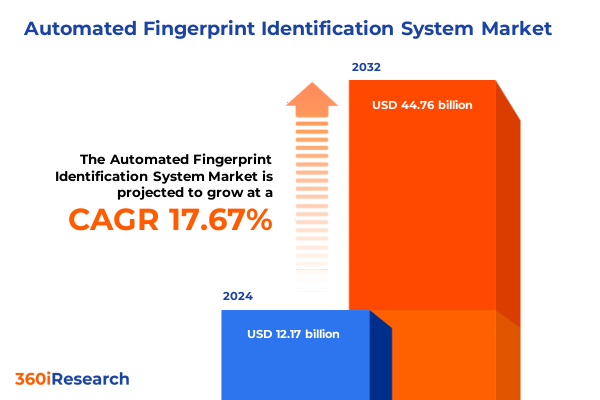

The Automated Fingerprint Identification System Market size was estimated at USD 14.25 billion in 2025 and expected to reach USD 16.69 billion in 2026, at a CAGR of 17.75% to reach USD 44.76 billion by 2032.

Unveiling the Evolution and Strategic Importance of Automated Fingerprint Identification Systems in Contemporary Security and Law Enforcement Environments

Automated fingerprint identification systems have emerged as a cornerstone of modern security and identity management frameworks, enabling rapid and reliable verification processes across both public and private sectors. This executive summary provides a holistic perspective on the technological advancements, regulatory developments, and market dynamics shaping this critical domain. In an era marked by escalating security threats and evolving privacy expectations, organizations are compelled to adopt robust biometric solutions that balance accuracy, speed, and compliance.

Over the past decade, improvements in sensor fidelity, algorithmic matching speed, and data integration capabilities have elevated fingerprint recognition from a specialized law enforcement tool to a versatile platform for wide-ranging applications. Concurrently, heightened regulatory scrutiny and new privacy mandates have introduced additional layers of complexity, requiring stakeholders to navigate a mosaic of domestic and international standards. As we delve into this analysis, the aim is to equip decision-makers with the strategic insights needed to assess system performance, understand key market drivers, and anticipate the factors that will influence procurement and deployment decisions in the years ahead.

Exploring the Pivotal Technological, Regulatory, and Operational Transformations Reshaping the Automated Fingerprint Identification System Industry Landscape

The landscape of automated fingerprint identification systems is undergoing transformative shifts driven by breakthroughs in machine learning, the proliferation of cloud-based architectures, and the integration of mobile biometric solutions. Historically, fingerprint matching relied on local processing of minutiae patterns, but today’s platforms harness deep neural networks to enhance matching accuracy and reduce false positives, even in cases involving smudged or partial impressions. In parallel, the advent of cloud‐native deployments has democratized access to advanced processing power, empowering smaller organizations to leverage capabilities once reserved for national law enforcement agencies.

Regulatory evolution is equally instrumental in reshaping industry dynamics. In recent years, data protection frameworks such as the California Consumer Privacy Act and similar statutes in other jurisdictions have mandated stricter controls around biometric data storage, consent mechanisms, and breach reporting protocols. Consequently, system providers are architecting more granular access controls and encryption protocols to maintain compliance without compromising system performance. Operationally, there is a clear pivot toward remote enrollment and contactless capture modalities, enabling efficient onboarding of diverse populations while reducing physical touchpoints-a shift that has been accelerated by heightened public health concerns.

Together, these technological, regulatory, and operational transformations are converging to redefine expectations around system interoperability, usability, and security. Stakeholders must adapt to this multifaceted environment by cultivating agile development roadmaps, investing in privacy‐by‐design approaches, and forging strategic partnerships that ensure continuous innovation in a rapidly evolving marketplace.

Assessing the Far-Reaching Consequences of the United States’ 2025 Tariff Measures on the Automated Fingerprint Identification System Ecosystem Across Industries

The United States’ tariff initiatives slated for 2025 have introduced new cost considerations and supply chain complexities for providers of automated fingerprint identification hardware and components. Measures targeting imported sensors, semiconductor chips, and related electronic modules have prompted device manufacturers to reassess sourcing strategies, with many seeking to diversify supplier portfolios beyond traditional offshore markets. This shift has also sparked greater interest in domestic and nearshore production facilities capable of meeting rigorous quality and compliance requirements at scale.

As procurement teams grapple with elevated duties on critical components, some system integrators have opted to absorb incremental costs to maintain competitive pricing, while others have renegotiated service agreements to offset financial pressures. In turn, downstream users-from government agencies to private corporations-are evaluating multi-vendor deployments to mitigate single-source dependencies. Moreover, the added lead times and logistical complexities associated with tariff‐affected shipments have underscored the importance of robust inventory management and contingency planning. In response, organizations are forging strategic alliances with logistics partners and exploring just-in-time delivery models to align inventory flows more closely with project timelines.

Collectively, these dynamics reflect the cumulative impact of tariff policies on the automated fingerprint identification ecosystem, reinforcing the need for resilient supply chains and proactive cost mitigation strategies. Looking ahead, stakeholders must continue to monitor trade policy developments while engaging with industry associations and government liaison offices to anticipate future shifts in duty structures and import regulations.

Delving into Core Market Segmentation Insights Revealing Key Drivers and Adoption Patterns Across Technology, Component, End User, and Application Dimensions

A nuanced understanding of market segmentation is essential for discerning demand patterns and tailoring product strategies across the automated fingerprint identification domain. From a technology perspective, two‐dimensional solutions remain prevalent in high-throughput environments, offering fast capture at relatively low cost. However, three‐dimensional imaging is gaining traction in scenarios demanding enhanced resistance to spoofing and presentation attacks, as its ability to capture ridge depth information delivers superior liveness detection.

Component segmentation reveals three critical categories: hardware, services, and software. Within hardware, capacitive sensors continue to anchor mass-market deployments thanks to their balance of affordability and performance, while optical modules-leveraging advanced imaging sensors-are favored for forensic-grade accuracy. Thermal sensors are emerging as a niche solution for harsh or variable environmental conditions. On the services front, consulting engagements are guiding large-scale deployments through requirements analysis and system design, whereas maintenance and support contracts ensure long-term operational stability and uptime. Software offerings split between application layers-responsible for user enrollment workflows, database management, and reporting-and middleware, which facilitates integration with external systems such as access control platforms and criminal justice databases.

End-user adoption spans banking and finance institutions seeking robust authentication for high-value transactions, defense organizations requiring rapid identification in field operations, government agencies managing civil registries, healthcare providers safeguarding patient identities, and transportation authorities streamlining border and cargo inspections. Meanwhile, application contexts vary from access control in corporate and residential settings to border security checkpoints, civil identification registries for national ID programs, and criminal investigation workflows that demand precise matching against latent prints. Each of these dimensions interacts to shape a complex market environment where solution providers must align product portfolios with the specific needs of diverse customer segments.

This comprehensive research report categorizes the Automated Fingerprint Identification System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

Uncovering Regional Dynamics Highlighting Growth Drivers, Regulatory Nuances, and Strategic Priorities in the Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics for automated fingerprint identification systems are shaped by distinct regulatory landscapes, infrastructure maturity, and strategic priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, public safety agencies in the United States and Canada continue to invest in modernization programs that upgrade legacy systems and enhance interoperability across federal, state, and local levels. Latin American governments are also ramping up civil registry projects, leveraging biometric enrollment to ensure accurate voter rolls and streamline social benefit distribution.

Within Europe, the Middle East & Africa region, the General Data Protection Regulation and related privacy mandates have established stringent requirements for biometric data processing, prompting solution providers to emphasize privacy-centric architectures and consent management tools in their offerings. Concurrently, defense and homeland security agencies in the Middle East are deploying large-scale systems for border control and criminal justice, often integrated with facial recognition and multi-biometric platforms. Sub-Saharan African nations are piloting digital identity initiatives to expand access to banking and government services, underscoring the technology’s potential for socioeconomic inclusion.

Asia-Pacific markets exhibit some of the fastest adoption rates, driven by substantial investments in national ID programs, smart city initiatives, and e-governance platforms. Countries such as India and Indonesia are scaling civil identification systems to enroll hundreds of millions of residents, while developed markets like Japan and Australia are integrating fingerprint recognition into public transport and healthcare access. Across these regions, ecosystem partnerships between local integrators and global technology providers are instrumental in tailoring solutions to linguistic, cultural, and infrastructural requirements. Understanding these regional nuances is vital for mapping opportunity landscapes and crafting go-to-market strategies that align with localized priorities and regulatory contexts.

This comprehensive research report examines key regions that drive the evolution of the Automated Fingerprint Identification System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Demonstrating Innovation, Strategic Partnerships, and Competitive Positioning in the Automated Fingerprint Identification System Arena

The competitive landscape of automated fingerprint identification systems is defined by a cadre of established technology vendors, innovative startups, and specialized integrators. Leading providers are differentiating their offerings through investments in artificial intelligence and deep learning algorithms that accelerate matching speeds and enhance accuracy rates. Some companies are pioneering embedded analytics modules that deliver real-time performance insights, enabling system administrators to monitor throughput, error rates, and user behavior patterns via intuitive dashboards.

Strategic partnerships are becoming increasingly common, as hardware manufacturers collaborate with middleware and software specialists to deliver end-to-end solutions that simplify deployment and integration. In parallel, alliances with cloud infrastructure providers enable scalable, on-demand processing that supports both peak load scenarios and geographically dispersed verification operations. Moreover, collaborative engagements with academic research institutions are fostering advances in sensor fusion, multispectral imaging, and presentation attack detection, positioning these players at the forefront of next-generation system capabilities.

At the same time, smaller niche vendors are capitalizing on specialized applications-such as ruggedized mobile capture devices for field operations and biometric kiosks for self-service enrollment-that cater to segments underserved by traditional offerings. By forging close relationships with system integrators and value-added resellers, these agile providers are rapidly gaining traction in markets where speed to deployment and customization are paramount. Overall, competitive positioning is increasingly dictated by an organization’s ability to deliver holistic solutions that seamlessly blend hardware, software, and services underpinned by robust support ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Fingerprint Identification System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Cogent, Inc.

- Afix Technologies Inc.

- Aware, Inc.

- BioEnable Technologies Pvt. Ltd.

- Crossmatch Technologies, Inc.

- Dermalog Identification Systems GmbH

- East Shore Technologies, Inc.

- Fujitsu Limited

- Gemalto

- Green Bit S.p.A.

- HID Global Corporation

- IDEMIA Public Security SAS

- Innovatrics a.s.

- M2SYS Technology Inc.

- NEC Corporation

- Papillon Systems LLC

- SecuGen Corporation

- Sonda Technologies Ltd.

- Suprema Inc.

- Thales Group

- Veridos GmbH

- ZKTeco Co., Ltd.

Strategic Recommendations Empowering Industry Leaders to Optimize Adoption, Mitigate Risks, and Capitalize on Emerging Opportunities in Automated Fingerprint Identification Systems

To thrive in the evolving automated fingerprint identification landscape, industry leaders must adopt a multifaceted strategic approach that balances technological innovation with operational resilience. First, investing in advanced machine learning frameworks that continuously refine matching algorithms will be critical for maintaining high accuracy rates and minimizing false identifications. Equally important is the deployment of modular, microservices-based architectures that allow for rapid feature updates without disrupting core system operations.

Second, building a resilient supply chain that mitigates tariff exposure and supplier concentration risk is essential. Organizations should diversify component sources, explore strategic partnerships with domestic suppliers, and implement inventory optimization practices that align stock levels with deployment schedules. By establishing contingency agreements and leveraging nearshore manufacturing capabilities, companies can reduce lead times and avoid critical component shortages.

Third, prioritizing privacy and data governance through privacy-by-design methodologies will reinforce customer trust and ensure compliance with evolving regulatory requirements. This entails embedding end-to-end encryption, granular consent mechanisms, and robust audit trails into system workflows. Finally, fostering cross-industry collaborations-whether through public-private partnerships or joint research initiatives-will facilitate the co-development of interoperability standards, presentation attack detection techniques, and integration frameworks that drive broader market adoption.

Outlining a Comprehensive Research Methodology Leveraging Rigorous Data Collection, Stakeholder Engagement, and Multidimensional Analysis for Robust Market Insights

The insights presented in this report are founded on a rigorous research methodology designed to deliver both breadth and depth of analysis. Initially, a comprehensive secondary research phase examined a wide array of industry publications, regulatory filings, academic papers, and trade association reports to establish a contextual baseline. This was complemented by an extensive primary research component, incorporating in-depth interviews with senior executives, technical architects, and procurement specialists from both vendor and end-user organizations.

Quantitative data was collected through structured surveys targeting system integrators and channel partners, providing statistical validation for qualitative insights. Case studies of successful deployments across diverse sectors enriched the analysis by highlighting best practices, common implementation challenges, and performance benchmarks. Data triangulation methods were employed to cross-verify findings, ensuring consistency between market observations, stakeholder perspectives, and documented performance metrics.

Throughout the research process, peer reviews and expert panel discussions were conducted to refine the analytical framework, validate key assumptions, and identify emerging trends. This multi-dimensional approach ensures that the conclusions and recommendations are grounded in robust evidence, offering decision-makers a reliable foundation for strategic planning and investment deliberations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Fingerprint Identification System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Fingerprint Identification System Market, by Component

- Automated Fingerprint Identification System Market, by Technology

- Automated Fingerprint Identification System Market, by Application

- Automated Fingerprint Identification System Market, by End User

- Automated Fingerprint Identification System Market, by Region

- Automated Fingerprint Identification System Market, by Group

- Automated Fingerprint Identification System Market, by Country

- United States Automated Fingerprint Identification System Market

- China Automated Fingerprint Identification System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Distilling Key Takeaways Emphasizing Industry Trajectories, Strategic Imperatives, and Future Outlook for Automated Fingerprint Identification Systems

The automated fingerprint identification system market stands at a pivotal juncture, characterized by rapid technological advancements, evolving regulatory landscapes, and shifting global trade dynamics. Key drivers such as the integration of artificial intelligence, the migration to cloud-native architectures, and the imperative for privacy-centric designs are propelling the industry toward greater accuracy, scalability, and user trust. Equally, the imposition of tariffs on critical components underscores the importance of supply chain agility and strategic sourcing strategies.

Looking forward, success will hinge on an organization’s ability to align product roadmaps with emerging standards, invest in interoperable platforms, and foster collaborative ecosystems that accelerate innovation. Regional dynamics-from the regulatory rigor of EMEA to the high-volume civil ID initiatives in Asia-Pacific-offer distinctive opportunities for vendors who can tailor their solutions to localized requirements. Ultimately, the convergence of technological prowess, regulatory compliance, and operational resilience will determine which players lead the market and which follow.

As stakeholders navigate these multifaceted challenges, the insights and strategic recommendations contained within this report serve as a guiding framework, illuminating pathways to sustainable growth and competitive differentiation in the automated fingerprint identification system domain.

Contact Ketan Rohom to Secure Your Detailed Report on the Automated Fingerprint Identification System Market and Drive Informed Strategic Decision Making Today

If you are prepared to deepen your understanding of how automated fingerprint identification systems can redefine your organization’s security protocols and strategic priorities, now is the time to act. Ketan Rohom, whose extensive experience in sales and marketing leadership uniquely positions him to guide you through the intricacies of this market segment, stands ready to assist you. By engaging directly with him, you will secure immediate access to the comprehensive research report that brings together cutting-edge analysis, cross-industry insights, and forward-looking perspectives tailored to your decision-making needs.

Seize this opportunity to empower your teams with the data and strategic clarity required to navigate tariff-driven supply chain challenges, leverage emerging technological innovations, and align your investments with regional growth trajectories. Reach out to Ketan Rohom to initiate a personalized consultation, explore bespoke data solutions, and obtain the detailed market intelligence necessary to secure a competitive edge. Your pathway to strategic confidence in the automated fingerprint identification system market begins with this decisive step.

- How big is the Automated Fingerprint Identification System Market?

- What is the Automated Fingerprint Identification System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?