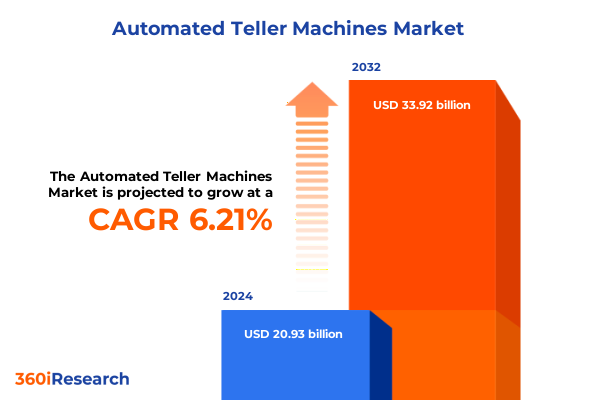

The Automated Teller Machines Market size was estimated at USD 26.26 billion in 2025 and expected to reach USD 27.66 billion in 2026, at a CAGR of 6.16% to reach USD 39.92 billion by 2032.

An illuminating overview setting the stage for understanding the evolving role and critical significance of ATMs in modern financial ecosystems

Modern financial ecosystems are being reshaped by a convergence of technological innovation, evolving customer expectations, and shifting regulatory imperatives, placing the Automated Teller Machine (ATM) at a pivotal juncture. Once conceived as simple cash dispensers, ATMs now function as multifaceted touchpoints that extend banking services beyond branch walls, blending physical and digital experiences. In this context, understanding the complex interplay among hardware innovation, software evolution, and service delivery is critical for decision makers.

As consumer preferences pivot toward self-service and omnichannel interactions, ATMs have become essential nodes in delivering seamless, secure transactions anywhere and anytime. Against a backdrop of rising cybersecurity threats and changing cash usage trends, industry participants must navigate a landscape where agility and resilience are paramount. This executive summary sets the stage for a holistic exploration of the ATM market, examining transformative shifts, regulatory influences, segmentation insights, regional dynamics, and competitive strategies to inform stakeholders’ strategic planning and investment priorities.

An in-depth exploration of transformative shifts redefining the ATM industry landscape propelled by digital innovation, consumer behavior, and regulatory dynamics

In recent years, the ATM landscape has undergone profound transformation as banks and independent deployers embrace digitalization with renewed vigor. Traditional dispenser models are being supplanted by hybrid devices that integrate advanced functions such as contactless transactions, video teller capabilities, and multifunction kiosk services. As a result, the industry is witnessing a transition from hardware-centric offerings toward software-defined architectures that can adapt dynamically to emerging demands and regulatory requirements.

Simultaneously, consumer behavior is evolving in response to the proliferation of mobile wallets, peer-to-peer payment platforms, and cardless ATM solutions. This shift is compelling providers to reimagine user interfaces and back-end systems, leveraging artificial intelligence and analytics to deliver personalized customer journeys. Moreover, open banking directives and API ecosystems are enabling seamless interoperability between ATMs and third-party fintechs, accelerating the emergence of value-added services. Regulatory emphasis on fraud prevention and data privacy has further driven the adoption of biometric authentication, real-time monitoring, and end-to-end encryption, reinforcing the need for a proactive security posture.

Taken together, these developments signify a new era in which ATMs serve not only as cash distribution points but also as strategic enablers of digital financial inclusion, operational efficiency, and enhanced customer engagement.

A comprehensive assessment of the cumulative repercussions of United States 2025 tariff policies on ATM hardware imports, service costs, and strategic sourcing

The imposition and continuation of targeted tariff measures by the United States in 2025 have exerted a marked influence on ATM hardware supply chains and cost structures. In particular, heightened duties on certain imported electronic components and machinery have elevated sourcing expenses for key device manufacturers. Consequently, providers are reassessing global procurement strategies and exploring alternative manufacturing bases to mitigate the impact of increased levies.

Beyond hardware, ancillary service costs have also been affected as the broader ecosystem experiences inflationary pressures. Managed service contracts and professional integration efforts now factor in higher equipment replacement and maintenance expenditures, prompting providers to seek process optimizations and strategic alliances to maintain margin integrity. This environment has accelerated interest in nearshoring initiatives, with select vendors establishing assembly facilities in duty-free zones or domestic industrial hubs to curtail tariff exposure and shorten lead times.

In sum, while tariffs have introduced short-term cost headwinds across hardware and service segments, they have simultaneously catalyzed supply chain diversification, spurred operational efficiency gains, and encouraged deeper collaboration among stakeholders to preserve value and ensure continuity in an increasingly complex trade landscape.

Nuanced segmentation insights unveiling critical differentiators across components, deployment models, end users, and application scenarios shaping ATM market dynamics

When examining component-level segmentation, the ATM ecosystem encompasses hardware installations ranging from drive-up units and freestanding kiosks to through-the-wall terminals. Complementing these physical devices, a suite of service offerings spans managed operations and professional assistance, with the latter subdividing into consulting engagements and system integration projects. On the software front, the environment is enriched by application solutions that facilitate user interfaces, middleware platforms-covering integration middleware and payment processing modules-and specialized security suites designed to safeguard transactions.

Deployment analysis reveals that industry participants often tailor their strategies across distinct configurations, whether deploying drive-up units to optimize curbside convenience, positioning freestanding terminals in high-footfall areas, or installing through-the-wall units to maximize lobby space efficiency. This strategic placement influences operational requirements and influences ancillary service models.

From an end-user perspective, the market caters to traditional banking institutions-comprising both corporate and retail banks-independent ATM deployers focused on fee-driven networks, and retail environments such as convenience stores and supermarkets, each presenting unique service expectations and transaction volumes. Application segmentation further elaborates on usage patterns, including bulk and envelope cash deposit functions, withdrawal services, domestic and international funds transfer capabilities, and information services such as balance inquiries and statement printing, all of which inform product design and support frameworks.

By integrating these layers of segmentation, stakeholders can refine product roadmaps, target service offerings more precisely, and align resource allocation with evolving customer demands.

This comprehensive research report categorizes the Automated Teller Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- End User

- Deployment

Strategic regional insights highlighting the distinct growth drivers, adoption patterns, and operational challenges across key global territories in the ATM domain

Across the Americas, the ATM landscape is characterized by a well-entrenched network of self-service terminals complementing digital banking channels. Financial institutions and independent operators are prioritizing the modernization of legacy units and the integration of cloud-based software to enhance user experiences, while also addressing challenges such as cash logistics optimization in both urban and remote areas. The region’s emphasis on interoperability and cross-border money movement has spurred investments in multi-functional terminals capable of supporting a broader range of transaction types.

In Europe, Middle East & Africa, a diverse regulatory mosaic coexists with robust digital banking initiatives. Nations within this territory are advancing cashless payment agendas, driving demand for ATMs that support contactless and QR-code transactions alongside traditional cash services. At the same time, regulatory frameworks around data protection and transaction monitoring are compelling providers to embed advanced security controls and ensure compliance with standards such as PSD2 and GDPR.

Meanwhile, Asia-Pacific markets are balancing persistent cash usage with an ambitious push toward financial inclusion. Government programs in India and China have catalyzed the rapid deployment of ATMs, including video teller machines that combine human assistance with self-service convenience. The adoption of mobile integration and multi-language interfaces in this region underscores the importance of adaptability in both hardware configuration and software customization.

These regional dynamics illuminate the necessity for tailored market approaches that address local regulatory requirements, consumer preferences, and infrastructure considerations to drive sustainable growth.

This comprehensive research report examines key regions that drive the evolution of the Automated Teller Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key corporate intelligence revealing competitive positioning, innovation trajectories, and partnership strategies among leading ATM solution providers

Leading companies within the ATM industry are distinguishing themselves through differentiated innovation pathways and strategic partnerships. One prominent provider has accelerated its shift toward a software-centric model, offering cloud-native management platforms that enable real-time remote monitoring, proactive maintenance, and seamless integration with digital wallets. This approach underscores a commitment to delivering end-to-end solutions that transcend traditional dispensing functionalities.

Another key player has fortified its global footprint by leveraging its strong presence in European and Latin American markets, marrying robust manufacturing capabilities with a localized service network. Their dual focus on hardware reliability and customizable software modules exemplifies a balanced strategy that addresses diverse customer requirements across mature and emerging economies.

Regional specialists are capitalizing on cost-effective manufacturing and deep banking relationships to drive adoption in high-growth markets. By forging alliances with major payment processors and cloud infrastructure providers, they are able to accelerate the rollout of enhanced security solutions, including biometric authentication and real-time fraud analytics. Complementing these efforts, strategic acquisitions and joint ventures have expanded capabilities in professional services, enabling them to deliver comprehensive consulting and integration offerings that optimize ATM ecosystems.

Collectively, the competitive landscape is defined by a race to deliver holistic, value-added propositions that leverage digital innovation, robust service portfolios, and strategic collaborations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Teller Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3CEMS Group

- AGS Transact Technologies Ltd.

- Brink’s Incorporated

- Diebold Nixdorf, Inc.

- Euronet Worldwide, Inc.

- Fujitsu Limited

- G4S Limited by Allied Universal

- GENMEGA, Inc.

- GRGBanking Equipment Co., Limited

- HANTLE Inc.

- HESS Cash Systems GmbH

- Hitachi Ltd.

- Hyosung Group

- Lipi Data Systems Ltd.

- NCR Corporation

- Oki Electric Industry Co., Ltd.

- RapidCash ATM

- Source Technologies

- Triton Systems, Inc.

Actionable strategic recommendations empowering industry leaders to navigate technological evolution, regulatory landscapes, and shifting consumer demands in the ATM sector

Industry leaders are advised to adopt software-defined ATM architectures that offer modularity and facilitate rapid feature deployment. By migrating core services to cloud-based platforms and embracing API-driven integration, organizations can accelerate digital transformation, reduce time to market for new features, and simplify compliance with evolving regulations.

To mitigate the impact of tariff volatility and supply chain disruptions, decision makers should pursue a diversified sourcing strategy. Nearshoring key assembly operations and establishing dual-source component supply chains will enhance resilience and reduce lead times. Simultaneously, investing in predictive maintenance powered by machine learning will help to optimize service schedules, lower operational costs, and improve uptime metrics.

Furthermore, deepening collaboration with fintech partners and payment networks will enable the development of differentiated, value-added services such as cardless transactions, cross-border remittances, and contextual marketing at the ATM. Embedding advanced security protocols-biometric verification, end-to-end encryption, and real-time anomaly detection-will be critical to fortifying trust and ensuring regulatory compliance.

By aligning technological investments with region-specific strategies and continuously refining service models, industry stakeholders can secure sustainable growth, enhance customer satisfaction, and maintain a competitive edge in a rapidly evolving marketplace.

A transparent overview of the rigorous research methodology underpinning data collection, validation processes, and analytical frameworks employed in this study

This study employs a meticulous, multi-layered approach to ensure data integrity and analytical rigor. Primary research comprised in-depth interviews with senior executives from financial institutions, independent ATM operators, technology vendors, and regulatory bodies. These qualitative insights were triangulated with quantitative data derived from publicly available filings, industry publications, and proprietary data repositories.

Secondary research encompassed extensive analysis of trade association reports, regulatory documentation, and technical white papers to validate market trends and regulatory drivers. A cross-verification process was applied to reconcile discrepancies between sources and to ensure consistency across regional and segment-level analyses.

Analytical frameworks-including Porter’s Five Forces, PESTLE, and SWOT evaluations-were employed to assess competitive dynamics, macroeconomic influences, and organizational strengths. Segmentation matrices were constructed based on component, deployment, end-user, and application criteria, enabling granular insight into market behavior without reliance on a single methodological lens.

Throughout the research lifecycle, quality control measures such as double-blind data validation, peer reviews, and audit trails were maintained to uphold transparency and minimize bias. This rigorous methodology underpins the credibility of the findings and supports actionable guidance for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Teller Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Teller Machines Market, by Component

- Automated Teller Machines Market, by Application

- Automated Teller Machines Market, by End User

- Automated Teller Machines Market, by Deployment

- Automated Teller Machines Market, by Region

- Automated Teller Machines Market, by Group

- Automated Teller Machines Market, by Country

- United States Automated Teller Machines Market

- China Automated Teller Machines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

A conclusive synthesis encapsulating core insights, industry implications, and the imperative imperatives guiding future developments in ATM technologies

The current trajectory of the ATM industry highlights a critical inflection point driven by the convergence of digital innovation, regulatory complexity, and shifting consumer expectations. As hardware platforms evolve into software-defined systems, operators must balance the imperative for modernization with operational resilience in an environment shaped by trade policy and cybersecurity imperatives.

Segmentation analysis reveals that success hinges on a nuanced understanding of component ecosystems, deployment models, end-user requirements, and application use cases. Regional dynamics underscore the need for localized strategies that address regulatory divergence, cash usage patterns, and market maturity levels.

Competitive intelligence demonstrates that leading providers are forging ahead with cloud-native services, strategic alliances, and robust security architectures to deliver differentiated offerings. Meanwhile, actionable recommendations point toward a transformative agenda centered on API-led integration, supply chain diversification, and fintech collaboration.

In conclusion, stakeholders equipped with these insights and guided by adaptive strategies will be well-positioned to navigate the evolving ATM landscape, capitalize on emerging opportunities, and deliver exceptional customer value in an increasingly interconnected financial services ecosystem.

Engaging call-to-action inviting stakeholders to connect with Ketan Rohom for accessing the full-depth market research report and bespoke insights for competitive advantage

To delve deeper into the comprehensive analysis of the ATM market and unlock tailored strategic insights, stakeholders are encouraged to reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can facilitate access to the full market research report. By engaging with Ketan Rohom, readers will gain personalized guidance on harnessing the data for competitive advantage, support in interpreting nuanced findings across segments and regions, and assistance in identifying bespoke opportunities that align with specific business objectives. This direct connection ensures a seamless acquisition process and opens channels for further advisory consultations, enabling organizations to implement informed decisions backed by rigorous industry intelligence and to stay ahead in an increasingly dynamic ATM environment.

- How big is the Automated Teller Machines Market?

- What is the Automated Teller Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?