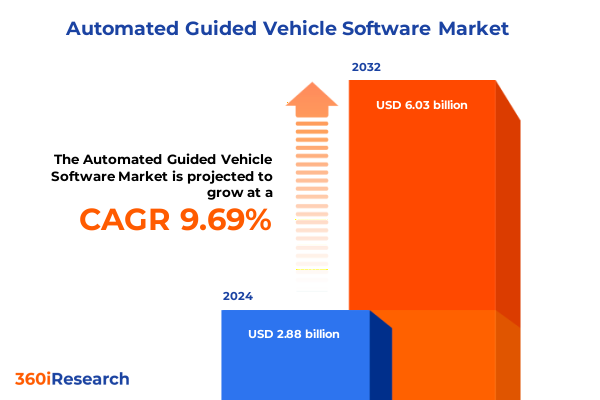

The Automated Guided Vehicle Software Market size was estimated at USD 3.14 billion in 2025 and expected to reach USD 3.44 billion in 2026, at a CAGR of 9.76% to reach USD 6.03 billion by 2032.

Pioneering Next-Generation Autonomous Material Handling Through Intelligent Software Solutions That Drive Operational Efficiency and Strategic Growth

Pioneering new frontiers in material handling, intelligent software for automated guided vehicles has emerged as the cornerstone of modern warehousing and production environments. As global supply chains evolve, organizations are increasingly embracing automated guided vehicle solutions to alleviate labor shortages, enhance throughput, and accelerate order fulfillment cycles. Within this context, a sophisticated suite of software functionalities underpins the performance, safety, and adaptability of AGV fleets, enabling businesses to address dynamic operational challenges while simultaneously driving efficiency gains.

Against a backdrop of heightened customer expectations, fluctuating demand patterns, and the imperative for cost optimization, AGV software platforms have transcended their traditional role as mere navigation tools. Today’s solutions integrate real-time data analytics, predictive maintenance algorithms, and multi-vehicle coordination features that collectively orchestrate highly responsive and resilient material flow processes. Moreover, as organizations strive to meet increasingly stringent safety standards, safety and security modules have become essential for real-time obstacle detection, zone protection, and compliance auditing.

Furthermore, when considering the diverse requirements of leading e-commerce and retail, food and beverage, healthcare, logistics and warehousing, and manufacturing operations, the modularity of these software platforms ensures seamless customization. From addressing distribution, packaging, and processing challenges in food and beverage environments to facilitating cross-docking, inventory visibility, and order picking and sorting across logistics hubs, AGV software continues to deliver significant adaptability. In manufacturing contexts, the integration of automotive assembly, electronics handling, and pharmaceutical material movement underscores the transformative potential of AGV intelligence. By leveraging these versatile solutions, organizations embark on a path toward predictive, autonomous, and scalable operations that form the foundation of next-generation supply chain excellence.

Embracing Unprecedented Technological Inflection Points That Are Transforming Automation Architectures Across Diverse Logistics and Manufacturing Environments

Across today’s industrial landscape, AGV software is undergoing a rapid metamorphosis driven by unprecedented technological inflection points. Cloud connectivity and edge computing architectures enable real-time monitoring of fleet health and performance, while advanced navigation algorithms harness machine learning to optimize travel paths in congested or dynamic environments. In parallel, the integration of Internet of Things sensors ensures continuous data streams, empowering path planning modules to recalibrate routes instantaneously based on live facility layouts or shifting demand patterns.

Meanwhile, safety and security software components have evolved from reactive systems into proactive protective frameworks. Through the incorporation of artificial intelligence-driven vision systems, AGV fleets can now predict potential collision scenarios and self-adjust speed and routing accordingly. Simultaneously, collaborative robotics features facilitate direct interaction between AGVs and mobile workforce units, fostering a cohesive ecosystem in which automated vehicles and human operators share space safely and efficiently.

Moreover, advances in user interface design have empowered non-technical personnel to define, deploy, and manage complex fleet management protocols with minimal training. By offering configurable dashboards, intuitive simulation environments, and plug-and-play integration with existing enterprise systems, modern AGV software platforms simplify the orchestration of multi-site deployments. As these transformative shifts continue to gather momentum, industry leaders are presented with extraordinary opportunities to reimagine material handling in ways that deliver resilience, agility, and cost effectiveness.

Navigating Evolving Trade Policies and Tariff Dynamics to Optimize Software-Driven Material Flow Strategies and Sustain Advantage Under Regulatory Shifts

When trade policies shift, the cost structures and strategic sourcing decisions of AGV solution providers undergo a profound reassessment. In 2025, the United States’ revised tariff framework on key robotics components-from precision sensors and high-performance motors to specialized semiconductors-has introduced new complexities for stakeholders across the supply chain. Suddenly, procurement teams must weigh the benefits of established overseas suppliers against the growing appeal of domestic manufacturing partnerships and nearshore contract manufacturing arrangements.

Consequently, AGV software architects are recalibrating their roadmaps to account for potential disruptions in hardware availability and cost volatility. This landscape has given rise to innovative licensing models that bundle software updates, compliance monitoring, and hardware assurance under unified service agreements. As a result, end customers can mitigate price fluctuation risks while ensuring uninterrupted access to the latest navigation, path planning, and fleet management enhancements.

In addition, tariff-driven pressures have accelerated conversations around localizing software development and support capabilities. By situating key engineering resources within regional hubs, AGV vendors can address compliance requirements more effectively and deliver faster customization for regulated industries such as healthcare and pharmaceuticals. This strategic pivot also enables companies to respond nimbly to future policy shifts, safeguarding both investments and customer confidence while preserving the integrity of automated systems.

Unlocking Strategic Insight Through Application Industry Deployment Software and Enterprise Size Segmentation Analysis for Intelligent AGV Solutions

Informed decision-making within the autonomous guided vehicle ecosystem relies upon a nuanced understanding of how application environments and operational priorities intersect. For instance, in e-commerce and retail settings, software modules must accommodate rapid fulfillment cycles and dynamic SKU variations, whereas food and beverage operators demand specialized tracking of chilled goods during distribution, precise control over filling and packaging lines, and strict processing protocols that safeguard product integrity. Meanwhile, healthcare facilities require stringent sterilization pathways and fail-safe navigation routines, prompting software developers to introduce enhanced safety layers and audit trails.

Transitioning to logistics and warehousing operations, cross-docking activities hinge on synchronized fleet coordination, inventory visibility engines that update in real time, and order picking and sorting workflows that minimize dwell time. Manufacturers, by contrast, leverage AGV platforms to underpin automotive assembly sequences, streamline electronic component transport, and enforce the rigorous handling standards of pharmaceutical products. Each of these contexts places distinct demands on software capabilities, driving continuous refinement of path planning algorithms, fleet management dashboards, and safety enforcement mechanisms.

Additionally, the choice between cloud and on-premise deployment models shapes integration, scalability, and data governance considerations. Cloud architectures offer elastic resource allocation and rapid feature upgrades, beneficial to large enterprises with multi-site operations, whereas on-premise installations deliver tighter control over sensitive data and system latency, often favored by small and medium-sized businesses in highly regulated sectors. Enterprise scale itself influences the depth of customization, support frameworks, and license structures, with large corporations typically adopting comprehensive enterprise agreements and SMEs opting for modular, consumption-based approaches.

This comprehensive research report categorizes the Automated Guided Vehicle Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Software Type

- Industry Vertical

- Deployment Mode

- Enterprise Size

Examining Regional Deployment Trends and Innovation Drivers Across the Americas Europe Middle East Africa and Asia Pacific in Autonomous Vehicle Software

As the Americas continue to lead in advanced automation initiatives, major distribution centers across the United States and Canada are refitting legacy warehouses with AGV fleets powered by cloud-native software, leveraging robust domestic infrastructure and favorable investment climates. In Mexico, nearshoring trends boost demand for agile systems capable of supporting cross-border logistics corridors. At the same time, Latin American markets are experimenting with subscription-based models to lower entry barriers and democratize access to cutting-edge navigation and safety technologies.

Shifting focus to Europe, the Middle East, and Africa, Germany and France are intensifying efforts around Industry 4.0 integration, where AGV platforms interoperate with digital twin ecosystems and predictive analytics engines to optimize throughput and energy consumption. The United Kingdom’s logistics hubs emphasize green credentials, directing software roadmaps toward energy-efficient routing and carbon tracking. Gulf states invest in smart port and airport applications, while early adopters in sub-Saharan Africa pilot AGV solutions to improve inbound supply chain resilience amidst infrastructure constraints.

Meanwhile, the Asia-Pacific region remains a crucible of rapid development. China’s manufacturing belt prioritizes domestic software innovation alongside aggressive government-backed automation schemes, while Japan and South Korea integrate robotics and materials handling in concert with established automotive and electronics sectors. India’s e-commerce boom fuels warehouse modernization, and Southeast Asian trade corridors explore collaborative deployments that blend cloud orchestration with edge-enabled navigation in high-temperature, high-humidity environments.

This comprehensive research report examines key regions that drive the evolution of the Automated Guided Vehicle Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Differentiators Among Leading Industry Vendors Delivering Innovative AGV Software Platforms and Collaborative Automation Solutions

Across a crowded and evolving landscape, a handful of leading vendors differentiate themselves through the depth of their software portfolios and the strategic breadth of their service ecosystems. Some providers have forged alliances with warehouse management system and ERP specialists, delivering unified platforms that seamlessly integrate AGV orchestration with inventory control and labor planning functions. Others prioritize modular architectures that allow clients to incrementally adopt advanced features-such as AI-enabled path optimization or multi-fleet coordination-without disrupting existing operations.

In addition, recent mergers and technology partnerships have given rise to hybrid offerings that blend on-premise reliability with cloud-delivered analytics, while a new wave of specialized startups focuses on niche applications such as high-density order picking or collaborative human-robot workcells. These companies leverage lightweight deployment kits and low-code interfaces to accelerate time to value. Simultaneously, established automation conglomerates emphasize global support networks and certified integration programs to address the complexities of multinational rollouts.

Innovation differentiation also stems from the integration of advanced safety and security features. By embedding real-time compliance reporting, remote monitoring dashboards, and blockchain-backed audit trails, forward-looking software providers help customers meet stringent regulatory requirements across regions. As competition intensifies, vendors that can demonstrate proven interoperability, robust cybersecurity measures, and a track record of continuous improvement will hold the upper hand.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Guided Vehicle Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aethon Inc.

- Align Production systems

- Convadis AG

- Daifuku Co. Ltd.

- Dürr AG

- Fleetx Technologies Private Limited

- GreyOrange Pte Ltd

- John Bean Technologies Corp.

- Jungheinrich AG

- Kinexon GmbH

- Kion Group AG

- Kollmorgen Corp

- KUKA AG

- MHP Management- und IT-Beratung GmbH

- Murata Machinery Ltd.

- Navitec Systems

- Proxima Robotics s.r.l.

- SSI Schaefer Group

- Stäubli International AG

- Suzhou Casun Intelligent Robot Co., Ltd.

- TGW Logistics Group

- Toyota Industries Corporation

- Verizon Communications Inc.

- WEWO Techmotion

- Zapi S.p.A.

Implementing Proactive Innovation and Operational Strategies to Unlock Value and Sustain Leadership in the Evolving Autonomous Vehicle Software Ecosystem

Industry leaders looking to capitalize on the immense potential of AGV software should first conduct a comprehensive review of their existing material handling workflows. By pinpointing high-impact pilot areas-such as dynamic order fulfillment zones or cross-dock transfer points-organizations can validate key performance indicators before scaling up. Equally important is the adoption of open architectures and API-driven integration frameworks that ensure seamless interoperability with enterprise resource planning, warehouse management, and predictive maintenance systems.

Next, decision-makers should prioritize investments in advanced navigation, path planning, and safety modules that leverage machine learning to adapt to changing facility layouts and seasonal demand fluctuations. Aligning these capabilities with a hybrid cloud and edge computing strategy will enable real-time responsiveness while maintaining data sovereignty. Additionally, evaluating total cost of ownership should account for the longer-term benefits of modular license structures, bundled compliance services, and proactive support offerings that hedge against hardware supply chain disruptions.

Finally, cross-functional collaboration between operations, IT, and procurement teams is crucial. Upskilling workforce talent to manage and interpret AGV software analytics, establishing governance protocols for tariff compliance, and forging strategic partnerships with system integrators will ensure that organizations remain agile. By following this multi-pronged approach, industry players can accelerate automation journeys, reduce risk exposure, and secure sustainable competitive advantages.

Outlining Rigorous Qualitative and Quantitative Research Techniques Employed for Comprehensive Autonomous Vehicle Software Market Intelligence

The insights presented in this report derive from a rigorous combination of qualitative and quantitative methodologies designed to capture the full spectrum of industry dynamics. Initially, secondary research was conducted across trade publications, technology white papers, and regulatory filings to establish a foundational understanding of AGV software trends, key regulatory developments, and emerging technology roadmaps. This desk research informed the development of detailed segmentation frameworks by application, software type, deployment mode, and enterprise size.

Subsequently, primary research involved structured interviews and workshops with senior executives, software architects, system integrators, and end-users. These sessions provided firsthand perspectives on implementation challenges, strategic priorities, and future requirements. Detailed surveys enhanced these qualitative insights by quantifying adoption drivers, integration complexities, and regional investment climates.

Once collected, all data underwent a strict triangulation process, cross-verified against multiple sources to ensure consistency and reliability. Scenario analysis techniques were then applied to assess the interplay between trade policy shifts, technology advancements, and market responses. Finally, iterative reviews with industry experts validated the findings and refined the actionable recommendations, ensuring a balanced, authoritative, and forward-looking perspective.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Guided Vehicle Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Guided Vehicle Software Market, by Software Type

- Automated Guided Vehicle Software Market, by Industry Vertical

- Automated Guided Vehicle Software Market, by Deployment Mode

- Automated Guided Vehicle Software Market, by Enterprise Size

- Automated Guided Vehicle Software Market, by Region

- Automated Guided Vehicle Software Market, by Group

- Automated Guided Vehicle Software Market, by Country

- United States Automated Guided Vehicle Software Market

- China Automated Guided Vehicle Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings into a Concise Strategic Narrative to Drive Decision Making and Shape the Future of Intelligent Automation

Synthesizing the insights from transformational technologies, shifting trade policies, and nuanced segmentation analyses reveals a compelling strategic narrative for stakeholders across the AGV software ecosystem. The convergence of artificial intelligence, cloud-edge architectures, and advanced safety frameworks is redefining how material handling operations are conceived, deployed, and optimized. In parallel, evolving tariff regimes in the United States and other major economies are prompting stakeholders to reassess procurement strategies, localize development efforts, and innovate service models to maintain competitive positioning.

Furthermore, granular segmentation by application industry, software functionality, deployment preferences, and enterprise scale underscores the importance of tailored solutions. Regional deployment trends in the Americas, Europe, the Middle East, Africa, and Asia-Pacific highlight the need for adaptable platforms that meet diverse regulatory, environmental, and operational requirements. Competitive dynamics among established conglomerates and agile newcomers further validate that success will hinge on software interoperability, modular licensing, and proven support ecosystems.

Collectively, these findings point to a future in which collaboration between operations, IT, and procurement will be instrumental. Organizations that invest strategically in AI-driven navigation, robust safety protocols, and flexible deployment strategies will be best positioned to harness the next wave of automation innovations. By aligning product roadmaps with evolving market realities, industry leaders can secure enduring value and navigate the path toward fully autonomous material handling.

Engage with Ketan Rohom to Access Exclusive Autonomous Guided Vehicle Software Market Analysis Tailored for Strategic Growth and Operational Excellence

To explore comprehensive insights, detailed analysis, and tailored strategic guidance for autonomous guided vehicle software deployment, speak directly with Ketan Rohom, the Associate Director of Sales & Marketing. By engaging in a direct consultation, you can uncover how to navigate evolving regulatory landscapes, harness advanced software capabilities, and future-proof your material handling operations for sustained growth. Reach out today to receive a personalized demonstration of the report’s executive summaries, in-depth case studies, and actionable roadmaps designed to align with your organization’s priorities and objectives. Secure your access to this exclusive research and position your team at the forefront of intelligent automation innovation.

- How big is the Automated Guided Vehicle Software Market?

- What is the Automated Guided Vehicle Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?