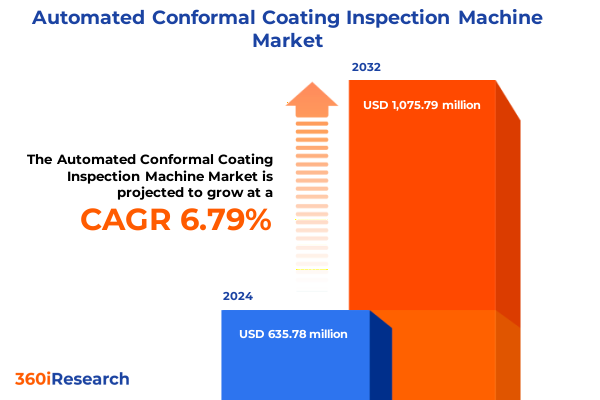

The Automated Conformal Coating Inspection Machine Market size was estimated at USD 668.50 million in 2025 and expected to reach USD 717.10 million in 2026, at a CAGR of 7.03% to reach USD 1,075.79 million by 2032.

Pioneering Advanced Inspection Solutions to Safeguard Coating Quality in Electronics Through Automated Conformal Coating Inspection Machines

Modern electronics manufacturing demands stringent quality assurance for conformal coatings applied to printed circuit boards and critical assemblies. Automated inspection systems provide non-contact, high-speed evaluation that is critical to detecting coating defects capable of causing functional failures under extreme environmental stress. Over the past decade, the transition from manual visual inspection to integrated automated platforms has significantly enhanced throughput and repeatability, enabling manufacturers to meet rigorous compliance mandates while reducing costly rework cycles.

By leveraging cutting-edge sensor technologies and data analytics, inspection machines now deliver detailed metrics on coating thickness uniformity, surface pinholes, delamination, and contamination. The convergence of high-resolution imaging with machine learning algorithms has revolutionized defect classification, empowering production teams with actionable insights in real time. Furthermore, the seamless integration of inline inspection within production lines establishes robust quality gates that mitigate the risk of defective assemblies progressing downstream.

As consumer electronics, automotive systems, aerospace platforms, and medical devices push the boundaries of miniaturization and functional complexity, the role of automated conformal coating inspection machines has never been more critical. These systems not only uphold product reliability but also support lean manufacturing initiatives by minimizing manual intervention. In this evolving landscape, organizations that invest in advanced inspection solutions will drive superior quality outcomes and maintain a sustainable competitive edge.

Unleashing Intelligent Vision and Sensor Innovations That Are Transforming Conformal Coating Inspection in Modern Electronics Manufacturing

Recent advancements in machine vision and sensor fusion are reshaping the conformal coating inspection landscape by enabling unprecedented levels of detail and accuracy. Three-dimensional vision systems have emerged as a powerful alternative to traditional two-dimensional cameras, offering depth perception capable of capturing coating topography with micrometer-scale precision. Combining structured light projection with advanced camera arrays, these solutions detect subtle anomalies-including microbubbles and uneven thickness-that were previously imperceptible.

Parallel developments in thermal imaging have extended capabilities beyond surface temperature mapping. Infrared thermography paired with microbolometer detectors now reveals voids and delamination hidden beneath multi-layer coatings by detecting thermal signatures during controlled heating cycles. This dual capability of surface and subsurface inspection enhances defect coverage without disrupting sensitive substrates, making it ideal for complex electronics assemblies. Additionally, ultrasonic pulse-echo and through-transmission techniques complement optical methods by offering volumetric insights that verify coating integrity throughout the assembly.

Laser scanning modalities, particularly confocal laser and triangulation systems, continue to set benchmarks for speed and resolution. Their non-destructive, inline approach enables rapid thickness measurement across complex geometries at production-scale throughput. Coupled with AI-driven analytics, these platforms not only flag defects but also predict emerging failure trends by correlating historical inspection data with stress simulation results. Consequently, manufacturers can proactively adjust process parameters to optimize coating application, reduce scrap rates, and accelerate time to market.

Assessing the Widespread Influence of 2025 United States Tariffs on Supply Chain Resilience and Cost Dynamics for Automated Inspection Equipment

The introduction of additional tariffs on electronic components and manufacturing equipment by the United States in early 2025 has significantly impacted the economics of automated inspection systems. Manufacturers are confronting increased landed costs for imported sensor modules and precision optics, driving them to reevaluate sourcing strategies and explore domestic alternatives. As a result, local producers of inspection machinery have experienced a surge in demand as OEMs seek to insulate themselves from tariff volatility by reshoring procurement and assembly operations.

The ripple effects of tariff policy extend well beyond direct hardware costs. Calibration instruments and specialized tooling, often sourced from global suppliers, now command higher premiums, intensifying pressure on capital budgets. In response, leading equipment providers have expedited the establishment of regional manufacturing hubs and forged partnerships with domestic distribution networks. This strategic realignment has improved lead times but also introduced complexities in maintaining consistent quality standards across geographically dispersed production facilities.

From an operational standpoint, the tariff regime has prompted industry stakeholders to optimize inventory management and negotiate multi-year supply contracts that incorporate tariff escalation clauses. Advanced analytics tools enable procurement teams to model the impact of prospective policy changes on total cost of ownership, thereby supporting more resilient budgeting. As a result, companies are better positioned to absorb incremental tariff burdens without compromising modernization initiatives, ensuring they retain a competitive posture in an environment defined by regulatory unpredictability.

Uncovering Critical Segmentation Dynamics Spanning Technology, Coating, Automation, Industry Verticals, Application and Channel Preferences

Inspection technologies underpinning conformal coating analysis span a diverse array of sensor modalities, each delivering unique capabilities tailored to specific process requirements. Laser scanning platforms, dissected into confocal and triangulation techniques, excel at capturing surface topography with high-speed precision, whereas machine vision ensembles-bifurcated into two-dimensional and emerging 3D systems-generate detailed imagery for advanced defect recognition. Thermal imaging solutions leverage both infrared thermography and microbolometer arrays to uncover hidden subsurface anomalies, while ultrasonic pulse-echo and through-transmission approaches provide volumetric assurance. X-ray inspection further bifurcates into computed tomography and focused ball grid array analysis, enabling comprehensive internal defect characterization.

The choice of coating material directly influences inspection strategies. UV-curable and waterborne acrylics require rapid-cycle thickness verification, while two-part and UV-curable epoxy systems demand strict monitoring of cure consistency and adhesion metrics. Parylene chemistries, differentiated between types C and N, present distinct barrier properties that necessitate precise thickness mapping. Aliphatic and aromatic polyurethanes introduce divergent surface uniformity challenges, and high-temperature versus room-temperature vulcanizing silicones vary in viscosity and cure dynamics, each affecting defect detection thresholds.

Automated inspection platforms manifest across a spectrum of operational configurations, from fully automated batch systems and inline continuous integration to manual benchtop fixtures and portable handheld devices. Semi-automated solutions that incorporate conveyor integration or dedicated workstations bridge the gap between high throughput and flexible deployment. End use industries-ranging from aerospace and defense applications for civil, military, and space systems to automotive segments encompassing ADAS sensor modules, electric vehicle assemblies, and internal combustion components-demand uncompromised reliability. Meanwhile, electronics manufacturers focus on consumer devices, semiconductor production lines, and telecommunications equipment, healthcare providers emphasize diagnostic, implantable, and surgical instruments, and industrial equipment producers seek inspection capabilities for heavy machinery, power generation assets, and robotics.

The applications spectrum includes connectors, printed circuit assemblies from single-sided to multi-layer designs, and circuit boards available in rigid, flexible, and rigid-flex formats, as well as relays and advanced sensor modules. Distribution channels range from direct sales to OEMs to specialized distributors-including OEM distributors and value-added resellers-and online platforms comprising manufacturer websites and third-party marketplaces, each shaping the procurement experience and service model for inspection solutions.

This comprehensive research report categorizes the Automated Conformal Coating Inspection Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Inspection Technology

- Coating Type

- Automation Level

- End Use Industry

- Application

- Distribution Channel

Exploring Regional Growth Drivers and Market Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific for Conformal Coating Inspection

The Americas region, anchored by a robust United States electronics manufacturing base, has emerged as a focal point for demand in automated coating inspection systems. Reshoring initiatives and federal incentives aimed at bolstering domestic production have fueled investments in advanced inspection platforms. Canada’s growing aerospace electronics sector and Mexico’s expanding automotive assembly operations offer adjacent opportunities for deploying both inline and benchtop inspection equipment. Across the region, local suppliers have deepened collaborations with integration partners to deliver turnkey solutions that combine hardware precision with responsive service support.

In Europe, the Middle East, and Africa, regulatory rigor and high-value end use cases are driving the uptake of multi-modal inspection technologies. Germany’s precision engineering culture propels demand for laser scanning and X-ray tomography systems, while the United Kingdom and France prioritize machine vision and thermal imaging capabilities in their aerospace and telecommunications sectors. Emerging markets across the Middle East and Africa are investing in flexible benchtop and handheld platforms to support maintenance and repair operations for critical infrastructure, leveraging cost-effective semi-automated solutions to bridge capability gaps.

Asia-Pacific continues to lead in volume, driven by large-scale electronics assembly hubs in China, Taiwan, and South Korea. Thermal imaging and machine vision inspection systems are integral to consumer electronics production lines, while Japan’s automotive and semiconductor equipment manufacturers require high-precision confocal and ultrasonic inspection modalities. Regional original equipment manufacturers leverage direct sales networks and online channels for rapid deployment, and partnerships with value-added resellers ensure scalable support in high-throughput environments. Across APAC, accelerated digital transformation initiatives underscore the imperative for scalable, data-rich inspection ecosystems that align with Industry 4.0 objectives.

This comprehensive research report examines key regions that drive the evolution of the Automated Conformal Coating Inspection Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovative Strategies, Strategic Alliances, and Competitive Advances Among Leading Vendors in Automated Conformal Coating Inspection

The competitive landscape of automated conformal coating inspection is characterized by a cohort of specialized technology vendors and integrated solution providers who continually enhance their offerings through innovation and collaboration. Market leaders have channeled investments into AI-driven analytics engines that continuously refine defect classification algorithms based on real-world inspection data. Several firms have expanded their portfolios through targeted acquisitions of software specialists, integrating cloud-based reporting and remote diagnostic functionalities into their hardware platforms.

Strategic alliances are reshaping go-to-market strategies, as equipment suppliers partner with coating material manufacturers to co-develop validated inspection protocols optimized for specific chemistries. Collaborations with industrial robotics companies have resulted in modular cell architectures that seamlessly incorporate inspection stations into automated production lines. Moreover, subscription-based service models offering predictive maintenance and calibration-as-a-service are gaining momentum, shifting the competitive focus from one-time hardware transactions to long-term value delivery throughout the equipment lifecycle.

Key vendors differentiate through modular hardware designs that support rapid deployment of multiple sensor modalities within a single inspection framework. This configurability allows manufacturers to adapt systems in response to evolving product mixes without major capital reinvestment. Competitive pressures have also driven enhancements in user experience, leading to more intuitive software interfaces and quicker changeover processes that reduce operator training requirements and minimize line downtime.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Conformal Coating Inspection Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anda Technologies USA, Inc.

- ASM Pacific Technology Limited

- CyberOptics Corporation

- Keyence Corporation

- KLA Corporation

- Koh Young Technology Inc.

- Mirtec Co., Ltd.

- Mycronic AB

- Nordson Corporation

- Omron Corporation

- Onto Innovation Inc.

- Viscom SE

Driving Excellence Through Strategic Adoption of AI, Supply Chain Resilience, and Integration for Inspection Technology Leadership

Industry leaders should prioritize the integration of AI-based analytics to enhance defect detection and process optimization. By harnessing machine learning models trained on historical inspection datasets, organizations can achieve continuous improvements in classification accuracy, reducing false positives and minimizing manual review cycles. Coupling these insights with advanced data visualization tools enables cross-functional teams to pinpoint production bottlenecks and adjust coating application parameters proactively in near real time.

Strengthening supply chain resilience is imperative in light of evolving tariff landscapes and geopolitical uncertainties. Executives are advised to pursue dual-sourcing strategies that balance global technology access with regional manufacturing partnerships. Embedding tariff escalation clauses within long-term supplier agreements can mitigate cost unpredictability and safeguard modernization roadmaps. Additionally, proactive inventory management supported by digital twin simulations allows stakeholders to anticipate component shortages and redeploy resources dynamically.

Seamless integration of inspection modules with enterprise manufacturing execution systems ensures that quality data flows unobstructed across the production lifecycle. Industry leaders should consider modular conveyor and robotic integrations that allow inspection stations to scale alongside throughput demands. Furthermore, fostering collaborative relationships between equipment OEMs and coating material suppliers can expedite protocol qualification, ensuring that inspection algorithms remain calibrated for new material formulations and regulatory requirements.

To support these strategic initiatives, investment in workforce upskilling is essential. Dedicated training programs focused on inspection system operation, data analytics, and process engineering will cultivate a talent pool capable of driving digital transformation. Establishing cross-disciplinary centers of excellence can facilitate knowledge sharing and accelerate adoption of best practices, positioning organizations at the forefront of conformal coating inspection innovation.

Detailing Rigorous Primary and Secondary Research Approaches Underpinning the Analysis of Conformal Coating Inspection Solutions

This report synthesizes insights derived from a rigorous research methodology combining secondary and primary data collection. The secondary research phase encompassed comprehensive analysis of industry whitepapers, technical standards, patent filings, and regulatory guidelines to map the technological ecosystem and identify emerging innovations. Augmenting this desk research, primary interviews were conducted with senior executives, process engineers, and quality leaders across leading electronics, aerospace, and automotive organizations to validate thematic findings and uncover latent market needs.

Quantitative data was triangulated using multiple sources, including financial disclosures of publicly traded equipment vendors, procurement databases, and transactional records from tier-one distribution partners. Qualitative feedback from expert panels and end users was integrated to refine segmentation frameworks and ensure that the analysis reflects real-world implementation challenges. Insights gathered through workshops and targeted web-based surveys further enriched the understanding of technology adoption drivers and pain points.

The research process adhered to a structured framework encompassing PESTEL analysis to assess macroeconomic forces, SWOT evaluations of leading vendors, and Porter’s Five Forces to gauge competitive intensity. Data integrity was maintained through cross-validation and peer review conducted by independent industry specialists. Confidentiality agreements protected proprietary contributions, ensuring that stakeholder insights were responsibly anonymized while preserving the depth and relevance of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Conformal Coating Inspection Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Conformal Coating Inspection Machine Market, by Inspection Technology

- Automated Conformal Coating Inspection Machine Market, by Coating Type

- Automated Conformal Coating Inspection Machine Market, by Automation Level

- Automated Conformal Coating Inspection Machine Market, by End Use Industry

- Automated Conformal Coating Inspection Machine Market, by Application

- Automated Conformal Coating Inspection Machine Market, by Distribution Channel

- Automated Conformal Coating Inspection Machine Market, by Region

- Automated Conformal Coating Inspection Machine Market, by Group

- Automated Conformal Coating Inspection Machine Market, by Country

- United States Automated Conformal Coating Inspection Machine Market

- China Automated Conformal Coating Inspection Machine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 4611 ]

Synthesizing Key Insights to Illuminate Pathways for Enhanced Quality Assurance and Sustainable Innovation in Conformal Coating Inspection

The evolving landscape of automated conformal coating inspection underscores a paradigm shift toward intelligent, multi-modal platforms that deliver comprehensive quality assurance across diverse end use applications. Technological convergence-spanning optical, thermal, ultrasonic, and X-ray modalities-is enabling defect detection capabilities that were previously unattainable. Concurrently, advancements in AI-driven analytics and modular system design are empowering manufacturers to respond swiftly to shifting product requirements while maintaining stringent compliance and reliability standards.

Strategic responses to regulatory changes, particularly the enactment of 2025 tariff measures, have highlighted the critical importance of supply chain diversification and regional operational agility. Organizations that embrace localized manufacturing partnerships and flexible sourcing models are better equipped to navigate policy fluctuations without derailing their modernization agendas. Additionally, the deep integration of inspection data with enterprise systems is catalyzing a new era of data-driven process optimization, unlocking productivity gains and accelerating time to market.

Looking ahead, a concerted emphasis on workforce development, cross-industry collaboration, and open standards will be crucial for sustaining innovation in conformal coating inspection. By fostering ecosystems of coating formulators, automation integrators, and analytics specialists, organizations can streamline protocol development and leverage shared resources. Ultimately, the collective drive toward smarter, more resilient inspection architectures will establish the foundation for next-generation electronics manufacturing.

Connect with Ketan Rohom to Acquire Comprehensive Insights and Elevate Your Conformal Coating Inspection Strategy Today

For executives seeking to navigate the complexities of conformal coating inspection and harness the transformative potential of advanced inspection technologies, the full market research report offers an indispensable resource. Under the stewardship of Ketan Rohom, Associate Director of Sales & Marketing, this report delves into granular analysis of technological innovations, tariff impacts, segmentation nuances, regional dynamics, and competitive strategies. Leveraging this intelligence will empower your organization to make informed investment decisions and optimize quality assurance workflows.

Engage directly with Ketan Rohom to unlock tailored briefings and explore how these insights can be strategically aligned with your operational objectives. Whether you seek in-depth consultation on selecting the optimal inspection modality, mitigating supply chain risks, or integrating AI-driven analytics, his expertise will guide your journey toward inspection excellence. Reach out today to secure your copy and position your enterprise at the forefront of conformal coating inspection innovation.

- How big is the Automated Conformal Coating Inspection Machine Market?

- What is the Automated Conformal Coating Inspection Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?