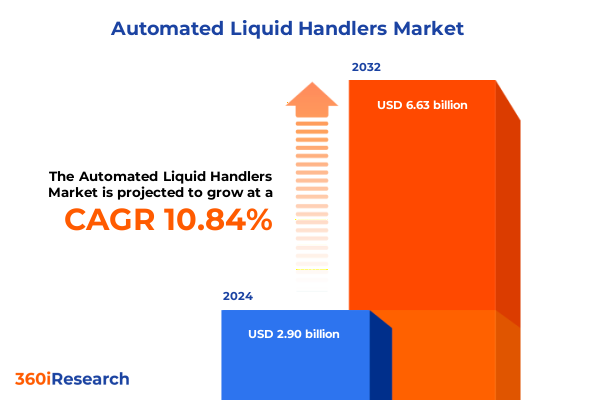

The Automated Liquid Handlers Market size was estimated at USD 3.22 billion in 2025 and expected to reach USD 3.57 billion in 2026, at a CAGR of 10.85% to reach USD 6.63 billion by 2032.

Opening the Doors to Automated Liquid Handlers Revolutionizing Laboratory Efficiency Through Precision, Speed, and Integrated Workflow Solutions

The automation of liquid handling has emerged as a cornerstone of modern laboratory operations, enabling researchers and technicians to achieve unprecedented levels of reproducibility and efficiency. As manual pipetting and sample preparation become increasingly inadequate to meet the complexity and volume of current workflows, automated liquid handlers deliver consistent precision across thousands of samples in a single run. This transition is propelled by the dual pressures of accelerating drug discovery timelines and the need for stringent quality control in clinical diagnostics, where regulatory compliance and traceability are non‐negotiable.

Over the past few years, the integration of robotics and software analytics has shifted automated liquid handlers from standalone instruments to fully integrated workflow orchestrators. Advanced scheduling algorithms now coordinate plate handling, reagent stocking, and waste management while real‐time data capture provides a transparent audit trail for every liquid transfer. This digital transformation reduces human error and frees skilled scientists to focus on experimental design rather than manual tasks. Furthermore, ongoing enhancements in instrument modularity and open‐platform interoperability allow facilities to tailor automation suites that align with their unique research models, extending the applicability of these systems from genomics and proteomics to high‐throughput screening and personalized medicine.

Unveiling the New Era of Laboratory Automation Where Artificial Intelligence and Robotics Converge to Redefine Throughput Reproducibility and Data Integrity

Laboratory automation has entered a new era in which artificial intelligence and robotics converge to redefine performance benchmarks. Machine learning algorithms now analyze pipetting movements and volume distributions in real time, dynamically adjusting aspiration speeds and liquid handling paths to optimize throughput while safeguarding sample integrity. At the same time, collaborative robotics arms equipped with vision systems automate the loading and unloading of labware, enabling continuous 24/7 operations with minimal human supervision.

In parallel, microfluidics and acoustic dispensing technologies are shrinking reaction volumes to nanoliter scales, driving down reagent consumption and reducing environmental waste. These innovations accelerate experimental cycles for high‐throughput screening and genomic library preparation, catalyzing discoveries in drug candidates and molecular diagnostics. Moreover, cloud‐based data platforms aggregate multiple instrument outputs into unified dashboards, providing cross‐platform insights that inform predictive maintenance schedules and resource allocation decisions. Together, these transformative shifts underscore a paradigm in which automated liquid handlers are no longer isolated instruments but integral nodes within a comprehensive digital laboratory ecosystem.

Assessing the Full Spectrum Effects of 2025 United States Tariff Adjustments on Automated Liquid Handler Supply Chains and Cost Structures

In 2025, the United States implemented a revised structure of tariffs on imported laboratory automation equipment, affecting a broad spectrum of components critical to automated liquid handlers. These adjustments, targeting pump assemblies, precision valves, and protective enclosures, have translated into elevated equipment acquisition costs for end users. As a result, many laboratories have been prompted to reevaluate procurement strategies, weighing the benefits of premium automation against the pressures of budgetary constraints.

Consequently, original equipment manufacturers (OEMs) have begun to diversify their supply chains, seeking non‐U.S. fabrication sites or sourcing alternative materials to mitigate the impact of levies on final product pricing. While some organizations have absorbed a portion of these costs to preserve customer relationships, others have passed the increases directly to purchasers, elongating payback periods and complicating return-on-investment calculations. In response, a growing number of laboratories are exploring refurbished instrumentation and extended service contracts as cost‐management tactics.

Looking ahead, the ongoing tariff environment is catalyzing a shift toward regional manufacturing hubs and closer partnerships between academic institutions and local OEMs. This reorientation promises to reduce logistical lead times and buffer against future policy fluctuations, albeit at the expense of streamlined global operations. Ultimately, the cumulative impact of the 2025 tariff measures is a recalibration of how laboratories approach capital investment, operational continuity, and risk diversification across the automation landscape.

Extracting Critical Insights from Product Type End User Application and Technology Segmentation to Illuminate Market Dynamics

Extracting critical insights from segmentation analyses reveals the nuanced dynamics shaping the automated liquid handler market. When examining product type segmentation, it is evident that dispensers, pipetting modules, tip eject assemblies, and washer units each cater to distinct workflow requirements. Dispenser platforms break down into peristaltic and syringe mechanisms, with peristaltic variants further leveraging piezoelectric and solenoid valve technologies to accommodate variable flow rates. Syringe‐driven dispensers, in contrast, deliver high‐pressure performance for viscous reagents. Pipetting solutions encompass acoustic droplet ejection alongside air displacement and positive displacement approaches, enabling laboratories to select modalities based on volume range and precision demands. Tip eject modules differentiate between adapter eject and nozzle eject designs, which optimize sample protection and cross‐contamination control, while washer systems span microplate washing and tube washing configurations to meet diverse sample cleanup protocols.

Turning to end user segmentation, academic research institutions prioritize modularity and protocol flexibility for exploratory studies, whereas biotechnology and pharmaceutical organizations concentrate on high‐throughput capacity and compliance standards. Clinical diagnostic laboratories, by necessity, demand traceable and validated workflows, and food and beverage testing operations emphasize throughput alongside stringent contamination prevention. Application‐based segmentation highlights the pivotal role of drug discovery in driving adoption, with genomics workflows subdivided into PCR amplification and sequencing preparation steps. High-throughput screening and proteomics applications benefit from batch processing and multiplexing capabilities. Finally, technology segmentation underscores the dominance of acoustic, air displacement, and positive displacement platforms, indicating that technological selection aligns closely with application-specific accuracy, throughput, and cost objectives.

This comprehensive research report categorizes the Automated Liquid Handlers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Delineating the Strategic Advantages and Adoption Trends Shaping the Americas Europe Middle East Africa and Asia Pacific Regions in Lab Automation

The Americas region leads in the adoption of automated liquid handlers, fueled by robust research funding in the United States and Canada. Major pharmaceutical hubs on the U.S. East and West Coasts leverage automation to accelerate high-throughput screening and genomics research, while Latin American centers are gradually integrating pipetting automation to bolster diagnostic capacities and agricultural biotechnology initiatives. Enhanced collaboration between academic consortia and regional OEMs continues to drive localized innovation in fluid handling precision and process automation.

Across Europe, the Middle East, and Africa, the landscape is characterized by a strong emphasis on compliance and standardization. European countries, particularly Germany, the United Kingdom, and France, lead investments in integrated laboratory automation platforms, aligning with stringent regulatory frameworks. Research initiatives in the Middle East are notably scaling in translational medicine, supported by public-private partnerships that fund next-generation automated workflows. In Africa, pilot programs in public health diagnostics are increasingly adopting washer and dispenser modules to streamline sample processing and reduce turnaround times.

In the Asia-Pacific region, markets such as China, Japan, South Korea, and India are witnessing rapid uptake of liquid handling automation, driven by expanding biopharmaceutical production and genomics research. Government-led initiatives in China and India emphasize self-reliance in biotechnology, incentivizing domestic manufacturing of automation hardware. Japan and South Korea maintain strong trajectories in precision medicine research, integrating acoustic dispensing and microfluidic technologies into hospital-based diagnostic laboratories. Regional supply chain enhancements and local R&D investments position Asia-Pacific as a critical growth frontier for automated liquid handler deployment.

This comprehensive research report examines key regions that drive the evolution of the Automated Liquid Handlers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Automated Liquid Handler Manufacturers Driving Innovation Through Strategic Alliances Technology Advancements and Market Positioning

The competitive landscape of automated liquid handler manufacturers is marked by a blend of established multinationals and agile niche innovators pursuing diverse growth strategies. Industry pioneers such as Tecan, Hamilton Company, Agilent Technologies, Thermo Fisher Scientific, and PerkinElmer have consistently expanded their portfolios through targeted acquisitions and strategic alliances. By integrating software platforms for workflow orchestration and data analytics, these firms reinforce end-to-end automation capabilities that span from sample preparation to downstream analysis.

At the same time, specialized players like Beckman Coulter and Eppendorf focus on optimized hardware designs and consumable ecosystems to maintain high margins in core pipetting and dispenser segments. Collaborations between instrument vendors and reagent suppliers have become increasingly common, facilitating bundled solutions that streamline procurement and validation processes. Emerging entrants leveraging microfluidic chip fabrication and acoustic droplet technologies continue to challenge conventional paradigms, pushing incumbents to accelerate innovation cycles.

Overall, market positioning hinges on a firm’s ability to deliver flexible, scalable platforms that accommodate evolving application needs while providing comprehensive service and support networks. As end users demand seamless integration with laboratory information management systems and cloud-based analytics, leading companies are investing heavily in open APIs and cybersecurity frameworks to differentiate their offerings. This confluence of strategic maneuvers shapes a dynamic environment in which continuous product enhancement and cross-industry partnerships drive sustained competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Liquid Handlers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Andrew Alliance SA by Waters Corporation is

- Aurora Biomed Inc.

- AutoGen, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Biotron Healthcare Pvt Ltd.

- Corning Incorporated

- Danaher Corporation

- Dynamic Devices

- Endress+Hauser Group Services AG

- Eppendorf SE

- FORMULATRIX, Inc.

- Gilson, Inc.

- Hamilton Company

- Hudson Robotics

- INTEGRA Biosciences AG

- IVEK Corporation

- Lonza Group Ltd.

- Megarobo Technologies Co., Ltd.

- METTLER TOLEDO

- PerkinElmer, Inc.

- QIAGEN N.V.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Implementing Actionable Strategies to Boost Automation Flexibility and Accelerate Adoption of Cutting Edge Liquid Handling Systems

Industry leaders should prioritize the development of modular liquid handling platforms that can be rapidly reconfigured for emerging applications, thereby reducing downtime and accelerating experimental throughput. By adopting open-architecture software interfaces, organizations enable seamless integration with existing laboratory information management systems, enhancing data traceability and workflow visibility. Concurrently, diversifying supply chains through multi-regional component sourcing and localized manufacturing partnerships will bolster resilience against policy shifts and tariff fluctuations.

Investments in workforce training programs are also essential to maximize the value of automation assets. Equipping laboratory personnel with skills in instrument programming, maintenance, and data analysis ensures optimal system utilization and empowers teams to troubleshoot advanced workflows independently. Additionally, forging collaborative research initiatives with reagent and consumable suppliers can streamline validation cycles, shorten time to deployment, and reduce overall project risks.

Finally, companies should embrace sustainability by optimizing protocols to minimize reagent volumes and waste generation. Integrating energy-efficient hardware components and promoting consumable recycling programs not only reduce environmental footprint but also align with corporate responsibility mandates. By executing these actionable recommendations, automation end users and OEMs can collectively drive innovation, operational excellence, and long-term competitiveness in the rapidly evolving field of liquid handling automation.

Outlining a Rigorous Research Methodology Underpinned by Qualitative Interviews Secondary Data Analysis and Expert Validation Processes

A rigorous research methodology underpins the insights presented in this report. Initially, comprehensive secondary research was conducted, drawing from peer-reviewed scientific journals, industry white papers, technical specifications published by instrumentation manufacturers, and regulatory guidelines governing clinical and diagnostic laboratories. These sources provided foundational context on technological advancements, compliance requirements, and historical adoption trends.

To enrich secondary findings, qualitative interviews were carried out with key stakeholders, including laboratory directors, process engineers, automation specialists, and procurement managers. These one-on-one discussions elucidated real-world challenges in implementation, deployment timelines, and return-on-value considerations. Interview data were systematically codified and triangulated against published case studies to identify consistent themes and best practices.

Expert validation rounds involved presenting preliminary findings to an advisory panel comprising distinguished academics, industry veterans, and technology consultants. Feedback from these sessions refined segment definitions, validated regional insights, and ensured that actionable recommendations resonated with operational realities. Throughout the process, data integrity was maintained through cross-verification, adherence to ethical research protocols, and ongoing review by an internal quality assurance team.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Liquid Handlers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Liquid Handlers Market, by Product Type

- Automated Liquid Handlers Market, by Technology

- Automated Liquid Handlers Market, by Application

- Automated Liquid Handlers Market, by End User

- Automated Liquid Handlers Market, by Region

- Automated Liquid Handlers Market, by Group

- Automated Liquid Handlers Market, by Country

- United States Automated Liquid Handlers Market

- China Automated Liquid Handlers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Insights Emphasizing the Strategic Imperative of Automated Liquid Handling Adoption to Drive Efficiency Through Innovation Integration and Scalability

The convergence of advanced robotics, artificial intelligence, and precision fluidics has permanently altered the laboratory landscape, establishing automated liquid handlers as indispensable assets across research and diagnostic settings. By synthesizing insights from segmentation, regional adoption, tariff impacts, and competitive strategies, this report illuminates the multifaceted value proposition of automation: enhanced throughput, heightened reproducibility, and comprehensive data transparency.

Laboratories that embrace configurable automation platforms and cultivate cross-functional collaborations will be best positioned to navigate evolving scientific demands. Addressing the challenges posed by 2025 tariffs through strategic supply chain diversification and localized partnerships can mitigate cost pressures and safeguard operational continuity. As organizations continue to integrate modular hardware, open software ecosystems, and sustainable practices, they will unlock new efficiencies and accelerate discovery pipelines.

Ultimately, automated liquid handlers offer a pathway to transform lab workflows into agile, data-driven processes. Stakeholders who commit to the recommendations outlined herein-spanning technology selection, process optimization, and workforce development-will drive competitive advantage and set new benchmarks for laboratory excellence in the age of automation.

Engage with Ketan Rohom Associate Director of Sales & Marketing to Unlock Automated Liquid Handling Insights and Purchase the Complete Research Report

To access unparalleled insights that will equip your team with the knowledge to make strategic investments in automated liquid handler technologies, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you will gain personalized guidance on how to leverage the full breadth of our research, including in‐depth profiles, trend analyses, and actionable recommendations tailored to your specific organizational priorities. Secure the complete report today to ensure your laboratory stays at the forefront of automation innovation and operational excellence.

- How big is the Automated Liquid Handlers Market?

- What is the Automated Liquid Handlers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?