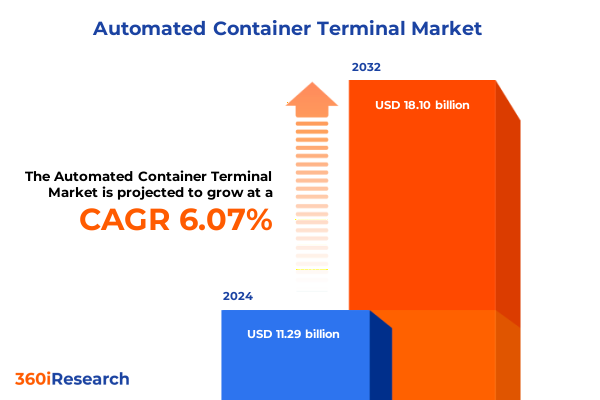

The Automated Container Terminal Market size was estimated at USD 11.93 billion in 2025 and expected to reach USD 12.64 billion in 2026, at a CAGR of 6.13% to reach USD 18.10 billion by 2032.

Establishing the Evolution and Strategic Importance of Automated Container Terminals in Global Supply Chain Management Amid Technological Disruption

The automated container terminal landscape is undergoing a profound transformation driven by advancements in robotics, artificial intelligence, and digital connectivity. These terminals, once a niche application in a handful of major ports, have now emerged as pivotal nodes in the global supply chain, reshaping the flow of goods and redefining competitive dynamics across shipping lines, terminal operators, and cargo owners. By harnessing automated stacking cranes, autonomous guided vehicles, and integrated terminal operating systems, ports can dramatically enhance throughput capacity, reduce turnaround times, and mitigate labor risks associated with manual operations.

Against this backdrop of technological innovation, stakeholders face complex decisions regarding capital allocation, technology selection, and change management. The capital-intensive nature of full automation demands rigorous assessment of total cost of ownership, return on investment horizons, and interoperability challenges with legacy infrastructure. Moreover, the convergence of real-time data analytics, predictive maintenance algorithms, and remote monitoring capabilities has introduced new paradigms for operational excellence, requiring leaders to rethink traditional port management strategies. In this context, this executive summary distills the core findings of our in-depth research, laying the foundation for informed decision-making as industry participants navigate the next era of port automation.

Uncovering Fundamental Disruptions in Port Operations Revealed by Digital Integration and Artificial Intelligence Advancements

Over the past decade, a series of transformative shifts have fundamentally altered the competitive landscape of container terminals. First, the emergence of interoperable digital platforms has enabled real-time visibility across the entire port ecosystem, breaking down data silos and facilitating seamless collaboration among stakeholders. This shift from isolated decision-making to integrated supply chain orchestration has significantly reduced dwell times for containers, optimized berth scheduling, and streamlined gate operations.

Concurrently, the maturation of AI-driven equipment control systems has redefined asset utilization. By applying machine learning to operational data such as crane movement patterns, equipment idle times, and container flow trajectories, terminal operators can dynamically adjust task allocations, predict maintenance needs, and maximize throughput with minimal human intervention. Additionally, heightened emphasis on sustainability has spurred investment in electric and hybrid automated equipment, reflecting a broader industry commitment to decarbonization and regulatory compliance. Emerging trends in remote operations centers and digital twin simulations further underscore the sector’s pivot toward a digital-first mindset, where predictive analytics and scenario planning drive continuous improvement.

Examining How 2025 U.S. Tariff Policies Are Reshaping Capital Investment Cycles and Supply Chains in Terminal Automation

In 2025, the cumulative impact of United States tariffs on trade flows and equipment procurement has introduced both challenges and opportunities for terminal automation projects. Elevated duties on imported cranes, automation hardware, and specialized sensors have led to a recalibration of investment timelines, as operators reassess total landed equipment costs. While these tariffs have increased capital expenditure in the near term, they have also accelerated domestic production of key components, fostering growth among U.S.-based robotics and sensor system manufacturers.

Moreover, fluctuations in import costs have prompted terminals to adopt modular upgrade strategies rather than full-scale system overhauls. By prioritizing incremental automation retrofits-starting with sensor multiplexing and performance monitoring software-operators can spread expenses over multiple fiscal periods and mitigate tariff exposure. On the demand side, some shipping lines have re-routed cargo to non-U.S. gateways, temporarily reducing throughput at tariff-impacted ports. However, projected capacity constraints at alternative hubs have underscored the strategic importance of maintaining competitiveness through targeted automation investments, ensuring resilience against future trade policy fluctuations.

Revealing In-Depth Multidimensional Segmentation Insights That Illuminate Diverse Operational Requirements and Technology Adoption Patterns

Segmentation analysis reveals nuanced insights across multiple dimensions of the automated container terminal market, highlighting the interplay between application contexts and technology adoption. The study of application-based segments juxtaposes inland ports against sea ports, uncovering distinct operational priorities: inland facilities emphasize hinterland connectivity and drayage optimization, whereas seaports focus on large-scale vessel handling and berth scheduling. In parallel, the contrast between fully automated and semi automated terminals illuminates varying return thresholds, with fully automated configurations delivering peak throughput gains at higher upfront costs, while semi automated setups offer more accessible entry points for mid-sized operators. From a service perspective, the landscape encompasses consulting engagements that shape project blueprints, installation projects that involve intricate equipment integration, and ongoing maintenance services that ensure system reliability and uptime.

Furthermore, the study delineates operation modes into automated control frameworks-where algorithms autonomously execute container handling tasks-and remote control systems that enable operators to manage equipment off-site. This distinction informs both workforce training and cybersecurity strategies. The assessment of automation levels, spanning level 1 through level 3, highlights a progression from basic assistance features to fully orchestrated, self-learning systems. End-user segmentation, including automotive, chemical, and oil & gas industries, demonstrates that sector-specific safety regulations, shipment volumes, and handling requirements significantly influence technology specifications. Lastly, component-level insights cover automated guided vehicles, rail-mounted gantry cranes, sensor systems-which further divide into load, proximity, and vision sensors-shuttle carriers, and software suites comprising performance monitoring, terminal operating systems, and yard planning modules. These granular insights enable stakeholders to tailor solutions that align precisely with their operational and financial goals.

This comprehensive research report categorizes the Automated Container Terminal market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Offering

- Project Type

- Application

- End User

Unveiling Regional Dynamics That Drive Divergent Automation Strategies and Investment Patterns Across Global Trade Corridors

Regional analysis underscores the differentiated pace and nature of automation adoption across the Americas, Europe, Middle East & Africa, and Asia-Pacific corridors. In the Americas, ports are capitalizing on advanced digital infrastructure and supportive government incentives to pilot ambitious fully automated terminals, leveraging shore-to-ship electrification and modular automation retrofits to enhance cargo throughput. Shifting westward, Europe, the Middle East & Africa region is characterized by stringent environmental regulations and complex stakeholder networks, driving a focus on hybrid automation solutions that balance emissions reduction with scalable performance. Collaborative consortiums among port authorities, equipment vendors, and technology startups foster innovation clusters, particularly in major Baltic, Mediterranean, and Gulf ports.

Meanwhile, the Asia-Pacific corridor remains the world’s most mature automation arena, with marquee facilities in East and Southeast Asia setting global benchmarks for operational efficiency. Here, sprawling mega-terminals deploy sophisticated multi-crane orchestration and integrated AI-based vessel planning, while second-tier ports increasingly adopt semi automated models to remain competitive. Cross-regional investment flows, especially from Asia-Pacific to the Americas and EMEA, highlight the diffusion of best practices and accelerate the global standardization of automation protocols. This interconnected landscape underpins a competitive dynamic where regional regulatory environments, trade patterns, and infrastructure maturity collectively shape strategic priorities.

This comprehensive research report examines key regions that drive the evolution of the Automated Container Terminal market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Diverse Strategic Archetypes of Leading Technology Providers and Service Integrators in Terminal Automation

Key companies within the automated container terminal ecosystem occupy diverse strategic positions defined by their technology portfolios, partnership networks, and service capabilities. Leading equipment manufacturers are advancing automated stacking crane designs with increased lifting speeds, enhanced safety interlocks, and digital twin integration for real-time monitoring. Robotics specialists are developing next-generation autonomous guided vehicles featuring adaptive navigation, collaborative robotics interfaces, and energy-efficient propulsion systems. Meanwhile, sensor system innovators are integrating multi-modal detection suites-merging load, proximity, and vision sensor data-to deliver granular situational awareness, bolstered by embedded edge computing for low-latency analytics.

On the software front, vendors of terminal operating systems are driving toward fully unified platforms that consolidate yard planning, vessel stowage, and performance monitoring into single dashboards. Emerging pure-play software disruptors are applying cloud-native architectures, microservices, and open APIs to facilitate rapid customization and third-party integration. Service providers are differentiating themselves by offering comprehensive end-to-end support bundles that span consulting, implementation, and managed maintenance contracts. Strategic alliances among component suppliers, integrators, and port authorities are increasingly commonplace, reflecting a shift from transactional relationships toward collaborative, co-innovation models that accelerate development cycles and de-risk project delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Container Terminal market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- akquinet GmbH

- APM Terminals B.V

- Camco Technologies NV

- Cavotec Group AB

- CMA CGM Group

- CyberLogitec Co., Ltd.

- DP World Limited

- Emerson Electric Co.

- Evergreen Marine Corp.

- Hiab Corporation

- IDENTEC GROUP AG

- INFORM Institut für Operations Research und Management GmbH

- Infyz Solutions Pvt. Ltd.

- Kaleris

- Konecranes Plc

- Künz GmbH

- Liebherr-International Deutschland GmbH

- Mitsubishi Electric Corporation

- MITSUI E&S Co., Ltd.

- ORBCOMM Inc.

- SANY HEAVY INDUSTRY CO., Ltd.

- Siemens AG

- t42 Tracking Solutions

- Tideworks by Carrix, Inc.

- Toshiba Mitsubishi-Electric Industrial Systems Corporation

- Total Soft Bank Ltd.

- Toyota Industries Corporation

- ZPMC Shanghai Zhenhua Heavy Industries Co. Ltd.

Laying Out Tactical Phased Execution Plans and Strategic Alliances to Drive Sustainable Automation Success in Container Terminals

To capitalize on automation trends and mitigate emerging risks, industry leaders should prioritize a phased approach to implementation that balances performance aspirations with financial pragmatism. Initially, securing executive alignment and establishing a cross-functional steering committee ensures that automation initiatives align with broader corporate objectives and risk management frameworks. Simultaneously, leaders should engage in proof-of-concept pilots at smaller terminal segments to validate technology compatibility with existing operations and identify integration challenges within a controlled environment.

As momentum builds, operators are advised to adopt modular upgrade paths, commencing with digital enablement layers such as sensor system deployments and performance monitoring software, before progressing to mechanical automation assets. This incremental model spreads capital outlays, enables knowledge transfer among in-house teams, and bolsters change management efforts by yielding early operational wins. Moreover, forging strategic partnerships with technology vendors and academia can fast-track innovation, particularly in applying AI-driven maintenance scheduling and cybersecurity hardening. Finally, embedding continuous improvement loops-leveraging digital twin simulations, real-time analytics, and stakeholder feedback-drives agility, ensuring that automated container terminals evolve in step with shifting trade patterns and regulatory landscapes.

Detailing the Comprehensive Mixed Methods Approach Integrating Primary Insights and Quantitative Benchmarks for Robust Findings

Our research methodology synthesized primary and secondary data sources to ensure analytical rigor and actionable insights. Primary inputs comprised in-depth interviews and structured surveys with terminal operators, shipping line executives, equipment manufacturers, and system integrators, providing firsthand perspectives on deployment challenges, technology performance, and strategic priorities. Concurrently, secondary research encompassed industry publications, regulatory filings, corporate white papers, and trade association reports, offering contextual clarity on market dynamics and policy implications.

Quantitative analysis included careful examination of project case studies spanning multiple regions, enabling benchmarking of throughput enhancements, energy consumption metrics, and system availability rates. Qualitative assessments focused on stakeholder sentiment, organizational readiness, and ecosystem collaboration models. Data triangulation methods were employed to reconcile discrepancies between sources and validate key findings. Finally, iterative peer reviews by subject matter experts and cross-functional workshops ensured that the final deliverables reflect both operational realities and strategic foresight, equipping decision-makers with the insights needed to navigate the complex terrain of port automation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Container Terminal market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Container Terminal Market, by Type

- Automated Container Terminal Market, by Offering

- Automated Container Terminal Market, by Project Type

- Automated Container Terminal Market, by Application

- Automated Container Terminal Market, by End User

- Automated Container Terminal Market, by Region

- Automated Container Terminal Market, by Group

- Automated Container Terminal Market, by Country

- United States Automated Container Terminal Market

- China Automated Container Terminal Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Discoveries to Chart a Strategic Path Forward for Automated Container Terminal Adoption and Innovation

Automated container terminals represent a critical frontier in the quest for supply chain resilience and operational excellence. The convergence of AI-driven control systems, modular automation assets, and advanced sensor networks is redefining how ports manage capacity, cost, and risk. While technology and policy headwinds-such as tariff pressures and evolving environmental mandates-pose challenges, they also act as catalysts for innovation, fostering the development of domestic supply chains and collaborative ecosystem models.

Moving forward, the successful deployment of container terminal automation will depend on strategic alignment across leadership, finance, and operations teams, as well as on the cultivation of partnerships that bridge technology silos. By adopting phased implementation strategies, leveraging regional best practices, and embedding continuous improvement cycles, industry participants can unlock significant productivity gains and secure competitive positioning in a rapidly transforming global trade landscape. The findings articulated in this executive summary provide a roadmap for organizations to harness the transformative potential of automation and chart a course toward sustainable growth.

Connect Directly with Ketan Rohom to Access In-Depth Analysis and Acquire the Definitive Automated Container Terminal Market Research Report

To secure comprehensive insights that drive strategic investment and operational efficiency in automated container terminals, contact Ketan Rohom, Associate Director of Sales and Marketing. Ketan brings deep expertise in maritime automation and can guide you through the benefits and applications illuminated by our study. Engage with him to access detailed analyses, customizable data sets, and executive-level briefings tailored to your organizational needs. Elevate your decision-making process by leveraging this authoritative report, and position your team at the forefront of container terminal innovation.

- How big is the Automated Container Terminal Market?

- What is the Automated Container Terminal Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?