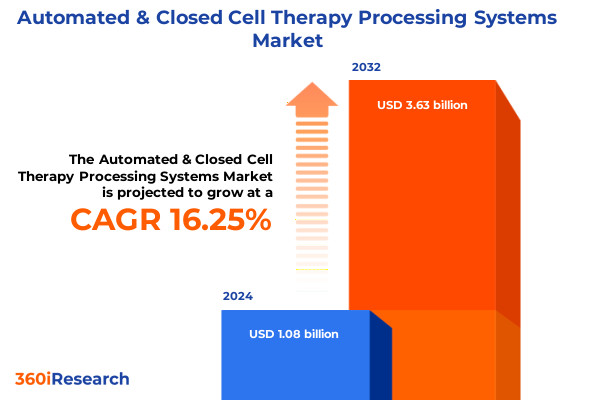

The Automated & Closed Cell Therapy Processing Systems Market size was estimated at USD 1.24 billion in 2025 and expected to reach USD 1.43 billion in 2026, at a CAGR of 16.49% to reach USD 3.63 billion by 2032.

Exploring the Core Landscape of Automated and Closed Cell Therapy Processing Technologies Shaping Bioprocessing Efficiency, Consistency, and Quality Control

The field of cell therapy has witnessed remarkable progress over the past decade, transitioning from experimental lab protocols into robust manufacturing pipelines capable of delivering life-saving treatments at scale. Central to this evolution is the emergence of automated and closed processing systems, which have redefined how biopharmaceutical manufacturers orchestrate cell separation, washing, formulation, and storage. By minimizing manual interventions and potential contamination risks, these technologies are not only elevating product consistency and yield but are also reshaping regulatory expectations and quality standards across the industry.

As clinical pipelines expand to encompass both allogeneic off-the-shelf therapies and autologous personalized treatments, the demands placed on bioprocessing infrastructures have intensified. Automated platforms, integrating sophisticated robotics and digital monitoring, enable real-time control and data capture, thereby accelerating process validation and reducing time to market. Meanwhile, closed systems facilitate compliance with stringent clean‐room requirements while preserving cell viability and function. Together, these innovations form the cornerstone of a more agile, reliable, and scalable cell therapy manufacturing paradigm, setting the stage for the next generation of therapeutic breakthroughs.

Unveiling Paradigm Shifts in Cell Therapy Processing as Automation and Closed Systems Transform Scalability, Throughput, and Regulatory Compliance

The cell therapy processing ecosystem is undergoing transformative shifts driven by the integration of advanced automation, closed‐system engineering, and data‐centric controls. Traditional workflows, once reliant on manual transfers and open‐bench operations, are being supplanted by end‐to‐end platforms that synchronize each step from cell harvest to final formulation. Automation has enabled manufacturers to increase throughput without proportionally raising labor costs, while closed architectures have addressed contamination concerns and regulatory scrutiny by creating hermetically sealed environments that isolate critical processes from external variables.

Simultaneously, the digitization of bioprocessing has facilitated seamless data logging, advanced analytics, and predictive modeling. Machine learning algorithms now interpret sensor data to forecast cell growth kinetics and detect deviations before they impact product quality. This confluence of robotics, software, and instrumentation marks a paradigm shift: process development cycles have shortened, technology transfer between sites has become more straightforward, and decentralized manufacturing models are gaining traction. In parallel, regulatory agencies have begun updating guidance to accommodate these innovations, recognizing that standardized automated systems can deliver greater consistency and traceability than traditional manual approaches.

Taken together, these shifts are redefining how companies approach capacity expansion, investment in fixed versus modular facilities, and partnerships with technology providers. The industry is moving from bespoke, site‐specific protocols toward harmonized, scalable platforms that can be deployed globally, ultimately promising to accelerate patient access to novel therapies.

Assessing the Cumulative Impact of Recently Implemented United States Tariffs on Cell Therapy Processing Equipment and Supply Chains in 2025

In 2025, implementation of updated United States tariff measures has had a ripple effect across the supply chains for cell therapy processing equipment and consumables. While tariffs focus primarily on certain imported medical instruments and specialized plasticware, their indirect impact on component sourcing, materials costs, and equipment architecture has been significant. Manufacturers that previously relied on competitively priced overseas suppliers have begun to reassess their procurement strategies, balancing tariff expenditures against the benefits of localized production and inventory buffering.

These cumulative tariff measures have increased landed costs for key modules such as single‐use bioreactors, sterile connectors, and filtration assemblies. In response, many system integrators have accelerated strategic partnerships with domestic fabricators or pursued in‐house manufacturing capabilities for critical components. This realignment has not only mitigated tariff burdens but also enhanced supply chain resilience and reduced lead times, supporting tighter production schedules and minimizing operational disruptions.

Moreover, the added cost pressures have incentivized adoption of systems that deliver higher throughput per batch, longer run times without intervention, and integrated component reuse strategies. As a result, industry leaders are prioritizing modular platforms that allow selective upgrades and component swaps, ensuring that tariff‐exposed elements can be quickly replaced or reconfigured. Although the initial impact of these tariffs has posed financial challenges for some, the net effect has been a stronger domestic innovation ecosystem and a renewed focus on flexible, scalable manufacturing solutions.

Leveraging Product, Application, Technology, End User, and Process Type Segmentation to Uncover Nuanced Opportunities in Cell Therapy Processing Markets

To navigate the complexity of the cell therapy processing market, segmentation plays a pivotal role in highlighting nuanced growth pockets and investment opportunities. Viewed through the lens of product type, the industry bifurcates into fully automated systems designed for hands‐off execution and closed systems engineered to maintain aseptic integrity. This distinction underpins divergent value propositions-automation excels in standardization and high‐throughput scenarios, whereas closed systems are favored for modularity and contamination control in clinical settings.

Application‐based segmentation further refines this landscape into allogeneic platforms, encompassing hematopoietic stem cell therapy, mesenchymal stem cell therapy, and natural killer cell therapy, alongside autologous workflows that include CAR T cell therapy in addition to parallel hematopoietic and mesenchymal programs. Each application niche imposes unique processing requirements, driving demand for tailored automation routines, specialized consumables, and analytics optimized for distinct cell phenotypes.

Technological segmentation highlights three principal separation modalities-centrifugation, filtration, and magnetic separation-each with its own subcategories such as density gradient, fixed angle, and swing bucket centrifugation; microfiltration and ultrafiltration; and immunomagnetic bead and paramagnetic separation. The choice of technology correlates directly with throughput needs, cell viability outcomes, and downstream assay compatibility.

End users span contract research organizations seeking flexible pilot systems, hospitals and clinics integrating point‐of‐care production, pharmaceutical and biotech companies building commercial capacity, and research institutes focused on exploratory protocols. Meanwhile, process type segmentation-from cell counting and analysis (encompassing both automated and manual counting) to cell preparation (formulation and thawing), cell separation modalities, cell storage for both short‐term and long‐term preservation, and cell washing methods ranging from automated modules to manual workflows-reveals a spectrum of workflows that can be incrementally automated or wholly transformed depending on scalability and compliance goals.

This comprehensive research report categorizes the Automated & Closed Cell Therapy Processing Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Process Type

- Application

- End User

Illuminating Regional Dynamics Across the Americas, Europe Middle East and Africa, and Asia Pacific to Inform Strategic Cell Therapy Processing Initiatives

Regionally, the Americas continue to lead with robust investment in R&D infrastructure, favorable reimbursement pathways, and a concentration of specialized manufacturing hubs. The North American landscape is characterized by a strong presence of both established equipment vendors and innovative startups developing proprietary closed and automated platforms. This region’s regulatory clarity and reimbursement incentives have accelerated clinical trial throughput and adoption of novel processing approaches, solidifying its position as a bellwether for global trends.

Across Europe, the Middle East, and Africa, fragmentation presents both challenges and prospects. Harmonization under frameworks like the European Medicines Agency’s guidance has fostered cross‐border collaboration, while emerging markets in the Middle East are investing in state‐of‐the‐art cell therapy centers. Variations in regulatory timelines and local sourcing requirements necessitate flexible system architectures adaptable to multiple certification standards and supply chain models.

In the Asia‐Pacific region, a combination of cost‐competitive manufacturing, government‐sponsored innovation grants, and rapid clinical adoption in markets such as China, Japan, and South Korea has fueled demand for scalable processing solutions. Local vendors are increasingly competing on price and customization, prompting global suppliers to deepen regional partnerships and invest in localized production facilities. These dynamics underscore the need for a geographically tailored go‐to‐market strategy that respects regional regulatory, economic, and infrastructure nuances.

This comprehensive research report examines key regions that drive the evolution of the Automated & Closed Cell Therapy Processing Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Shaping the Automated and Closed Cell Therapy Processing Ecosystem Through Strategic Partnerships and Collaborative Approaches

Innovation in automated and closed cell therapy processing is concentrated among a set of pioneering companies that have leveraged both organic development and strategic alliances. Key players have expanded their portfolios through collaborations with specialist consumable manufacturers, software developers, and clinical service providers. This ecosystem approach has enabled them to offer integrated solutions that combine hardware, single‐use disposables, and data analytics into cohesive workflows.

Major incumbents have also pursued targeted acquisitions of niche automation startups, integrating microfluidics, AI‐driven monitoring, and advanced sensor arrays into legacy platforms. These acquisitions have not only broadened the technology spectrum but have also accelerated time to market for enhanced system features. Meanwhile, emerging players with disruptive technologies are partnering with research institutes to validate novel separation or washing techniques, aiming to carve out distinct competitive advantages.

Cross‐company consortia have formed around open architecture initiatives, promoting interoperability between devices from different vendors. Such collaborative frameworks are gaining traction as end users seek to avoid vendor lock‐in and maximize the flexibility of their manufacturing suites. Through these strategic partnerships and collaborative approaches, industry leaders and disruptors alike are shaping the contours of next‐generation bioprocessing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated & Closed Cell Therapy Processing Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bio-Techne Corporation

- BioLife Solutions Inc.

- BioSpherix, Ltd.

- Cellares Inc.

- Corning Incorporated

- Cytiva

- Danaher Corporation

- Fresenius SE & Co. KGaA

- General Electric Company

- Lonza Group AG

- Merck KGaA

- Miltenyi Biotec B.V. & Co. KG

- Novartis AG

- Pluristem Therapeutics Inc.

- Regeneus Ltd.

- Sartorius AG

- STEMCELL Technologies Canada Inc.

- Terumo Corporation

- Thermo Fisher Scientific, Inc.

- Thermogenesis Holdings, Inc.

Delivering Actionable Strategic Recommendations to Accelerate Adoption, Boost Efficiency, and Drive Innovation in Automated and Closed Cell Therapy Processing

To stay ahead in the rapidly evolving landscape of cell therapy processing, industry leaders should pursue a multipronged strategy focused on technological agility, regulatory alignment, and operational resilience. First, organizations must adopt modular systems that allow incremental automation, enabling swift integration of new separation or analytics modules without overhauling entire workflows. This flexibility reduces capital risk and facilitates continuous process improvement.

Second, proactive engagement with regulatory bodies is essential for streamlining validation pathways. By collaborating on precompetitive initiatives and sharing real‐world performance data, manufacturers can help shape guidelines that support advanced closed and automated architectures. Such partnerships expedite approval timelines and foster greater confidence in emerging technologies.

Third, investment in digital infrastructure-ranging from cloud‐based process data management to predictive maintenance algorithms-can enhance decision‐making and minimize downtime. Leveraging machine learning to analyze sensor outputs provides early warnings of deviations and supports continuous process verification.

Finally, diversifying supply chains through a balanced mix of domestic fabrication and strategic global partnerships will mitigate the impact of trade uncertainties and tariff fluctuations. Cultivating relationships with multiple qualified vendors for critical modules ensures business continuity and cost predictability. By implementing these recommendations, stakeholders can accelerate adoption, boost efficiency, and secure a competitive edge in the dynamic cell therapy bioprocessing market.

Outlining a Rigorous Research Methodology Combining Primary Interviews, Secondary Research, and Expert Insights for Automated and Closed Cell Therapy Analysis

This analysis is underpinned by a comprehensive research methodology combining primary interviews, secondary research, and expert insights. A series of in‐depth discussions with senior executives, process engineers, clinical manufacturing leads, and regulatory consultants provided firsthand perspectives on emerging trends, pain points, and strategic priorities. Supplementing these conversations, extensive review of peer‐reviewed journals, patent filings, technical whitepapers, and regulatory guidelines ensured a robust understanding of technological advances and compliance frameworks.

Secondary research encompassed analysis of corporate filings, press releases, and public tender databases to map vendor capabilities, partnership networks, and capital investments. Technology roadmaps and product launch histories were cross‐referenced against clinical pipeline data to assess adoption patterns and identify white spaces in automated processing offerings. Expert insights were synthesized through a structured validation process, allowing for triangulation of data points and consolidation of key takeaways.

The result is a rigorous examination that balances qualitative narratives with quantitative indicators of growth and innovation, providing decision‐makers with a credible foundation for strategic planning in the automated and closed cell therapy processing domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated & Closed Cell Therapy Processing Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated & Closed Cell Therapy Processing Systems Market, by Product Type

- Automated & Closed Cell Therapy Processing Systems Market, by Technology

- Automated & Closed Cell Therapy Processing Systems Market, by Process Type

- Automated & Closed Cell Therapy Processing Systems Market, by Application

- Automated & Closed Cell Therapy Processing Systems Market, by End User

- Automated & Closed Cell Therapy Processing Systems Market, by Region

- Automated & Closed Cell Therapy Processing Systems Market, by Group

- Automated & Closed Cell Therapy Processing Systems Market, by Country

- United States Automated & Closed Cell Therapy Processing Systems Market

- China Automated & Closed Cell Therapy Processing Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Future Outlook to Navigate the Evolving Terrain of Automated and Closed Cell Therapy Processing Technologies

As the cell therapy industry marches toward commercialization and global deployment, automated and closed processing systems will remain critical enablers of scalability, cost control, and regulatory compliance. The harmonization of modular hardware, intelligent software, and single‐use disposables is reshaping operational paradigms, turning once‐cumbersome workflows into reproducible, high‐throughput manufacturing lines.

Looking ahead, advancements in microfluidic technologies, inline analytics, and digital twins are poised to further refine process control and accelerate technology transfer across geographies. Collaborative open architecture initiatives may democratize access to best‐in‐class modules, reducing time to integration and mitigating risks of vendor dependency. Regional dynamics, from the mature demand in the Americas to the rapid growth in Asia‐Pacific, will dictate localized strategies, underscoring the importance of adaptability and regional partnerships.

Ultimately, stakeholders that embrace these innovations and proactively address supply chain, regulatory, and data management challenges will secure lasting competitive advantages. By synthesizing the insights presented in this executive summary, decision‐makers can chart a course toward efficient, compliant, and patient-centric cell therapy manufacturing ecosystems.

Engaging with Ketan Rohom to Unlock Comprehensive Insights and Empower Strategic Decision Making in Automated and Closed Cell Therapy Processing

To gain an in-depth understanding of automated and closed cell therapy processing systems and to secure the full report packed with detailed analysis, strategic insights, and tailored recommendations, readers are encouraged to connect with Ketan Rohom, Associate Director of Sales & Marketing. Whether you are aiming to optimize existing workflows, assess emerging technologies, or refine your strategic roadmap, Ketan can guide you through the purchase process and provide personalized support to address your organization’s unique needs. Reach out today to access the definitive resource that will empower your next phase of innovation and growth in cell therapy bioprocessing.

- How big is the Automated & Closed Cell Therapy Processing Systems Market?

- What is the Automated & Closed Cell Therapy Processing Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?