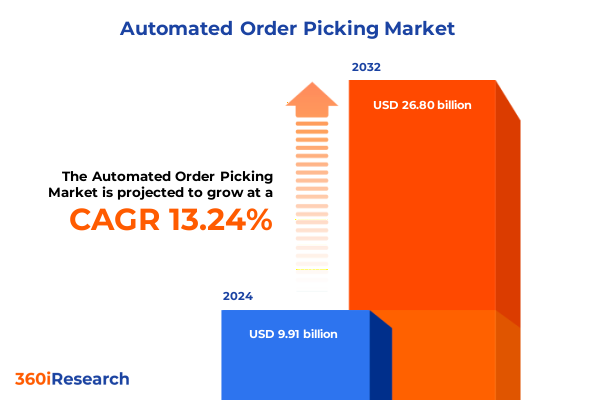

The Automated Order Picking Market size was estimated at USD 11.14 billion in 2025 and expected to reach USD 12.52 billion in 2026, at a CAGR of 13.36% to reach USD 26.80 billion by 2032.

Revolutionizing Fulfillment Efficiency with Next-Generation Automated Order Picking Technologies and Strategic Supply Chain Adaptations

Automated order picking has emerged as a cornerstone of modern warehouse operations, fundamentally reshaping how businesses fulfill customer demands in an era defined by speed and precision. As e-commerce volumes continue to surge, organizations across industries are seeking technologies capable of handling high-throughput picking tasks with minimal error rates. Solutions ranging from robotic arms and autonomous vehicles to sophisticated vision systems are increasingly being deployed to address labor shortages and reduce cycle times. While the upfront investments can be substantial, the resulting improvements in order accuracy and throughput deliver measurable operational efficiencies that are critical in today’s competitive marketplace. Transitioning from traditional manual processes to a hybrid model that leverages automation not only accelerates order processing but also redeploys human talent toward value-added activities such as exception handling and quality assurance.

Unprecedented Technological and Operational Shifts Redefining Automated Order Picking in Response to Evolving Market and Workforce Dynamics

The automated order picking landscape is undergoing transformative shifts driven by breakthroughs in artificial intelligence, sensor fusion, and real-time data analytics. AI-powered robotics now deliver greater flexibility, enabling systems to handle diverse item profiles and adapt dynamically to fluctuating order volumes. For instance, Amazon’s deployment of over one million robots has nearly matched its human workforce, boosting deliveries per employee from 175 in 2015 to almost 3,870, and accelerating its path toward more autonomous operations. Meanwhile, voice-activated guidance and augmented reality are streamlining picker workflows, reducing training times and error rates as warehouse environments grow more complex.

Autonomous mobile robots (AMRs) represent another paradigm shift, navigating without fixed pathways and coordinating through advanced machine-learning algorithms. Their ability to integrate seamlessly with existing warehouse management systems fosters a modular approach to automation that suits mid-sized and large distribution centers alike. Furthermore, digital twin technology, which creates virtual replicas of physical facilities, allows planners to simulate layout changes, prevent bottlenecks, and optimize routes before committing to capital projects. As a result, companies are not only increasing throughput but also enhancing agility, enabling rapid reconfiguration to address seasonal peaks and product mix variations.

Assessing the Ripple Effects of 2025 United States Tariff Policies on Automation Investment, Supply Chain Resilience, and Robotics Adoption Trends

In early 2025, the latest round of United States tariffs introduced by the federal administration reverberated across global supply chains, elevating costs for robotics components such as sensors, actuators, and rare earth magnets. Components sourced predominantly from China now attract levies that inflate equipment prices, creating headwinds for automation vendors and end users alike. Swiss industrial firm ABB has reported tentative buying patterns among major buyers, as policy uncertainty delays investment decisions and dampens expansion plans.

Simultaneously, some organizations are accelerating their automation roadmaps in response to tariff-induced labor cost increases. Food and beverage producers, for example, have turned to robotics-as-a-service models to shore up production continuity amid supply chain volatility, witnessing adoption uplifts of nearly 17% within months of tariff announcements. Counterintuitively, extended trade restrictions have spurred local sourcing initiatives, prompting reshoring of critical manufacturing steps and fostering domestic supply chain resilience. Despite these adaptive strategies, experts caution that prolonged tariffs without clear policy timelines could prolong capital uncertainty, potentially suppressing long-term robotics integration and slowing the evolution toward fully autonomous fulfillment centers.

Illuminating the Multifaceted Segmentation Landscape Reveals Technology, Industry, Component, Function, and Warehouse Type Drivers

A comprehensive examination of the automated order picking arena reveals that technological segmentation is key to understanding solution adoption. Under the technology lens, automated storage and retrieval systems coexist with autonomous mobile robots, distinct conveyor and sortation networks, and goods-to-person interfaces. Each category subdivides further, from micro-load to mini-load and unit-load ASRS configurations, and from laser-guided to vision-guided mobile robots, highlighting varying trade-offs between speed, flexibility, and footprint. Conveyors and sortation systems range from traditional belt-based frameworks to parcel sorters and roller conveyors, while goods-to-person platforms continue to push the envelope in ergonomic and throughput gains.

Parallel segmentation by end-user industry underscores divergent automation priorities. The automotive sector prioritizes high-precision part handling, while e-commerce and retail players-spanning electronics, fashion, and grocery verticals-balance scalability with pick accuracy. Food and beverage operators emphasize hygienic design and throughput, healthcare and pharmaceuticals demand exacting traceability, and logistics and distribution networks, both in-house and third-party, seek integrated solutions that connect seamlessly with warehouse management and control systems. Within component classification, the autonomy of automation hinges on the confluence of hardware elements-ranging from actuators to sensors and cameras-complemented by services such as consulting, integration, maintenance, and support, all orchestrated through specialized robotics management software, warehouse control systems, and warehouse management platforms. Functional segmentation spotlights the specialized nature of packaging workflows-boxing, labeling, wrapping-alongside palletizing, picking, and sortation technologies such as cross-belt and high-speed sortation. Finally, the warehouse type dimension distinguishes between cold storage environments, where thermal constraints shape system design, and non-temperature-controlled spaces, which accommodate a broader array of goods but may prioritize speed and density over environmental safeguards.

This comprehensive research report categorizes the Automated Order Picking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Function

- End-User Industry

- Warehouse Type

Regional Dynamics Highlight Distinct Growth Patterns and Strategic Priorities Across the Americas, EMEA, and Asia-Pacific Automated Order Picking Markets

The regional dimension of automated order picking underscores distinct dynamics across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, North American leaders leverage deep local manufacturing ecosystems and advanced robotics research to pilot and scale novel automation frameworks. Latin American adopters, though offset by infrastructure variability, are rapidly implementing flexible mobile systems to manage surging e-commerce demands and reduce reliance on manual picking. Transitioning eastward, the EMEA region combines stringent sustainability mandates with legacy logistics networks, driving investment in energy-efficient systems and smart integration of IoT and blockchain for enhanced traceability. Western European distribution hubs are trialing electric-powered robots and digital twins, while Middle Eastern logistics parks aim to become regional e-commerce gateways through public-private partnerships that emphasize cutting-edge warehouse technologies.

In the Asia-Pacific, the convergence of high-growth economies and strategic trade corridors has fueled a prolific uptake of automation. Southeast Asian quick-commerce and dark-store models mandate high-speed sortation and modular mobile fleets, whereas China and Japan-with established robotics manufacturing bases-pursue increasingly autonomous operations supported by AI-driven analytics. Australia’s sparse geography and temperature extremes have led to specialized solutions for remote cold storage, while India’s e-commerce boom is spurring investments in centralized distribution hubs that deploy both fixed ASRS and mobile robot swarms to address labor constraints and realign supply chain resilience.

This comprehensive research report examines key regions that drive the evolution of the Automated Order Picking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Illuminates Strategic Collaborations, Innovative Offerings, and Competitive Positioning Shaping Automation Solutions

Leading companies in the automated order picking domain are carving out differentiated value propositions through strategic partnerships, continuous R&D, and expansive service portfolios. Global robotics integrators emphasize end-to-end solution delivery, coupling hardware design with bespoke software customization and lifecycle support. Specialized mobile robotics vendors focus on navigation precision and scalability, often collaborating with WMS providers to deliver cohesive technology stacks. Traditional automation giants are expanding their offerings to include cloud-based control systems and predictive maintenance services, aiming to foster recurring revenue streams. Meanwhile, innovative start-ups are disrupting conventional models through robots-as-a-service and pay-per-use frameworks that lower entry barriers and accelerate deployment cycles. Key players also concentrate on open-architecture platforms to facilitate third-party integrations and accommodate industry-specific adaptations, underscoring a broader shift toward ecosystem-driven automation strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Order Picking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AutoStore AS

- Bastian Solutions, LLC

- Daifuku Co., Ltd.

- Dematic Corp.

- Exotec SAS

- Fortna Inc.

- Honeywell Intelligrated

- KNAPP AG

- Locus Robotics Corp.

- Murata Machinery, Ltd.

- SSI Schäfer

- Swisslog AG

- Symbotic Inc.

- TGW Logistics Group GmbH

- Vanderlande Industries B.V.

Actionable Strategies for Industry Executives to Leverage Automation Innovations, Navigate Trade Policy Uncertainty, and Drive Sustainable Growth

Industry leaders seeking to capitalize on automated order picking must adopt a multi-pronged approach that balances technology selection, policy navigation, and workforce strategy. First, aligning automation roadmaps with core business objectives ensures that investments deliver measurable performance gains; pilot programs should be structured to validate ROI while allowing rapid scaling across multiple sites. Second, proactive engagement with policymakers and trade associations can provide advance visibility into potential tariff changes, enabling contingency measures such as diversified sourcing or component localization. Third, developing a robust talent ecosystem-through targeted reskilling initiatives, academic partnerships, and in-house training academies-will bridge the skills gap and empower workers to oversee complex automation systems. Finally, sustainability considerations should be embedded into solution design, with energy monitoring, recyclable materials, and intelligent scheduling driving both regulatory compliance and brand differentiation.

Rigorous Multi-Phase Research Methodology Ensures Data Integrity, Comprehensive Analysis, and Insightful Market Perspectives for Decision-Making

Our research methodology integrates primary and secondary data collection across multiple phases to ensure analytical rigor and comprehensive coverage. Initially, we conducted in-depth interviews with over 50 industry stakeholders, including C-level executives, plant managers, and technology providers, to capture first-hand perspectives on automation challenges and priorities. Secondary sources comprised peer-reviewed journals, technical white papers, and publicly available government trade documents to substantiate tariff backgrounds and regional policy frameworks. Quantitative analysis was performed using a bottom-up approach, aggregating technology deployments and installation rates across key verticals, while scenario modeling assessed the potential impact of tariff fluctuations and supply chain disruptions. Data validation protocols included triangulation of interview responses with vendor shipment records and independent audit reports. Finally, insights were peer-reviewed by an advisory panel of robotics and logistics experts to ensure accuracy, relevance, and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Order Picking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Order Picking Market, by Technology

- Automated Order Picking Market, by Component

- Automated Order Picking Market, by Function

- Automated Order Picking Market, by End-User Industry

- Automated Order Picking Market, by Warehouse Type

- Automated Order Picking Market, by Region

- Automated Order Picking Market, by Group

- Automated Order Picking Market, by Country

- United States Automated Order Picking Market

- China Automated Order Picking Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Consolidating Insights into Automated Order Picking Underscores Critical Trends, Challenges, and Opportunities for Future Operational Excellence

In conclusion, automated order picking stands at the nexus of technological innovation and strategic resilience, offering enterprises a pathway to meet ever-increasing fulfillment expectations while navigating a complex trade environment. The confluence of AI-enabled robotics, modular automation platforms, and advanced analytics is reshaping warehouse design and operational paradigms. At the same time, geopolitical factors such as evolving tariffs are prompting organizations to rethink supply chain architectures, driving a resurgence in domestic sourcing and diversified manufacturing footprints. Segmentation insights reveal that no single solution fits all; rather, success depends on aligning technology capabilities with industry-specific requirements, warehouse environments, and functional priorities. Regional analysis underscores that strategic investments are concentrated in areas that blend high growth potential with supportive policy landscapes. As competitive pressures intensify, companies that embrace end-to-end automation strategies, foster ecosystem partnerships, and invest in workforce transformation will be best positioned to achieve sustained operational excellence and long-term growth.

Engage with Ketan Rohom to Unlock Comprehensive Automated Order Picking Insights and Propel Your Strategic Decision-Making with Our Latest Report

To explore the full breadth of automated order picking insights, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage directly to discuss tailored research solutions that address your organization’s unique operational needs and supply chain challenges. Ketan’s expertise spans strategic market positioning, technology evaluation, and customized analytics, ensuring you receive the precise intelligence and actionable guidance necessary to stay ahead in a rapidly evolving automation landscape. Don’t miss this opportunity to leverage our comprehensive report and unlock new pathways to efficiency, cost savings, and competitive differentiation-reach out today to secure your copy and begin transforming your warehouse operations.

- How big is the Automated Order Picking Market?

- What is the Automated Order Picking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?