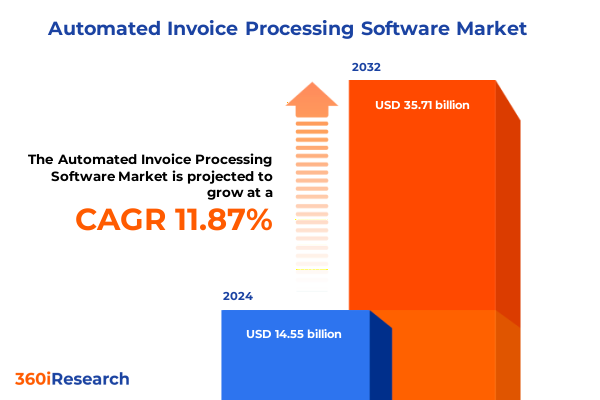

The Automated Invoice Processing Software Market size was estimated at USD 17.27 billion in 2025 and expected to reach USD 19.20 billion in 2026, at a CAGR of 10.93% to reach USD 35.71 billion by 2032.

Embarking on a New Era of Automated Invoice Processing as Intelligent Cloud and On-Premise Solutions Redefine Financial Efficiency Across Enterprises

The landscape of financial operations has evolved dramatically over the past decade, driven by the need for speed, accuracy, and seamless integration in handling high volumes of transactions. Traditional manual invoice processing has long been plagued by inefficiencies, errors, and delayed payments, creating bottlenecks that impede cash flow and obscure financial visibility. As enterprises scale, these challenges are magnified, fueling the imperative for automation and intelligent software solutions. In response, organizations worldwide have accelerated the adoption of automated invoice processing platforms that leverage advanced technologies to transform accounts payable functions.

By integrating Optical Character Recognition (OCR), machine learning, and workflow orchestration, modern invoice processing solutions capture, validate, and route invoice data with minimal human intervention. This shift not only reduces operational costs but also enhances compliance, fraud prevention, and strategic decision-making. Notably, a recent industry study finds that approximately seventy-five percent of accounts payable departments are currently utilizing some form of automation and AI tooling to optimize core processes, with over fifty-five percent employing sophisticated OCR and machine learning technologies to extract and classify invoice details efficiently.

Moreover, AI-driven analytics now empower finance teams to glean actionable insights from historical payment data, enabling predictive forecasting of cash flow and dynamic optimization of approval workflows. As the demand for real-time financial intelligence grows, organizations are recognizing the value of transforming accounts payable from a back-office cost center into a strategic function that contributes to overall business agility and profitability. This introduction sets the stage for a deep dive into the critical trends, challenges, and strategic imperatives shaping the automated invoice processing market.

How Artificial Intelligence and Cloud-Native Innovations Are Catalyzing a Paradigm Shift in Invoice Processing Workflows for Financial Teams

The automated invoice processing market is experiencing a profound transformation propelled by artificial intelligence, cloud-native architectures, and hyperautomation. AI-powered Optical Character Recognition systems now achieve accuracy rates of up to ninety-nine percent when extracting invoice data, auto-matching line items, and detecting anomalies before they cascade into payment errors. These innovations are underpinned by machine learning models that continuously refine their performance based on user corrections and evolving document formats, reducing the need for manual template creation and accelerating time to value. Advances in continuous learning algorithms are expected to boost the agility of finance departments, enabling them to adapt rapidly to new invoice types and compliance requirements.

Simultaneously, the shift to multi-tenant cloud deployments is unlocking unprecedented scalability and global accessibility, allowing organizations to process peak invoice volumes without the capital expenditure and maintenance overhead associated with traditional on-premise solutions. Cloud platforms enable seamless upgrades, enhanced security protocols, and centralized analytics, while single-tenant and hosted on-premise options remain essential for enterprises with stringent data sovereignty and customization requirements. This fluid interplay between deployment modes underscores the market’s commitment to meeting diverse organizational needs without compromising performance or compliance.

Furthermore, the convergence of rule-based automation with AI-driven decision engines is redefining workflow management. Routine tasks such as vendor validation, exception handling, and approval routing are now handled autonomously, guided by predictive analytics that signal potential risk factors and cash flow opportunities. As digital transformation initiatives intensify across industries, finance leaders are charting a course toward end-to-end procure-to-pay digitization, leveraging integrated platforms that unify invoice capture, payment execution, and reporting. This transformative shift establishes a new standard for operational efficiency and strategic insight.

Assessing the Cumulative Effects of 2025 United States Import Tariffs on Invoice Processing Practices Cash Flow Management and Supply Chain Stability

In early 2025, the United States implemented a series of import tariffs that reverberated across global supply chains and financial operations. With rates ranging from ten percent to twenty-five percent on steel, aluminum, and various high-tech components, businesses faced escalating input costs and heightened uncertainty. As a direct consequence, companies sought to preserve cash reserves by delaying payments and rigorously scrutinizing invoices. Research indicates that invoice rejection rates surged from 1.86 percent to 6.95 percent year over year during the first quarter of 2025, amounting to over 2.9 million rejected invoices across more than 270 million transactions examined.

Economists warn that these tariff measures could increase manufacturing costs by up to four and a half percent, squeezing profit margins and challenging finance teams to mitigate liquidity risks. As a result, organizations have renegotiated contract terms, adjusted payment schedules, and restructured approval workflows to manage working capital more proactively. The surge in invoice rejections reflects a broader trend of risk aversion and cash flow optimization, as enterprises grapple with both direct tariff costs and indirect impacts such as supply delays and fluctuating vendor pricing.

Despite these headwinds, automated invoice processing solutions have proven instrumental in enabling resilience. By providing real-time visibility into outstanding liabilities, dynamic analytics dashboards empower financial leaders to anticipate liquidity gaps, identify high-risk vendor relationships, and capitalize on early-payment discounts when cash flow permits. This confluence of trade policy volatility and digital finance capabilities underscores the importance of agile, data-driven invoice management strategies in safeguarding enterprise stability.

Uncovering Critical Segmentation Insights That Inform Deployment Modes Organization Sizes Solution Types and Vertical-Specific Invoice Automation Strategies

A nuanced understanding of market segmentation is essential for tailoring invoice processing offerings to diverse customer needs. Deployment preferences vary significantly: while multitenant cloud platforms dominate emerging midsize businesses seeking rapid scalability, single-tenant configurations and hosted on-premise environments remain indispensable for highly regulated sectors that demand granular control over data and customization. Similarly, the balance between cloud and traditional on-premise adoption reflects a strategic choice between operational agility and absolute system ownership.

Organizational scale further shapes buyer behavior. Large enterprises leverage vast transaction volumes to negotiate enterprise-grade SLAs, advanced analytics, and strategic vendor networks, whereas midmarket firms prioritize integrated payment processing and user-friendly interfaces to streamline cash application. Small businesses, on the other hand, often require a lean, subscription-based model that minimizes upfront costs and accelerates ROI, with intuitive invoice capture and basic reporting features.

Solution specialization also influences purchase decisions. Analytics and reporting modules encompass both operational reporting for daily invoice volume tracking and predictive analytics that forecast cash flow trajectories. Invoice capture solutions vary across non-OCR manual entry and advanced OCR engines that integrate natural language processing. Payment processing differentiates between check issuance and electronic funds transfers, each with distinct settlement cycles and compliance considerations. Meanwhile, workflow management blends rule-based automation for straightforward routing with AI-driven automation capable of autonomously resolving exceptions.

Industry verticals introduce additional complexity. Financial institutions demand robust audit trails and integration with core banking systems, while healthcare providers focus on compliance with patient privacy regulations and billing codes. IT and telecom companies prioritize rapid vendor onboarding and scalable invoice networks, whereas manufacturing and retail enterprises emphasize supply chain integration and multi-currency support. Each segment’s unique requirements underscore the importance of configurable, modular platforms.

This comprehensive research report categorizes the Automated Invoice Processing Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Organization Size

- Solution Type

- Industry Vertical

Evaluating Regional Dynamics in the Automated Invoice Processing Market Across Americas Europe Middle East Africa and Asia-Pacific Fiscal Landscapes

Regional dynamics play a pivotal role in shaping the adoption and evolution of automated invoice processing technologies. In the Americas, North American enterprises lead the charge, leveraging a mature digital infrastructure and favorable regulatory frameworks to implement cloud-based invoice capture and payment automation at scale. Latin American markets, while still developing digital maturity, are witnessing rapid uptake of subscription models as organizations seek to modernize financial operations and enhance transparency across cross-border transactions. This growth is driven by increasing regulatory mandates and the need for efficient tax compliance in a complex fiscal environment.

In Europe, the Middle East, and Africa, stringent data protection regulations and e-invoicing mandates-such as the European Union’s EN 16931 standard-have accelerated the shift toward end-to-end digital invoice lifecycles. Businesses operating in this region prioritize solutions that ensure legal compliance while supporting diverse local requirements, from VAT reporting in Europe to electronic invoicing frameworks in the Gulf Cooperation Council countries. The emphasis on compliance and interoperability has made EMEA a center of excellence for e-invoicing innovation.

The Asia-Pacific landscape presents a heterogeneous outlook. Mature markets like Australia and Japan exhibit high penetration of AI-driven invoice automation, with enterprises integrating advanced analytics to optimize working capital. Emerging economies across Southeast Asia and India are rapidly adopting cloud-first solutions to address manual processing challenges and drive operational efficiency. Regional initiatives promoting e-commerce integration and digital payment networks further catalyze demand for invoice automation, as businesses seek seamless connectivity across multi-national supply chains.

This comprehensive research report examines key regions that drive the evolution of the Automated Invoice Processing Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Companies Shaping the Automated Invoice Processing Landscape with Strategic Innovations and Analyst Recognitions

Leading technology providers continue to shape the competitive landscape through strategic innovations and industry recognition. Basware has been positioned as a Leader in the 2025 Gartner Magic Quadrant for Accounts Payable Applications, reflecting its robust AI-driven invoice lifecycle management capabilities and expansive dataset of over 2.2 billion processed invoices. The platform’s end-to-end compliance engine and intelligent automation features enable enterprises to achieve touchless invoice processing, anomaly detection, and comprehensive financial oversight across global operations.

SAP’s Concur and Ariba offerings have garnered accolades in IDC MarketScape assessments for accounts payable automation across large enterprise, midmarket, and small business segments. Their AI-first approach, combined with the SAP Business Network’s seamless buyer-supplier collaboration, empowers organizations to reduce cycle times, minimize exceptions, and leverage invoices as strategic assets for growth and profitability.

In addition to these established leaders, emerging players such as Coupa, Tipalti, FreshBooks, Xero, Zoho, AvidXchange, and Esker are gaining traction by targeting niche markets and delivering modular, API-driven platforms. Their focus on usability, rapid integration, and flexible pricing models resonates with small to mid-sized enterprises seeking cost-effective automation. The diverse competitive ecosystem underscores ongoing innovation and the importance of vendor partnerships in driving successful deployments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Invoice Processing Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AvidXchange, Inc.

- Basware Oyj

- Coupa Software Incorporated

- Emburse, Inc.

- Esker S.A.

- Finexio, Inc.

- IBM Corporation

- Kofax Limited

- OpenText Corporation

- Oracle Corporation

- SAP SE

- Stampli Inc.

- Tipalti Holdings, Inc.

- Tradeshift AB

- Yooz SAS

Strategic Action Plans for Industry Leaders to Leverage Automation, AI, and Best Practices in Invoice Processing for Sustainable Competitive Advantage

To realize the full potential of automated invoice processing, industry leaders should adopt a multifaceted strategy that aligns technology, process optimization, and organizational change management. First, finance executives must prioritize the implementation of AI-powered data capture and anomaly detection capabilities to minimize manual interventions and unlock actionable insights. This entails not only deploying best-in-class OCR and machine learning engines but also establishing feedback loops that continuously refine model accuracy and adapt to evolving document formats.

Second, organizations should evaluate deployment options with an eye toward scalability and data governance. Cloud-native solutions deliver rapid elasticity and centralized analytics, while hybrid and hosted on-premise models may better serve enterprises with stringent regulatory requirements or data residency concerns. A clear roadmap for migration and integration with existing ERP and procurement systems is essential to avoid disruption and maximize return on investment.

Third, embedding finance and procurement teams into cross-functional governance structures will ensure that automated workflows align with broader operational objectives. By defining key performance indicators-such as invoice exception rates, cycle times, and discount capture percentages-and monitoring them through dynamic dashboards, stakeholders can measure progress and drive continuous improvement.

Finally, ongoing training and change management are critical to fostering user adoption and realizing strategic benefits. Tailored workshops, hands-on simulations, and executive sponsorship will help finance professionals embrace automation, shift from transactional tasks to value-added analysis, and champion a culture of innovation across the organization.

Transparent Research Methodology Combining Primary and Secondary Data Sources Expert Interviews and Rigorous Validation to Ensure Analytical Credibility

This research combines rigorous primary and secondary methodologies to ensure analytical depth and credibility. Primary insights were obtained through expert interviews with finance executives, technology architects, and industry consultants, providing firsthand perspectives on implementation challenges, strategic priorities, and emerging trends. These qualitative findings were triangulated with quantitative data from company case studies, vendor reports, and publicly available industry analyses.

Secondary research encompassed a comprehensive review of analyst reports, regulatory publications, and technology whitepapers to map the competitive landscape, benchmark solution capabilities, and validate market dynamics. Special attention was paid to major analyst frameworks such as the Gartner Magic Quadrant and the IDC MarketScape, enabling objective assessments of vendor positioning and feature differentiation.

Segmentation analysis was structured around deployment mode, organization size, solution type, and industry vertical, reflecting the multifaceted nature of buyer requirements. Regional insights were informed by an examination of e-invoicing mandates, trade policies, and infrastructure maturity across the Americas, EMEA, and Asia-Pacific.

A final validation layer involved peer review by subject matter experts and data verification checks to ensure consistency, accuracy, and relevance of all findings. This structured methodology underpins the report’s robust conclusions and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Invoice Processing Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Invoice Processing Software Market, by Deployment Mode

- Automated Invoice Processing Software Market, by Organization Size

- Automated Invoice Processing Software Market, by Solution Type

- Automated Invoice Processing Software Market, by Industry Vertical

- Automated Invoice Processing Software Market, by Region

- Automated Invoice Processing Software Market, by Group

- Automated Invoice Processing Software Market, by Country

- United States Automated Invoice Processing Software Market

- China Automated Invoice Processing Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings to Chart the Path Forward in Automated Invoice Processing With Emphasis on Innovation Collaboration and Operational Excellence

As automated invoice processing continues to evolve, organizations that embrace intelligent, scalable solutions will distinguish themselves through enhanced operational agility, financial visibility, and regulatory compliance. The integration of AI-driven data capture, predictive analytics, and autonomous workflows is redefining the traditional roles of accounts payable, elevating the function from transactional processing to strategic financial management.

The cumulative impact of 2025 trade policies, including elevated tariffs and supply chain disruptions, has underscored the importance of real-time invoice visibility and dynamic cash flow optimization. Businesses equipped with advanced automation platforms are better positioned to navigate cost pressures, mitigate risk, and capitalize on early-payment discounts, thus safeguarding profitability in volatile market conditions.

Strategic segmentation analysis reveals the necessity of tailored deployment strategies, whether cloud-native multitenant platforms for midmarket agility or hosted on-premise solutions for regulated industries. Regional nuances further highlight the critical role of compliance engines and e-invoicing frameworks in driving global adoption.

Looking ahead, the convergence of finance and procurement through unified procure-to-pay suites, embedded financial services, and ecosystem-driven collaboration will define the next phase of innovation. By aligning technology investments with organizational objectives, industry leaders can unlock significant efficiency gains and transform accounts payable into a catalyst for sustained competitive advantage.

Engage With Associate Director Ketan Rohom to Secure Your Comprehensive Automated Invoice Processing Market Research Report Today

To explore the comprehensive insights, data-driven analyses, and strategic guidance encapsulated in this report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise and tailored service can help you leverage cutting-edge market intelligence to optimize technology investments, refine go-to-market strategies, and drive operational excellence. Contact Ketan Rohom today to secure your copy of the full automated invoice processing market research report and transform your finance operations with confidence.

- How big is the Automated Invoice Processing Software Market?

- What is the Automated Invoice Processing Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?