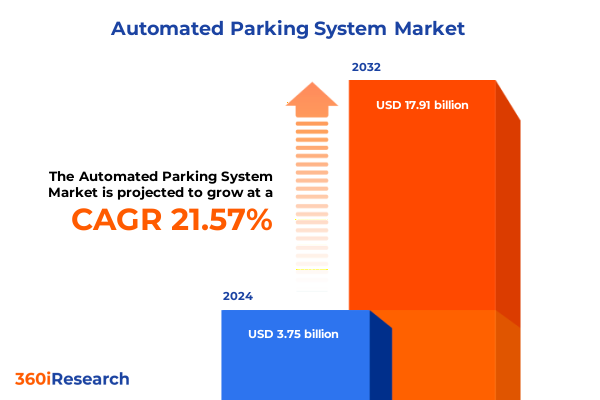

The Automated Parking System Market size was estimated at USD 4.51 billion in 2025 and expected to reach USD 5.41 billion in 2026, at a CAGR of 21.77% to reach USD 17.91 billion by 2032.

Recognizing the Critical Role of Automated Parking Systems in Addressing Urban Congestion Customer Expectations and Emerging Mobility Trends

Urban centers around the world are grappling with mounting vehicle densities and the consequential strain on parking resources. In response, automated parking systems have emerged as a pivotal solution to unlock real estate value, streamline traffic flows, and elevate user satisfaction. As urban planners and infrastructure providers seek to integrate smart mobility frameworks, automated parking technology stands poised at the intersection of innovation and necessity.

Over the past decade, the proliferation of smart city initiatives has underscored the strategic importance of efficient parking management. Automated systems that utilize advanced sensors and software not only reduce search times but also support environmental objectives by minimizing idle vehicle emissions. Concurrently, the convergence of digital transformation and urbanization pressures has accelerated demand for next-generation parking infrastructures that can seamlessly integrate into broader mobility ecosystems.

Looking ahead, the introduction of connected vehicle platforms, real-time data analytics, and sustainability-driven design criteria will further propel the automated parking segment into mainstream adoption. Stakeholders must therefore appreciate both the technical and operational imperatives that underpin this market. This executive summary synthesizes the latest industry dynamics, regulatory considerations, and segmentation perspectives to offer a concise yet comprehensive introduction to the evolving landscape of automated parking systems.

Examining the Technological Innovations Regulatory Developments and Consumer Preferences That Are Disrupting the Automated Parking Landscape

Automated parking systems today are influenced by a confluence of technological breakthroughs, shifting regulatory frameworks, and evolving end-user preferences. First, advancements in sensor miniaturization, machine learning algorithms, and connectivity protocols have enabled more reliable and cost-effective deployments. These innovations have unlocked new use cases, from fully robotic garages in high-density urban cores to compact systems that retrofit into existing structures, thereby broadening the addressable market.

Simultaneously, governments and municipalities are enacting policies aimed at reducing carbon footprints and promoting intelligent transportation. Incentives for green infrastructure and mandates for smart parking solutions are driving public and private investment alike. In parallel, emerging safety and cybersecurity standards are shaping product development roadmaps, requiring vendors to embed robust data protection and fail-safe mechanisms within their offerings.

Consumer expectations have also shifted markedly, with end users demanding seamless, on-demand experiences akin to ride-hailing and retail checkout applications. The rise of connected vehicles and digital wallets has heightened the importance of frictionless entry, payment, and exit processes. As a result, providers are prioritizing user interface design and mobile integration to ensure that automated parking systems align with modern consumer habits and brand expectations.

Assessing How 2025 United States Tariff Policies on Automotive and Sensor Components Are Reshaping Supply Chains and Cost Structures

In 2025, tariff adjustments in the United States have introduced additional duties on imported automotive hardware and sensor components, altering cost structures across the automated parking supply chain. Components such as cameras, infrared modules, and control electronics are now subject to higher duties, which has increased procurement expenses for integrators and system constructors. The cumulative effect has been a push toward domestic sourcing and the exploration of alternative materials to mitigate tariff liabilities.

These policy shifts have also prompted a reevaluation of supplier partnerships and logistics strategies. Companies with vertically integrated manufacturing capabilities have found themselves at a competitive advantage, while those reliant on overseas suppliers are accelerating diversification efforts. Transit of critical components through tariff-free trade agreements and bonded warehouses has emerged as a tactical response to preserve margin integrity without compromising on product functionality.

In light of these challenges, industry players are adopting more resilient supply chain models, leveraging nearshoring options and dual-sourcing arrangements. At the same time, increased collaboration between manufacturers and logistics providers aims to optimize inventory holding, reduce lead times, and ensure compliance with evolving trade regulations. Such strategic steps are crucial in maintaining project timelines and safeguarding end-user pricing models amid fluctuating duty regimes.

Deriving Strategic Perspectives Through a Comprehensive Analysis of Application Offering Sensor Parking Type and End User Segmentation Frameworks

A nuanced examination of application segmentation reveals a clear dichotomy between off-street and on-street installations. Off-street systems, typically located within parking garages or dedicated facilities, are characterized by higher upfront complexity and integration costs, yet they deliver substantial throughput and enhanced security. Conversely, on-street solutions leverage existing curbside real estate and focus on rapid deployment, offering lower-impact footprint and accelerated time to operational status. Both approaches demand tailored designs and operational workflows to meet divergent urban planning objectives.

When analyzing the offering spectrum, hardware investments remain foundational, particularly in car lifts, conveyors, and deck racks, which underpin the mechanical orchestration of automated parking. Yet the growing prominence of service models-encompassing maintenance, remote monitoring, and warranty programs-complements hardware by safeguarding uptime and lifetime performance. Software platforms, meanwhile, act as the connective tissue, delivering reservation management, dynamic pricing, and operational analytics that refine decision-making and elevate user experiences.

Sensor architecture serves as a technological linchpin, with camera, infrared, radar, and ultrasonic modalities each presenting distinct advantages. Camera systems offer high-resolution imaging suitable for license plate recognition, while infrared sensors excel in low-light detection. Radar provides robust obstacle mapping under diverse weather conditions, and ultrasonic modules furnish precise proximity measurements for real-time positioning. The optimal mix of sensor types is determined by site-specific parameters, environmental factors, and performance requirements.

Further differentiation arises across parking type, where private installations-often found in residential or corporate campuses-emphasize exclusivity and custom configuration, whereas public facilities prioritize scalability and throughput to accommodate high volumes of transient users. End-user segmentation spans commercial, municipal, and residential sectors. In commercial contexts such as hospitality, office, and retail venues, premium convenience and brand alignment are paramount. Municipal and public works applications require alignment with urban mobility plans, public safety regulations, and budgetary constraints. Residential deployments in multifamily and single-family environments highlight compact design, noise mitigation, and ease of integration within community guidelines.

This comprehensive research report categorizes the Automated Parking System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Sensor Type

- Parking Type

- Application

- End User

Highlighting Regional Variations in Adoption Infrastructure Readiness and Regulatory Environments Across the Americas EMEA and Asia-Pacific Markets

The Americas region exhibits robust adoption of automated parking technologies, driven by major metropolitan hubs that prioritize smart infrastructure and private investment. North American projects often feature integrated mobility hubs that combine parking with shared mobility services, ride-hailing zones, and electric vehicle charging points. Latin America, while still emerging in this sector, shows growing interest in pilot programs that address severe urban congestion and parking scarcity, particularly in densely populated cities.

Across Europe, Middle East, and Africa, regulatory initiatives serve as a primary catalyst for uptake. European Union directives on emissions reduction and urban planning are motivating public authorities to fund demonstration sites and public-private partnerships. Meanwhile, the Middle East has witnessed notable deployments in large-scale mixed-use developments, leveraging state-backed financing to create iconic cityscapes. In Africa, limited infrastructure budgets constrain widespread adoption, yet select first-mover cities are exploring modular systems to modernize aging parking assets.

The Asia-Pacific landscape is marked by dynamic growth and competitive innovation, as countries such as Japan, South Korea, and Singapore spearhead turnkey automated parking installations to maximize limited land availability. China’s vast urbanization push has led to the mass deployment of high-density robotic garages in tier-one cities, with local manufacturers offering cost-competitive solutions. Southeast Asian markets are also catching up, with pilot installations in key financial centers and hospitality districts demonstrating strong proof of concept for broader rollouts.

This comprehensive research report examines key regions that drive the evolution of the Automated Parking System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automated Parking System Providers and Emerging Players to Uncover Their Strategic Initiatives Partnerships and Technological Differentiators

Market incumbents and emerging players alike are refining their strategic positioning to capitalize on evolving demand. Established industrial conglomerates have deployed dedicated automated parking divisions, leveraging deep expertise in mechanical engineering and manufacturing scale. These firms often secure marquee projects through turnkey solutions, supported by global service networks that ensure consistent maintenance and upgrades.

At the same time, technology-focused entrants are differentiating through proprietary software and advanced sensor fusion capabilities. By integrating artificial intelligence for predictive analytics and dynamic optimization, these innovators deliver enhanced operational efficiency and superior user interfaces. Partnerships with smart city consortiums and automotive manufacturers further strengthen their ecosystems, enabling cross-domain integration and new revenue streams through data-driven services.

In addition, regional specialists are emerging in local markets, offering tailored solutions that align with specific regulatory requirements and cultural preferences. These companies frequently engage in joint ventures with international vendors, blending local market knowledge with global best practices. Moreover, alliances between sensor manufacturers, software developers, and systems integrators are becoming more common, fostering end-to-end interoperability and accelerating deployment timelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Parking System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Dayang Parking Company Ltd.

- Guangdong Cosmo Intelligent Parking Equipment Co., Ltd.

- Klaus Multiparking GmbH

- Lodige Industries GmbH

- Mitsubishi Electric Corporation

- Miyoshi Engineering Works, Ltd.

- Otto Wöhr GmbH

- ParkPlus Systems Inc.

- Robotic Parking Systems, Inc.

- Shanghai Shangli Parking Equipment Co., Ltd.

- TIBA Parktechnik GmbH

- Westfalia Parking Technologies GmbH

Outlining Practical Data-Driven Recommendations for Industry Stakeholders to Enhance Competitiveness Drive Innovation and Navigate Market Dynamics

Industry stakeholders should prioritize investment in next-generation sensor fusion and edge computing capabilities to enhance system accuracy and responsiveness. By deploying distributed computing architectures closer to operational sites, real-time decision-making is improved while network latency is minimized. This foundational upgrade can markedly boost throughput and reduce error rates, driving user satisfaction and operational reliability.

Simultaneously, forging strategic alliances across the automotive, real estate, and technology sectors can unlock comprehensive mobility ecosystems. Collaborative partnerships enable shared data platforms for dynamically managing parking availability, traffic flows, and multimodal integration. Stakeholders are encouraged to pursue joint development agreements that align complementary strengths and accelerate time to market.

In light of recent trade policy shifts, organizations should reassess supply chain resilience by diversifying sourcing across multiple geographies. Nearshoring critical component production and establishing buffer inventory strategies will mitigate potential disruptions and protect margin integrity. Moreover, engaging with policymakers to shape upcoming regulatory revisions can yield clarity and foster conducive operating environments.

Finally, embracing a service-oriented mindset by bundling maintenance, analytics, and customer support offerings will cultivate recurring revenue streams and reinforce long-term client relationships. By leveraging data-driven insights to proactively schedule service interventions and optimize asset performance, providers can differentiate on reliability and reinforce the total value proposition offered to end users.

Detailing the Rigorous Research Methodology Incorporating Primary Interviews Secondary Sources and Multi-Dimensional Data Triangulation for Comprehensive Analysis

This research draws on a dual approach, combining extensive primary interviews with key industry executives, municipal planners, and technology innovators alongside a comprehensive review of secondary sources. Through direct engagement with C-suite and technical experts, the study captures real-time insights into deployment challenges, regulatory impacts, and evolving customer priorities. These firsthand perspectives anchor the analysis in contemporary operational realities.

Complementing these interviews, the report synthesizes information from peer-reviewed journals, industry white papers, and authoritative conference proceedings. Data points are triangulated across multiple sources to validate trends and ensure robustness of qualitative observations. The methodology also incorporates comparative case studies, enabling cross-regional benchmarking and the identification of best practices in system design and project execution.

Analytical frameworks such as SWOT analysis, technology readiness assessments, and value chain mapping provide structured lenses through which competitive landscapes and innovation trajectories are examined. Scenario planning exercises further test the resilience of strategies under varying regulatory and economic conditions. The combination of rigorous data triangulation and scenario insights yields a holistic understanding of the automated parking domain, free from bias and grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Parking System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Parking System Market, by Offering

- Automated Parking System Market, by Sensor Type

- Automated Parking System Market, by Parking Type

- Automated Parking System Market, by Application

- Automated Parking System Market, by End User

- Automated Parking System Market, by Region

- Automated Parking System Market, by Group

- Automated Parking System Market, by Country

- United States Automated Parking System Market

- China Automated Parking System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights to Illuminate the Future Outlook of Automated Parking Solutions Amidst Technological and Regulatory Evolutions

The automated parking system sector is at a pivotal juncture, shaped by technological breakthroughs, policy initiatives, and evolving user expectations. Leading-edge sensor fusion, intelligent software platforms, and modular infrastructure designs are converging to redefine parking operations and urban mobility. At the same time, tariff-induced shifts in supply chain dynamics underscore the importance of strategic agility and manufacturing resilience.

As regional adoption patterns unfold, market participants must balance global best practices with local regulatory contexts and infrastructural constraints. Partnerships among technology firms, real estate developers, and public entities will be instrumental in deploying pilot programs, scaling successful models, and integrating parking solutions within broader smart city and mobility-as-a-service frameworks.

Looking forward, the emphasis on sustainability and digital resilience will drive demand for systems that not only optimize space utilization but also support carbon reduction targets and data security mandates. Decision-makers who align technology investments with long-term urban development objectives will secure a competitive edge and catalyze the next wave of innovation in automated parking.

Engaging Decision-Makers to Secure Their Competitive Edge by Connecting with Ketan Rohom to Access the Automated Parking System Market Research Report Today

With an increasingly competitive market and rapid technology evolution, now is the time to secure comprehensive insights and gain a decisive advantage. Engage directly with Ketan Rohom to explore how this in-depth research can inform your strategic roadmap and illuminate untapped growth opportunities. By accessing the full automated parking system market research report, decision-makers will obtain a robust framework to navigate regulatory shifts, optimize technology investments, and accelerate sustainable deployment. Reach out today to unlock critical findings, leverage expert analysis, and empower your organization to lead the charge in next-generation parking solutions.

- How big is the Automated Parking System Market?

- What is the Automated Parking System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?