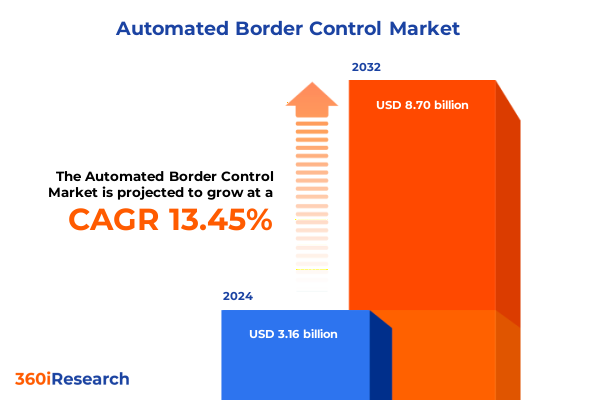

The Automated Border Control Market size was estimated at USD 3.58 billion in 2025 and expected to reach USD 4.05 billion in 2026, at a CAGR of 13.52% to reach USD 8.70 billion by 2032.

Introducing the evolution of automated border control systems and their strategic significance in shaping future cross-border security operations

The accelerating pace of global travel and evolving security threats have propelled automated border control systems to the forefront of cross-border management strategies. As nations seek to streamline passenger processing while safeguarding against illicit activities, the convergence of advanced biometric technologies and intelligent software solutions has become indispensable. This introductory section establishes the strategic context of automated border control, highlighting the interplay between operational efficiency, traveler experience, and national security imperatives.

In recent years, the migration from manual passport checks to self-service eGates and kiosks has demonstrated significant improvements in throughput and accuracy. The integration of facial recognition, fingerprint scanning, and iris authentication has reduced dwell times at checkpoints, while sophisticated risk assessment algorithms have enhanced threat detection capabilities. Moreover, the shift toward a contactless traveler journey has accelerated in the wake of public health considerations, underscoring the dual role of automated border control in safety and service excellence.

This report synthesizes current industry developments to present a cohesive narrative on the state of automated border control. It lays the foundation for a deeper exploration of transformative shifts, tariff influences, segmentation insights, regional variances, and strategic recommendations. By delineating the technological, regulatory, and economic drivers shaping this market, the introduction frames the comprehensive analysis that follows, orienting decision-makers on the critical factors that will define the next decade of cross-border systems evolution.

Exploring the transformative technological and regulatory shifts that are revolutionizing the automated border control landscape

Automated border control has experienced a profound transformation driven by technological advancements, changing traveler expectations, and shifting security priorities. Traditional eGates have evolved from simple document readers into sophisticated platforms capable of multi-modal biometric verification and real-time risk analytics. Meanwhile, novel form factors such as mobile identity checkpoints and unattended eKiosks have emerged to address congestion in non-aviation points of entry, exemplifying the growing flexibility required by diverse transit environments.

Furthermore, the adoption of cloud-native architectures and microservices has enabled seamless integration of biometric identification software with border control management platforms. This interoperability allows authorities to leverage shared watchlists, data analytics dashboards, and predictive modeling to proactively allocate resources and detect anomalies. In parallel, artificial intelligence has become integral to liveness detection, ensuring that spoofing attempts are mitigated through behavioral and physiological challenge-response mechanisms.

In addition to technical innovations, regulatory frameworks have shifted to accommodate cross-border data exchange and privacy safeguards. International standards bodies have collaborated to harmonize biometric data formats, facilitating travel facilitation programs while upholding data protection mandates. Consequently, automated border control vendors have invested in privacy-by-design principles, implementing encryption, secure APIs, and consent-driven data flows to align with evolving global and regional regulations. These transformative shifts underscore the accelerating convergence of security, efficiency, and traveler centricity.

Assessing the cumulative effects of newly enacted United States tariffs on hardware components and industry cost structures in 2025

The imposition of new United States tariffs in early 2025 on key hardware components has created both challenges and adaptation opportunities for border control system integrators. Increased duties on biometric sensors, fingerprint scanners, and facial recognition modules have elevated procurement costs, prompting stakeholders to reassess supply chain resilience and component sourcing strategies. Consequently, some solution providers have negotiated revised contracts with primary manufacturers or sought alternative suppliers in tariff-exempt jurisdictions to maintain price competitiveness.

Moreover, the ripple effects of these tariffs extend beyond hardware procurement. System integrators have encountered higher total cost of ownership for deployed eGates and mobile checkpoints, leading to longer return-on-investment horizons. In response, contract negotiations with airport authorities and border security forces have shifted focus toward service-based models, whereby maintenance and support fees are structured as recurring subscriptions rather than capital expenditures. This evolution in pricing architecture aims to distribute tariff-driven cost increases over multi-year agreements, thereby preserving procurement momentum.

Despite these short-term headwinds, the cumulative impact of tariffs has also spurred innovation in modular design and local assembly capabilities. Industry participants are exploring localized integration hubs and onshore assembly partnerships to circumvent elevated import duties, thereby fostering domestic capacity development. As a result, the tariff landscape of 2025 has catalyzed a strategic recalibration of sourcing, pricing, and manufacturing frameworks that will reverberate through the automated border control ecosystem.

Illuminating critical segmentation dimensions spanning components, modules, applications, and end users to decode market dynamics

A nuanced understanding of market segmentation reveals how component, module, application, and end-user dimensions collectively shape competitive strategies. When examining the component spectrum, hardware innovations such as biometric sensors, facial recognition systems, fingerprint scanners, and iris recognition units interplay with software platforms dedicated to biometric identification, border control management, and visitor registration. Complementing these are specialized services spanning consulting, system integration, and maintenance support, each critical to lifecycle optimization and operational continuity.

In parallel, the module segmentation underscores distinct deployment scenarios with eGates designed for high-throughput environments, eKiosks tailored to resource-constrained checkpoints, and mobile gates offering rapid redeployment for surge or emergency operations. This modular perspective aligns with evolving application use cases, where airports demand peak efficiency, land border crossings require robust security controls under variable conditions, and seaport terminals balance passenger and vehicle throughput within complex maritime infrastructures.

The end-user segment further refines market priorities by highlighting the divergent needs of airport authorities focused on throughput and traveler experience, border security forces tasked with threat interdiction, government agencies overseeing policy compliance, and private security contractors delivering bespoke solutions. Recognizing these four segmentation dimensions enables stakeholders to tailor product roadmaps, service offerings, and partnership models, ensuring alignment with specific requirements and operational contexts.

This comprehensive research report categorizes the Automated Border Control market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Module

- Capacity Tier

- Application

- End User

Uncovering diverse regional growth patterns and strategic priorities across the Americas, Europe Middle East and Africa, and Asia Pacific

Regional dynamics in the automated border control domain exhibit pronounced variation across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, modernization efforts at major international airports have accelerated the replacement of legacy checkpoints with biometrically enabled eGates, spurred by policy mandates to enhance traveler facilitation and counter cross-border crime. Public–private partnerships have been instrumental in financing large-scale deployments and enabling technology pilot programs at secondary airports.

Conversely, in Europe, the Middle East, and Africa, regulatory frameworks such as the European Entry/Exit System have catalyzed unified biometric data architecture and interoperability across Schengen states, while Gulf Cooperation Council members invest heavily in smart border corridors to accommodate large volumes of pilgrim and business travel. In sub-Saharan Africa, pilot initiatives focus on modular eKiosks and mobile gates to bolster land border control in remote regions, underscoring the importance of adaptable, low-footprint solutions.

Meanwhile, the Asia Pacific region stands at the forefront of biometric innovation, leveraging widespread mobile adoption to pilot smartphone-based traveler enrollment and eKiosk integration. Large hub airports in East Asia have rolled out facial recognition boarding systems linked to national identity registries, whereas Southeast Asian nations prioritize flexible, cloud-enabled border management platforms to support both air and maritime gateways. These regional nuances highlight the strategic imperatives that drive differentiated investment strategies and technology roadmaps across geographies.

This comprehensive research report examines key regions that drive the evolution of the Automated Border Control market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing major strategic alliances, technology investments, and competitive tactics driving leadership in automated border control

Leading industry participants are forging strategic partnerships, expanding solution portfolios, and leveraging acquisitions to secure competitive advantage. Key market players have invested in research and development to enhance biometric sensor accuracy, reduce false acceptance rates, and streamline enrollment processes. At the same time, alliances between software developers and hardware manufacturers are delivering fully integrated end-to-end platforms that simplify procurement and deployment for end users.

Moreover, notable strategic moves include cross-sector collaborations with telecommunications providers to harness 5G connectivity for real-time video analytics at remote checkpoints, and partnerships with cloud service operators to deliver scalable border control management software. Such joint ventures enable rapid scaling of digital infrastructure and ensure compliance with stringent data sovereignty requirements across different territories. In parallel, targeted acquisitions of niche service firms have expanded maintenance and system integration capabilities, reinforcing customer support frameworks.

As competitive dynamics intensify, companies are also differentiating through advanced analytics offerings, embedding machine learning algorithms within surveillance systems to predict traveler flow patterns and optimize resource allocation. These innovations underscore a shift toward outcome-based service models, where performance metrics and operational benchmarks are linked to supplier agreements, driving continuous improvement and stronger alignment with end-user objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Border Control market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Amadeus IT Group SA

- Atos SE

- Cambaum GmbH

- Cognitec Systems GmbH by Salto Systems, S.L.

- COMINFO, a.s.

- DERMALOG Identification Systems GmbH

- dormakaba International Holding AG

- eKiosk GmbH

- Fujitsu Limited

- Gunnebo AB

- HID Global Corporation by ASSA ABLOY

- IDEMIA Group

- IER SAS

- IN Groupe

- Indra Sistemas, S.A.

- Leidos, Inc.

- Magnetic Autocontrol GmbH by FAAC SpA

- Naitec S.r.l.

- NEC Corporation

- NetSeT Global Solutions

- Portwell, Inc. by Posiflex Technology, Inc.

- Regula Forensics, Inc.

- RTX Corporation

- secunet Security Networks AG

- Securiport LLC

- Société Internationale de Télécommunications Aéronautiques S.C.R.L.

- Thales Group

- Unisys Corporation

- Veridos GmbH

- ZETES Industries S.A.

Guiding industry leaders toward modular architectures, diversified sourcing and performance-based models for sustainable competitive advantage

Industry leaders should prioritize the development of interoperable, modular solutions that address varied checkpoint environments while accommodating future regulatory shifts. To this end, investing in open architecture frameworks and standardized APIs will facilitate seamless integration with existing border management systems and third-party data sources. Additionally, diversifying supply chains by qualifying multiple component vendors across different regions can mitigate the impact of trade policy changes and ensure continuity of critical hardware availability.

Furthermore, cultivating strategic collaborations with government bodies and international standards organizations can accelerate the adoption of harmonized biometric protocols and foster mutual recognition agreements. Such engagement not only streamlines certification processes but also enhances cross-border data exchange capabilities. Complementing these partnerships, embedding advanced analytics and AI-driven decision support tools within control room software will empower security forces to anticipate threat patterns and optimize staffing levels.

Finally, adopting outcome-based commercial models that align vendor incentives with operational performance metrics can drive ongoing innovation and cost efficiency. By structuring contracts around key performance indicators like throughput rates and system uptime, stakeholders can establish shared accountability and foster a culture of continuous enhancement. This multifaceted approach equips industry leaders to navigate evolving market dynamics and secure sustainable competitive advantage.

Outlining a comprehensive hybrid research methodology integrating primary interviews, secondary analysis and expert validation to ensure robust insights

This study employs a hybrid research methodology combining primary insights with rigorous secondary analysis to ensure robustness and reliability. Initially, in-depth interviews were conducted with senior executives, system integrators, and end-user representatives from airports, border security agencies, and private security firms to glean firsthand perspectives on operational challenges and technology adoption trajectories. These qualitative insights were further triangulated through structured surveys targeting technical stakeholders and procurement specialists.

Complementing primary research, extensive secondary data was sourced from regulatory whitepapers, technology standards bodies, industry consortium publications, and reputable news outlets to map regulatory developments and technology roadmaps. Market reports were cross-referenced for consistency, and technology performance benchmarks were validated through laboratory test results and vendor-provided documentation. Data points were subjected to a multi-stage validation process to filter out anomalies and reconcile discrepancies.

Finally, quantitative findings from primary surveys and secondary datasets were synthesized through data modeling techniques to identify key segmentation trends, regional variances, and the financial impact of tariffs. All research findings underwent peer review by an expert advisory panel specializing in biometrics, border management, and cybersecurity to ensure methodological integrity and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Border Control market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Border Control Market, by Component

- Automated Border Control Market, by Module

- Automated Border Control Market, by Capacity Tier

- Automated Border Control Market, by Application

- Automated Border Control Market, by End User

- Automated Border Control Market, by Region

- Automated Border Control Market, by Group

- Automated Border Control Market, by Country

- United States Automated Border Control Market

- China Automated Border Control Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing critical findings on technological evolution, tariff impact, segmentation and regional variances to chart future strategic imperatives

In summary, the automated border control market stands at a pivotal juncture shaped by rapid technological innovation, evolving regulatory frameworks, and shifting trade policies. The convergence of advanced biometrics, AI-driven analytics, and cloud-native platforms is ushering in a new era of contactless, efficient, and secure traveler processing. While the 2025 United States tariffs have introduced cost pressures, they have also stimulated strategic sourcing adaptations and modular design innovations.

Segmentation analysis clarifies how component diversity, modular deployment, application contexts, and end-user requirements coalesce to define solution roadmaps. Regional insights underscore the necessity of tailored approaches, as investment priorities and regulatory landscapes vary markedly across the Americas, Europe, Middle East and Africa, and Asia Pacific. Concurrently, competitive dynamics are intensifying as leading players forge alliances, invest in R&D, and embrace outcome-based service models.

Looking ahead, industry stakeholders who adopt interoperable architectures, diversify supplier bases, and collaborate on harmonized standards will be best positioned to capitalize on growth opportunities. The actionable recommendations provided herein offer a strategic blueprint for navigating complexity, driving operational excellence, and sustaining competitive advantage. This conclusion reinforces the imperative for decision-makers to leverage comprehensive market intelligence in shaping their automated border control strategies.

Unlock unparalleled market intelligence and secure direct access to the definitive automated border control research report through a consult with Ketan Rohom

To explore comprehensive insights, strategic guidance, and detailed market analysis of the automated border control industry, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engage in a tailored consultation to understand how advanced biometric solutions, emerging regulatory trends, and regional dynamics can shape your organizational growth and competitive positioning. Reach out today to secure full access to the definitive market research report, featuring in-depth segmentation, regional breakdowns, tariff impact assessments, and actionable recommendations that will empower informed decision-making and accelerate your investment strategies.

- How big is the Automated Border Control Market?

- What is the Automated Border Control Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?