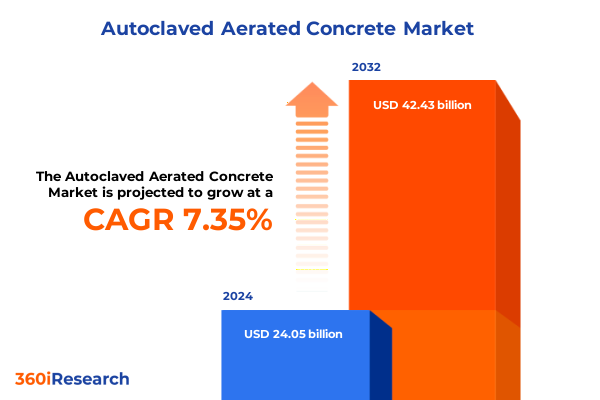

The Autoclaved Aerated Concrete Market size was estimated at USD 25.80 billion in 2025 and expected to reach USD 27.69 billion in 2026, at a CAGR of 7.36% to reach USD 42.43 billion by 2032.

Embracing Eco-Efficiency and Structural Innovation Through Advanced Steam-Cured Lightweight Construction Materials

Autoclaved aerated concrete has emerged as a cornerstone material in contemporary construction, blending ecological responsibility with structural performance. This lightweight, precast building solution capitalizes on advanced chemistry and steam-curing processes to yield panels and blocks that deliver high thermal efficiency, fire resistance, and workability. By integrating air pockets into the cementitious matrix, the material achieves a unique balance between load-bearing capacity and insulation properties.

The momentum behind autoclaved aerated concrete stems from escalating demands for carbon footprint reduction and resource efficiency. As global construction standards tighten, developers and engineers increasingly turn to innovative materials that align with green building certifications and energy codes. In parallel, urbanization pressures and affordable housing imperatives have catalyzed adoption, enabling firms to accelerate project timelines while meeting stringent sustainability benchmarks.

Moreover, autoclaved aerated concrete’s modular nature and compatibility with digital fabrication techniques facilitate lean construction methodologies. Combined with enhancements in production scalability, these attributes position the material at the forefront of the circular economy ethos. As stakeholders seek materials that optimize life-cycle costs and environmental impact, autoclaved aerated concrete continues to redefine the parameters of modern building practice.

Mapping the Digital, Automation, and Circularity-Focused Transformations Reshaping the AAC Market Dynamics

The autoclaved aerated concrete landscape is undergoing monumental shifts propelled by technological, regulatory, and market-driven forces. Foremost among these is the integration of digital design tools, which enable precise customization of block and panel geometries, accelerating on-site assembly and minimizing waste. Building information modeling platforms now incorporate specialized AAC modules, empowering architects to simulate thermal performance and structural behavior before procurement.

Concurrently, investments in production automation, including robotics for cutting and finishing, have streamlined operations, reducing labor intensity and enhancing consistency. This mechanization trend dovetails with an expanded focus on alternative binders and supplementary cementitious materials, which aim to lower embodied carbon. Suppliers are experimenting with industrial by-products and recycled aggregates to bolster circularity and cost efficiency.

Supply chain resilience has also ascended as a strategic priority. In response to global disruptions, manufacturers are diversifying raw material sourcing and establishing decentralized production units closer to high-growth urban centers. This geographic dispersion mitigates logistics vulnerabilities and tailors product portfolios to region-specific building codes and climatological requirements.

Ultimately, these transformative shifts underscore a paradigm wherein autoclaved aerated concrete is no longer a niche alternative but a digitally enabled, sustainability-driven mainstay capable of meeting the evolving demands of modern construction.

Evaluating the Multifaceted Repercussions of 2025 U.S. Import Duties on Supply Chain Dynamics and Pricing Structures

The United States’ imposition of increased import duties on autoclaved aerated concrete products in early 2025 has yielded multifaceted repercussions across industry stakeholders. These tariffs, targeting key source markets with historically competitive pricing, have elevated landed costs for imported panels and blocks, prompting developers to reassess material procurement strategies. In turn, domestic producers have seen a resurgence in demand, enabling incremental capacity expansions in states with established cement and steam-curing infrastructure.

However, cost pressures have reverberated downstream, as construction firms confront narrower margins when substituting higher-priced domestic AAC or alternative masonry materials. This has spurred negotiations between suppliers and general contractors to renegotiate supply contracts and to explore long-term purchase agreements. Furthermore, the tariffs have incentivized certain multinational manufacturers to consider relocating or augmenting production facilities within North America to circumvent duty burdens, fostering new investment dynamics.

Regulatory bodies have also responded, with state and local permitting agencies fast-tracking approvals for domestic AAC plants to bolster housing affordability objectives. Simultaneously, advocacy groups and industry associations are engaging with policymakers to calibrate tariff levels in alignment with broader economic and sustainability goals.

In aggregate, the 2025 tariff regime has catalyzed a rebalancing of the autoclaved aerated concrete supply chain, reinforcing homegrown production while challenging stakeholders to innovate in cost management and logistical efficiency.

Uncovering Detailed Product, Application, End-Use, and Channel Insights Shaping AAC Adoption Across Diverse Construction Verticals

An in-depth look at product type segmentation reveals that traditional block offerings, encompassing both hollow and solid variants, continue to command substantial market interest due to ease of handling and proven performance in load-bearing and non-load-bearing applications alike. Yet floor and wall panels, benefiting from streamlined on-site installation and enhanced dimensional accuracy, are gaining traction among developers focused on accelerated schedules and design versatility.

Application-based distinctions underscore that residential projects, particularly single-family dwellings, leverage the material’s insulation benefits to meet stringent energy codes, while multifamily constructions exploit panelized systems for uniformity and speed. In the commercial domain, offices and hospitality venues are drawn to AAC’s acoustic attenuation and fire-resistive qualities. Industrial users, including warehousing and manufacturing facilities, value the product’s durability and cost-effective thermal management under extensive floor loads.

End-use deployment further clarifies performance considerations: first floors and ground-level slabs incorporate dense panels for foundational support, whereas upper floors emphasize lighter partitions to reduce structural demands. Exterior partitioning consistently harnesses non-combustible solid blocks, while interior layouts alternate between wall panels and hollow partitions to optimize layout flexibility.

Distribution channels are adapting to customer preferences, with direct sales forging long-term partnerships, distributors expanding regional inventories for rapid delivery, and online platforms emerging as efficient conduits for smaller project orders. Strength grades from M5 to M12.5 address diverse structural requirements, while density variations balance load handling with thermal performance, affirming the technology’s capacity to address bespoke project specifications.

This comprehensive research report categorizes the Autoclaved Aerated Concrete market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Strength Grade

- Density

- Application

- End Use

- Distribution Channel

Assessing the Diverse Drivers of AAC Expansion Across the Americas, EMEA, and Asia-Pacific Construction Markets

Navigating the regional landscape, the Americas market remains a powerhouse, propelled by robust infrastructure spending and policy incentives for energy-efficient construction. The United States leads adoption through targeted building codes and federal grant programs promoting low-carbon materials, while Canada’s expansion is underpinned by cold-climate insulation demands. Latin American markets, although embryonic, show promise as urbanization intensifies and investment in affordable housing accelerates.

Across Europe, the Middle East and Africa, Western Europe’s mature construction sector is balancing heritage conservation with modern sustainability imperatives, positioning AAC as an optimal retrofit and new-build solution. In the Middle East, rapid urban expansions and mega-project developments are driving demand for fire-resistant, thermally robust panels in extreme climates. Meanwhile, sub-Saharan Africa’s nascent construction boom is gradually recognizing AAC’s benefits in cost management and thermal comfort.

The Asia-Pacific region epitomizes dynamic growth, with China and India scaling up production to address housing shortages and environmental mandates. Southeast Asian economies are integrating AAC panels into smart city initiatives, capitalizing on prefabrication for speed and quality control. Australia and New Zealand exhibit growing interest in earthquake-resilient structures, where AAC’s lightweight profile and seismic resilience are advantageous.

This tri-regional snapshot illustrates how regulatory frameworks, climatic conditions, and development priorities collectively inform strategic market positioning for autoclaved aerated concrete manufacturers.

This comprehensive research report examines key regions that drive the evolution of the Autoclaved Aerated Concrete market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Innovations, Sustainability Initiatives, and Digitalization Efforts of Top AAC Industry Players

Leading the autoclaved aerated concrete sector, several global enterprises are pioneering innovations while scaling their footprints. One prominent manufacturer has invested heavily in automated production lines across North America and Europe, emphasizing lean manufacturing principles to reduce waste and enhance throughput. This approach has translated into consistent quality gains, enabling the supplier to secure long-term partnerships with large construction conglomerates.

Another key player has differentiated through sustainable sourcing of raw materials, integrating industrial by-products such as fly ash and slag into the mix design. By achieving lower embodied carbon values, this company has positioned itself as a preferred partner for green building certifications and government tenders that prioritize environmental performance.

A third influential competitor has capitalized on digital marketing and e-commerce platforms to serve small to mid-sized contractors, offering rapid online ordering and door-to-site delivery services. This digital-first strategy has unlocked new customer segments and fostered higher repeat purchase rates.

Across the board, leading companies are forming strategic alliances with technology startups, research institutes, and policy groups to co-develop next-generation AAC formulations and to shape favorable regulatory environments. Their collective efforts underscore an industry trend toward collaboration, digital transformation, and sustainability leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autoclaved Aerated Concrete market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACICO Group

- Aercon India

- Bauroc International AS

- Biltech Building Elements Limited

- Brickwell

- Buildmate Projects Pvt. Ltd.

- CSR Ltd.

- Eastland Building Materials Co., Ltd.

- Ecorex Buildtech Pvt. Ltd.

- Godrej & Boyce Manufacturing Company Limited

- H+H International A/S

- HIL Limited

- Infitech Group

- JK Lakshmi Cement Ltd.

- Magicrete Building Solutions Pvt Ltd.

- Solbet Sp Z.o.o.

- UAL Industries Ltd.

- UltraTech Cement Ltd.

- Wehrhahn GmbH

- Xella Group

Harnessing Automation, Sustainable Partnerships, and Policy Advocacy to Elevate AAC Market Leadership and Resilience

Industry leaders should prioritize continued investment in automated and flexible manufacturing solutions to remain agile amid fluctuating material costs and tariff implications. By expanding modular plant designs, companies can adapt production capacity in proximity to key markets, optimizing logistics and reducing carbon emissions.

It is imperative to forge collaborative research partnerships focused on advanced binder chemistries and recycled feedstocks. Such alliances will accelerate the development of ultra-low-carbon AAC variants, aligning product portfolios with tightening environmental regulations and corporate sustainability objectives.

Furthermore, enterprises must refine their go-to-market strategies by leveraging data analytics to forecast regional demand patterns and by enhancing online ordering capabilities. Integrating customer relationship management systems with digital supply chain platforms will not only improve transparency but also strengthen customer loyalty through personalized service offerings.

Engagement with policymakers remains crucial: proactive advocacy for tariff adjustments and supportive incentives can create a more stable trade environment. Establishing industry consortiums to present unified positions on regulatory matters will amplify influence and facilitate the advancement of construction standards that recognize AAC’s performance benefits.

Ultimately, combining operational excellence with strategic collaborations and policy engagement will empower companies to seize emerging opportunities and fortify their market leadership in the autoclaved aerated concrete arena.

Detailing the Comprehensive Mixed-Methods Research Design Integrating Multi-Source Data and Stakeholder Validation

This research leveraged a mixed-methods approach, beginning with an exhaustive review of industry publications, technical whitepapers, and governmental policy documents related to autoclaved aerated concrete. Complementary secondary sources included trade journals, company filings, and patent databases to capture innovation trajectories and regulatory changes.

Primary insights were garnered through in-depth interviews with plant managers, R&D directors, procurement executives, and regulatory officials across key regions. These qualitative discussions illuminated real-world challenges around production scalability, supply chain disruptions, and market entry barriers.

Quantitative data was compiled from procurement records, trade statistics, and construction permit filings to map historical adoption trends and to identify surges associated with policy shifts or infrastructural investments. Data triangulation ensured that findings reflected both macroeconomic influences and firm-level dynamics.

Throughout the engagement, iterative validation workshops were conducted with senior industry stakeholders to confirm the accuracy of interpretations and to refine strategic recommendations. This rigorous methodology ensures that the report’s conclusions rest on a solid empirical foundation, offering stakeholders actionable and reliable market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autoclaved Aerated Concrete market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autoclaved Aerated Concrete Market, by Product Type

- Autoclaved Aerated Concrete Market, by Strength Grade

- Autoclaved Aerated Concrete Market, by Density

- Autoclaved Aerated Concrete Market, by Application

- Autoclaved Aerated Concrete Market, by End Use

- Autoclaved Aerated Concrete Market, by Distribution Channel

- Autoclaved Aerated Concrete Market, by Region

- Autoclaved Aerated Concrete Market, by Group

- Autoclaved Aerated Concrete Market, by Country

- United States Autoclaved Aerated Concrete Market

- China Autoclaved Aerated Concrete Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Market Drivers, Regional Dynamics, and Competitive Strategies to Forecast the Future Trajectory of AAC

Autoclaved aerated concrete stands at the nexus of sustainability, performance, and innovation within the construction materials landscape. Its maturation from a niche alternative to a mainstream solution reflects concerted advances in digital design, automated production, and green chemistry. The imposition of U.S. tariffs in 2025 has reshaped supply chains, bolstered domestic manufacturing, and underscored the strategic importance of operational agility.

Segmentation analysis reveals that a wide spectrum of product types, applications, and distribution channels collectively drives the material’s appeal across residential, commercial, and industrial sectors. Regional dynamics demonstrate that while established markets in the Americas and EMEA continue to optimize existing usage, Asia-Pacific’s rapid expansion underscores global growth potential.

Industry frontrunners are differentiating through sustainable material sourcing, digital sales platforms, and collaborative innovation initiatives. Their strategies, coupled with actionable recommendations around automation and policy advocacy, chart a clear path for continued market penetration.

As the construction sector navigates evolving regulatory and environmental imperatives, autoclaved aerated concrete is poised to deliver high-performance, low-impact building solutions. Stakeholders equipped with robust intelligence and strategic foresight will capitalize on the next wave of AAC adoption trajectories.

Empower Your Strategic Decisions with Personalized Guidance from Ketan Rohom to Acquire the Definitive AAC Market Intelligence Report Immediately

Ketan Rohom, with his profound expertise in sales and market dynamics, invites industry stakeholders to secure access to the comprehensive market research report on autoclaved aerated concrete. The report offers a deep dive into technology innovations, regulatory landscapes, and competitive movements essential for informed decision-making. By partnering with Ketan, readers will gain direct guidance on interpreting critical findings, leveraging data-driven insights, and identifying strategic opportunities for growth.

Engaging with Ketan opens the door to bespoke consultations tailored to unique business challenges, from optimizing supply chains to navigating evolving tariff structures. His role as Associate Director for Sales & Marketing ensures that every dialogue is oriented toward actionable outcomes and measurable impact. Readers are encouraged to reach out promptly to initiate an in-depth discussion, secure volume licensing options, or arrange a personalized walkthrough of the report’s most compelling sections.

Reserve your copy today to benefit from early access pricing and to position your organization at the forefront of the autoclaved aerated concrete market’s next wave of expansion. Connect with Ketan Rohom to unlock the strategic intelligence that will drive your market leadership and set the foundation for sustained competitive advantage.

- How big is the Autoclaved Aerated Concrete Market?

- What is the Autoclaved Aerated Concrete Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?