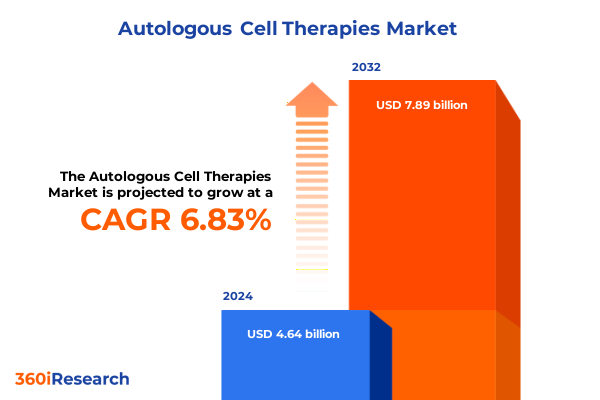

The Autologous Cell Therapies Market size was estimated at USD 4.95 billion in 2025 and expected to reach USD 5.27 billion in 2026, at a CAGR of 6.88% to reach USD 7.89 billion by 2032.

An authoritative introduction to autologous cell therapies summarizing clinical momentum, manufacturing complexity, regulatory expectations, and operational imperatives

Autologous cell therapies-treatments derived from a patient’s own cells and engineered or expanded ex vivo-have moved from experimental clinics into standard-of-care pathways for several hematologic malignancies and are expanding into broader therapeutic areas. This maturation has been driven by sustained clinical proof-of-concept, iterative improvements in manufacturing platforms, and a growing ecosystem of specialized contract manufacturers and point-of-care technologies. At the same time, the modality retains a distinct operational profile: individualized manufacturing runs, tight cold-chain dependencies, and a regulatory environment that balances expedited pathways for serious conditions with rigorous chemistry, manufacturing, and controls expectations. These constraints, when paired with the clinical promise, make autologous therapies uniquely valuable but operationally complex.

Transitioning from pioneering clinical programs to routine commercial delivery requires sustained alignment across clinical, manufacturing, regulatory, and payer stakeholders. The industry’s regulatory framework continues to evolve with targeted guidances focused on potency, comparability, and quality-control expectations for cellular products; developers should view those guidances as active guardrails that steer technical design choices, comparability strategies, and lifecycle planning. Operational readiness-encompassing validated cold-chain procedures, robust leukapheresis-to-manufacture workflows, and contingency planning for logistics interruptions-remains a critical determinant of patient access and program viability. Taken together, these dynamics create a near-term imperative for sponsors and service providers to optimize processes that reduce turnaround time and increase reproducibility while preserving clinical performance and patient safety.

Transformative technological and clinical inflection points that are shifting therapeutic design, manufacturing models, and delivery pathways across autologous programs

The last 24 months have produced several substantive inflection points that are reshaping how autologous programs are designed, manufactured, and delivered. On the clinical front, advances in alternative immune effector cells-particularly engineered natural killer cells and induced pluripotent stem cell platforms-are expanding therapeutic design choices, creating hybrid pathways where autologous approaches coexist with donor-derived or off-the-shelf alternatives. These developments are not replacing autologous therapies but are forcing sponsors to re-evaluate where autologous approaches deliver unique patient or efficacy advantages and where platform efficiencies justify a shift to alternative constructs. This rebalancing drives new decisions about lead indications, clinical trial design, and commercialization pathways.

From a manufacturing and technology perspective, adoption of closed, automated instruments and modular process platforms is accelerating. These architectures reduce manual touchpoints, enhance reproducibility, and enable both centralized and decentralized production models that can compress vein-to-vein intervals for high-acuity patients. Simultaneously, genetic modification toolsets have diversified: viral vector approaches remain central for many current programs, while non-viral editing and transient mRNA methods are gaining traction where rapid iteration, cost control, or regulatory profiles are advantageous. Point-of-care and mobile processing solutions are moving from pilot projects into operational pilots in hospitals and academic centers, and industry stakeholders are actively assessing the tradeoffs between on-site production and centralized CDMO models in terms of quality, speed, and total cost of care. These technology and modality shifts require integrated planning across development, supply chain, and clinical operations so that platform choices remain aligned with long-term commercial and patient-access objectives.

Assessing the cumulative operational and strategic consequences of recent 2025 United States tariff actions on autologous cell therapy supply chains and manufacturing choices

Policy changes enacted in 2025 have introduced new tariff dynamics that materially affect the input-cost base and strategic calculus for autologous cell therapy programs. Tariff measures and trade-policy signals aimed at reshaping broader pharmaceutical and medical supply chains have increased attention on where critical inputs are sourced, how manufacturing equipment is procured, and which geographies minimize exposure to discretionary duties. For autologous therapies, the most immediate consequences are felt through higher landed costs for consumables and specialized equipment, greater uncertainty for imported viral vector components and critical reagents, and the prospect of extended lead times as suppliers reshuffle production footprints to mitigate tariff risk.

Industry reaction has been pragmatic and rapid. Large sponsors and CDMOs are accelerating expansion or acquisition plans within the United States and allied geographies to reduce tariff exposure and to ensure continuity for advanced therapy production. At the operational level, companies are reallocating capital expenditures, revalidating alternate suppliers, and integrating tariff-sensitivity analyses into procurement and scenario-planning exercises. Many life sciences firms are also transferring a proportion of incremental costs to customers or payers where contractual terms permit, while some are absorbing costs to preserve patient access and competitive positioning. Importantly, tariff-driven reshoring and capacity expansion alter the competitive landscape: it favors organizations with sufficient capital to invest in new manufacturing lines and those with established regulatory and quality infrastructures to expedite tech transfer and site qualification. The net effect is both a near-term operational burden and a multi-year strategic realignment toward more geographically distributed production footprints.

Integrated segmentation insights showing how therapy areas, cell types, source tissues, process technologies, and end-user models jointly determine program design and manufacturing strategy

Segment dynamics in autologous therapies must be read as an interconnected matrix where indication selection, cell biology, harvesting source, process technology, and care-delivery settings jointly determine commercial and operational decisions. Therapy areas span dermatology with an emphasis on wound healing, immunology with routes into autoimmune disease management and transplant-rejection modulation, neurology targeting Parkinson’s disease and spinal cord injury, oncology addressing both hematological cancers and solid tumors, and orthopedics focused on bone regeneration and cartilage repair. Each therapeutic target creates distinct requirements for cell potency, durability, regulatory evidence, and acceptable manufacturing latency. As a result, clinical prioritization must account for how a chosen indication tolerates vein-to-vein delays, the need for repeat dosing, and the acceptable safety margin for cell manipulation.

Cell-type choices further refine development pathways: dendritic cell approaches and natural killer cell constructs introduce different safety and scalability profiles compared with stem-cell and T-cell platforms. CAR-NK approaches are increasingly attractive where safety and off-the-shelf compatibility are priorities, while stem-cell families-including hematopoietic stem cells, iPSC-derived constructs, and mesenchymal stromal applications-bring unique manufacturing and differentiation challenges. T-cell programs, hyphenated to CAR-T and TCR-T technologies, remain integral for oncology workstreams but demand rigorous vector and potency-control strategies. Source tissue selection-adipose tissue, bone marrow, cord blood, and peripheral blood-affects cell yield, donor burden, and downstream isolation protocols, and therefore should be considered early in protocol design.

Process-technology segmentation plays a determinative role in cost and scale decisions. Expansion systems, formulation strategies including cryopreservation and lyophilization for certain gene-therapy modalities, genetic modification split between viral and non-viral approaches, and isolation technologies collectively shape batch architecture and quality-control burdens. Finally, end-user segmentation-contract manufacturing organizations, hospitals with academic medical centers or community hospitals, research institutes, and specialty clinics-defines who will operate or access the final product and which governance, training, and facility investments are required. Integrating these five segmentation lenses offers a practical roadmap for selecting indications and partner models that simultaneously optimize clinical outcomes and manufacturing feasibility.

This comprehensive research report categorizes the Autologous Cell Therapies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Area

- Cell Type

- Source Tissue

- Process Technology

- End User

Key regional insights describing how Americas, Europe Middle East and Africa, and Asia‑Pacific footprints influence manufacturing location choice, access, and regulatory strategy

Regional dynamics are a critical determinant of where autologous programs will scale and how quickly patients will gain access. In the Americas, investment momentum is strongest where incentives align for onshoring clinical‑scale capacity and where academic medical centers pilot point-of-care production. North American regulatory and reimbursement systems, combined with established hospital networks, make the Americas a natural proving ground for decentralized or hybrid manufacturing approaches, especially for high-acuity oncology indications. In Europe, the Middle East, and Africa, regulatory pathways emphasize harmonized quality expectations across jurisdictions, and progressive national frameworks in several European states support center-of-excellence models that centralize expertise while enabling cross-border patient access. This region often prioritizes integrated health‑system adoption through academic partnerships and national health technology assessments.

Asia‑Pacific presents a differentiated picture: several countries are rapidly building manufacturing capabilities while also expanding clinical trial throughput and patient access programs. Government incentives, capacity investments, and willingness to adopt advanced therapies for high-burden indications make Asia‑Pacific an attractive region for clinical scale-up and for locating certain supply-chain elements. However, sponsors must navigate a diverse patchwork of regulatory timelines and local requirements. Across all regions, tariff-driven policy shifts and capacity investments are prompting sponsors to reassess regional footprints, to accelerate tech transfers to lower‑risk geographies, and to pursue partnerships that combine local regulatory expertise with global quality standards. These regional choices will influence where vein‑to‑vein time can be shortened, where decentralized models are viable, and how commercially sustainable delivery pathways are established.

This comprehensive research report examines key regions that drive the evolution of the Autologous Cell Therapies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company and partnership dynamics distilled into strategic differentiators that determine which organizations will enable reliable autologous therapy commercialization

The competitive landscape for autologous cell therapies is composed of a combination of large integrated pharmaceutical companies, specialized contract development and manufacturing organizations, platform technology providers, and smaller clinical-stage biotechnology innovators. Contract manufacturers are expanding both capacity and platform offerings to capture more end-to-end workloads-from automated closed‑system unit operations through viral-vector supply and final fill/finish-thereby reducing the technical friction of commercialization for sponsors. At the same time, platform vendors that offer automated, closed, and modular instruments are becoming pivotal partners for hospitals and academic centers seeking point-of-care production capability, enabling operators to standardize workflows and reduce operator-dependent variability.

Strategic partnerships between sponsor organizations, CMOs, and platform providers are increasingly common: they accelerate tech transfers, enable rapid scale-up of validated processes, and de-risk supply chains by clustering complementary capabilities. The market favors partners with demonstrated regulatory-track records, broad technical portfolios across cell types, and the ability to deliver reliable cold‑chain logistics. Capital-rich pharmaceutical companies are leveraging acquisitions or greenfield investments to secure dedicated capacity in key geographies, while specialized CDMOs and technology providers are differentiating through service breadth, quality certifications, and program execution speed. For sponsors assessing collaborations, the most valuable partner attributes are deep autologous experience, validated closed-system platforms, and demonstrable supply-chain resilience under policy volatility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autologous Cell Therapies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abata Therapeutics

- Achilles Therapeutics plc

- Adaptimmune Therapeutics PLC

- Adicet Bio Inc.

- AIVITA Biomedical, Inc.

- Aspen Neuroscienc Inc.

- Bellicum Phamaceuticals, Inc.

- BioLineRx Ltd.

- BioSpace, Inc.

- BrainStorm Cell Limited.

- Bristol-Myers Squibb Company

- Carisma Therapeutics Inc.

- Catalent, Inc.

- Cell Therapy Catapult Ltd.

- Fate Therapeutics Inc.

- GentiBio, Inc.

- IASO BioTherapeutics

- Kyverna Therapeutics, Inc.

- NOVADIP Biosciences S.A.

- Orchard Therapeutics Inc.

- T-knife Therapeutics, Inc.

- ThermoGenesis Holdings, Inc.

- Triumvira Immunologics Inc.

- Vita Therapeutics, Inc.

Actionable strategic recommendations for sponsors and service providers to secure supply chains, optimize manufacturing, and accelerate patient‑centric delivery of autologous therapies

Industry leaders must mobilize against two parallel objectives: preserving clinical fidelity and constructing resilient, cost‑effective delivery systems. First, prioritize clinical comparability and process robustness by investing in closed automation, validated cryochain protocols, and potency assays that can be tracked across decentralized and centralized workflows. These investments reduce variability, shorten time-to-release, and support regulator-ready comparability packages. Second, accelerate supplier diversification and scenario planning: build a tiered supplier map that identifies alternate sources for critical reagents, plasticware, and vector supply, and incorporate tariff sensitivity into procurement contracts and capital planning. These steps will mitigate short-term cost shocks and reduce single‑point failure risk.

Third, actively evaluate hybrid manufacturing models where centralized vector and formulation production pairs with localized expansion or finishing to compress vein‑to‑vein timelines. Fourth, engage early and transparently with regulators to align on potency, stability, and comparability criteria; leveraging published guidance and direct agency feedback will materially reduce regulatory friction during scale-up. Fifth, develop payer engagement strategies that translate clinical value into durable reimbursement pathways by generating evidence on real-world durability, quality-of-life outcomes, and cost offsets from avoided downstream care. Finally, cultivate partnerships with experienced CDMOs and platform vendors that can deliver rapid tech transfer, validated platforms, and end-to-end quality systems. Executing on these recommendations will protect patient access while positioning organizations to capture long-term value as autologous therapies broaden their therapeutic footprint.

Transparent explanation of research methods, data sources, interview panels, and analytical frameworks used to ensure rigorous and actionable autologous therapy insights

This analysis synthesizes primary and secondary research, expert interviews, and cross‑disciplinary validation to create a practical, action‑oriented picture of the autologous therapy landscape. The secondary research component included regulatory guidance reviews, peer‑reviewed literature on manufacturing and logistics, commercial press tracking for capacity investments, and company disclosures related to facility expansions and platform rollouts. Primary research comprised structured interviews with senior leaders from clinical programs, manufacturing operations, CDMOs, hospital‑based production units, and payers; these interviews informed risk assessments, technology adoption barriers, and practical timelines for scale-up.

Analytical methods combined qualitative thematic analysis of interviews with process‑level mapping, supplier risk scoring, and scenario planning for tariff and geopolitical shocks. Cross-validation was applied by triangulating interview claims against public filings, regulatory guidances, and peer-reviewed process studies. All findings were reviewed by a subject-matter advisory panel with expertise in regulatory affairs, cell-manufacturing engineering, and hospital operations to ensure the report’s recommendations are operationally viable and regulatorily defensible. Confidential primary inputs used in the final analytics were de‑identified and aggregated to preserve source anonymity while ensuring analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autologous Cell Therapies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autologous Cell Therapies Market, by Therapy Area

- Autologous Cell Therapies Market, by Cell Type

- Autologous Cell Therapies Market, by Source Tissue

- Autologous Cell Therapies Market, by Process Technology

- Autologous Cell Therapies Market, by End User

- Autologous Cell Therapies Market, by Region

- Autologous Cell Therapies Market, by Group

- Autologous Cell Therapies Market, by Country

- United States Autologous Cell Therapies Market

- China Autologous Cell Therapies Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

A concise concluding synthesis connecting clinical promise to operational realities and the strategic levers that will determine future commercial success for autologous therapies

Autologous cell therapies sit at a strategic inflection point: their clinical potential is tangible and expanding, yet the pathway to routine, equitable patient access is constrained by manufacturing complexity, supply-chain fragility, and evolving policy headwinds. The combination of clinical innovation-ranging from next-generation immune effector cells to refined stem-cell constructs-and operational innovation-such as automated closed systems, modular platforms, and advanced cryochain logistics-creates clear technical paths to reduce variability and shorten delivery times. However, recent trade and tariff developments have introduced a new layer of operational risk that will influence sourcing, capital allocation, and where production capacity is located.

Going forward, organizations that succeed will be those that integrate clinical strategy with pragmatic operational investments: teams that align indication selection with manufacturability, secure diversified suppliers for critical inputs, and build relationships with experienced CDMOs and platform providers. Equally important is proactive regulatory engagement and payer evidence generation to convert clinical efficacy into sustainable coverage models. When combined, these elements create a resilient commercial blueprint: one that preserves the clinical advantages of autologous approaches while enabling scalable, repeatable, and patient-centric delivery models across geographies.

Take decisive commercial action to purchase a tailored autologous cell therapy market intelligence report and arrange a strategic briefing with a senior sales lead

To purchase the full autologous cell therapies market intelligence report and to arrange a tailored briefing, please contact the sales and marketing lead. Ketan Rohom, Associate Director, Sales & Marketing, will coordinate a demonstration of the report’s executive dashboards, customized segment deep dives, and enterprise-level strategic guidance. Engaging directly will ensure the report is scoped to your organization’s therapeutic focus, manufacturing model, and regional priorities, and will speed delivery of supplemental annexes such as primary interview transcripts, supplier diligence worksheets, and regulatory submission checklists.

Ketan can arrange an exploratory call to clarify which analytic modules-therapy area deep dive, cell type technology mapping, supply chain stress-testing, or reimbursement scenario planning-are most relevant to your commercial objectives. This engagement is designed to translate the report’s findings into immediate next steps: stakeholder workshops, vendor selection timelines, and prioritized investment roadmaps.

Purchasing access unlocks a packaged combination of the written report, interactive tables, editable slide decks for investor or board briefings, and a one-hour analyst Q&A. For organizations pursuing rapid operational changes-such as relocating manufacturing capacity, establishing point-of-care production, or initiating technology transfers-the tailored briefing with Ketan will identify high-impact actions and near-term milestones. We recommend initiating contact as early as possible to align the briefing with your fiscal planning cycle and procurement timelines.

- How big is the Autologous Cell Therapies Market?

- What is the Autologous Cell Therapies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?