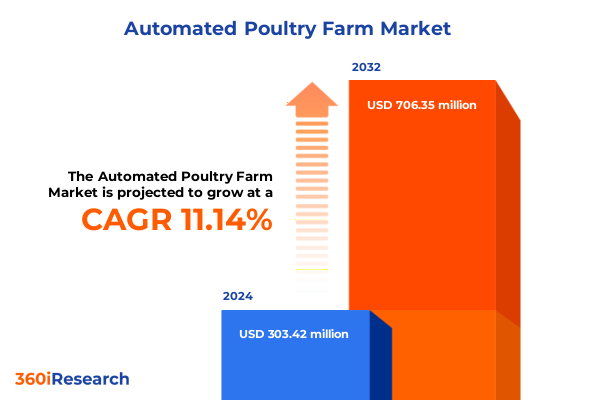

The Automated Poultry Farm Market size was estimated at USD 335.40 million in 2025 and expected to reach USD 371.23 million in 2026, at a CAGR of 11.22% to reach USD 706.35 million by 2032.

Driving Efficiency and Sustainability in Automated Poultry Farming with Advanced Robotics, IoT Monitoring, Data Analytics, and Operational Best Practices

Automated poultry farming has emerged as a critical evolution in modern agriculture, marrying technological innovation with time-honored husbandry practices to meet escalating global protein demands. As labor shortages and sustainability mandates intensify, producers are increasingly turning to robotics, sensor networks, and advanced analytics to enhance operational resilience. This report seeks to illuminate how automation technologies-from climate control systems to data-driven monitoring software-are reshaping the competitive fabric of poultry production.

Moreover, the convergence of Internet of Things (IoT) platforms and artificial intelligence (AI) has enabled unprecedented levels of real-time oversight, predictive health diagnostics, and resource efficiency. By integrating modular hardware components with cloud-enabled decision engines, forward-thinking operators are achieving significant gains in flock health management and energy usage optimization. Consequently, these advancements are driving a constructive feedback loop that promotes continuous improvement and cost savings.

In addition, the rapid maturation of service-based offerings such as consulting, training, and support services has catalyzed smoother technology adoption curves, particularly among independent farmers and mid-sized enterprises. Through ongoing maintenance programs and best-practice guidance, end users are better equipped to leverage software analytics and automation hardware in concert. This introduction sets the stage for a deeper exploration of the transformative market shifts, regulatory factors, segmentation dynamics, regional variations, and strategic imperatives that will define the future of automated poultry farming.

Exploring Industry-Wide Paradigm Shifts in Poultry Farming through Integration of Automation, Digitalization, Sustainable Practices, and Next-Gen Technologies

The landscape of poultry production is undergoing a fundamental metamorphosis as automation technologies transition from isolated trials to integrated, end-to-end systems. Traditional manual interventions are giving way to synchronized networks of climate-controlled houses, automated feeders, and AI-enabled monitoring software that collectively optimize every stage of the production cycle. Farms that once relied on manual egg collection are now deploying robotic arms capable of sorting and transporting eggs with precision, while cloud-based platforms ingest real-time sensor data to fine-tune environmental conditions.

Furthermore, as data-driven insights become central to decision-making, service providers have expanded their portfolios to include advanced analytics software, farm management systems, and consulting engagements aimed at operational benchmarking and continuous improvement. These offerings are tailored to diverse automation levels, with semi-automatic systems providing transitional value for growers seeking incremental upgrades and fully automatic solutions delivering end-to-end autonomy for high-volume producers.

Additionally, the emphasis on sustainable practices-ranging from energy-efficient lighting and ventilation systems to optimized feed conversion ratios-has galvanized research on lifecycle impacts and circular resource flows. Poultry enterprises are increasingly subject to stringent welfare and environmental standards, prompting investments in monitoring systems that track animal welfare metrics and emissions outputs. In this milieu, next-generation technologies such as machine vision for health diagnostics and robotics for biosecurity are rapidly gaining traction, setting the stage for accelerated innovation and market expansion.

Understanding the Comprehensive Effects of 2025 United States Tariff Policies on Automated Poultry Farming Supply Chains, Costs, and Export Dynamics

The introduction of comprehensive tariffs by the United States in 2025 has exerted multi-layered pressures on automated poultry farming supply chains and export channels. In early 2025, the administration imposed a 25% duty on select agricultural equipment imported from key trading partners, while simultaneously raising levies on poultry inputs and machinery to 20% amid broader trade negotiations. Retaliatory tariffs from major importers such as China and Canada have directly impacted exports of chicken parts, which historically enjoyed strong overseas demand. Notably, China’s 34% surcharge on U.S. poultry and suspension of product imports from certain suppliers precipitated a 25% decline in American chicken exports to that market, constraining high-margin sales opportunities for automated producers.

Consequently, domestically oriented farmers have faced elevated costs for imported climate control units, feeding systems, and monitoring sensors essential to automated operations. Egg imports intended to stabilize domestic supply were also subjected to proposed 10% to 26% tariffs, creating upward pressure on input costs just as wholesale prices began to normalize following bird flu–induced shortages. Moreover, increased levies on fertilizer and feed inputs, which rely heavily on imported potash, have amplified operational expenditures. These cumulative duties have prompted producers to reevaluate supplier contracts, source alternative equipment providers, and, in some cases, delay planned automation investments to preserve short-term cash flow.

Unveiling Key Market Segmentation Insights from System Architectures and Automation Levels to Farm Types, End Users, and Distribution Channels

In examining automated poultry farming through a segmentation lens, distinct insights emerge regarding system architectures, automation sophistication, farm models, end-user profiles, and distribution pathways. Hardware solutions encompass modular climate control components, egg collection units, feeding apparatuses, and monitoring platforms that form the physical backbone of modern facilities. Complementing these are professional services-from consulting and training to maintenance and support-that ensure seamless system implementation and ongoing operational resilience. On the software side, analytics, farm management, and monitoring applications deliver actionable intelligence that drives proactive decision-making.

Automation levels range from semi-automatic frameworks that introduce targeted mechanization to fully automatic ecosystems that leverage robotics and AI for autonomous operation. This spectrum enables growers at different resource thresholds to adopt incremental improvements or pursue comprehensive digital transformations. Farm types, including breeder, broiler, and layer operations, benefit from tailored automation designs that address unique production cycles and welfare considerations. Equally, end users span contract farming operators managing distributed assets, independent farmers optimizing individual sites, and vertically integrated enterprises orchestrating large-scale portfolios. Lastly, distribution channels-offline sales networks supported by equipment dealers and digital e-commerce platforms-determine the accessibility and speed of procurement, influencing adoption curves across geographies.

This comprehensive research report categorizes the Automated Poultry Farm market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Poultry Type

- Automation Level

- Deployment Mode

- Application

- End User

- Distribution Channel

Differentiating Regional Dynamics in Automated Poultry Farming Adoption across the Americas, EMEA Regulatory Landscapes, and Asia-Pacific Growth

Regional dynamics play a pivotal role in determining how automation strategies are adopted and scaled. In the Americas, established breeding and processing complexes in the United States and Canada leverage mature agri-tech infrastructures, robust capital markets, and comprehensive regulatory frameworks. This environment fosters rapid uptake of advanced robotics for feeding, egg collection, and climate management, particularly among large-scale operators focused on optimizing yield and consistency.

In contrast, the Europe, Middle East & Africa region is shaped by stringent animal welfare and environmental mandates that elevate demand for sophisticated monitoring and control systems. Producers are working with service providers to deploy customized training and support, ensuring compliance with evolving regulations and enhancing their resilience amid resource constraints. Emerging markets in Africa are beginning to adopt semi-automatic systems, driven by government‐backed initiatives aimed at food security and job creation.

Meanwhile, Asia-Pacific stands out for its dynamic growth, underpinned by rising protein consumption across populous economies, accelerated urbanization, and targeted government incentives for agricultural modernization. Broiler and layer farms in Southeast Asia deploy real-time analytics to refine feed conversion and biosecurity protocols, while advanced operations in Australia and Japan invest in end-to-end automation to meet exacting quality and traceability standards. Across all regions, divergent regulatory landscapes, infrastructure maturity, and capital access underscore the necessity of geographically tailored strategies.

This comprehensive research report examines key regions that drive the evolution of the Automated Poultry Farm market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Prominent Technology Providers and Agricultural Innovators Driving Transformation in Automated Poultry Farming with Advanced Solutions

Industry-leading poultry producers are at the forefront of adopting automation to streamline processes and enhance product quality. Major U.S. brands such as Sanderson Farms have committed substantial investments to deploy AI-powered sensors for real-time monitoring of production metrics and robotic handling systems to reduce manual interventions. Similarly, Perdue and Pilgrim’s Pride have integrated robotics into their processing plants to bolster throughput and consistency, while JBS USA leverages predictive analytics for production scheduling and inventory control, underscoring the link between digital transformation and operational excellence.

Complementing these global players are specialized technology providers driving innovation in automation hardware and software. Octopus Robots SAS offers autonomous cleaning and biosecurity robots tailored to poultry houses, while Faromatics delivers smart welfare-monitoring platforms that integrate with farm management systems. AgriRobotics’ modular robot fleets and ChickenGuard’s automated coop door solutions address both large-scale and backyard setups, and Jansen Poultry Equipment provides comprehensive feeding, egg collection, and litter management robots across global markets. In parallel, YieldX’s AI-driven biosecurity suite exemplifies the next wave of innovation by detecting and preventing disease threats through environmental analytics, aligning sustainability with enhanced food safety.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Poultry Farm market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A Hotraco Company

- AGICO GROUP

- Agrotop Ltd.

- Big Dutchman International GmbH

- CHORE-TIME by CTB, Inc.

- Connect Group For Poultry Project Ltd.

- Dynamic Automation

- FAMtech International Co., Ltd.

- Hebei Dingtuo Machinery And Equipment Co. Ltd.

- Hebei Hightop Livestock Farming Equipment Co., Ltd.

- Hebei Weizhengheng Animal Husbandry Machinery Equipment Co. Ltd.

- Henan Poul Tech Machinery Co., Ltd.

- Jamesway Incubator Company

- Jansen Poultry Equipment

- Liaocheng Motong Machinery Equipment Co. Ltd

- LiVi Machinery

- LUBING Maschinenfabrik Ludwig Bening GmbH & Co. KG

- ME International Installation GmbH

- NYBSYS

- OFFICINE FACCO & C. Spa

- Petersime NV

- Poltek

- Poultrix Ltd.

- Reliance Poultry Equipment

- Roxell BV

- Supreme Equipments Pvt. Ltd.

- Tecno Poultry Equipment Spa

- TEXHA LLC

- Valco Companies, Inc.

- Vencomatic Group

Implementing Strategic Roadmaps for Industry Leaders to Accelerate Adoption, Enhance Efficiency, Mitigate Risks, and Strengthen Competitive Advantage

To capitalize on automation’s full potential, industry leaders should develop clear roadmaps that align technology investments with operational objectives and regulatory requirements. Investment strategies must prioritize modular systems that can be scaled incrementally, enabling producers to validate performance improvements before committing to campus-wide deployments. In parallel, fostering partnerships with integrators and service providers ensures that installation, training, and ongoing maintenance support keep pace with evolving system complexities.

Moreover, organizations should establish cross-functional teams that bridge operations, IT, and animal health expertise, facilitating rapid adoption of analytics platforms and AI tools. By embedding digital literacy into training curricula and incentivizing data-driven decision-making, leaders can cultivate a culture of continuous improvement. Risk mitigation strategies-including diversification of equipment suppliers and proactive tariff contingency planning-will further shield operations from sudden policy shifts. Finally, prioritizing sustainability metrics, such as energy consumption and welfare indicators, will not only satisfy regulatory mandates but also resonate with increasingly conscientious consumers.

Elaborating a Rigorous Research Methodology Combining Data Collection, Expert Consultations, Triangulation Techniques, and Analytical Frameworks

This research integrates a multi-tiered methodology to ensure rigor and relevance. It begins with extensive secondary research drawing on government publications, industry journals, and publicly available trade data to establish a foundational understanding of market drivers, technological trends, and regulatory landscapes. Subsequently, primary interviews with poultry farm operators, equipment manufacturers, and software vendors provide qualitative insights into real-world adoption challenges and value realization.

Data triangulation techniques reconcile quantitative indicators-such as shipment volumes and tariff schedules-with qualitative feedback, enhancing the validity of findings. Supplementing these steps, expert consultations with agronomists, animal welfare specialists, and trade analysts refine the competitive landscape analysis and emerging trend projections. Finally, the analytical framework employs scenario planning and SWOT assessments to deliver robust strategic perspectives that guide stakeholders across the automated poultry farming ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Poultry Farm market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Poultry Farm Market, by System Type

- Automated Poultry Farm Market, by Poultry Type

- Automated Poultry Farm Market, by Automation Level

- Automated Poultry Farm Market, by Deployment Mode

- Automated Poultry Farm Market, by Application

- Automated Poultry Farm Market, by End User

- Automated Poultry Farm Market, by Distribution Channel

- Automated Poultry Farm Market, by Region

- Automated Poultry Farm Market, by Group

- Automated Poultry Farm Market, by Country

- United States Automated Poultry Farm Market

- China Automated Poultry Farm Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights and Strategic Imperatives to Define the Future Trajectory of Automated Poultry Farming Innovation and Growth

The automated poultry farming sector stands at a pivotal juncture where technology, sustainability, and regulatory imperatives converge to redefine production paradigms. As hardware, software, and service ecosystems mature, the strategic interplay of advanced robotics, AI-driven analytics, and robust support networks will delineate market leadership. Producers who navigate tariff headwinds with agile supply strategies, leverage segmentation insights to tailor solutions, and adapt to region-specific dynamics will unlock superior operational resilience and growth.

Looking ahead, continuous innovation in biosecurity, environmental control, and predictive health diagnostics will be instrumental in meeting global protein demands sustainably. By aligning strategic investments with a clear understanding of market segmentation, regulatory landscapes, and competitive offerings, industry participants can forge a path toward efficiency gains, risk mitigation, and differentiated value propositions. This synthesis of insights and imperatives offers a roadmap for stakeholders to harness automation’s transformative potential and shape the future of poultry production.

Engage Directly with Ketan Rohom to Unlock Comprehensive Market Intelligence and Acquire the Definitive Automated Poultry Farm Research Report Today

To explore how these insights can propel your strategic initiatives and operational excellence, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By engaging directly, you will gain priority access to a comprehensive suite of intelligence that spans detailed technology assessments, regulatory analyses, and actionable recommendations tailored to automated poultry farming. Prepare to harness this definitive market research to inform investment decisions, refine your product roadmap, and secure a competitive edge in an increasingly dynamic landscape. Connect today and position your organization at the forefront of poultry automation innovation.

- How big is the Automated Poultry Farm Market?

- What is the Automated Poultry Farm Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?