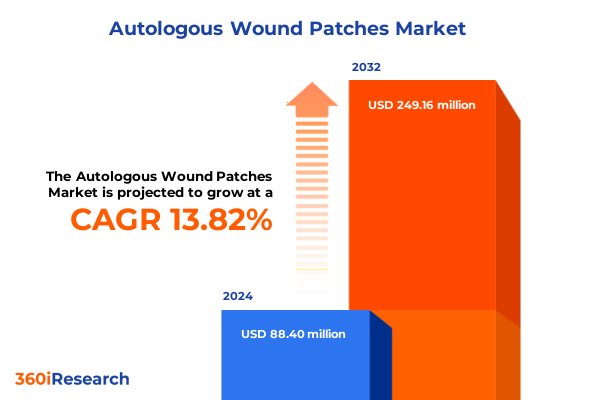

The Autologous Wound Patches Market size was estimated at USD 100.90 million in 2025 and expected to reach USD 113.03 million in 2026, at a CAGR of 13.78% to reach USD 249.16 million by 2032.

Harnessing Patient-Derived Autologous Wound Patches to Transform Regenerative Therapies and Elevate Wound Care Outcomes across Healthcare Settings

Autologous wound patches are emerging as a cornerstone of regenerative medicine, harnessing a patient’s own cellular and extracellular components to catalyze healing processes that traditional therapies cannot achieve. Through the cultivation of patient-derived cells combined with bioactive matrices, these patches deliver growth factors and stem cells directly to the wound bed, offering enhanced biocompatibility, reduced immunogenic risk, and accelerated tissue remodeling. As the global population ages and the prevalence of comorbidities such as diabetes and vascular disease continues to rise, the need for advanced wound care solutions that minimize infection risk and hospital readmissions has intensified.

The promise of autologous patches extends across both acute and chronic injury scenarios. In acute settings, such as surgical incisions or traumatic lacerations, these constructs support rapid epithelialization and robust dermal regeneration. For chronic wounds, particularly diabetic foot ulcers and venous leg ulcers, autologous approaches have demonstrated the ability to re-establish vascular networks and mitigate inflammation over sustained treatment courses. Regulatory bodies are increasingly recognizing the transformative potential of these therapies, with expedited pathways and breakthrough therapy designations reducing time-to-market for pioneering products.

In this context, it is imperative to understand the multi-faceted drivers reshaping the landscape of autologous wound patches. From cutting-edge manufacturing technologies and shifting trade policies to diverse end-user requirements and regional adoption patterns, a holistic view of these forces will equip stakeholders to navigate emerging opportunities and challenges effectively.

Emerging 3D Bioprinting, Hydrogel Innovations, and Precision Scaffold Technologies Driving the Next Generation of Personalized Wound Repair

The autologous wound patch landscape is being redefined by groundbreaking advances in manufacturing and material science, ushering in an era of precision-engineered constructs tailored to individual patient biology. At the forefront is 3D bioprinting, which leverages patient-specific bioinks to fabricate scaffolds with intricate architectures that mirror native tissue microenvironments. This technology enables the spatial deposition of cells and growth factors with micrometer-scale accuracy, enhancing vascularization and accelerating tissue integration while addressing the regulatory complexities associated with off-the-shelf grafts turn1search0.

Parallel to bioprinting, hydrogel innovations are revolutionizing patch performance. Gelatin-methacryloyl (GelMA) hydrogels, enriched with antimicrobial nanoparticles or responsive drug-release mechanisms, are demonstrating exceptional biofunctionality and mechanical resilience in preclinical models. These hydrogels can be engineered to release cytokines or antibiotics in response to local pH or enzyme levels, offering dynamic support during both inflammatory and proliferative wound healing phases turn1search1.

Moreover, hybrid scaffold systems that combine natural polymers such as collagen and hyaluronic acid with synthetic frameworks are gaining traction for their tunable degradation profiles and high cell viability. Embedded within these scaffolds, autologous cells can persist long enough to secrete extracellular matrix and instruct host tissue regeneration before being safely resorbed. Together, these interconnected technological shifts are paving the way for truly personalized wound repair solutions that adapt to each patient’s unique healing trajectory turn1search2.

Evaluating the Aggregate Financial and Operational Consequences of 2025 U.S. Tariff Policy on Autologous Wound Patch Production and Distribution

In 2025, U.S. tariff policies have exerted a pronounced influence on the cost dynamics and supply strategies underpinning autologous wound patch production. Section 301 tariffs targeting imports of syringes, needles, latex gloves, and disposable face masks from China were raised from 7.5% to 25% during 2024 and maintained at that level into 2025, while rubber medical and surgical gloves faced a 50% levy as part of a broader push to bolster domestic manufacturing turn0search6. These measures have consequently increased the landed cost of key raw materials such as hydrogel precursors, scaffold membranes, and single-use bioprinter cartridges.

Simultaneously, leading medical device manufacturers have reported substantial ongoing expenses related to bilateral tariffs with China, with organizations such as GE Healthcare estimating cumulative impacts reaching into the hundreds of millions of dollars in 2025 turn0news14. Although some companies have mitigated short-term cost inflation through existing inventory and supplier contracts, extended reliance on imported specialty polymers and bioinks remains a critical exposure. The tariff environment has incentivized both large-scale enterprises and niche innovators to evaluate localized production strategies, including in-house hydrogel synthesis and on-demand 3D printing to reduce cross-border dependencies.

Looking ahead, industry stakeholders are advocating for targeted exemptions or adjusted classification codes for advanced regenerative materials. Such actions could help preserve access to high-performance inputs without compromising policy objectives related to domestic job creation and supply chain security. As the debate over U.S. trade policy continues, the cumulative effect of these tariffs underscores the importance of agile procurement and diversification tactics for organizations committed to scaling autologous wound patch technologies.

Decoding Product Type, Technology, Application, End User and Distribution Dynamics Elevating Strategic Decisions in the Autologous Wound Patch Landscape

A nuanced understanding of market segmentation is essential for aligning product innovation with clinical needs and distribution realities. When considering product types, gels offer homogeneity and ease of application suited for irregular wound beds, sheets provide structural support ideal for burn treatment, while sprays facilitate rapid coverage and are favored in acute care settings. Each format demands distinct process controls, sterilization protocols, and packaging solutions to maintain cellular viability and therapeutic efficacy.

Segmentation by technology reveals that 3D bioprinting platforms excel in creating bespoke constructs for complex wounds, hydrogel systems deliver controlled release and moisture retention, and scaffold-based patches provide mechanical reinforcement and guided tissue ingrowth. Innovations across these technology categories drive differential adoption rates among surgical centers, outpatient clinics, and research hospital networks.

By application, acute wounds benefit from fast-acting autologous products that expedite closure and minimize scarring, burn wounds necessitate robust matrices capable of supporting extensive tissue regeneration, and chronic wounds require sustained cell viability and angiogenic stimulation over prolonged treatment windows. Understanding these distinct therapeutic pathways enables manufacturers to tailor patch compositions and delivery methods.

End-users further refine market focus: home healthcare providers prioritize easy-to-use kits with remote monitoring capabilities, hospitals require scalable, shelf-stable solutions compatible with existing wound care protocols, and specialty clinics demand high-performance patches integrated into multidisciplinary treatment regimens. Finally, distribution channels such as hospital pharmacies support bulk procurement for inpatient settings, online pharmacies emphasize patient convenience through direct shipment, and retail pharmacies cater to consumer access in outpatient and home care environments. Strategic alignment across these segmentation layers forms the backbone of effective commercialization and adoption strategies.

This comprehensive research report categorizes the Autologous Wound Patches market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Unearthing Regional Variations in Adoption, Regulatory Pathways and Market Drivers Shaping Autologous Wound Patch Access in Americas, EMEA and APAC

Regional factors play a pivotal role in shaping the trajectory of autologous wound patch adoption and market maturity. In the Americas, favorable reimbursement frameworks in the United States and Canada, combined with streamlined regulatory pathways for autologous grafts, have cultivated a robust environment for early adopters and innovators. Leading academic medical centers and home healthcare networks are establishing center-of-excellence programs, integrating telemedicine follow-up with patch application protocols to enhance patient adherence and outcomes.

Across Europe, the Middle East, and Africa, heterogeneity in health technology assessments and varying levels of infrastructure investment influence uptake. Western European markets benefit from established advanced therapy medicinal product (ATMP) regulations, allowing for conditional marketing authorizations and post-market surveillance systems. In contrast, regions within EMEA are exploring public-private partnerships to expand manufacturing capabilities and localize clinical trials, particularly in the Gulf Cooperation Council and South Africa, where rising incidence of diabetic foot complications underscores unmet clinical demand.

Asia-Pacific is characterized by dynamic growth driven by rising healthcare expenditure, expanding regenerative medicine ecosystems, and proactive government initiatives. Japan’s revised regenerative medicine act has fast-tracked approval of autologous therapies, while China’s investment in domestic biomanufacturing is laying the groundwork for large-scale production facilities. Australia and South Korea are forging international collaborations to validate autologous patch protocols in diverse patient populations, leveraging digital platforms to disseminate best practices across geographically dispersed settings.

This comprehensive research report examines key regions that drive the evolution of the Autologous Wound Patches market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Innovative Industry Leaders Pioneering Autologous Wound Patch Development through Strategic Partnerships and Cutting-Edge Research Pipelines

Industry leaders are deploying diverse strategies to secure leadership in the autologous wound patch domain. Organogenesis has leveraged strategic alliances and acquisitions to broaden its portfolio, integrating advanced cellular skin substitutes with cutting-edge scaffold technologies and expanding its global manufacturing footprint. Meanwhile, Osiris Therapeutics has capitalized on the proven efficacy of its placental membrane-derived products, Grafix and GrafixPL Prime, to penetrate new clinical segments and establish partnerships that scale distribution channels across North America and Europe turn2search5.

Vericel’s Epicel platform exemplifies the potential of autologous keratinocyte autografts in addressing full-thickness burns, supported by robust clinical data and an established reimbursement legacy. PolarityTE, with its SkinTE technology, is advancing toward point-of-care bioprinting solutions that enable same-day generation of autologous skin patches directly within hospital settings. LifeNet Health’s TheraSkin combines human-derived allograft with bioactive components to offer a flexible intermediate between pure autologous and allogeneic therapies, while Applied Biologics is exploring next-generation scaffolds enriched with antimicrobial and pro-angiogenic agents.

Emerging contenders are also capturing attention; small-batch developers are pioneering handheld bioprinting devices equipped with live imaging feedback, and specialty biotechs are harnessing gene-edited autologous cells to enhance therapeutic potency. Collectively, these companies illustrate a vibrant innovation ecosystem that is redefining wound care paradigms through strategic R&D investments and collaborative ventures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autologous Wound Patches market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlloSource

- Anika Therapeutics, Inc.

- Athersys, Inc.

- Aziyo Biologics, Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- BioTissue, Inc.

- CollPlant Biotechnologies Ltd.

- Cook Biotech Incorporated

- Cytori Therapeutics, Inc.

- Euroskin Graftbank

- Humacyte, Inc.

- Integra LifeSciences Holdings Corporation

- LifeNet Health, Inc.

- MiMedx Group, Inc.

- Mölnlycke Health Care AB

- Organogenesis Holdings Inc.

- Osiris Therapeutics, Inc.

- RTI Surgical Holdings, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Terumo Corporation

- Tissue Regenix Group plc

- Tutogen Medical GmbH

- Xtant Medical Holdings, Inc.

Strategic Imperatives for Healthcare Stakeholders to Optimize R&D Focus, Supply Chain Resilience and Regulatory Engagement in Autologous Patch Innovation

To thrive amid evolving market dynamics, stakeholders should prioritize strategic initiatives that drive innovation and resilience. First, investing in modular manufacturing capabilities-such as localized hydrogel synthesis and on-site bioprinting platforms-will mitigate tariff exposure and streamline supply chains by reducing reliance on cross-border imports. Simultaneously, fostering collaborative research partnerships with academic institutions and contract development organizations can accelerate the translation of novel materials into clinical candidates.

Engagement with regulatory authorities is crucial: proactive dialogue on classification criteria, quality control standards, and post-market evidence generation will facilitate harmonized pathways and avoid approval delays. Stakeholders should also advocate for targeted policy adjustments or tariff exemptions for critical regenerative inputs, underpinning cost efficiencies and market access.

Optimizing reimbursement strategies is imperative; aligning clinical trial designs with payer endpoints and real-world evidence requirements will strengthen the value proposition for autologous patches. Integrating digital health tools-such as remote monitoring, patient-reported outcome measures, and telemedicine follow-up-can enhance adherence, demonstrate economic impact, and solidify reimbursement coverage.

Finally, establishing clear educational programs for surgeons, wound care specialists, and home care providers will drive adoption by showcasing procedural best practices, comparatives against standard of care, and documented patient benefits. By executing these recommendations, industry leaders can position themselves at the vanguard of this rapidly maturing segment.

Unveiling Our Comprehensive Research Framework Integrating Secondary Intelligence, Expert Consultations and Multi-Stakeholder Validation for Robust Insights

This research leverages a robust, multi-tiered methodology to ensure the credibility and depth of insights presented. Initially, a comprehensive review of scientific literature, regulatory filings, and patent registries was conducted to map technological advancements and identify leading platforms. Publicly available financial disclosures, press releases, and government trade data provided context on market dynamics, tariff impacts, and corporate strategy developments.

To validate secondary research findings, expert consultations were carried out with key opinion leaders including wound care surgeons, regenerative medicine specialists, and supply chain executives. These structured interviews elucidated real-world challenges in autologous patch adoption, procurement intricacies, and clinical outcome expectations. Feedback from distribution channel partners and payer representatives enriched our understanding of reimbursement considerations and market access hurdles.

Quantitative data were triangulated through cross-referencing industry databases, customs records, and regulatory agency publications to ensure accuracy in tariff and regional insights. Ethical standards were adhered to at all stages, and proprietary analytics frameworks were applied to distill segmentation, competitive landscapes, and actionable recommendations.

The cumulative approach-combining rigorous desk research, stakeholder engagement, and data triangulation-affords a comprehensive vantage point on the autologous wound patch market, underpinning the strategic guidance provided in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autologous Wound Patches market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autologous Wound Patches Market, by Product Type

- Autologous Wound Patches Market, by Technology

- Autologous Wound Patches Market, by Application

- Autologous Wound Patches Market, by End User

- Autologous Wound Patches Market, by Distribution Channel

- Autologous Wound Patches Market, by Region

- Autologous Wound Patches Market, by Group

- Autologous Wound Patches Market, by Country

- United States Autologous Wound Patches Market

- China Autologous Wound Patches Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Consolidating Key Takeaways and Forward-Looking Perspectives to Guide Stakeholders in the Dynamic Evolution of Autologous Wound Patches

The evolution of autologous wound patches reflects a convergence of patient-centric innovation, material science breakthroughs, and adaptive market strategies. From the precision of 3D bioprinting to the functional versatility of advanced hydrogel formulations, these technologies are redefining wound management outcomes and reshaping care pathways across diverse clinical settings. Tariff-induced supply chain pressures have underscored the importance of localized manufacturing and policy advocacy, driving organizations to strengthen resilience and agility.

Segmentation analysis has revealed that product type, technology, application context, end-user demands, and distribution channels all merit close calibration to ensure therapeutic efficacy and commercial success. Regional disparities in regulatory frameworks and healthcare infrastructure further highlight the necessity of tailored market entry approaches and strategic partnerships. Industry leaders-from established biotechs to nimble startups-are actively forging R&D alliances, optimizing reimbursement strategies, and embracing digital health to support evidence-based adoption.

The recommendations outlined-focused on manufacturing diversification, regulatory engagement, payer alignment, and clinician education-offer a clear roadmap for stakeholders to capture emerging opportunities and surmount prevailing challenges. As the autologous wound patch field continues to mature, ongoing collaboration among innovators, clinicians, and policymakers will be pivotal in translating scientific promise into improved patient outcomes and sustainable growth.

Secure your essential market intelligence on autologous wound patches by collaborating with Ketan Rohom to fuel strategic innovation

To access the full breadth of data and strategic guidance presented in this comprehensive market research report on autologous wound patches, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By initiating this conversation, you will gain personalized insights into how this research can be tailored to your organization’s strategic goals, whether you are refining your R&D roadmap, evaluating partnership opportunities, or strengthening your regulatory positioning. Engage with Ketan to discuss customized packages, explore licensing options, and schedule an executive briefing that will empower your team with the intelligence needed to stay competitive in this rapidly evolving field. Reach out to Ketan today and take the first step toward transforming your market approach with actionable, evidence-based insights.

- How big is the Autologous Wound Patches Market?

- What is the Autologous Wound Patches Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?