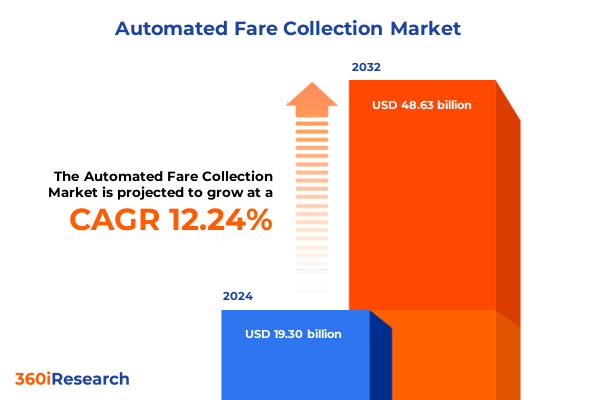

The Automated Fare Collection Market size was estimated at USD 21.60 billion in 2025 and expected to reach USD 24.19 billion in 2026, at a CAGR of 12.28% to reach USD 48.63 billion by 2032.

Exploring the Evolution of Automated Fare Collection Systems to Navigate the Intersection of Urban Mobility Challenges and Technological Innovations

Automated fare collection represents the converging point of transit operations and digital payment ecosystems, redefining how passengers interact with urban mobility networks. At its core, this transformative technology integrates hardware such as smart card readers, validators, and ticket vending machines with software platforms that support both card based and account based ticketing. As public transport agencies and tolling authorities grapple with increasing passenger volumes and the imperative to enhance operational efficiency, automated fare collection has emerged as a pivotal solution to streamline boarding processes, reduce fare evasion, and unlock valuable ridership data.

Over recent years, industry momentum has coalesced around digital transformation initiatives and smart city agendas, prompting transit agencies to explore cloud enabled solutions and mobile based payment options. This executive summary provides a structured overview of the key themes shaping the future of automated fare collection, highlights the strategic influence of United States tariff changes in 2025, and delivers segmentation and regional perspectives designed to support decision makers. By articulating market dynamics, leading vendor insights, and actionable recommendations, this summary aims to equip both technology providers and transit authorities with the knowledge to navigate an increasingly competitive and innovation driven environment.

Uncovering Transformative Dynamics Reshaping the Automated Fare Collection Landscape Amidst Digital Disruption and Transportation Modernization Trends

The automated fare collection landscape is experiencing a fundamental shift driven by the convergence of open payment frameworks and next generation validation technologies. Traditional card based systems are rapidly giving way to open loop strategies that enable riders to tap contactless bank cards or mobile wallets without the need for closed proprietary media. Simultaneously, account based ticketing architectures are enabling more personalized fare structures and dynamic pricing models, as transit operators leverage real time data streams to adjust services and improve revenue management.

In parallel, the adoption of cloud native deployments has accelerated pilot programs and full scale rollouts, allowing agencies to sidestep the capital intensity of on premises infrastructure. Cloud environments facilitate seamless software updates, advanced analytics and enhanced resilience while reducing the total cost of ownership. Furthermore, integration of biometric authentication and Internet of Things enabled validators is fostering frictionless boarding experiences, setting the stage for deeper interoperability across multimodal transport networks.

Assessing the Cumulative Consequences of 2025 United States Tariffs on Automated Fare Collection Supply Chains and Technology Adoption Strategies

With the implementation of new United States tariffs in 2025, hardware vendors in the automated fare collection domain have confronted elevated import duties on key components. Smart card readers, ticket vending machines, and electronic validators sourced from overseas manufacturing hubs have become significantly costlier, prompting many suppliers to reevaluate global supply chain strategies. This tariff environment has led to a renewed focus on domestic production capabilities and component localization to mitigate exposure to trade policy volatility.

As a consequence, service providers and transit agencies are seeking alternative procurement models and considering long term maintenance contracts that include cost escalation clauses tied to tariff movements. In the interim, many projects faced delays as budgets were adjusted to accommodate higher initial capital expenditures. However, the tariff pressures have also spurred innovation in software centric offerings, with vendors expanding their portfolio of consulting, system integration, and cloud based subscription services where duties are less impactful, thereby preserving project viability and fostering deeper, value added partnerships.

Revealing Core Market Segmentation Insights Across Components Deployment Payment Technologies End Users Applications and Transport Modes for AFC

Analyzing component level dynamics reveals that hardware demand remains foundational for system rollouts, particularly for smart card readers, validators, and enhanced ticket vending machines. Yet the proportionate growth of software led solutions such as account based back end platforms is reshaping project budgets, as agencies prioritize real time reporting modules alongside traditional analytical reporting capabilities. This shift fuels a growing emphasis on consulting and systems integration services, where expert teams guide deployment, customization and post launch optimization.

Deployment modalities are likewise evolving, with cloud centric architectures gaining traction over on premises installations. The scalability of hosted environments accommodates peak ridership fluctuations and facilitates accelerated software upgrades. In conjunction with this trend, diverse payment technologies are being woven into the digital wallet ecosystem. Barcode implementations now involve both 1D and 2D formats, and contactless solutions hinge on NFC and RFID protocols, while magnetic stripe systems persist as a transitional bridge. Meanwhile, mobile centric variants leverage standardized QR code interactions as well as dedicated applications to enhance rider engagement and reduce dependency on physical media.

Diverse end user contexts further underscore the comprehensive nature of the market. Parking infrastructures, whether on street or off street, demand agile ticketing options to maximize throughput and minimize downtime. Public transport authorities, spanning both bus operators and metro systems, require integrated clearing and settlement workflows, including financial settlement and inter operator clearing, to streamline interoperable travel across jurisdictional boundaries. Tolling agencies responsible for bridges and highways depend on robust real time reporting to manage traffic flows and ensure seamless revenue capture. Overlaying these functions, transport modes from light rail and metro networks to bus, car, and taxi services, extending also to cargo ships and ferry fleets, all rely on uniform ticketing and back end settlement processes to deliver consistent user experiences and operational transparency.

This comprehensive research report categorizes the Automated Fare Collection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Payment Technology

- End User

- Application

- Transport Mode

Comparative Regional Examination of Automated Fare Collection Adoption Trends Across the Americas Europe Middle East Africa and Asia Pacific Territories

In the Americas, modernization initiatives are being driven by major metropolitan transit authorities looking to integrate open payment and account based ticketing into legacy infrastructures. United States projects emphasize interoperability with national bank card networks, while Latin American systems often blend mobile centric QR implementations with cloud based clearing and settlement hubs, reflecting regional mobile wallet proliferation.

Across Europe, Middle East and Africa, regulatory frameworks such as the EU’s interoperability directives and emerging digital identity protocols in the Middle East are accelerating the rollout of unified NFC and RFID solutions. Africa’s urban centers are cautiously piloting account based fare media to reduce cash handling, with system integrators delivering turnkey consulting services tailored to diverse city scales.

Asia Pacific illustrates the fastest technology adoption curve globally. China’s domestic suppliers dominate hardware and software ecosystems, while India’s transit authorities pursue large scale contactless smart card programs coupled with real time reporting for passenger insights. Southeast Asian operators are leapfrogging straight to mobile app based ticketing enhanced by QR code interactions, driven by widespread smartphone penetration and existing digital finance frameworks.

This comprehensive research report examines key regions that drive the evolution of the Automated Fare Collection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements of Leading Automated Fare Collection Providers Driving Innovation Partnerships and Competitive Differentiation in the Market

Leading providers are differentiating through strategic partnerships and platform expansions. Cubic Transportation Systems continues to evolve its account based architecture, forging alliances with cloud infrastructure firms to deliver resilient multimodal solutions. Thales Group integrates global consultancy services with advanced software suites, positioning itself as an end to end technology partner for transit authorities.

Scheidt & Bachmann and INIT drive hardware innovation in validator and ticket vending machine design, while concurrently investing in integrated software modules for real time and analytical reporting. Vendors like Vix Technology and Masabi are spearheading mobile centric and open payment frameworks, emphasizing application based ticketing and QR code engagement. Additionally, companies such as Conduent and Genfare leverage extensive operational data to refine consulting services, ensuring system deployments align with long term ridership growth strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Fare Collection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Conduent Incorporated

- Conduent Incorporated

- Cubic Transportation Systems, Inc.

- GMV Innovating Solutions S.L.

- Hitachi, Ltd.

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- Indra Sistemas S.A.

- Indra Sistemas S.A.

- INIT Innovations in Transportation GmbH

- International Business Machines Corporation

- LECIP Holdings Corporation

- Masabi Ltd.

- Masabi Ltd.

- NEC Corporation

- Nippon Signal Co., Ltd.

- Omron Corporation

- Samsung SDS Co., Ltd.

- Scheidt & Bachmann GmbH

- Siemens AG

- Thales S.A.

- Vix Technology Pty Ltd

- Vix Technology Pty Ltd

Crafting Actionable Strategic Recommendations to Empower Industry Leaders to Capitalize on Emerging Technologies Regulatory Shifts and Market Opportunities

Industry leaders seeking to capitalize on emergent market opportunities should prioritize software centric revenue streams by expanding account based ticketing and real time analytics offerings. Embracing cloud first deployment models will not only mitigate near term hardware tariff exposures but also facilitate agile enhancements and cross agency integrations. Moreover, forging partnerships with domestic manufacturing entities can reduce supply chain risk and generate local value creation.

Concurrent investment in mobile payment technology enriches the rider experience and broadens fare media options. Organizations are advised to pilot open loop contactless schemes that support bank issued cards and digital wallets, thereby minimizing physical card issuance costs. Engaging with regulatory bodies to shape interoperability standards will further accelerate network expansions and promote seamless multimodal travel. Finally, leveraging data insights from analytical reporting can inform strategic fare policies and targeted marketing initiatives to drive sustained ridership growth and revenue optimization.

Detailing Rigorous Research Methodology Integrating Primary Qualitative Interviews Secondary Data Triangulation and In Depth Market Analysis Techniques

This analysis is underpinned by a mixed methods approach combining primary qualitative interviews with transit agency executives, technology vendors, and systems integrators. Over the course of multiple in depth discussions, key operational challenges and technology priorities were identified, forming the basis for thematic insights. Secondary research encompassed an extensive review of publicly available technical standards, regulatory filings, and vendor white papers to ensure a comprehensive understanding of existing system architectures and emerging solutions.

Data triangulation techniques were applied to corroborate qualitative findings with documented project deployments and procurement announcements. Segmentation analysis was conducted to map component, deployment, payment technology, end user, application, and transport mode dimensions against regional adoption patterns. Throughout the research process quality assurance protocols were implemented to validate source credibility and maintain analytical rigor, ensuring the final insights reliably inform strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Fare Collection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Fare Collection Market, by Component

- Automated Fare Collection Market, by Deployment

- Automated Fare Collection Market, by Payment Technology

- Automated Fare Collection Market, by End User

- Automated Fare Collection Market, by Application

- Automated Fare Collection Market, by Transport Mode

- Automated Fare Collection Market, by Region

- Automated Fare Collection Market, by Group

- Automated Fare Collection Market, by Country

- United States Automated Fare Collection Market

- China Automated Fare Collection Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Drawing Conclusive Reflections on the Current Automated Fare Collection Environment and Illuminating Strategic Imperatives for Stakeholders’ Future Success

The current automated fare collection environment is characterized by rapid technological evolution and shifting policy landscapes. As transit authorities adopt account based and mobile centric systems they are poised to deliver more personalized and efficient passenger experiences. However, external factors such as tariff adjustments underscore the importance of resilient supply chain strategies and adaptive roll out plans.

Segmentation analysis highlights that while hardware remains foundational, software and services will increasingly determine competitive positioning. Regional insights reveal that each geography pursues distinct deployment approaches influenced by regulatory environments and digital infrastructure maturity. Maintaining strategic agility and fostering collaboration across stakeholders will be critical to harness the full potential of automated fare collection solutions and secure long term operational sustainability.

Engaging Call To Action Encouraging Direct Collaboration with Ketan Rohom for Tailored Insights and Acquisition of Comprehensive Automated Fare Collection Research

For tailored insights and in depth guidance on automated fare collection system strategies and technology pathways please reach out to Ketan Rohom who brings extensive experience in sales and marketing leadership. By engaging directly you can secure customized advisory on optimizing deployments across account based and card based systems, navigating tariff impacts, and integrating emerging payment technologies. Ketan Rohom stands ready to provide you with full access to the comprehensive market research report, ensuring you gain the actionable intelligence needed to drive growth and competitive advantage in this rapidly evolving sector

- How big is the Automated Fare Collection Market?

- What is the Automated Fare Collection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?