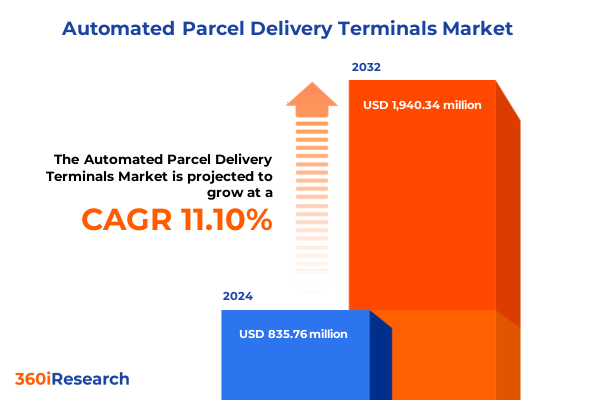

The Automated Parcel Delivery Terminals Market size was estimated at USD 922.64 million in 2025 and expected to reach USD 1,024.48 million in 2026, at a CAGR of 11.20% to reach USD 1,940.33 million by 2032.

Setting the Stage for Revolutionary Automated Parcel Delivery Solutions in a Fast-Evolving Global Logistics Environment

The logistics industry is undergoing a profound transformation as consumer expectations for rapid, convenient, and reliable delivery services continue to rise. Automated parcel delivery terminals have emerged as a pivotal innovation in the last-mile segment, enabling retailers, carriers, and service providers to streamline operations, minimize delivery costs, and deliver around-the-clock accessibility to end users. These unattended kiosks, often deployed in high-traffic locations such as supermarkets, transit hubs, and office buildings, serve as secure drop-off and pick-up points that transcend the limitations of traditional home delivery methods.

In this dynamic environment, market participants are channeling significant investments into advanced hardware solutions, robust software platforms, and integrated service offerings capable of handling diverse package sizes and fluctuating parcel volumes. Digital connectivity enhancements-including real-time tracking, mobile notifications, and remote management dashboards-have elevated the customer experience and enabled operators to optimize locker capacity and throughput. Furthermore, the convergence of IoT sensors, cloud-based analytics, and seamless payment integrations is redefining operational visibility and unlocking new revenue streams through value-added services.

Against the backdrop of rapid e-commerce growth and mounting urbanization pressures, the adoption of automated parcel terminals is set to redefine last-mile logistics. Stakeholders across the ecosystem-from manufacturers and technology providers to retail chains and postal authorities-must navigate a complex web of strategic considerations, including technology integration, site selection, regulatory compliance, and sustainability imperatives. As we embark on this exploration of market dynamics, the following sections will illuminate transformative trends, segmentation nuances, regional differentiators, and actionable strategies essential for driving success in this burgeoning domain.

Exploring the Technological and Consumer-Driven Shifts Reshaping the Automated Parcel Delivery Terminal Ecosystem Worldwide

Over the past several years, the automated parcel delivery terminal ecosystem has been propelled by a series of transformative shifts that extend well beyond simple mechanization of locker units. Driven by exponential growth in e-commerce volumes, consumer demand for omnichannel experiences has surged, compelling retailers and carriers to deploy digitally enabled pickup points that bridge the gap between online shopping and brick-and-mortar convenience. This paradigm shift has been further amplified by the proliferation of micro-fulfillment centers and urban consolidation hubs designed to reduce delivery distances and environmental impact.

Simultaneously, advancements in artificial intelligence and robotics have empowered operators to enhance terminal throughput and predictive maintenance capabilities. Machine-learning algorithms analyze historical usage patterns to forecast peak demand periods, enabling dynamic allocation of resources and targeted expansion of terminal networks. IoT-enabled sensors embedded within locker modules continuously monitor temperature, humidity, and package volume, triggering automated alerts for preventive maintenance and capacity adjustments. Collectively, these technological evolutions are redefining operational efficiency and unlocking unprecedented levels of scalability.

Consumer behavior has also undergone a fundamental transformation, with time-definite deliveries and flexible pickup windows becoming table stakes in the modern shopping experience. The seamless integration of mobile wallets, biometric authentication, and touchless interfaces addresses both convenience and health considerations, especially when viewed against the backdrop of heightened hygiene awareness. As the industry landscape continues to evolve, the interplay between digital innovation, consumer-centric design, and sustainable practices will remain at the forefront of strategic decision-making for terminal operators and technology vendors alike.

Assessing How Recent United States Tariff Policies in 2025 Are Driving Significant Changes in Supply Chains and Terminal Economics

In 2025, the United States implemented a new set of tariff measures targeting imported components and finished units associated with automated parcel delivery terminal systems. These policy changes have exerted considerable pressure on cost structures across the supply chain, as key hardware elements such as industrial-grade lockers, electronic locking mechanisms, and embedded sensors often originate from Asia-Pacific manufacturing hubs. The increased duties have prompted terminal producers to reassess procurement strategies and explore localized sourcing options to maintain competitive pricing and mitigate margin erosion.

As a direct consequence of elevated import costs, many operators have accelerated investments in domestic assembly and manufacturing partnerships. By collaborating with North American steel fabricators and electronics integrators, market participants are seeking to reduce lead times, improve supply chain resilience, and capitalize on government incentives for reshoring strategic industries. While these efforts have introduced initial capital expenditures to establish local production capabilities, the long-term benefits include decreased exposure to tariff volatility and enhanced control over quality assurance.

Furthermore, the tariff-driven cost escalation has spurred innovations in design optimization, with several vendors unveiling modular locker platforms that leverage standardized, interchangeable components. This approach not only streamlines inventory management but also simplifies regulatory compliance, as modules can be adapted to meet regional safety standards and environmental regulations. In parallel, software providers are offering subscription-based licensing models that decouple digital platform access from hardware expenditures, enabling operators to spread costs over time and align technology investments with recurring revenue streams.

Unveiling Intricate Segment Perspectives Through Component, Package Size, Functionality, Deployment, and Application Type Dimensions

Analyzing the market through a component lens reveals a tripartite structure encompassing robust hardware, comprehensive service offerings, and sophisticated software platforms. Hardware investments encompass the physical locker units, electronic locking devices, and environmental control systems, while service portfolios include installation, maintenance, and customer support solutions that ensure seamless uptime. Software modules provide the critical connective tissue, enabling remote monitoring, real-time reporting, and integration with carrier networks and retail point-of-sale systems.

When examining package size preferences, small lockers have emerged as a go-to solution for high-frequency, lightweight parcels, optimizing space for rapid turnover. Medium-sized compartments accommodate standard merchandise such as apparel and consumer electronics, striking a balance between capacity and flexibility. Large-package modules address the growing need to handle bulkier items, including home appliances and oversized retail goods, often integrated into specialized terminal rows or standalone units in retail parking areas.

Functionality segmentation underscores three distinct modes of operation in the ecosystem: two-way terminals that support both drop-off and pick-up transactions, facilitating returns and exchanges; single-dimension parcel drop-off stations designed to streamline outbound logistics; and dedicated pick-up terminals optimized for consumer retrieval workflows. This functional clarity empowers operators to tailor deployments according to local demand profiles and logistical network configurations.

Deployment environments further divide the market into indoor and outdoor applications. Indoor terminals, typically situated within shopping malls, office complexes, and residential lobbies, benefit from climate-controlled conditions and enhanced security controls. In contrast, outdoor lockers-engineered with weather-resistant exteriors and reinforced locking systems-are strategically placed in urban centers, transit stops, and campus environments to maximize accessibility and round-the-clock availability.

From an application type standpoint, e-commerce retailers remain the primary adopters of parcel terminals, leveraging the network to reduce last-mile delivery costs and enhance customer satisfaction. Healthcare organizations are tapping into secure locker solutions for medical supply distribution and sample collection, prioritizing temperature-controlled compartments for sensitive items. Logistics providers incorporate terminals into multimodal networks to facilitate consolidated carrier handoffs and reverse logistics processes. Meanwhile, brick-and-mortar retailers utilize locker installations to support click-and-collect initiatives, driving incremental foot traffic and enhancing in-store cross-sell opportunities.

This comprehensive research report categorizes the Automated Parcel Delivery Terminals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Functionality

- Deployment

- Application Type

Dissecting Regional Trends and Growth Drivers across Americas, Europe Middle East Africa, and Asia Pacific Parcel Terminal Markets

The Americas region continues to lead in the deployment of automated parcel delivery terminals, buoyed by high consumer adoption rates and mature e-commerce ecosystems. In the United States and Canada, dense urban corridors have witnessed extensive rollout of locker networks by major carriers and retail chains, creating an accessible mesh of pickup points. Operators in Latin America are rapidly adopting the technology to address logistical challenges in sprawling metropolitan areas, leveraging both public-private partnerships and fintech solutions to expand financial inclusion through contactless payment integration.

Europe, Middle East, and Africa (EMEA) present a tapestry of market maturity profiles, with Western Europe often serving as a test bed for advanced terminal innovations. Countries such as Germany, the United Kingdom, and the Netherlands showcase high locker-per-capita penetration, fueled by regulatory support for sustainable logistics and proactive initiatives to alleviate urban congestion. In the Middle East, large-scale smart city projects and government-led infrastructure programs are creating greenfield opportunities for terminal deployment, while select African markets are embracing modular, solar-powered units to overcome limited grid reliability.

Asia-Pacific (APAC) is characterized by the most rapid growth trajectory, underpinned by exponential e-commerce expansion in China, India, and Southeast Asia. Major postal operators and private logistics firms in China have integrated massive public locker networks with mobile applications, enabling seamless peer-to-peer parcel exchange and last-mile outsourcing. In India, a surge in digital payments and tier-2 city expansions has catalyzed investments in strategically located terminal banks. Meanwhile, Southeast Asian nations are exploring hybrid indoor-outdoor models to adapt to varied climatic conditions and urban density challenges.

This comprehensive research report examines key regions that drive the evolution of the Automated Parcel Delivery Terminals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Approaches in Transforming Automated Parcel Terminal Services Globally

Industry pioneers have distinguished themselves through product innovation, strategic alliances, and agile market expansion tactics. One leading hardware manufacturer introduced a multi-temperature locker line that accommodates perishable goods, opening doors for fresh food and pharmaceutical delivery use cases. Another technology group forged partnerships with major postal operators to co-develop embedded software solutions that synchronize real-time tracking data across diverse carrier networks, enhancing end-to-end visibility.

A global software vendor secured alliances with retail franchises and financial institutions to integrate digital payment ecosystems directly into terminal interfaces, thus streamlining checkout processes and unlocking new monetization channels. Meanwhile, a logistics company expanded its footprint through acquisitions of regional locker management firms, consolidating service capabilities and standardizing operational protocols across disparate markets.

Several emerging contenders are also reshaping the competitive landscape by focusing on niche applications. A healthcare-focused provider launched temperature-controlled modules with advanced insulation and remote climate monitoring, while a startup specializing in micro-fulfillment unveiled autonomous mobile terminals that can be redeployed dynamically based on real-time demand signals. Collectively, these strategic moves underscore the critical importance of agility, cross-sector collaboration, and continuous R&D investment in maintaining differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Parcel Delivery Terminals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bell and Howell LLC

- ByBox Holdings Limited

- Cleveron AS

- Daifuku Co., Ltd.

- Dematic Corporation

- ENGY Company

- Fives Group

- InPost S.A.

- Keba AG

- Leonardo S.p.A.

- LockTec GmbH

- Murata Machinery Ltd.

- NEC Corporation

- Neopost Group

- OPEX Corporation

- Pitney Bowes Inc.

- Quadient S.A.

- Schneider Electric SE

- Smartbox Ecommerce Solutions Pvt. Ltd.

- Solystic SAS

- Toshiba Corporation

- TZ Limited

- Vanderlande Industries B.V.

- Winnsen Industry Co., Ltd.

- Yaskawa Electric Corporation

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities in Automated Parcel Delivery Networks

To thrive amid intensifying competition and evolving consumer expectations, industry leaders must adopt a multi-pronged strategic roadmap. First, designing modular hardware architectures will enable rapid customization for varied use cases and simplify lifecycle management. By standardizing core components and leveraging interchangeable modules, companies can reduce production costs and accelerate time-to-market for new terminal models.

Second, integrating advanced analytics and AI-driven insights into operations will optimize network performance and deliver predictive maintenance capabilities. Real-time data streams from terminals should feed into centralized platforms that identify utilization trends, detect anomalies, and recommend capacity adjustments. This proactive approach to maintenance and distribution planning will minimize downtime and enhance customer satisfaction.

Third, expanding service portfolios through value-added offerings-such as on-demand lifetime agreements, locker reconfiguration services, and branded promotional experiences-can bolster recurring revenue streams. Collaborations with retail partners and logistics providers should focus on co-creating integrated solutions that align with emerging omnichannel retail strategies.

Fourth, forging strategic alliances with carriers, property owners, and government entities will secure prime deployment sites and establish mutually beneficial revenue-sharing models. Co-locating terminals in high-footfall zones and transportation hubs maximizes accessibility, while partnerships with local authorities can unlock subsidies and streamline permit processes.

Finally, prioritizing sustainability and regulatory compliance across the entire value chain is imperative. Deploying energy-efficient hardware components, implementing closed-loop recycling programs, and adhering to regional data privacy standards will enhance brand reputation and preempt potential legal challenges.

Comprehensive Research Framework Outlining Data Collection, Analysis Techniques, and Validation Processes for Terminal Market Insights

The research methodology underpinning this analysis combines rigorous primary and secondary data collection techniques to ensure comprehensive market coverage and objective insights. Primary research was conducted through structured interviews with senior executives representing hardware manufacturers, software providers, logistics operators, and end-user organizations. These consultations probed strategic priorities, technology adoption drivers, and deployment challenges across diverse geographies.

Secondary data sources included industry reports, regulatory filings, patent databases, corporate press releases, and financial statements to capture macroeconomic trends, competitive landscapes, and policy developments. Quantitative data was triangulated through statistical modeling, comparative analysis of shipment volumes, and desk research on tariff schedules and trade flows.

Data validation was reinforced through expert panel reviews comprising logistics professors, supply chain consultants, and technology specialists. Feedback loops ensured that emerging hypotheses were tested against real-world scenarios and regional nuances. Analytical frameworks such as SWOT, PESTEL, and Porter’s Five Forces were applied to evaluate market structure, competitiveness, and risk factors.

Visualization tools were utilized to map terminal network densities, segment hierarchies, and technology adoption curves. Wherever possible, metrics were normalized to account for currency fluctuations and adjusted for regional purchasing power parity. This blended approach delivers both strategic depth and practical applicability, guiding stakeholders through critical decision points in terminal network planning and platform selection.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Parcel Delivery Terminals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Parcel Delivery Terminals Market, by Component

- Automated Parcel Delivery Terminals Market, by Functionality

- Automated Parcel Delivery Terminals Market, by Deployment

- Automated Parcel Delivery Terminals Market, by Application Type

- Automated Parcel Delivery Terminals Market, by Region

- Automated Parcel Delivery Terminals Market, by Group

- Automated Parcel Delivery Terminals Market, by Country

- United States Automated Parcel Delivery Terminals Market

- China Automated Parcel Delivery Terminals Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Critical Industry Findings and Forecasting the Strategic Outlook for Automated Parcel Delivery Terminals Amidst Evolving Logistics Dynamics

The automated parcel delivery terminal sector stands at the nexus of technological innovation, consumer convenience, and logistics optimization. Our analysis has spotlighted the profound influence of digital transformation, tariff reshaping of supply chains, nuanced segmentation dynamics, and region-specific growth profiles. Leading players are differentiating through modular hardware, integrated software ecosystems, and strategic collaborations that address the end-to-end customer journey.

Regional disparities underscore the need for tailored deployment strategies, with mature markets favoring sophisticated indoor networks and emerging regions prioritizing cost-effective outdoor solutions. The 2025 tariff landscape in the United States has catalyzed a shift toward domestic manufacturing, design modularity, and flexible financing models that collectively mitigate trade policy risks.

Looking ahead, success in this domain will hinge on the ability to harness data-driven intelligence, foster ecosystem partnerships, and iterate rapidly in response to evolving consumer behaviors. Sustainability and regulatory compliance will remain critical pillars, demanding proactive engagement with policymakers and investment in green technologies. As market participants navigate this dynamic terrain, the insights and recommendations presented herein will serve as a foundation for strategic planning and competitive differentiation.

Unlock In-Depth Market Intelligence on Automated Parcel Delivery Terminals by Engaging Directly with Ketan Rohom for Customized Purchase Options

Elevate your strategic planning with access to exhaustive insights on the automated parcel delivery terminals landscape. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored report packages, discuss specific market segments, and secure the intelligence you need to outpace competitors and capture emerging opportunities. Connect directly with Ketan to finalize your purchase and unlock data-driven decision support that empowers your organization’s growth trajectory.

- How big is the Automated Parcel Delivery Terminals Market?

- What is the Automated Parcel Delivery Terminals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?