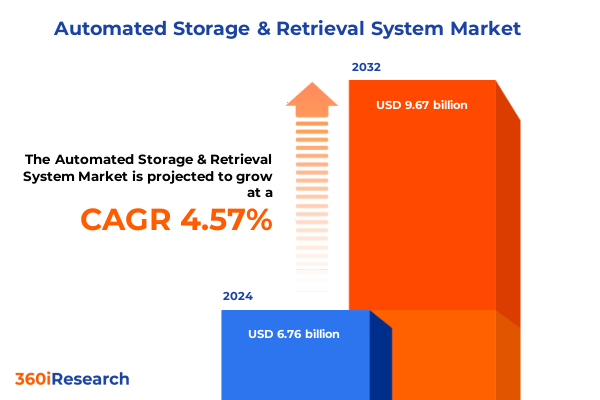

The Automated Storage & Retrieval System Market size was estimated at USD 7.04 billion in 2025 and expected to reach USD 7.35 billion in 2026, at a CAGR of 4.62% to reach USD 9.67 billion by 2032.

Catalyzing Modern Warehousing Advancements by Harnessing Automated Storage and Retrieval Systems to Meet Rising E-commerce and Industry Automation Demands

The dynamic evolution of global supply chains has magnified the importance of transformative warehousing solutions. As e-commerce proliferates and customer expectations evolve toward next-day and same-day delivery, organizations are tasked with balancing speed, accuracy, and cost efficiency. Automated Storage and Retrieval Systems (ASRS) stand at the forefront of this warehouse revolution, offering high-density storage, rapid order fulfillment, and seamless integration with modern warehouse management systems. Industry data indicates that leading enterprises are accelerating ASRS deployments to reduce labor dependency and optimize space utilization amid ongoing labor shortages and rising operational expenses.

Emerging smart warehouses are now characterized by real-time inventory visibility, AI-enhanced decision-making, and modular automation that scales with business needs. By leveraging robotics-such as high-bay cranes, shuttle systems, and vertical lift modules-organizations can achieve precision in picking and replenishment processes while minimizing errors and enhancing throughput. This convergence of robotics, software integration, and data analytics underscores the pivotal role ASRS will play in meeting the next wave of e-fulfillment demands and future-proofing warehousing operations.

Navigating the Emerging Smart Warehouse Revolution Fueled by Robotics, Artificial Intelligence, and Data-Driven Automation Strategies

The warehouse landscape is undergoing a profound transformation driven by the adoption of autonomous mobile robots (AMRs), AI-powered shuttle systems, and collaborative robotics. Unlike traditional AGVs, AMRs employ LiDAR and computer vision to navigate dynamic environments without fixed guide paths, enabling warehouses to respond rapidly to fluctuating order volumes and layout changes. Integration of these robots with dynamic shelving and automated sortation creates fluid workflows that adjust in real time to peak periods and seasonal shifts, eliminating bottlenecks and maximizing equipment utilization.

Concurrently, digital twin technology and IoT sensor networks are emerging as game-changers in predictive maintenance and operational planning. By creating virtual replicas of warehouse environments, organizations can simulate scenarios-such as equipment failures or demand surges-and proactively optimize layouts and resource allocation. Advanced machine vision systems enhance accuracy in product identification and quality inspections, while predictive analytics forecast demand peaks and adjust inventory replenishment strategies. Together, these capabilities facilitate a shift from reactive to proactive warehouse management, delivering greater reliability and cost control.

Assessing the Compounded Effects of 2025 U.S. Tariff Policies on Automated Storage and Retrieval System Supply Chains and Cost Structures

Recent U.S. tariff policies have introduced complex cost considerations for ASRS providers and end-users alike. The expansion of duties on steel and aluminum imports-rising to 25% in March 2025-has elevated raw material costs for high-bay cranes, structural racking, and shuttle components, prompting vendors to reevaluate sourcing strategies and adjust pricing models. According to trade experts, this consolidation of tariff measures is impacting key import channels, leading to extended lead times and reshuffled supplier networks.

In response, many manufacturers are diversifying production footprints through nearshoring and reshoring initiatives, establishing secondary assembly hubs in tariff-exempt regions such as Mexico under USMCA provisions. Third-party logistics partners are also playing a critical role by offering forward-deployed inventory services that mitigate tariff exposure and support just-in-time replenishment. These strategic adaptations underscore the necessity for ASRS stakeholders to integrate trade-compliance considerations into system design and deployment planning, ensuring resilience against future policy shifts.

Uncovering Critical Segmentation Perspectives Across ASRS Types, Functions, and Industry Verticals to Drive Tailored Investment and Deployment Decisions

Differentiation by system type is a core element of strategic ASRS implementation, with each architecture addressing unique operational requirements. Carousel-based solutions excel in compact order-picking environments, optimizing cycle times for small-parts distribution, whereas mini-load cranes deliver precise handling in light-duty assembly and kitting processes. Robotic cube-based systems combine dense storage grids with automated bots for dynamic slotting, while robotic shuttle-based platforms balance scalability with rapid throughput across medium-density operations. Unit-load cranes showcase exceptional capacity for heavy goods, streamlining bulk storage in automotive and aerospace warehouses, and vertical lift modules offer vertical scalability that conserves valuable floor space during seasonal fluctuations.

Functional segmentation further refines deployment strategies by aligning system capabilities with core workflow demands. In assembly operations, ASRS ensures timely delivery of sub-assemblies and tools, maintaining continuous production rhythms. Distribution centers leverage high-speed retrieval for order consolidation and cross-docking, reducing dwell times and improving turn rates. Kitting environments benefit from configurable storage zones that group component sets efficiently, while order-picking-focused designs bring goods directly to operators, elevating picking accuracy. Storage-centric solutions emphasize density and accessibility, safeguarding inventory integrity and optimizing real-estate investments.

Industry verticals drive tailored ASRS adoption, with aerospace and defense facilities valuing seismic-rated, secure handling for critical components, and automotive plants integrating unit-load cranes within just-in-time frameworks. Electronics and semiconductor fabs prioritize clean-room-compatible modules and climate-controlled corridors to maintain yield, while healthcare and pharmaceutical distribution centers lean on VLMs and enclosed carousels to meet strict regulatory standards. Retail and e-commerce infrastructures demand flexible, high-throughput solutions capable of accommodating rapid SKU proliferation and peak-period surges, ensuring seamless multichannel fulfillment.

This comprehensive research report categorizes the Automated Storage & Retrieval System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Modularity

- Load Type

- End User

- Application

Gaining Strategic Regional Perspectives on Automated Storage and Retrieval System Adoption Trends and Growth Drivers in the Americas, EMEA, and Asia-Pacific

North America leads global ASRS adoption, propelled by surging e-commerce volumes and heightened consumer expectations for rapid delivery. U.S. distribution centers are integrating AI-enhanced retrieval systems that forecast demand and adjust storage locations dynamically, yielding substantial throughput gains. Government incentives for advanced manufacturing and robust investments in smart logistics infrastructure have further fueled deployments, while partnerships between OEMs and 3PL providers enable flexible, tariff-resilient inventory strategies that enhance regional supply-chain agility.

In Europe, sustainability mandates and energy-efficiency directives are driving the modernization of warehouse estates. Leading ASRS providers are rolling out regenerative-power cranes and low-energy shuttle fleets that integrate seamlessly with renewable energy sources. Strong emphasis on Industry 4.0 interoperability has also spurred widespread adoption of digital twins and predictive maintenance programs, positioning Europe as a vanguard for green, data-driven distribution hubs that comply with stringent environmental regulations.

Asia-Pacific remains the fastest-growing market for ASRS, with China commanding over half of regional installations and government programs like "Made in China 2025" incentivizing smart logistics investments. Japan’s robotics expertise and India’s expansion of automated fulfillment centers underpin APAC’s growth trajectory, while Southeast Asian manufacturing corridors are increasingly deploying modular shuttle grids to accommodate urban land constraints. Regional collaborations between local integrators and global technology leaders are accelerating ASRS penetration across manufacturing, food & beverage, and e-commerce verticals.

This comprehensive research report examines key regions that drive the evolution of the Automated Storage & Retrieval System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automated Storage and Retrieval System Providers’ Recent Strategic Initiatives, Innovations, and Collaborations Shaping Industry Leadership

The competitive landscape of ASRS solutions is dominated by a cadre of global providers that continually innovate through M&A, technology alliances, and product development. Dematic, a subsidiary of the KION Group, has expanded its shuttle-based portfolio and launched AI-driven control software that optimizes multi-aisle flows. Daifuku has emphasized modular designs and cloud-native WMS integration to simplify deployments across diverse site configurations. Swisslog has accelerated its focus on micro-fulfillment, unveiling hydrodynamically optimized shuttles for high-throughput urban facilities. SSI Schafer underscores sustainability through regenerative drive systems in its cranes and is pioneering digital twin applications for remote diagnostics. Murata Machinery is deepening its robotics offerings, coupling vision-guided picking with dynamic storage racks to enhance small-parts accuracy. Kardex Remstar continues to lead in VLM innovations with zero-energy braking modules, and Knapp advances collaborative robotics with intuitive human-machine interfaces. Vanderlande leverages aerospace-grade components for its belt-less sortation systems, and TGW emphasizes smart controls that align inventory buffering with just-in-time assembly lines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Storage & Retrieval System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Addverb Technologies Limited

- Aiut Technologies LLP

- Automation Logistics Corporation

- Beumer Group GmbH & Co KG

- Daifuku Co., Ltd.

- Dematic Corporation

- Effistack India PVT LTD.

- Ferretto Group SpA

- Fives Group

- Honeywell International Inc.

- Hänel GmbH & Co. KG

- IHI Corporation

- Jungheinrich AG

- Kardex Group

- Kion Group AG

- KNAPP AG

- KUKA AG

- Mecalux, S.A.

- Murata Machinery, Ltd.

- Sencorp Inc.

- Siemens AG

- SSI SCHAEFER Group

- System Logistics Corporation

- TGW Logistics Group

- Toyota Industries Corporation

- Toyota Material Handling, Inc.

- Westfalia Technologies, Inc.

Delivering Tactical Recommendations for Leaders to Enhance Agility, Drive Sustainable Scalability, and Capitalize on Automated Storage and Retrieval Advancements

Leaders in warehousing and logistics should prioritize integration of AI and predictive analytics to unlock real-time optimization of storage density and retrieval sequences. By deploying machine-learning models that continuously refine slotting logic based on SKU velocity and seasonality, organizations can drive sustainable throughput gains and minimize labor costs. Establishing cross-functional task forces that include supply-chain, IT, and operations experts will accelerate these technology rollouts and ensure alignment with broader digital transformation objectives.

To mitigate tariff-driven supply-chain volatility, companies must diversify sourcing networks and engage 3PL partners capable of forward-deployed inventory staging in favorable trade jurisdictions. This approach not only buffers cost shocks but also supports rapid scaling of ASRS capacity in response to demand fluctuations. Additionally, investing in modular automation architectures-such as plug-and-play shuttle modules and scalable crane extensions-allows flexibility in capital allocation and reduces time to productivity for phased expansion initiatives.

Finally, fostering a skilled workforce through targeted training programs in robotics maintenance and data analytics is essential to maximize ASRS ROI. Collaborating with integrators to develop tailored upskilling curricula and leveraging online learning platforms can bridge technical gaps. Proactive engagement with sustainability frameworks-highlighting energy-efficient system options and lifecycle assessments-will also position organizations favorably with ESG stakeholders and drive long-term cost discipline.

Explaining the Rigorous Multi-Stage Research Process, Data Collection Techniques, and Analytical Framework Underpinning Actionable Insights on ASRS Technologies

The research framework employed for this analysis comprised a multi-stage methodology. Secondary research included a comprehensive review of industry publications, government filings, and technology briefs to map the ASRS landscape and identify emergent trends. Primary research involved in-depth interviews with key stakeholders, including end-users, integrators, and technology providers, to validate findings and capture nuanced perspectives on deployment challenges and opportunities.

Quantitative data were triangulated through multiple sources-market surveys, proprietary shipping and installation data, and supplier performance metrics-to ensure robustness. Our analytical approach integrated SWOT and Porter’s Five Forces frameworks to distill competitive dynamics and strategic imperatives. Finally, qualitative insights were synthesized into actionable recommendations through cross-functional workshops, enabling a holistic view of market dynamics and future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Storage & Retrieval System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Storage & Retrieval System Market, by System Type

- Automated Storage & Retrieval System Market, by Modularity

- Automated Storage & Retrieval System Market, by Load Type

- Automated Storage & Retrieval System Market, by End User

- Automated Storage & Retrieval System Market, by Application

- Automated Storage & Retrieval System Market, by Region

- Automated Storage & Retrieval System Market, by Group

- Automated Storage & Retrieval System Market, by Country

- United States Automated Storage & Retrieval System Market

- China Automated Storage & Retrieval System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing the Strategic Imperatives and Forward-Looking Opportunities in Automated Storage and Retrieval System Adoption for Future-Proofed Supply Chains

In summary, Automated Storage and Retrieval Systems represent a cornerstone of modern warehouse and supply-chain optimization, enabling organizations to achieve unparalleled efficiency, accuracy, and spatial utilization. The convergence of AI, robotics, and data-driven analytics is redefining intralogistics, driving a shift toward predictive, resilient operations.

As tariff landscapes evolve and global trade dynamics shift, ASRS stakeholders must adopt flexible architectures, diversify sourcing, and invest in workforce capabilities to maintain competitive advantage. By aligning strategic priorities with sustainability objectives and leveraging forward-deployed inventory strategies, businesses can navigate the complexities of contemporary warehousing and position themselves for long-term growth.

Connect with Ketan Rohom to Unlock Comprehensive Market Intelligence on Automated Storage and Retrieval Systems and Accelerate Strategic Growth Decisions Today

Explore definitive market research and unlock tailored intelligence to address your strategic challenges in warehouse automation.

Connect today to engage with Ketan Rohom, Associate Director of Sales & Marketing, for an in-depth discussion on how advanced ASRS insights can empower your organization’s growth trajectory and operational resilience.

Secure your competitive edge now by accessing the comprehensive Automated Storage and Retrieval Systems report-designed to equip decision-makers with the critical data and expert analysis needed to drive informed investments and innovative solutions.

- How big is the Automated Storage & Retrieval System Market?

- What is the Automated Storage & Retrieval System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?