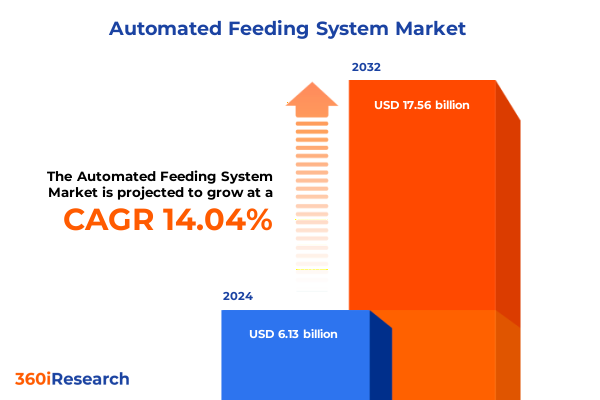

The Automated Feeding System Market size was estimated at USD 6.98 billion in 2025 and expected to reach USD 7.95 billion in 2026, at a CAGR of 14.07% to reach USD 17.56 billion by 2032.

Unveiling the Dynamics of Automated Feeding Systems as a Cornerstone for Efficiency in Modern Animal Husbandry and Livestock Management

Automated feeding systems have rapidly evolved from niche innovations to central pillars of modern livestock and aquaculture operations. As agricultural stakeholders grapple with intensifying pressures around labor shortages, rising feed costs, and sustainability mandates, these technologies deliver precision, consistency, and efficiency at scales previously unattainable. By leveraging mechanized feeders capable of delivering exact feed volumes on programmable schedules, producers can optimize growth rates, reduce waste, and improve animal welfare simultaneously.

In recent years, the industry has witnessed a paradigm shift in how feeding regimens are designed and executed. Early-generation devices relied on rudimentary timers and manual adjustments, whereas contemporary solutions integrate real-time sensor feedback, remote control interfaces, and advanced analytics. This confluence of hardware and software transforms feeding management into a data-driven discipline, enabling corrective actions that align with strict biosecurity protocols and production targets.

Against this backdrop, decision-makers must navigate a complex landscape of technology providers, regulatory frameworks, and operational constraints. The following summary distills critical developments shaping the automated feeding systems market, offering strategic clarity on adoption drivers, competitive dynamics, and emerging best practices. By grounding strategic planning in these insights, leadership teams can unlock productivity gains and future-proof their operations in a sector defined by rapid technological progress and exacting performance demands.

Navigating the Wave of Technological Disruption and Sustainability Demands Transforming Automated Feeding Solutions Across the Agricultural Value Chain

A wave of technological disruptions is redefining the contours of feeding automation, propelled by advances in connectivity, artificial intelligence, and sensor miniaturization. The proliferation of Internet of Things (IoT) networks in barn environments enables granular monitoring of feeder performance, feed consumption patterns, and animal behavior. This real-time telemetry empowers predictive maintenance that prevents costly downtime and facilitates dynamic adjustments to feeding regimens based on environmental factors such as temperature, humidity, and barn occupancy.

Simultaneously, sustainability considerations are exerting transformative pressure on feed delivery mechanisms. As global stakeholders demand transparency around resource utilization and carbon footprints, automated systems are being retrofitted with modular components optimized for low energy consumption and minimal feed spillage. The integration of renewable energy sources, such as solar panels powering feeder actuators, is transitioning from experimental pilot projects to commercially viable solutions, underscoring the sector’s commitment to environmental stewardship.

Moreover, the convergence of robotics and machine vision is unlocking new frontiers for high-density livestock operations. Automated mobile feeders capable of navigating barn aisles autonomously are reducing manual labor and streamlining feed deployment across diverse animal groups. These robotic platforms leverage machine learning algorithms to identify individual animals and tailor feeding volumes, further enhancing productivity while maintaining rigorous standards of animal welfare. As these innovations mature, the industry is poised for a shift from static feeding stations to fully integrated, autonomous feeding ecosystems.

Assessing the Ramifications of 2025 United States Tariff Measures on Imported Components and the Adaptive Response of Automated Feeding System Manufacturers

The imposition of new United States tariff measures in early 2025 has reverberated through import-dependent segments of the automated feeding systems supply chain. Components such as precision sensors, actuator motors, and control modules-often sourced from East Asian and European manufacturers-now incur elevated duties that translate into higher equipment costs for end users. In response, leading system integrators have accelerated efforts to diversify their sourcing strategies by partnering with domestic suppliers and investing in localized production capabilities.

This strategic pivot toward nearshoring has yielded two critical outcomes. First, it mitigates exposure to cross-border trade volatility and reduces lead times for essential parts. Second, it fosters deeper collaboration between feeder manufacturers and U.S.-based electronics fabricators, expediting the adaptation of control technologies to meet evolving regulatory standards. While initial capital expenditures for onshore tooling have been substantial, stakeholders report that long-term cost efficiencies and supply chain resilience offset the short-term financial burdens.

Furthermore, the tariff-driven cost environment has catalyzed a wave of engineering innovations aimed at reducing dependency on high-tariff components. For example, some manufacturers have redesigned feeder controllers using modular architectures that can swap in alternative sensor types with lower import duties. Others have pursued strategic alliances with tariff-exempt material suppliers to reclassify certain assemblies under more favorable Harmonized Tariff Schedule categories. Collectively, these adaptive strategies underscore the industry’s agility in navigating policy-induced market disruptions.

Deciphering Market Trajectories through Comprehensive Analysis of Animal Type, Feeder Design, Automation Level, Control Technology, and Distribution Channel Segmentation

Detailed segmentation analysis reveals distinct adoption patterns and technology preferences across the automated feeding ecosystem. Animal type segmentation indicates that aquaculture operations-encompassing both fish and shrimp-have surged toward systems that precisely meter feed to minimize water contamination, while cattle producers managing beef and dairy herds increasingly rely on robust belt feeders to handle high feed volumes with minimal maintenance. Companion animal markets, specifically cats and dogs, demonstrate selective uptake of bowl and magnetic feeders tailored for pet care automation, and poultry farms focused on broilers and layers deploy vibratory and screw feeders designed for uniform distribution and connectivity to environmental controls. In parallel, swine operations segmenting growers, sows, and weaners are gravitating toward sensor-based control technology enabling customized feeding curves that support distinct growth phases.

Turning to feeder type segmentation, the market’s breadth spans belt, bowl, magnetic, screw, and vibratory solutions, each fulfilling unique operational requirements. Automation level analysis shows a growing share of fully automatic installations where centralized control platforms orchestrate feeding schedules across multiple zones, although semi automatic setups retain traction in smaller-scale operations seeking cost-effective automation. The control technology dimension distinguishes remote controlled systems that afford manual override options, sensor based feeders employing photoelectric, proximity, and ultrasonic sensors for precise delivery, and timer based units using electronic or mechanical timers valued for simplicity and reliability.

Completing the segmentation landscape, distribution channel insights highlight the coexistence of offline networks-featuring distributors, OEM partnerships, and specialty agri-supply stores-and online pathways through manufacturer websites and third party retailers. This diversified channel mix underscores how end users weigh factors such as technical support, warranty services, and ease of procurement alongside product capabilities when selecting automated feeding solutions.

This comprehensive research report categorizes the Automated Feeding System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Feeder Type

- Automation Level

- Control Technology

- Distribution Channel

Uncovering Regional Variations in Automated Feeding System Adoption Patterns Across the Americas, Europe Middle East Africa, and Asia-Pacific Territories

Regional dynamics in automated feeding system adoption underscore the influence of agricultural practices, regulatory frameworks, and economic conditions across major territories. In the Americas, robust capital expenditure cycles in livestock and aquaculture sectors are driving investments in high-capacity belt feeders and advanced sensor networks, facilitating enhanced feed conversion ratios and operational scalability. Producers in North and South America benefit from supportive government incentives promoting agtech modernization, thereby accelerating the shift toward remote controlled and fully integrated feeding platforms.

In contrast, Europe, Middle East, and Africa exhibit a strong regulatory emphasis on animal welfare standards and environmental compliance, prompting widespread integration of sensor based control technologies. Farms across Western Europe leverage photoelectric and proximity sensors to adhere to stringent guidelines on feed distribution uniformity, while operations in the Middle East and Africa often prioritize timer based fixtures for their resilience to harsh climatic conditions and reliability under intermittent power availability.

Turning to the Asia-Pacific region, rapid growth trajectories in aquaculture and poultry industries are evident, with producers favoring bowl and vibratory feeders that can be easily calibrated for species-specific feeding programs. High population densities and rising protein demand have spurred local manufacturing of semi automatic systems, although a burgeoning appetite for fully automatic, remote monitoring solutions is emerging in advanced markets such as Japan and Australia. Overall, these regional insights underscore how contextual factors shape both the pace of technology adoption and the configuration of automated feeding solutions deployed across global agricultural landscapes.

This comprehensive research report examines key regions that drive the evolution of the Automated Feeding System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Competitive Differentiation in Automated Feeding System Development and Deployment

The competitive landscape in the automated feeding systems arena is characterized by both legacy equipment pioneers and agile newcomers introducing disruptive technologies. Established manufacturers leverage decades of application expertise to deliver turnkey solutions that integrate seamlessly with existing barn management systems. These firms are expanding their portfolios to include sensor based modules and cloud connectivity, thereby reinforcing customer relationships through service contracts and predictive maintenance agreements.

Conversely, technology-driven enterprises are capitalizing on software-centric value propositions, offering platform-agnostic controllers and open APIs that facilitate interoperability with third-party farm management software. These entrants often adopt subscription-based licensing models for analytics dashboards and alerting services, shifting the value equation from hardware sales to continuous-service revenue streams. Partnerships between telecom providers and feeder manufacturers are also proliferating, enabling low-power wide-area network deployments that extend remote control capabilities to remote or under-served agricultural regions.

Strategic collaborations are further shaping product roadmaps, with cross-industry alliances between robotics firms and animal nutrition specialists yielding smart feeding robots capable of individualized rationing based on biometric data. Meanwhile, mergers and acquisitions continue to recalibrate market share, as global players acquire niche innovators to swiftly augment their automation offerings. Collectively, these competitive dynamics underscore the importance of technological differentiation and service excellence for sustained market relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Feeding System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afimilk Ltd.

- Agrologic Ltd.

- Bauer Technics A.S.

- Big Dutchman International GmbH

- Cormall A/S

- DeLaval Inc.

- Fancom B.V.

- GEA Farm Technologies GmbH

- HETWIN Automation Systems GmbH

- Hokofarm Group B.V.

- JFC Manufacturing Ltd.

- Jyden Bur A/S

- Lely Industries N.V.

- Pellon Group Oy

- RiKoTec GmbH

- Rovibec Agrisolutions Inc.

- SKIOLD A/S

- Trioliet B.V.

- VDL Agrotech B.V.

- Wasserbauer GmbH

Charting Strategic Initiatives for Industry Leaders to Leverage Technological Advances and Strengthen Market Position in Automated Feeding Solutions

Industry leaders poised to capitalize on the next wave of feeding automation should prioritize integration of advanced control technologies, including sensor based feedback loops that adapt feeding regimens in real time. Investing in research and development to refine photoelectric, proximity, and ultrasonic sensing accuracy will yield differentiated product offerings that address both environmental and animal welfare imperatives. At the same time, establishing partnerships with local electronics fabricators can mitigate tariff exposure and ensure agile component sourcing.

To strengthen market positioning, executives should deploy modular system architectures that support seamless upgrades from timer based to fully automatic configurations, thereby nurturing long-term customer relationships and recurring revenue opportunities. Emphasizing interoperability through open communication protocols will enable connectivity with emerging precision livestock farming platforms, unlocking data synergies that elevate operational decision-making.

Leaders must also expand their service portfolios by offering predictive maintenance and remote diagnostics as part of subscription-based models. This shift not only diversifies revenue streams but also enhances customer retention through value-added support. Moreover, a targeted go-to-market approach that blends offline partnerships with a robust online presence will cater to diverse procurement preferences, ensuring broad accessibility for both large-scale enterprises and smallholder operations.

Outlining Rigorous Data Collection and Analytical Approaches Underpinning Insights into Automated Feeding System Market Dynamics and Trends

This analysis synthesizes primary insights gathered through extensive interviews with livestock producers, aquaculture operators, technology integrators, and supply chain executives. Expert consultations were conducted to validate operational challenges, technology adoption drivers, and regional policy implications. Concurrently, secondary research encompassed a thorough review of industry publications, patent filings, regulatory documentation, and company financial disclosures to ensure comprehensive coverage of competitive developments and innovation trajectories.

Key data points were triangulated using standardized frameworks such as SWOT and PESTEL analyses to assess the influence of political, economic, social, technological, environmental, and legal factors on market dynamics. Additionally, thematic content analysis was applied to survey responses, enabling quantification of emerging priorities such as sustainability, animal welfare, and supply chain resilience. Rigorous data quality checks were performed at each stage, including peer review of qualitative findings and statistical validation of quantitative metrics, ensuring the robustness and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Feeding System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Feeding System Market, by Animal Type

- Automated Feeding System Market, by Feeder Type

- Automated Feeding System Market, by Automation Level

- Automated Feeding System Market, by Control Technology

- Automated Feeding System Market, by Distribution Channel

- Automated Feeding System Market, by Region

- Automated Feeding System Market, by Group

- Automated Feeding System Market, by Country

- United States Automated Feeding System Market

- China Automated Feeding System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesis of Key Findings Highlighting Technological Evolution, Policy Impacts, Segmentation Nuances, and Strategic Implications in Feeding Automation

The evolving ecosystem of feeding automation reveals a clear trajectory toward fully integrated, data-driven solutions that deliver operational efficiencies, environmental benefits, and enhanced animal welfare. Technological advancements in IoT connectivity, robotics, and sensor miniaturization are unlocking new capabilities for precision feeding, driving a shift away from manual and semi automatic configurations.

Policy dynamics, particularly the 2025 United States tariff measures, have underscored the strategic value of supply chain diversification and domestic component sourcing. Manufacturers have responded with innovative designs and strategic alliances that bolster resilience while maintaining cost competitiveness. Segmentation analysis highlights the nuanced preferences across animal types, feeder designs, automation levels, control technologies, and distribution channels, illuminating pathways for targeted investment.

Regional insights further demonstrate how contextual factors shape technology adoption, with the Americas emphasizing scalability, EMEA driven by regulatory compliance, and Asia-Pacific propelled by rapid demand growth. Competitive intelligence underscores the importance of service-led differentiation and strategic partnerships, suggesting that future success will hinge on a balanced approach to hardware innovation, software integration, and customer-centric service offerings.

Collectively, these findings offer a cohesive roadmap for stakeholders seeking to navigate the complexities of the automated feeding systems landscape, ensuring informed decision-making in a rapidly evolving market.

Engage with Ketan Rohom to Secure Full Access to In-Depth Automated Feeding System Market Intelligence for Strategic Decision Making

We invite decision-makers seeking a competitive edge to connect directly with Ketan Rohom, whose deep expertise in facilitating access to comprehensive market intelligence can guide your organization toward informed investment and product development strategies. Engaging with Ketan Rohom ensures you receive tailored insights and actionable data that align with your specific operational needs and strategic objectives. Reach out today to secure the full report and benefit from personalized consultation on how to leverage the latest automated feeding system trends and innovations. This collaboration will empower your team to navigate complex market dynamics with confidence and accelerate your path to industry leadership.

- How big is the Automated Feeding System Market?

- What is the Automated Feeding System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?