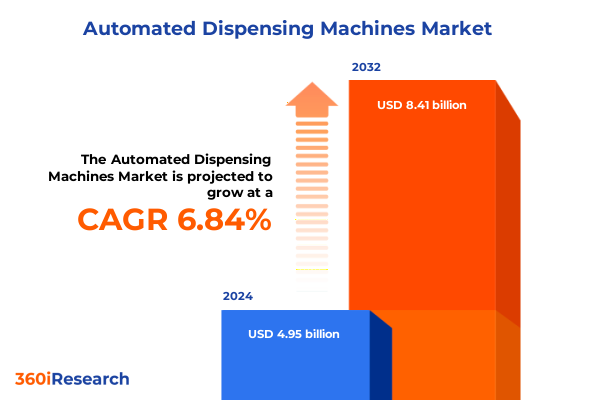

The Automated Dispensing Machines Market size was estimated at USD 5.23 billion in 2025 and expected to reach USD 5.53 billion in 2026, at a CAGR of 7.01% to reach USD 8.41 billion by 2032.

Navigating the Evolution of Medication Distribution Through Automated Dispensing Technologies in Modern Healthcare Facilities and Operational Challenges

Automated dispensing machines have emerged as pivotal components in modern healthcare delivery, addressing the pressing need for precision and efficiency in medication handling. As healthcare systems strive for higher safety standards and cost containment, these solutions enable institutions to automate repetitive tasks, reduce manual errors, and optimize inventory management. This transformation extends beyond mere technology adoption; it reshapes workflows by empowering clinical and pharmacy teams to focus on patient-centered care rather than administrative burdens.

Consequently, organizations that integrate automated dispensing equipment experience shortened medication turnaround times and heightened compliance with safety regulations. Regulatory bodies increasingly recognize the role of automation in advancing patient safety, prompting healthcare leaders to evaluate existing medication distribution processes under a new lens. Moreover, the convergence of IoT connectivity and real-time analytics within these machines cultivates a data-rich environment, facilitating proactive maintenance and continuous improvement.

In addition, the ongoing shift towards value-based care models amplifies the strategic importance of optimized dispensing operations. As a result, both acute care facilities and community-based providers are reassessing traditional medication management frameworks. Through the lens of digital transformation, automated dispensing machines represent not just capital investments but catalysts for operational advancement, setting the stage for deeper exploration of transformative trends and emerging challenges ahead.

Unveiling the Critical Technological and Regulatory Shifts Shaping the Future Landscape of Automated Dispensing Solutions Across Healthcare Networks

Healthcare environments are witnessing a profound transformation driven by advances in automation, artificial intelligence, and regulatory reforms. Over the last two years, the integration of machine learning algorithms into automated dispensing solutions has enhanced predictive restocking, enabling systems to anticipate medication demand and minimize stockouts. This integration streamlines procurement cycles while ensuring high-priority medications remain readily available.

Simultaneously, regulatory agencies have introduced more stringent guidelines around medication safety and traceability, catalyzing the adoption of barcoding and RFID capabilities within dispensing units. These enhancements not only reinforce compliance but also create a transparent audit trail for each medication transaction, fostering accountability and adherence to best practices.

Moreover, the shift toward patient-centric care models drives demand for decentralized dispensing in outpatient and home care settings. Ambulatory clinics and at-home infusion centers increasingly deploy compact automated units, extending the benefits of precision and safety beyond hospital walls. Consequently, manufacturers are innovating modular, cloud-enabled platforms that seamlessly integrate with electronic health records and telehealth infrastructures, underscoring the convergence of dispensing automation and digital health ecosystems.

As a result, providers can leverage integrated analytics to gain actionable insights into medication utilization trends, operational bottlenecks, and staff productivity. This confluence of technology and policy reshapes the competitive landscape, compelling stakeholders to reassess their strategies in anticipation of evolving clinical and regulatory demands.

Assessing the Comprehensive Economic and Supply Chain Repercussions of Recent United States Tariff Adjustments on Dispensing Equipment Providers

The 2025 United States tariff adjustments have introduced significant complexities for automated dispensing machine manufacturers and end users alike. With heightened duties imposed on certain imported components, companies face increased production costs, compelling them to reevaluate supply chain strategies. Consequently, many providers are exploring nearshoring alternatives and strengthening relationships with domestic suppliers to mitigate cost pressures and maintain product availability.

Beyond direct cost implications, elongated customs clearance times exacerbate delivery delays, affecting rollout schedules for new installations and upgrades. Healthcare operators now contend with unpredictable lead times, prompting contingency planning that includes stockpiling critical hardware modules and software licenses. Furthermore, the uncertainty surrounding future tariff revisions has amplified currency fluctuation risks, driving procurement teams to hedge against financial volatility through diversified vendor portfolios.

In addition, the tariff environment has stimulated innovation in component design, as manufacturers seek to reduce reliance on high-tariff materials. This shift encourages the development of locally sourced alternatives and fosters collaboration with regional technology partners. While these adaptations incur upfront research and development expenses, they ultimately bolster supply chain resilience and support long-term sustainability.

Overall, the cumulative impact of these trade policies underscores the importance of agile planning and proactive risk management. Industry participants that navigate tariff-driven headwinds through strategic sourcing and flexible manufacturing will secure a competitive advantage, ensuring uninterrupted delivery of automated dispensing capabilities across diverse healthcare settings.

Decoding Market Dynamics Through Multifaceted Segmentation Insights Spanning Applications Products Components Channels Capacities and End User Ecosystems

A nuanced understanding of market composition emerges when analyzing application contexts, product typologies, functional components, distribution channels, end user profiles, and capacity specifications. Through the lens of application, inpatient environments anchor automated dispensing systems within hospital pharmacy operations, enhancing medication tracking and reducing administration errors, while outpatient settings extend these benefits to ambulatory clinics and increasingly to home care services that demand portability and user-friendly interfaces.

Regarding product differentiation, bench top units serve compact pharmacy locations requiring space-efficient solutions, whereas floor standing models deliver higher capacity and integrated workflow support suited for larger facilities. Component segmentation further reveals a trifurcation into hardware, services, and software domains, where hardware reliability, installation and maintenance services, and advanced training and support infrastructures collectively determine system performance and user adoption rates.

Channel dynamics influence market reach, with direct sales enabling tailored engagements and customized solutions, while distributor networks deliver broader geographic coverage and local support presence. End user segmentation delineates between clinics and others-which encompass independent and chain clinics as well as research institutes-hospital pharmacies, and retail pharmacies, each with distinct procurement cycles and regulatory compliance requirements. Capacity considerations further stratify solutions by canister volumes, ranging from one to two canisters in minimal setups to specialized configurations exceeding six canisters, including seven to ten and eleven or more canister options designed for high-volume medication dispensing.

Integrating these segmentation insights offers stakeholders a comprehensive framework to align product development, service delivery, and go-to-market strategies with evolving healthcare demands and operational constraints.

This comprehensive research report categorizes the Automated Dispensing Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Capacity

- Application

- End User

- Sales Channel

Exploring Distinct Growth Patterns and Strategic Drivers Across the Americas Europe Middle East Africa and Asia Pacific Regional Markets

Regional dynamics paint a diverse tableau of growth trajectories and strategic imperatives across the Americas, Europe, Middle East & Africa, and Asia-Pacific domains. In the Americas, stringent safety regulations and value-based reimbursement frameworks drive hospital systems to invest heavily in automation. Advanced analytics deployments, coupled with robust installation and maintenance networks, underpin greater acceptance of high-capacity floor standing units in metropolitan healthcare hubs.

Conversely, the Europe, Middle East & Africa region presents a mosaic of regulatory landscapes and infrastructure maturities. While Western European nations advance standardized interoperability mandates and government-funded technology grants, Middle Eastern markets emphasize public-private partnerships to modernize hospital pharmacies. In Africa, selective private hospital investments and donor-supported health initiatives create emerging opportunities for scalable bench top solutions equipped with offline synchronization capabilities.

Meanwhile, the Asia-Pacific region exhibits rapid uptake of intelligent dispensing platforms, fueled by national digital health agendas and expanding home care initiatives. Governments in several markets incentivize domestic manufacturing through subsidies and streamlined approval processes, encouraging global suppliers to establish local production footprints. The proliferation of direct sales channels and distributor alliances further facilitates tailored service offerings in both tier-one cities and underserved rural areas.

Together, these regional insights highlight the importance of adaptive business models that respect local regulatory nuances, leverage strategic partnerships, and align solution portfolios with distinct healthcare infrastructure requirements.

This comprehensive research report examines key regions that drive the evolution of the Automated Dispensing Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Automated Dispensing Equipment Innovators and Their Strategic Initiatives Elevating Operational Excellence and Market Competitiveness

Leading industry participants have adopted divergent strategies to fortify their market positions through targeted innovation and strategic collaborations. Several pioneering companies have expanded hardware portfolios with modular architectures, enabling seamless scalability from single-canister bench top models to multi-canister floor standing configurations. By integrating IoT-enabled diagnostic tools, these providers reduce system downtime through proactive component replacement and predictive maintenance alerts.

In parallel, top-tier service oriented firms invest substantially in professional training and technical support infrastructures, cultivating a network of certified technicians capable of rapid deployment across multifaceted healthcare settings. Supplementing these efforts, software-centric vendors forge alliances with electronic health record platforms to deliver unified medication management experiences, driving operational efficiencies and enhancing end-to-end visibility.

Additionally, a growing number of innovators pursue strategic acquisitions to augment their technology stacks and broaden geographic reach. These corporate maneuvers enable companies to access specialized capabilities in AI-driven analytics, cloud integration, and user-centric interface design. Partnerships with regional distributors further bolster market access, while co-development agreements with academic research institutes inspire next-generation feature sets tailored to emerging clinical protocols.

Such competitive maneuvers underscore the sector’s emphasis on holistic solution portfolios that address both technological performance and service excellence. As a result, organizations that blend hardware innovation, comprehensive service delivery, and ecosystem partnerships secure leadership in a rapidly evolving marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Dispensing Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accu-Chart Plus Healthcare System Inc.

- AlixaRx, LLC

- ALPHR Technology

- AmerisourceBergen Corporation

- ARxIUM

- Baxter International Inc.

- Becton Dickinson and Company

- Capsa Healthcare

- Cerner Corporation by Oracle Corporation

- Emporos Systems Corporation

- Holmarc Opto-Mechatronics Ltd.

- Innovation Associates, Inc

- McKesson Corporation

- Meditec Pty Ltd.

- NewIcon Oy

- Nordson Corporation

- Omnicell Inc.

- Parata Systems LLC

- Pharmaself24

- ScriptPro LLC

- Swisslog Holding AG

- TOSHO Inc.

- TOUCHPOINT MEDICAL, INC.

- Willach Pharmacy Solutions

- Yuyama Co., Ltd.

Implementing Proactive Strategies to Harness Automation Advancements Optimize Compliance and Drive Sustainable Growth within Dispensing Ecosystems

Healthcare leaders should consider proactive investments in advanced analytics capabilities to harness the full potential of automated dispensing systems. By deploying machine learning models that predict medication demand patterns, organizations can streamline inventory management and minimize waste. This approach also enables dynamic adjustment of restocking thresholds based on clinical usage trends, improving fiscal stewardship while sustaining patient safety objectives.

Moreover, manufacturers and providers must pursue strategic supplier diversification to mitigate ongoing tariff-related headwinds. Cultivating relationships with regional component vendors and nearshore partners ensures supply continuity and reduces exposure to customs delays. Concurrently, collaborative R&D programs with local technology ecosystems can accelerate the development of tariff-compliant hardware alternatives while distributing innovation risks.

In addition, industry participants should enhance their service portfolios by integrating value-added offerings such as virtual training modules and remote maintenance support. Such initiatives not only foster user proficiency but also unlock recurring revenue streams and reinforce customer loyalty. Equally important, aligning solution interfaces with electronic health record and telehealth platforms promotes cohesive digital workflows, thereby elevating overall operational performance.

Ultimately, organizations that combine strategic sourcing agility, data-driven decision making, and customer-centric service models will be poised to navigate market complexities effectively. These actions collectively deliver tangible value, sustaining competitive advantage and driving long-term success within the automated dispensing ecosystem.

Detailing Rigorous Research Frameworks Data Collection and Analytical Methodologies Underpinning the Automated Dispensing Equipment Market Insights

This analysis employs a robust research framework designed to ensure comprehensive and reliable insights. Primary research involved in-depth interviews with healthcare executives, pharmacy directors, and technology vendors to capture firsthand perspectives on operational challenges and adoption drivers. These qualitative engagements were complemented by direct consultations with regulatory experts to interpret the implications of new safety and tariff regulations.

Secondary data collection encompassed a wide range of publicly available resources, including peer-reviewed journals, industry publications, and corporate filings. Regulatory filings and technical white papers provided critical context for understanding integration requirements, certification processes, and compliance benchmarks. In addition, cross-referencing information from multiple reputable sources enabled triangulation of key findings and reinforced data validity.

Analytical methodologies combined both top-down and bottom-up approaches to synthesize trends across segmentation dimensions, regional markets, and competitive landscapes. Process mapping techniques elucidated the end-to-end medication distribution workflows, while scenario analysis assessed the impact of tariff fluctuations on procurement and supply chain resilience. Throughout the research, independent validation steps, including stakeholder reviews and expert panel discussions, ensured that conclusions reflect current market realities.

By adhering to these rigorous procedures, the study delivers an evidence-based narrative that equips decision-makers with actionable insights and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Dispensing Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Dispensing Machines Market, by Product Type

- Automated Dispensing Machines Market, by Component

- Automated Dispensing Machines Market, by Capacity

- Automated Dispensing Machines Market, by Application

- Automated Dispensing Machines Market, by End User

- Automated Dispensing Machines Market, by Sales Channel

- Automated Dispensing Machines Market, by Region

- Automated Dispensing Machines Market, by Group

- Automated Dispensing Machines Market, by Country

- United States Automated Dispensing Machines Market

- China Automated Dispensing Machines Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding with Strategic Perspectives on Future Innovation Pathways and Collaborative Opportunities to Advance Automated Medication Distribution

As the healthcare sector continues its digital transformation, automated dispensing machines have become indispensable tools for enhancing medication safety, operational efficiency, and regulatory compliance. The convergence of AI-driven analytics, IoT connectivity, and user-centric designs is reshaping medication management practices in acute care, outpatient, and home care environments alike. Going forward, the integration of these systems with broader digital health platforms will unlock new opportunities for patient engagement and clinical decision support.

Collaborative innovation will play a critical role in addressing emerging challenges, from supply chain disruptions driven by trade policies to the evolving regulatory landscape that demands traceability and data transparency. By fostering partnerships between technology vendors, healthcare providers, and regulatory agencies, stakeholders can co-create solutions that balance safety, cost-effectiveness, and ease of use.

Ultimately, the sustainable evolution of automated dispensing ecosystems hinges on the ability to adapt to dynamic market forces while maintaining unwavering focus on patient outcomes. Organizations that embrace continuous improvement, leverage actionable intelligence, and prioritize stakeholder collaboration will lead the charge toward a more efficient, resilient, and patient-centric medication distribution future.

Engage Directly with Our Associate Director to Unlock In Depth Analysis and Secure Comprehensive Market Intelligence on Automated Dispensing Equipment

Engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to deepen your understanding of automated dispensing machine dynamics essential for informed decision making. He brings extensive expertise in tailoring insights to align with organizational priorities across clinical, operational, and strategic functions.

Connect today to explore bespoke research solutions that illuminate technological trajectories, regulatory influences, and supply chain considerations. Ketan’s guidance ensures you secure the comprehensive market intelligence necessary to optimize procurement strategies, enhance service delivery, and strengthen competitive positioning through data-driven clarity and actionable perspectives.

- How big is the Automated Dispensing Machines Market?

- What is the Automated Dispensing Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?