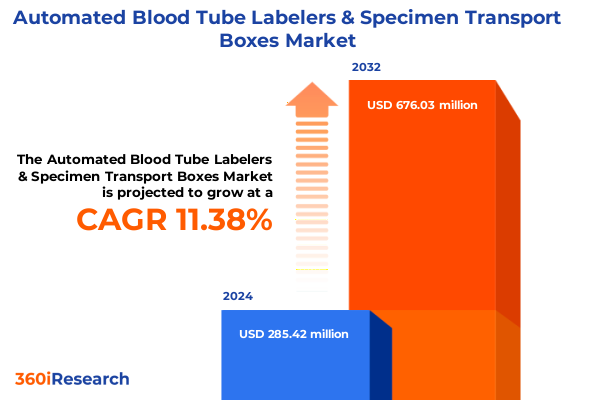

The Automated Blood Tube Labelers & Specimen Transport Boxes Market size was estimated at USD 314.85 million in 2025 and expected to reach USD 347.75 million in 2026, at a CAGR of 11.53% to reach USD 676.02 million by 2032.

Accelerating Precision and Efficiency in Clinical Specimen Management Through Automated Blood Tube Labeling and Transport Innovations

Clinical laboratories and healthcare facilities face mounting pressure to enhance accuracy and throughput in specimen handling. With diagnostic testing volumes rising globally, even marginal reductions in labeling errors can translate into significant improvements in patient outcomes and operational efficiency. Against this backdrop, the integration of automated blood tube labelers offers a robust solution to mitigate manual mistakes, enforce standardized workflows, and support compliance with stringent regulatory frameworks. Moreover, the parallel evolution of specimen transport boxes-tailored to maintain sample integrity through advanced insulation and tracking capabilities-addresses critical challenges related to cold chain management and biohazard containment.

As laboratories strive to accommodate diverse testing modalities and accelerate turnaround times, automated labeling and transport solutions are emerging as indispensable components of modern clinical logistics. Consequently, stakeholders across diagnostics, hospitals, and research institutes are reevaluating legacy processes to prioritize seamless interoperability between label printers, laboratory information systems, and supply chain platforms. Furthermore, the convergence of digital connectivity and real-time monitoring tools is redefining expectations for transparency and traceability in specimen handling.

Emergence of Automation, Advanced Materials, and Digital Integration Redefining the Blood Tube Labeling and Specimen Transport Ecosystem

Over the past few years, the market has witnessed a transformative shift driven by automation, advanced materials, and digital integration. Automated blood tube labelers are no longer perceived as luxury add-ons; instead, they have become core pillars of laboratory modernization. High-throughput label printer applicators now leverage AI-driven vision systems to verify barcode quality on each tube, ensuring end-to-end quality control and reducing the risk of misidentification. Simultaneously, pre-printed labelers have evolved to support dynamic demand patterns, enabling just-in-time printing while minimizing inventory waste.

Meanwhile, specimen transport boxes have undergone material innovations to enhance thermal performance and sustainability. Insulated variants constructed from polyethylene, polypropylene, and advanced styrofoam formulations now offer extended temperature stability for critical samples, whereas non-insulated options crafted from sturdy cardboard and reinforced plastics cater to ambient transport scenarios. Furthermore, the rise of IoT-enabled sensors and RFID tagging has infused specimen movement with unprecedented transparency, enabling continuous monitoring of temperature, location, and handling conditions. Consequently, integrated ecosystems that unify label verification, sample tracking, and environmental monitoring are setting new benchmarks for reliability and efficiency.

Navigating the Rippling Effects of 2025 United States Tariff Adjustments on Global Supply Chains for Clinical Labelers and Transport Containers

In 2025, adjustments to United States trade policies introduced elevated tariff rates on several categories of imported goods, directly impacting raw materials and components used in automated labeling and specimen transport solutions. Plastics such as polyethylene and polypropylene, essential for insulated box production, have seen duty increases, while metal parts and electronic modules for label printer applicators have encountered supplementary levies. Consequently, manufacturers and distributors have faced upward pressure on input costs, prompting many to explore alternative sourcing strategies and renegotiate supplier agreements.

As a result of these tariff shifts, several leading equipment providers have accelerated efforts to localize production and strengthen domestic supply chains. By fostering closer collaboration with regional Tier 1 and Tier 2 suppliers, companies aim to mitigate volatility and reduce lead times. However, the transition has also shed light on capacity constraints within the United States, underscoring the need for strategic investments in manufacturing infrastructure. In parallel, importers have rebalanced their portfolios to include tariff-exempt materials where feasible, underscoring the importance of agile procurement practices. Collectively, these adjustments have reshaped cost structures and triggered a broader reassessment of global trade dependencies within the clinical logistics market.

Unveiling Strategic Market Segmentation Patterns Across Product Types, End Users, Technologies, Applications, and Distribution Channels in Clinical Logistics

The market’s architecture unfolds across five critical segmentation pillars, each offering unique vantage points for strategic decision-making. Based on product type, automated labelers and specimen transport boxes define two interlocking categories. Automated labelers split into label printer applicators, endowed with real-time printing and application capabilities, and pre-printed labelers, designed to streamline batch workflows. Specimen transport boxes branch into insulated and non-insulated formats, with insulated boxes further delineated by materials such as polyethylene, polypropylene, and styrofoam, while non-insulated variants rely on durable cardboard or plastic constructions. Transitioning from products to users, the end-user landscape comprises diagnostic laboratories, hospitals, and research institutes, each exhibiting distinct throughput requirements and regulatory mandates.

Turning to technology, direct thermal, laser etching, and thermal transfer methods offer varied trade-offs in print resolution, durability, and cost per label. These technological pathways enable laboratories to tailor solutions to specific temperature, chemical resistance, and barcode longevity criteria. Application by nature encompasses logistics management, patient identification, sample tracking, and storage management, reflecting the multifaceted roles of automated labeling within clinical workflows. Finally, distribution channels span direct sales engagements, distributor partnerships, and digital storefronts, offering flexible procurement models that align with the diverse purchasing preferences of institutional buyers. This holistic segmentation framework illuminates the market’s complexity, guiding stakeholders toward precision-aligned strategies.

This comprehensive research report categorizes the Automated Blood Tube Labelers & Specimen Transport Boxes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Application

- Distribution Channel

Distinct Growth Dynamics and Operational Challenges Across the Americas, Europe, Middle East & Africa, and Asia-Pacific in Clinical Specimen Management

Regional dynamics underscore the market’s varied growth rhythms and operational priorities. In the Americas, advanced economies lead in the adoption of high-speed label printer applicators and next-generation transport containers. Stringent regulatory frameworks and reimbursement models incentivize investments in automation, particularly in the United States and Canada. Latin American centers, while at a nascent adoption stage, are charting accelerated digitalization pathways driven by expanding diagnostic networks and foreign partnerships.

Across Europe, the Middle East, and Africa, complex regulatory harmonization efforts-spanning the European Union’s in vitro diagnostics regulations to the Middle East’s expanding healthcare infrastructure-shape procurement cycles and product requirements. Emphasis on cross-border sample transfers in clinical trials and biobanking has amplified demand for rigorously validated transport boxes with traceable cold chain controls. Meanwhile, Africa’s emerging markets present a dual opportunity: basic infrastructure investments alongside leapfrogged deployments of compact, low-cost automation solutions. In the Asia-Pacific region, rapid hospital network expansions in China, India, and Southeast Asia are propelling demand for both direct thermal labelers and advanced insulated carriers. Cost optimization drives a strong pivot toward localized manufacturing, even as multinational suppliers deepen regional footprints to capture long-term growth potential.

This comprehensive research report examines key regions that drive the evolution of the Automated Blood Tube Labelers & Specimen Transport Boxes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Highlighting Leading Innovators, Key Partnerships, and Technological Differentiators in Specimen Labeling and Transport Solutions

Within this evolving ecosystem, a cadre of industry leaders and agile challengers is shaping the competitive landscape. Established life science conglomerates continue to invest heavily in R&D, expanding product portfolios through both organic innovation and strategic partnerships. At the same time, niche specialists focusing on cold chain packaging have leveraged material science breakthroughs to deliver novel insulation systems and sustainable alternatives. Collaborative ventures between labeling hardware manufacturers and laboratory information system providers have accelerated end-to-end solutions, embedding real-time data analytics into routine specimen processing.

Moreover, regional upstarts in Asia and Latin America are challenging incumbents by offering cost-competitive, locally tailored solutions. These companies often adopt modular production models, enabling rapid customization for specific material preferences and regulatory certifications. Strategic acquisitions have emerged as a key tactic, with major players bolstering their transport box portfolios by integrating advanced IoT sensor technologies from targeted buyouts. Across the board, the interplay between global giants and regional innovators is fostering a dynamic environment of continuous improvement, where speed to market and adaptability have become critical competitive differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Blood Tube Labelers & Specimen Transport Boxes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- Avery Dennison Corporation

- Azenta Life Sciences

- Becton, Dickinson and Company

- Computype

- Greiner Bio-One International GmbH

- INPECO SA

- Kobayashi Create Co., Ltd.

- Lmb Technologie GmbH

- Radiometer Medical ApS

- Sarstedt AG & Co. KG

- Sarstedt AG & Co. KG

- Techno Medica Co., Ltd.

- Thermo Fisher Scientific Inc.

Strategic Roadmap for Industry Leaders to Optimize Automation, Strengthen Supply Chains, and Enhance Patient Safety in Laboratory Operations

To navigate this multifaceted market, industry leaders must prioritize a cohesive, technology-driven roadmap that aligns product innovation with operational resilience. First, dedicating resources to modular automation platforms can deliver scalable throughput enhancements while protecting capital investments. Simultaneously, forging strategic alliances with domestic suppliers will bolster supply chain agility and mitigate exposure to tariff shocks. Equally important is the integration of digital monitoring and analytics capabilities to capture granular performance metrics, enabling proactive maintenance and continuous quality validation.

Furthermore, organizations should champion sustainable materials in transport box design, meeting both environmental targets and evolving customer expectations. Investing in cross-functional training programs will empower laboratory personnel to maximize system uptime and uphold rigorous compliance standards. Finally, adopting a hybrid distribution strategy-combining direct engagement for complex solutions with online channels for standard consumables-can optimize market reach and reduce procurement friction. By embracing these actionable steps, market participants can solidify their competitive edge and drive superior patient safety outcomes.

Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data, and Rigorous Data Triangulation for Unparalleled Market Insights

This comprehensive analysis is grounded in a rigorous research methodology that blends primary and secondary data sources. Initially, in-depth interviews were conducted with senior executives, procurement managers, and laboratory directors to capture firsthand perspectives on technological priorities, pain points, and investment rationales. These qualitative insights were complemented by a thorough review of industry publications, regulatory filings, and corporate disclosures to chart ecosystem dynamics and emerging best practices.

To ensure analytical robustness, data triangulation techniques were employed, cross-verifying findings across multiple inputs and testing key assumptions through quantitative modeling. Supplementary workshops with domain experts provided iterative feedback, refining the segmentation framework and validating regional assessments. Throughout the process, standardized data governance protocols and stringent quality checks were applied, yielding a highly credible and transparent foundation for the market insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Blood Tube Labelers & Specimen Transport Boxes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Blood Tube Labelers & Specimen Transport Boxes Market, by Product Type

- Automated Blood Tube Labelers & Specimen Transport Boxes Market, by Technology

- Automated Blood Tube Labelers & Specimen Transport Boxes Market, by End User

- Automated Blood Tube Labelers & Specimen Transport Boxes Market, by Application

- Automated Blood Tube Labelers & Specimen Transport Boxes Market, by Distribution Channel

- Automated Blood Tube Labelers & Specimen Transport Boxes Market, by Region

- Automated Blood Tube Labelers & Specimen Transport Boxes Market, by Group

- Automated Blood Tube Labelers & Specimen Transport Boxes Market, by Country

- United States Automated Blood Tube Labelers & Specimen Transport Boxes Market

- China Automated Blood Tube Labelers & Specimen Transport Boxes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Market Transformations and Revealing Strategic Imperatives to Capitalize on Growth Opportunities in Automated Labeling and Specimen Transport

In summary, the landscape of automated blood tube labeling and specimen transport solutions is undergoing a rapid metamorphosis. Automation, digital integration, and material innovations are converging to elevate specimen handling accuracy, throughput, and traceability. Concurrently, shifts in tariff regimes have prompted stakeholders to rethink supply chain architectures, with a clear impetus toward domestic sourcing and resilient procurement strategies. The market’s granular segmentation across product types, end users, technologies, applications, and distribution channels underscores its inherent complexity and the necessity for tailored playbooks.

Regional nuances further amplify the need for customized approaches, as adoption drivers and regulatory landscapes vary markedly across the Americas, EMEA, and Asia-Pacific. Against this backdrop, the competitive arena is defined by a delicate balance between global incumbents and emerging regional challengers, each leveraging strategic partnerships and innovation to capture share. Ultimately, the strategic imperatives distilled herein will empower decision-makers to harness growth opportunities, optimize operations, and deliver enhanced safety and compliance in clinical specimen management.

Engage With Ketan Rohom to Access Exclusive Market Intelligence and Secure Your Definitive Research Report on Clinical Labelers and Transport Box Solutions

To delve into the full breadth of these insights and harness the strategic advantages outlined, we invite you to connect directly with Ketan Rohom, Associate Director for Sales & Marketing. His expertise in clinical logistics and specimen management will guide you through the report’s findings and support your organization in implementing best-in-class solutions. By securing this comprehensive research report, you will gain unparalleled access to the latest developments, competitive benchmarks, and actionable intelligence required to drive operational excellence. Reach out to Ketan Rohom today to discuss customized engagement options, explore tailored advisory services, and obtain the definitive resource for automated blood tube labelers and specimen transport box markets.

- How big is the Automated Blood Tube Labelers & Specimen Transport Boxes Market?

- What is the Automated Blood Tube Labelers & Specimen Transport Boxes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?