every facet of their operations. Securing a diversified supplier network that spans geographies and technology specializations will help mitigate tariff-induced cost shocks and ensure continuity of device availability. Furthermore, companies should accelerate investments in digital integration, developing connected injection platforms that deliver real-time usage insights and support remote patient management programs.

Innovation roadmaps must account for evolving clinical and regulatory requirements, with a focus on human-centered design principles that minimize user errors and enhance therapy adherence. Strategic collaborations-with contract manufacturers, software developers, and healthcare providers-can expedite time to market and unlock new revenue streams through service-based offerings. Finally, strengthening go-to-market strategies by leveraging both traditional distribution channels and direct digital engagement models will allow stakeholders to capture value across diverse end-use environments.

Detailing Rigorous Research Methodology Integrating Primary and Secondary Data to Ensure Robustness of Auto-Injector Market Insights

Our research methodology is built upon a rigorous process that integrates both primary and secondary intelligence to validate findings and ensure depth of insight. Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory filings, patent databases, and industry white papers to establish a robust knowledge base on device technologies, approval pathways, and market dynamics. Primary research involved conducting in-depth interviews with key opinion leaders, including device engineers, regulatory specialists, healthcare providers, and patient advocates, to capture real-world perspectives on performance benchmarks and unmet needs.

Data triangulation methodologies were applied to reconcile insights from disparate sources and to identify areas of consensus versus emerging debate. Quantitative and qualitative analyses were synthesized to build an integrated narrative around technological trends, competitive positioning, and strategic imperatives. The outcome is a multidimensional report that balances granular device-level assessments with high-level strategic recommendations, designed to equip decision-makers with the actionable insights required to navigate the auto-injector landscape confidently.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Auto-Injectors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Auto-Injectors Market, by Type

- Auto-Injectors Market, by Mode of Administration

- Auto-Injectors Market, by Indication

- Auto-Injectors Market, by Distribution Channel

- Auto-Injectors Market, by End Use

- Auto-Injectors Market, by Region

- Auto-Injectors Market, by Group

- Auto-Injectors Market, by Country

- United States Auto-Injectors Market

- China Auto-Injectors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Takeaways to Highlight Future Trajectories and Strategic Opportunities Within the Auto-Injector Industry

As auto-injectors continue to reshape the paradigms of drug delivery, the industry stands at the threshold of unprecedented growth opportunities and novel challenges. Advances in digital health, combined with an intensifying focus on patient experience, are redefining what constitutes best-in-class injection systems. In parallel, regulatory shifts and trade policy dynamics underscore the importance of strategic agility and supply chain diversification.

The confluence of these factors signals a future in which successful players will be those that seamlessly integrate device innovation with data-driven service models, while maintaining the resilience to absorb external shocks. By embracing an end-to-end perspective-spanning design, manufacturing, distribution, and post-market support-organizations can unlock sustainable competitive advantage and deliver on the promise of patient-centric care.

Engage with an Industry Expert to Obtain Tailored Auto-Injector Market Research Insights That Drive Strategic Growth and Competitive Differentiation

For organizations seeking to navigate the complex terrain of auto-injector innovation and commercialization, partnering directly with an industry expert can accelerate strategic momentum. Ketan Rohom, as Associate Director of Sales & Marketing, offers a personalized consultation designed to align decision-makers with the precise insights needed to optimize product development pipelines, refine go-to-market frameworks, and strengthen competitive positioning. Engaging with Ketan provides direct access to a deep well of analytical rigor, tailored advisory support, and an expedited path to leveraging our full suite of research deliverables for maximum impact. Connect today to secure a comprehensive auto-injector market research report that’s calibrated to drive your organization’s growth ambitions and inform executive-level decision-making without delay

- How big is the Auto-Injectors Market?

- What is the Auto-Injectors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?