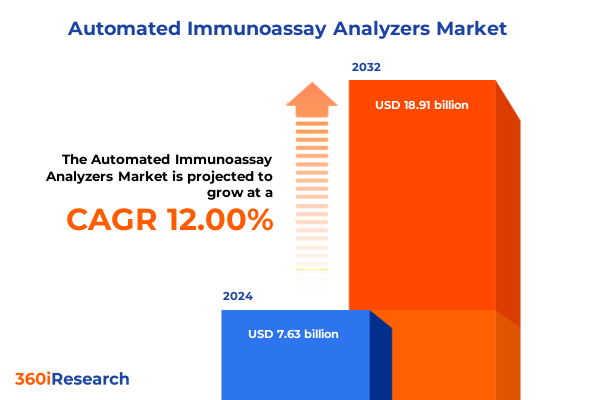

The Automated Immunoassay Analyzers Market size was estimated at USD 8.53 billion in 2025 and expected to reach USD 9.53 billion in 2026, at a CAGR of 12.04% to reach USD 18.91 billion by 2032.

Overview of Automated Immunoassay Analyzer Evolution and Its Critical Role in Modern Clinical Diagnostics Landscape Enabling High-throughput Precision Testing

The evolution of automated immunoassay analyzers has fundamentally reshaped the diagnostic landscape, enabling laboratories to achieve unprecedented levels of efficiency, accuracy, and consistency in testing. Where manual immunoassays once dominated, today’s fully automated platforms integrate advanced robotics, precision fluidics, and sophisticated software to streamline workflows and reduce turnaround times. As clinical demands expand in volume and complexity, the transition from labor-intensive assays to high-throughput, walkaway systems has become essential to meet patient care objectives and regulatory standards. Furthermore, the convergence of digital health solutions with analyzer functionality is driving a paradigm shift in data management, allowing for real-time monitoring, remote troubleshooting, and seamless integration with laboratory information systems.

In addition to operational improvements, modern immunoassay analyzers are designed to support a broader menu of assays, facilitating multiplex testing and consolidation of platforms, which directly addresses the growing need for flexible, multi-parameter diagnostics. As healthcare institutions navigate staffing challenges and budgetary constraints, instrument consolidation, coupled with automation, delivers both cost and time savings. Consequently, laboratories can redirect skilled personnel from manual pipetting toward more value-added activities such as result interpretation, quality improvement, and clinician engagement. Ultimately, this technological evolution is setting the stage for a new era of personalized medicine, in which precise biomarker quantification underpins early detection, treatment stratification, and therapeutic monitoring.

Key Technological and Market-driven Shifts Reshaping Automated Immunoassay Analyzer Capabilities and Adoption Across Healthcare Settings

Recent years have witnessed transformative shifts that extend far beyond incremental enhancements in immunoassay capabilities. The integration of digital and connectivity features into analyzer platforms has redefined expectations for data utilization, enabling predictive maintenance, usage analytics, and assay performance insights. Machine learning algorithms now optimize calibration curves and flag aberrant results, reducing the need for manual intervention and improving assay reliability. At the same time, manufacturers are introducing modular designs that allow labs to scale their systems according to fluctuating workloads, ensuring that capital investments remain adaptable as testing volumes change.

Moreover, the growing emphasis on value-based care has prompted laboratories to seek comprehensive diagnostic solutions that align with reimbursement models, demonstrating the clinical utility and cost-effectiveness of each biomarker tested. The rise of point-of-care and near-patient testing has further challenged centralized labs, pushing analyzer vendors to develop compact benchtop platforms with near-instantaneous turnaround times. In response, the market is experiencing an influx of hybrid systems that bridge the gap between high-capacity floor-standing analyzers and decentralized devices. Together, these technological and market-driven shifts are accelerating the adoption of advanced immunoassay solutions across diverse healthcare settings, ultimately elevating diagnostic standards and patient outcomes.

Assessment of 2025 United States Tariff Policy Effects on Automated Immunoassay Analyzers Highlighting Supply Chain and Cost Dynamics

The implementation of new tariff structures by the United States in early 2025 has introduced significant cost and supply chain implications for imported immunoassay analyzers and reagents. Import duties imposed on key instrument components and assay kits have increased landed costs, prompting some laboratories to reexamine procurement strategies and explore domestic sourcing alternatives. In particular, reagents and spare parts originating from regions subject to higher duties have experienced extended lead times, as suppliers navigate the complexities of customs clearances and updated trade regulations.

In response, several analyzer manufacturers have initiated adjustments to their supply networks, relocating manufacturing or assembly operations to facilities within tariff-exempt jurisdictions. These strategic relocations aim to mitigate cost pressures and maintain service levels for end users. Simultaneously, distributors have renegotiated contracts to incorporate tariff pass-through clauses, shifting a portion of the duty burden onto buyers. Although these measures have helped stabilize availability, they have also underscored the importance of proactive tariff risk management. Laboratories are now prioritizing multi-source agreements and exploring vendor-neutral harmonization of consumables to ensure continuity of care irrespective of geopolitical fluctuations.

In-depth Segmentation Analysis Illuminating Product Type Throughput End Users Technology and Applications Driving Automated Immunoassay Market Trends

A nuanced segmentation analysis reveals the diversity of laboratory requirements and the tailored solutions that vendors must deliver. When evaluating product form factors, benchtop analyzers cater to smaller or decentralized clinical settings where bench space is at a premium, and rapid walkaway testing is critical. On the other hand, floor-standing systems provide the throughput capacity and process automation that high-volume central laboratories demand, supporting uninterrupted bulk processing of assay panels. This differentiation underscores the need for scalable solutions aligned with each laboratory’s physical footprint and testing complexity.

End user profiles further refine these requirements. Clinical laboratories prioritize comprehensive assay menus and integration with high-throughput workflows, while hospital-based labs seek analyzers that can handle urgent stat testing alongside routine panels. Research institutes require flexible systems capable of accommodating experimental assays and method development, often valuing open-access platforms for protocol customization. Taken together, these variations drive the development of analyzer features such as onboard reagent stability monitoring, auto-dilution capabilities, and real-time quality control.

Throughput segmentation highlights the gradient of demand from low to medium to high sample volumes. Low-throughput analyzers specialize in focused applications within niche departments, whereas medium-throughput instruments achieve a balance between flexibility and capacity, often serving midsize laboratories with mixed workloads. High-throughput platforms, meanwhile, deliver fully automated sample loading, barcoded tracking, and batch processing functionalities that enable laboratories to meet peak testing demands without sacrificing precision.

Technological distinctions shape the choice of detection methodology. Chemiluminescence immunoassay systems remain popular for their sensitivity, whereas electrochemiluminescence platforms offer enhanced dynamic range and multiplexing potential. Enzyme-linked immunosorbent assay technologies continue to provide a cost-effective solution for specialized assays, and fluorescent immunoassay systems bring rapid kinetics and multiplex capabilities. Each detection mode addresses specific clinical requirements, from low-concentration hormone quantification to rapid antigen screening.

Finally, application-driven segmentation captures the clinical importance of immunoassay analyzers across specialties. In cardiology, analyzers focus on cardiac markers for acute myocardial infarction risk stratification. Endocrinology applications demand precise monitoring of diabetes via insulin and HbA1c assays as well as thyroid-stimulating hormone and free T4 analysis for thyroid disorders. Infectious disease testing continues to evolve with panels for Covid-19 antigens, hepatitis serologies, and HIV antibody screening. Oncology assays, centered on tumor markers, provide critical information for cancer diagnosis and therapeutic monitoring. This layered segmentation enables vendors to tailor instrument and assay portfolios to the specific performance parameters required by each clinical discipline.

This comprehensive research report categorizes the Automated Immunoassay Analyzers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Throughput

- Technology

- Application

- End User

Strategic Regional Perspectives on Automated Immunoassay Analyzer Adoption and Challenges Across Americas EMEA and Asia Pacific Markets

Regional dynamics exerce a profound influence on immunoassay analyzer adoption, as healthcare infrastructure, regulatory environments, and reimbursement frameworks vary significantly. In the Americas, investments in large-scale central laboratories and networked hospital systems drive demand for high-capacity floor-standing platforms and consolidated inventory management. The growing focus on point-of-care testing in rural or underserved regions further amplifies interest in compact benchtop systems with rapid assay turnaround.

Across Europe, the Middle East, and Africa, heterogeneous regulatory requirements present both challenges and opportunities for vendors. Amid stringent regulations in Western Europe, laboratories emphasize compliance with in vitro diagnostic directives and data integrity standards, favoring platforms with robust quality management systems. In the Middle East and Africa, expanding healthcare infrastructure and partnerships with public health agencies support the deployment of both mobile and fixed-site analyzers, especially in response to infectious disease surveillance and large-scale immunization programs.

Asia-Pacific exhibits one of the fastest growth trajectories, driven by rising healthcare expenditures, expanding clinical trial activities, and increasing urbanization. In markets such as Japan and South Korea, a strong emphasis on precision medicine encourages uptake of high-throughput and multiplex immunoassay solutions. Emerging markets in Southeast Asia and India demonstrate growing interest in modular, cost-effective analyzers that balance performance with affordability. Across all regions, strategic collaborations between local distributors and global manufacturers are critical to addressing diverse customer needs and navigating evolving regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Automated Immunoassay Analyzers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Insights from Leading Manufacturers and Emerging Innovators Shaping Automated Immunoassay Analyzer Industry Dynamics

The competitive arena of automated immunoassay analyzers is defined by established diagnostics leaders and agile innovators alike, each vying for prominence through differentiated offerings and strategic partnerships. Major firms leverage integrated platforms that combine immunoassay modules with clinical chemistry and hematology analyzers, aiming to deliver consolidated workflows and unified data management. These companies increasingly expand their service portfolios to include software upgrades, remote diagnostics, and field support agreements that enhance customer retention and system uptime.

Concurrently, specialized vendors are carving niche positions by focusing on emerging technologies such as multiplex bead-based assays and point-of-care automation. These innovators often collaborate with academic institutions and biotechnology firms to co-develop novel biomarkers and custom assays, accelerating time-to-market for new diagnostic tests. Alliances between reagent suppliers and instrument manufacturers have also become more prevalent, ensuring optimized reagent-instrument compatibility and streamlined regulatory approvals.

In addition, several companies are investing in digital ecosystems that encompass cloud-based analytics, artificial intelligence, and real-time performance dashboards. These software-driven strategies not only support predictive maintenance and operational efficiency but also enable laboratories to extract deeper insights from test result patterns and throughput metrics. As a result, the competitive landscape continues to shift towards providers capable of delivering end-to-end solutions that combine robust hardware, cutting-edge assays, and advanced informatics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Immunoassay Analyzers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- DiaSorin S.p.A.

- Illumina, Inc.

- Laboratory Corporation of America Holdings

- Luminex Corporation by DiaSorin Company

- Medline Industries, LP

- Meril Life Sciences Pvt. Ltd.

- Ortho Clinical Diagnostics, Inc.

- PerkinElmer, Inc.

- PHC Europe B.V.

- Qiagen N.V.

- Randox Laboratories

- Roche Holding AG

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Actionable Strategies for Industry Stakeholders to Enhance Innovation Collaboration and Operational Efficiency in Automated Immunoassay Analyzer Sector

To thrive amid evolving market conditions, industry stakeholders should prioritize investment in flexible automation architectures that can accommodate both current and future assay requirements. Establishing collaborative partnerships with reagent suppliers and software developers will facilitate the rapid co-creation of application-specific modules and digital enhancements. In parallel, companies must address supply chain resilience by diversifying manufacturing sites, implementing just-in-time inventory strategies, and maintaining buffer stocks of critical components to mitigate tariff and logistical disruptions.

Moreover, organizations should engage proactively with regulatory bodies to expedite the clearance of novel assays and digital tools, leveraging real‐world evidence and performance data to demonstrate clinical utility. Embracing predictive maintenance capabilities and remote monitoring solutions will reduce downtime and service costs, while training initiatives aimed at end users will optimize instrument utilization and assay accuracy. Finally, by incorporating advanced analytics into service agreements, vendors can offer value‐based pricing models tied to key performance indicators such as uptime, turnaround time, and assay reproducibility, aligning financial incentives with laboratory success.

Robust Research Framework Combining Qualitative and Quantitative Approaches to Ensure Comprehensive Automated Immunoassay Industry Intelligence

This research is grounded in a rigorous methodology that integrates both qualitative and quantitative approaches to deliver robust and actionable insights. Primary research consisted of in-depth interviews with senior executives from diagnostic manufacturers, laboratory directors, procurement managers, and key opinion leaders across major geographies. These conversations provided first-hand perspectives on emerging trends, technology adoption barriers, and strategic roadmaps. Secondary research involved a comprehensive review of industry publications, regulatory filings, white papers, and clinical studies to validate market dynamics and technological developments.

Market segmentation frameworks were developed by mapping instrument attributes, application requirements, and end-user preferences to identify distinct customer cohorts. Data triangulation ensured consistency across multiple sources, while a series of workshops with subject-matter experts refined the assumptions and definitions used throughout the analysis. The research team also employed a proprietary database to track product launches, patent filings, and merger and acquisition activity, establishing a precedent for identifying high-growth innovation areas.

To enhance transparency and replicability, detailed appendices outline the list of interview participants, data sources, and key definitions. Quality control mechanisms, including peer reviews and editorial audits, were implemented at each stage to uphold the integrity and reliability of the findings. By combining diverse data sets with expert insights, this methodology ensures that conclusions are both comprehensive and grounded in real-world practice.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Immunoassay Analyzers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Immunoassay Analyzers Market, by Product Type

- Automated Immunoassay Analyzers Market, by Throughput

- Automated Immunoassay Analyzers Market, by Technology

- Automated Immunoassay Analyzers Market, by Application

- Automated Immunoassay Analyzers Market, by End User

- Automated Immunoassay Analyzers Market, by Region

- Automated Immunoassay Analyzers Market, by Group

- Automated Immunoassay Analyzers Market, by Country

- United States Automated Immunoassay Analyzers Market

- China Automated Immunoassay Analyzers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Key Findings Emphasizing the Strategic Importance of Automated Immunoassay Analyzers for Healthcare Innovation

The synthesis of our analysis reveals that the transformation of automated immunoassay analyzers is central to advancing diagnostic excellence and operational efficiency in modern laboratories. Technological innovations such as machine learning-driven quality control, modular system designs, and expanded assay menus have collectively elevated the standard of care. At the same time, regulatory shifts and trade policies have underscored the need for flexible supply chain architectures and collaborative partnerships to maintain uninterrupted access to critical diagnostic tools.

Segmented insights demonstrate that one size does not fit all; product form factor, throughput capacity, detection technology, and clinical application each play a pivotal role in aligning solutions with laboratory objectives. Regional nuances further emphasize the importance of tailored market strategies, with growth patterns in the Americas, EMEA, and Asia-Pacific reflecting unique healthcare infrastructures and regulatory landscapes. Competitive dynamics reveal a balance between integrated incumbents and specialized disruptors, all striving to differentiate through software ecosystems, reagent innovation, and service excellence.

Ultimately, the convergence of automation, connectivity, and assay diversity positions automated immunoassay analyzers as indispensable assets in the pursuit of personalized medicine and population health management. By embracing actionable recommendations around strategic investments, regulatory engagement, and value-based partnerships, stakeholders can capitalize on this pivotal moment in diagnostic evolution.

Reach Out to Ketan Rohom to Unlock Exclusive Insights and Elevate Diagnostic Strategies with Comprehensive Automated Immunoassay Report

I invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights that will empower your organization’s diagnostic strategies and decision-making. By partnering with Ketan, you can access exclusive data on instrument performance, technology adoption patterns, and emerging clinical applications. His expertise in guiding healthcare organizations through complex purchasing decisions ensures that you receive personalized support aligned with your operational and financial objectives. Reach out today to discover how this comprehensive report will help you optimize your immunoassay workflow, streamline budgeting and procurement, and accelerate the delivery of critical patient results. Connect with Ketan to secure your copy and position your organization at the forefront of diagnostic innovation.

- How big is the Automated Immunoassay Analyzers Market?

- What is the Automated Immunoassay Analyzers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?