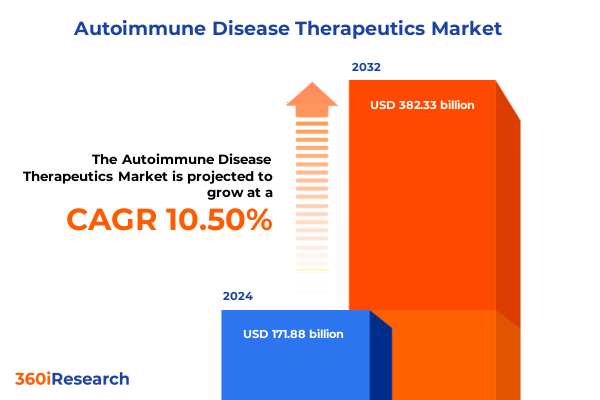

The Autoimmune Disease Therapeutics Market size was estimated at USD 189.77 billion in 2025 and expected to reach USD 209.53 billion in 2026, at a CAGR of 10.52% to reach USD 382.33 billion by 2032.

Navigating the Evolving Terrain of Autoimmune Disease Therapeutics: A Comprehensive Overview of Emerging Opportunities and Challenges

The field of autoimmune disease therapeutics has entered an era of unprecedented complexity and opportunity, driven by converging scientific advances, evolving patient needs, and a shifting regulatory landscape. Immunology researchers have made remarkable strides in understanding the molecular underpinnings of conditions such as rheumatoid arthritis, multiple sclerosis, and lupus, laying the groundwork for a new generation of targeted therapies. Simultaneously, advances in gene editing, biologic manufacturing, and digital health technologies are redefining the possibilities for precision medicine. As stakeholders navigate this landscape, they must balance the promise of innovation against challenges such as high development costs, evolving payer expectations, and the intricacies of global supply chains in a post-pandemic world.

Against this backdrop, executive leadership in pharmaceutical and biotechnology organizations requires a strategic vantage point that integrates translational science, market access considerations, and patient-centric delivery models. By examining the latest breakthroughs in therapeutic modalities-ranging from monoclonal antibodies and fusion proteins to small-molecule inhibitors and gene therapies-this analysis sets the stage for a deeper exploration of the forces reshaping market dynamics. Furthermore, it underscores the importance of an agile approach to portfolio management, one that can adapt to emerging regulatory frameworks and evolving reimbursement pathways.

Unpacking the Profound Transformative Shifts Reshaping the Autoimmune Disease Therapeutics Landscape and Driving Future Innovations

In recent years, the autoimmune therapeutics landscape has undergone transformative shifts driven by the maturation of biologic platforms and the rapid emergence of small-molecule innovations. Biologics, once limited to early-generation monoclonal antibodies, have diversified into fusion proteins that deliver multifunctional mechanisms of action and gene therapies that hold the promise of durable remissions. At the same time, small molecules have evolved beyond conventional corticosteroids to include advanced JAK inhibitors that offer oral convenience and targeted immune modulation. These breakthroughs have elevated expectations for safety, efficacy, and patient quality of life.

Moreover, the integration of real-world evidence and digital health tools has fundamentally altered clinical development pathways. Patient registries, remote monitoring devices, and advanced analytics enable adaptive trial designs and streamlined regulatory interactions. Consequently, pharmaceutical sponsors are forging new collaborative models with healthcare providers and payers to demonstrate long-term value and cost-effectiveness. As a result, the industry is witnessing a shift from broad-spectrum immunosuppression to tailored therapeutics that leverage molecular diagnostics and patient stratification. This evolution underscores the strategic imperative for companies to align R&D investments with emerging modalities and digital infrastructure enhancements.

Assessing the Cumulative Impact of Recent United States Tariffs on Supply Chains and Access in the Autoimmune Disease Therapeutics Sector

The introduction of enhanced tariffs on imported active pharmaceutical ingredients and biologic components by the United States in early 2025 has reverberated across global supply chains for autoimmune disease therapeutics. These policy measures, aimed at bolstering domestic manufacturing capacity, have simultaneously increased input costs for companies reliant on specialized raw materials sourced from Europe and Asia. Consequently, many organizations have accelerated their plans to diversify supplier bases and invest in onshore production capabilities to mitigate future tariff volatility.

Furthermore, manufacturers have adopted strategic pricing adjustments and long-term supply contracts to safeguard margin structures while maintaining patient access. In parallel, stakeholder dialogues with regulatory authorities have intensified, focusing on streamlined approval pathways for manufacturing changes and quality variances. As a result of these cumulative impacts, the industry is witnessing a broader reassessment of risk management frameworks across distribution networks. Ultimately, the tariff environment has highlighted the critical importance of supply-chain resilience and strategic localization in securing uninterrupted patient treatment regimens.

Revealing Critical Insights Across Therapeutic Types Disease Categories Administration Routes Applications and End-User Segments in Therapeutics

A nuanced exploration of therapeutic types reveals that the market’s growth trajectory is anchored in a spectrum of innovative modalities. Among these, antihyperglycemics perform a niche role in type 1 diabetes management, while biologics-comprising monoclonal antibodies, fusion proteins, and emergent gene therapies-dominate R&D pipelines with their promise of targeted intervention. Likewise, small molecules, including corticosteroids and the latest JAK inhibitors, remain essential for rapid-onset symptom control and oral administration convenience. Beyond these, cytokine inhibitors and immunomodulators continue to refine immune-axis targeting, whereas immunosuppressants and phosphodiesterase inhibitors address chronic inflammation through multifaceted pathways.

When analyzed by disease type, it becomes evident that conditions such as rheumatoid arthritis and psoriasis have benefited most from biologic innovations, while emerging therapies for lupus erythematosus and multiple sclerosis emphasize personalized approaches. Inflammatory bowel disease research is expanding its focus on gut-targeted biologics, and type 1 diabetes studies are increasingly integrating beta-cell preservation strategies. Streamlining treatment regimens through oral and injectable (intramuscular, intravenous, subcutaneous) routes of administration has enhanced patient adherence and enabled home-based care models. Meanwhile, therapeutic applications have diversified to encompass disease progression alteration, immune system modulation, pain management, and direct reduction of inflammation. Ultimately, end-user dynamics across ambulatory surgical centers, hospitals, and research institutes are shaping adoption curves, with each channel demanding customization of delivery models and integrated patient support services.

This comprehensive research report categorizes the Autoimmune Disease Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Types

- Disease Type

- Route of Administration

- Therapeutic Application

- End-User

Highlighting Distinct Regional Dynamics and Growth Drivers Across the Americas Europe Middle East & Africa and Asia-Pacific Autoimmune Therapeutics Markets

Regional analysis highlights the distinct forces driving growth across the Americas, Europe Middle East & Africa, and Asia-Pacific markets for autoimmune disease therapeutics. Within the Americas, robust healthcare infrastructure, a high prevalence of autoimmune conditions, and accelerated reimbursement pathways have cultivated a receptive environment for novel biologics and small molecules. Market entry strategies frequently emphasize local partnerships with contract manufacturing organizations to navigate complex regulatory certainties and optimize distribution networks.

In the Europe Middle East & Africa region, heterogeneous regulatory frameworks and variable healthcare budgets necessitate flexible market access approaches. While Western European nations continue to adopt high-cost therapies through value-based agreements, emerging markets in the Middle East and Africa are gradually embracing biosimilars and biosuperiors to improve affordability. Cross-border collaborations and regional health initiatives are pivotal in expanding patient reach. Conversely, the Asia-Pacific landscape is characterized by rapid biotech innovation clusters in China, Japan, and Australia, supported by favorable government incentives and growing domestic R&D investments. Local manufacturing capabilities are scaling quickly, enabling earlier launches and region-specific formulations tailored to genetic and epidemiological variations.

This comprehensive research report examines key regions that drive the evolution of the Autoimmune Disease Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves Innovative Pipelines and Competitive Positioning of Leading Players in Autoimmune Disease Therapeutics

Key industry participants are strategically positioning themselves to capitalize on the evolving autoimmune therapeutics landscape. Leading multinational pharmaceutical corporations are injecting significant resources into next-generation biologic platforms and complementary gene-editing techniques. For instance, several established players have secured licensing agreements for novel cell therapy approaches, while simultaneously expanding their global biologics manufacturing footprints to support high-volume monoclonal antibody production.

Meanwhile, agile biotech innovators are targeting niche indications with precision-engineered fusion proteins and First-in-Class modalities. These smaller organizations frequently collaborate with academic centers and leverage venture capital partnerships to accelerate early-stage development. Additionally, strategic alliances between large pharmaceutical firms and emerging tech-focused biotechs are becoming increasingly common, as they combine robust distribution capabilities with disruptive science to shorten time-to-market. As a result, the competitive landscape is coalescing around collaboration-driven innovation, with an emphasis on differentiated pipelines and scalable manufacturing solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autoimmune Disease Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- BioAgilytix Labs, LLC

- bioMerieux S.A.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Exagen, Inc.

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline PLC

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Merck & Co., Inc.

- Novartis AG

- Pfizer, Inc.

- Sanofi S.A.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Trinity Biotech PLC

- UCB S.A.

- Werfen S.A.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Navigate Challenges in Autoimmune Disease Therapeutics Markets

To thrive in this dynamic environment, industry leaders should prioritize the development of flexible supply chains and invest in onshore or near-shore manufacturing facilities to mitigate tariff-related risks. Embracing modular production systems and single-use technologies will facilitate rapid scale-up and cost containment. Concurrently, organizations must adopt a patient-centric mindset by integrating digital health solutions, such as remote monitoring platforms and telemedicine services, to enhance clinical trial enrollment and real-world evidence generation.

Furthermore, forging symbiotic partnerships across academia, contract research organizations, and payers will be critical to demonstrate long-term outcomes and secure value-based contracting arrangements. Leveraging advanced analytics and artificial intelligence can optimize clinical trial designs and target patient subpopulations most likely to respond to specific mechanisms of action. Finally, leaders should explore emerging markets with tailored access strategies, balancing biosimilar adoption with premium biologic launches to maximize both reach and profitability.

Outlining Rigorous Research Methodologies Employed to Ensure Comprehensive Reliable Insights into Autoimmune Disease Therapeutics

This report synthesizes insights from a robust research methodology that combines primary and secondary data collection. In the primary phase, in-depth interviews were conducted with a diverse panel of stakeholders, including senior R&D executives, regulatory experts, and clinical practitioners, to capture qualitative perspectives on unmet needs, pipeline advancements, and policy developments. Concurrently, secondary research drew upon peer-reviewed journals, regulatory filings, patent databases, and industry publications to validate and enrich the narrative with documented evidence.

Data triangulation was employed to reconcile disparate information sources, ensuring both accuracy and relevance. A multi-tiered review process, involving cross-functional experts and external advisors, verified key findings and mitigated bias. Geographic coverage spanned North America, Europe, the Middle East, Africa, and Asia-Pacific, enabling comparative analysis of regulatory environments, market access frameworks, and manufacturing capacities. The culmination of these rigorous methods is a coherent, actionable body of knowledge designed to inform strategic decisions and guide stakeholders toward sustainable growth in autoimmune disease therapeutics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autoimmune Disease Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autoimmune Disease Therapeutics Market, by Therapeutic Types

- Autoimmune Disease Therapeutics Market, by Disease Type

- Autoimmune Disease Therapeutics Market, by Route of Administration

- Autoimmune Disease Therapeutics Market, by Therapeutic Application

- Autoimmune Disease Therapeutics Market, by End-User

- Autoimmune Disease Therapeutics Market, by Region

- Autoimmune Disease Therapeutics Market, by Group

- Autoimmune Disease Therapeutics Market, by Country

- United States Autoimmune Disease Therapeutics Market

- China Autoimmune Disease Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Strategic Learnings and Future Outlook for Stakeholder Value Creation in the Autoimmune Disease Therapeutics Ecosystem

Drawing together the insights from market dynamics, policy impacts, and segmentation analysis, this synthesis underscores the intersection of innovation, patient centricity, and operational resilience in autoimmune disease therapeutics. Stakeholders are now positioned to leverage breakthroughs in both advanced biologics and small molecules to address unmet clinical needs, while navigating an evolving tariff and regulatory landscape. By aligning product development with tailored market access strategies and emerging digital health infrastructures, organizations can secure competitive differentiation.

As the field continues to advance, maintaining an agile posture will be paramount. Stakeholders who proactively foster collaborative networks, invest in localized manufacturing, and harness data-driven decision-making will optimize therapeutic impact and commercial success. Ultimately, the collective effort of industry participants, regulators, and healthcare stakeholders will shape the next generation of autoimmune treatments, delivering enhanced quality of life for patients worldwide.

Connect with Ketan Rohom to Unlock Detailed Insights Empowering Strategic Decisions in Autoimmune Disease Therapeutics

To explore this comprehensive report and gain access to the strategic insights, methodologies, and tailored recommendations within the field of autoimmune disease therapeutics, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. In your discussion, you will uncover how the report’s in-depth analysis can be customized to your organization’s unique objectives, empowering you to shape informed decisions with confidence. By engaging with Ketan Rohom, you will learn how to integrate these insights seamlessly into your strategic planning process, prioritize investments effectively, and accelerate time-to-value in critical markets. Don’t miss the opportunity to harness the collective expertise and forward-looking perspectives captured in this market research deliverable; reach out today to secure your copy and begin translating knowledge into sustainable competitive advantage.

- How big is the Autoimmune Disease Therapeutics Market?

- What is the Autoimmune Disease Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?