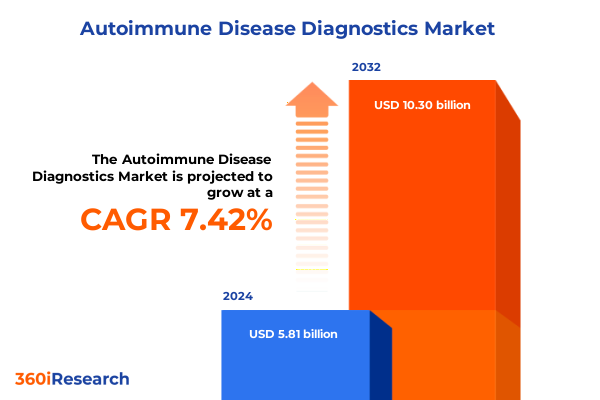

The Autoimmune Disease Diagnostics Market size was estimated at USD 6.23 billion in 2025 and expected to reach USD 6.68 billion in 2026, at a CAGR of 7.45% to reach USD 10.30 billion by 2032.

How converging clinical, technological, and operational forces are redefining autoimmune diagnostics toward integrated, data-driven patient care

The landscape of autoimmune disease diagnostics is at an inflection point, driven by converging technological, clinical, and commercial forces that are reshaping how diseases are identified, stratified, and monitored. Clinical practice is moving away from single-analyte, episodic testing toward integrated diagnostic strategies that combine serology, molecular profiling, imaging, and algorithmic interpretation to produce actionable, patient-centric results. This shift is underpinned by advances in assay multiplexing, genomic and proteomic platforms, and smarter laboratory operations that together enable earlier, more precise diagnosis and ongoing disease activity monitoring.

Clinicians and laboratory leaders are demanding diagnostics that reduce time-to-diagnosis, increase reproducibility, and deliver longitudinal value across care pathways. As a result, product development has accelerated toward higher-throughput assay kits, next-generation sequencing and proteomic workflows, and instrument platforms that can be integrated into automated laboratory ecosystems. This evolution also alters stakeholder expectations: payers, hospital systems, and specialty clinics seek diagnostics that demonstrate clinical utility, operational efficiency, and predictable total cost of care impacts. Given these pressures, market participants must align R&D, regulatory strategy, and commercialization planning to the realities of a faster, data-rich diagnostic era.

Major disruptive shifts are transforming diagnostics from single tests to integrated, multiplexed and digitally enabled platforms that support personalized autoimmune care

Established diagnostic paradigms are being disrupted by a set of transformative shifts that collectively change what constitutes meaningful clinical information. Multiplex immunoassays and multi-analyte autoantibody panels now enable simultaneous interrogation of disease signatures previously assessed through sequential testing, decreasing diagnostic latency and improving differential diagnosis between overlapping autoimmune syndromes. At the same time, the incorporation of genomic technologies such as next-generation sequencing and targeted molecular panels is expanding the ability to detect hereditary and immune-modulating variants that influence disease susceptibility and therapeutic response. These modalities are increasingly complemented by advanced imaging protocols and quantitative inflammatory biomarkers that together support a layered diagnostic narrative rather than a single-point determination.

Laboratory modernization and digitalization have been equally transformative. Adoption of laboratory automation and cloud-enabled laboratory information systems is enabling higher throughput, tighter quality controls, and integrated data aggregation for AI-driven interpretation. This digital backbone supports decision-support tools that help clinicians interpret complex biomarker patterns and correlate them with imaging and clinical history, enabling risk stratification and personalized monitoring. Concurrently, regulatory frameworks and professional society guidelines are evolving to provide clearer pathways for demonstrating clinical utility and integrating novel diagnostics into standard-of-care algorithms. Together, these shifts are changing competitive dynamics, privileging organizations that can deliver validated, interoperable diagnostic solutions that fit clinical workflows and payer expectations.

How 2025 tariff developments are reshaping procurement, manufacturing footprint decisions, and operational resilience across the autoimmune diagnostics value chain

Recent tariff policy movements and trade actions have introduced an additional layer of supply-chain and cost uncertainty for diagnostic manufacturers, laboratory operators, and healthcare systems. Changes in U.S. Section 301 tariffs announced in late 2024 and finalized with effective dates into 2025 increased duties on certain strategic product categories, and some actions explicitly targeted goods used across healthcare supply chains. Those policy changes have influenced import costs for equipment, disposable devices, and selected consumables, prompting manufacturers and distributors to revisit sourcing strategies, price-setting, and inventory buffering approaches. The practical effect has been an acceleration of supplier diversification efforts, nearshoring conversations, and surcharge practices while purchasers seek contract assurances and alternative vendors to mitigate exposure to duty-driven cost inflation.

Industry responses have varied. Some life sciences companies introduced temporary surcharges or adjusted pricing to account for elevated import costs, while others pursued manufacturing footprint shifts and strategic inventory management to limit disruption. Observations from corporate responses and advisory analyses indicate that procurement leaders are increasingly embedding tariff scenario planning into capital investment reviews and that R&D teams are factoring component availability and import risk into platform design choices. For diagnostic laboratories, the tariff environment has heightened the premium placed on instruments and assay kits that reduce reagent consumption or allow substitution of locally sourced consumables, thereby insulating operations from episodic trade policy shocks. These dynamics underscore a near-term imperative to treat trade-policy risk as a core input to commercial and operational planning for diagnostic products and services.

Segment-level clarity showing how product, test type, technology, sample, indication, distribution channel, and end-user priorities determine adoption pathways and commercial value

A granular segmentation lens reveals where clinical and commercial opportunities converge and where operational risk concentrates, informing prioritization for product development and go-to-market strategies. When considering product type, assay kits and reagents continue to be the primary vector for near-term clinical impact due to their role in enabling multiplex panels and reflex testing algorithms, while instrument platforms are focal for labs seeking throughput gains and workflow consolidation. In terms of test type, the diagnostic landscape spans classical autoantibodies and immunologic assays, genetic testing modalities, imaging-based diagnostics, and inflammatory markers; within these categories, disease-specific antibody subpanels, molecular chromosomal and targeted molecular tests, advanced imaging modalities like MRI and PET/CT, and familiar inflammatory markers each serve distinct clinical use cases from screening to monitoring. Technical choices matter: enzyme-linked immunosorbent assays and immunofluorescence remain workhorses for serology, multiplex assays and flow cytometry support broader phenotyping, and next-generation sequencing unlocks genetic insights and complex biomarker discovery. Sample type considerations also shape product design and adoption pathways, with blood the dominant sample matrix for most autoimmune markers, and saliva or urine emerging as noninvasive alternatives for some applications.

Indication-driven segmentation further clarifies demand patterns. Organ-specific autoimmune diagnostics address focused pathways such as thyroid autoimmunity and neurological or pancreatic targets, while systemic autoimmune disease diagnostics-covering conditions like rheumatoid arthritis and systemic lupus erythematosus-often require multi-analyte strategies and integration with imaging and functional tests. Distribution channels and end users create the final layer of go-to-market nuance: offline, institutional procurement dynamics continue to dominate high-complexity testing and instrument sales, while online channels accelerate access to kits and point-of-care solutions for ambulatory and decentralized settings. Diagnostic laboratories, hospitals, ambulatory care centers, and research institutions each prioritize different value drivers, from throughput and regulatory compliance to clinical interpretability and cost-per-test, which means product positioning must be tailored across these segments to capture adoption momentum.

This comprehensive research report categorizes the Autoimmune Disease Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Test Type

- Technology

- Sample Type

- Indication

- Distribution Channel

- End User

Regional commercialization playbooks that balance regulatory rigor, payer expectations, and supply-chain dynamics to maximize diagnostic adoption across diverse healthcare systems

Regional dynamics materially influence commercialization strategies for autoimmune diagnostics by shaping regulatory expectations, reimbursement pathways, and supply chain choices. In the Americas, advanced clinical infrastructure and centralized laboratory networks support rapid uptake of high-throughput assays and integrated platforms, but the region’s sensitivity to tariff-driven input costs and reimbursement pressures requires a clear value proposition tied to demonstrable clinical utility and workflow efficiency. Europe, the Middle East & Africa presents heterogeneous regulatory environments with varying adoption rates; in Western Europe, strong regulatory harmonization and public payer scrutiny demand robust health economic evidence, whereas pockets in the Middle East and Africa prioritize cost-effective, robust diagnostics that can function in constrained infrastructures. Asia-Pacific combines high-growth demand with a complex mix of domestic manufacturing strengths and regulatory divergence; many markets in the region favor locally manufactured reagents and instruments, and bilateral trade developments can rapidly influence procurement behavior.

These regional differences imply differentiated launch roadmaps. Manufacturers should adopt a market-by-market regulatory and reimbursement playbook, leveraging local clinical partnerships to build real-world evidence where payer scrutiny is high, while emphasizing cost, supply chain resilience, and service models in regions where procurement flexibility and manufacturing sourcing are decisive. Partnerships with regional distributors, flexible pricing strategies, and modular instrument-to-assay bundles are commonly effective approaches for navigating these geographic idiosyncrasies.

This comprehensive research report examines key regions that drive the evolution of the Autoimmune Disease Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive dynamics driven by platform incumbency, niche assay innovation, and service-oriented differentiation that prioritize validation and supply resiliency

The competitive environment in autoimmune diagnostics is characterized by a combination of established diagnostics manufacturers, specialist assay developers, and agile platform companies that are investing in multiplexing, automation, and interpretative software. Incumbent players continue to leverage installed instrument bases to promote consumables and assay catalogs, while smaller specialist firms focus on high-value niche diagnostics, unique biomarker panels, or novel sample-preparation technologies that simplify clinical workflows. Strategic partnerships and co-development agreements are increasingly common, enabling diagnostics companies to pair novel assays with validated instrument footprints and laboratory automation partners to accelerate uptake.

Beyond product synergies, companies are differentiating through data and services-clinical decision support, sample logistics, and managed laboratory services are converging with classical product offerings to create stickier commercial relationships. In this environment, entities that combine robust clinical validation with interoperable data platforms and flexible commercial models gain an advantage, especially when they can demonstrate how diagnostic outputs change clinical management or reduce downstream costs. Given ongoing supply-chain and tariff pressures, firms with diversified manufacturing footprints or resilient procurement strategies are better positioned to maintain stable supply and competitive pricing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autoimmune Disease Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- AESKU.GROUP GmbH & Co. KG

- Autobio Diagnostics Co., Ltd.

- Beckman Coulter, Inc. by Danaher Corporation

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- BioAgilytix Labs

- bioMerieux SA

- Chengdu Maccura Biotechnology Co., Ltd.

- DiaSorin S.p.A.

- Exagen Inc.

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline plc

- Grifols, S.A

- Hemagen Diagnostics, Inc.

- Labcorp Holdings Inc.

- Medical & Biological Laboratories Co. Ltd

- Menarini Group

- Merck KGaA

- Progentec Diagnostics, Inc.

- Quest Diagnostics, Inc.

- Revvity, Inc.

- RSR Limited

- Sebia S.A.

- Shanghai Kehua Bio-Engineering Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shenzhen YHLO Biotech Co.,Ltd.

- Siemens Healthineers AG

- Svar Life Science AB

- Takeda Pharmaceutical Company Limited

- Thermo Fisher Scientific Inc.

- Trinity Biotech PLC

- Werfen Group

Actionable strategic and operational moves for leaders to future-proof product development, supply chains, and commercialization in autoimmune diagnostics

Industry leaders should adopt a sequence of pragmatic, actionable moves that align R&D, supply chain, and commercial execution with the realities of clinical practice and policy risk. First, prioritize modular product development that allows assays to operate across multiple instrument platforms and sample types, reducing single-point dependency and widening clinical utility. Next, build clinical evidence programs that pair diagnostic readouts with clearly defined clinical decision pathways and health economic models so payers and hospital systems can quantify downstream value. Concurrently, intensify supply-chain scenario planning: qualify second-source suppliers for key reagents, evaluate nearshoring or regional manufacturing hubs for critical components, and embed tariff-sensitivity analyses in procurement contracts and pricing models.

Operationally, accelerate laboratory integration pathways by developing middleware compatibility, cloud-enabled reporting, and clinician-facing interpretive tools that reduce adoption friction. From a go-to-market perspective, tailor channel strategies to end-user needs-offer managed-service agreements or reagent rental models for high-throughput sites, and provide simplified kit- and cloud-based interpretive services to ambulatory settings. Finally, prioritize partnerships with clinical centers and payers to generate pragmatic evidence and to pilot reimbursement pathways. These combined steps will materially increase the odds of sustained adoption while hedging against policy and supply volatility.

Transparent multi-method research design combining stakeholder interviews, literature synthesis, and scenario analysis to produce actionable diagnostic insights

This research synthesizes a multi-method approach combining primary stakeholder interviews, secondary literature synthesis, and structured signal detection across policy and industry datasets. Primary research involved confidential interviews with laboratory directors, procurement leads, hospital system executives, and diagnostic product managers to capture operational pain points, adoption criteria, and procurement behaviors. Secondary sources included peer-reviewed clinical guidelines and technology reviews, regulatory announcements, and industry commentary to validate clinical utility narratives and to track regulatory and trade-policy developments.

Analytical methods included segmentation mapping across product, test type, technology, sample, indication, distribution channel, and end-user to identify high-opportunity clusters and downstream integration challenges. Scenario analysis was used to model supply-chain and tariff shocks, testing the resilience of different commercial and manufacturing strategies. Evidence weighting prioritized peer-reviewed clinical guidance and regulatory decisions where available, complemented by real-world operational inputs from laboratory professionals to ensure relevance. Throughout, data provenance and methodological assumptions are documented so that readers can trace how conclusions were reached and adapt the framework to organization-specific data or constraints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autoimmune Disease Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autoimmune Disease Diagnostics Market, by Product

- Autoimmune Disease Diagnostics Market, by Test Type

- Autoimmune Disease Diagnostics Market, by Technology

- Autoimmune Disease Diagnostics Market, by Sample Type

- Autoimmune Disease Diagnostics Market, by Indication

- Autoimmune Disease Diagnostics Market, by Distribution Channel

- Autoimmune Disease Diagnostics Market, by End User

- Autoimmune Disease Diagnostics Market, by Region

- Autoimmune Disease Diagnostics Market, by Group

- Autoimmune Disease Diagnostics Market, by Country

- United States Autoimmune Disease Diagnostics Market

- China Autoimmune Disease Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Converging technology and policy dynamics create opportunities for validated, resilient diagnostic solutions that improve patient care while managing execution risk

Autoimmune disease diagnostics stand at the intersection of rapid technological opportunity and practical operational constraints. Advancements in multiplex assays, molecular profiling, and laboratory automation create concrete pathways to earlier and more precise diagnosis, while digital integration and AI-driven interpretation promise to convert complex biomarker signatures into actionable clinical decisions. At the same time, macro-level forces-trade policy shifts, supply-chain fragility, and payer scrutiny-introduce material execution risk that must be actively managed.

The strategic imperative is clear: organizations that pair clinical-grade validation with flexible product architectures, resilient supply strategies, and clinician-friendly digital tools will capture disproportionate value. Equally important is the need for sustained engagement with payers and clinical leaders to demonstrate health economic benefit and to ensure that new diagnostics are integrated into care pathways. With thoughtful alignment of technology, evidence, and operational resilience, the sector can deliver measurable improvements in patient outcomes while navigating near-term policy and market turbulence.

Secure a tailored executive briefing and purchase pathway with the Associate Director of Sales & Marketing to convert research insights into commercial outcomes quickly

For an executive-grade, actionable market research report tailored to procurement, strategy, and business development leaders in autoimmune disease diagnostics, contact Ketan Rohom, Associate Director, Sales & Marketing, to arrange access to the full report, licensing options, and bespoke briefings. The research pack includes a detailed breakdown of technology adoption pathways, regulatory milestone tracking, region- and channel-specific commercialization intelligence, and a modular set of slide-ready visuals suitable for board and investor review.

Engaging directly will secure a prioritized briefing that aligns the report’s insights with your organizational priorities, including custom scenario work to test tariff, supply chain, and reimbursement shocks against product- and indication-level strategies. Request a tailored walk-through to identify which diagnostic segments and geographies present the most immediate opportunities and which require risk mitigation or supplier diversification. A coordinated buy-in process can also unlock bundled advisory hours for implementation planning and provider engagement strategies.

To proceed, ask for a proposal that outlines deliverables, timelines, and options for a short, high-impact executive workshop to translate research findings into a 90-day action plan for commercialization, procurement, or clinical adoption initiatives. Ketan can coordinate pricing, licensing, and scheduling of a confidential briefing to help convert this research into measurable commercial outcomes.

- How big is the Autoimmune Disease Diagnostics Market?

- What is the Autoimmune Disease Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?