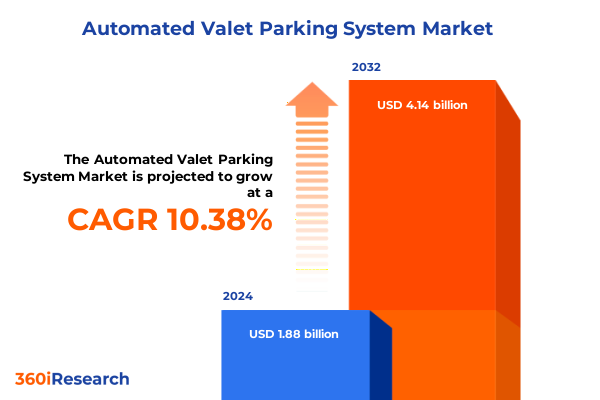

The Automated Valet Parking System Market size was estimated at USD 2.24 billion in 2025 and expected to reach USD 2.42 billion in 2026, at a CAGR of 8.43% to reach USD 3.95 billion by 2032.

Revolutionary Urban Parking Automation Is Redefining Space Utilization and User Experience in Modern Cities

Operating at the intersection of urbanization, technological innovation, and ever-increasing demand for seamless mobility, the Automated Valet Parking System has emerged as a pivotal solution to today’s congested infrastructure challenges. As cities worldwide grapple with limited parking real estate and heightened environmental concerns, this technology offers a pathway to optimize space while reducing emissions associated with vehicles circulating in search of spots.

This introductory overview sets the stage for an in-depth exploration of the drivers catalyzing market evolution. By replacing manual interventions with intelligent robotics, sensor arrays, and cloud-connected management platforms, automated valet systems are redefining the parking experience for developers, operators, and consumers alike. In the sections that follow, we unpack transformative shifts, assess tariff impacts shaping the U.S. landscape in 2025, and reveal actionable intelligence across segmentation, region, company dynamics, and strategic recommendations.

How Fusion of AI, Connectivity, and Smart City Imperatives Propelled Autonomous Parking Into the Mainstream

The past five years have seen a profound transition in the automotive and mobility sectors, driven by the convergence of connectivity, artificial intelligence, and robotics. Automated Valet Parking Systems are a prime example of such convergence, as these solutions integrate complex sensor networks, machine learning algorithms, and real-time communication protocols to autonomously maneuver vehicles in structured facilities.

Meanwhile, sustainability imperatives and regulatory mandates have amplified interest in solutions that minimize land use and emissions. Public and private stakeholders are increasingly funding pilot projects in smart city districts, utilizing data-driven insights to optimize traffic patterns and reduce carbon footprints. This momentum extends to end users, who now demand frictionless experiences from curb to parking bay, expecting digital engagement at every touchpoint.

Consequently, legacy parking operators are compelled to partner with technology providers, blending established operational know-how with emergent digital capabilities. The resulting ecosystem is one where modular hardware deployments can be scaled across multiple sites, and software platforms continuously evolve through over-the-air updates. This paradigm shift has set the stage for rapid adoption, thereby laying the groundwork for the next wave of urban mobility enhancements.

Examining 2025 U.S. Tariffs on Robotics Components and Their Strategic Ripples Through Automated Parking Procurement

In 2025, U.S. trade policies have imposed new tariff structures on imported robotics components and specialized sensors critical to Automated Valet Parking deployments. These measures, intended to bolster domestic manufacturing, have inadvertently influenced capital expenditure planning for many operators. With duties rising on precision sensor arrays and autonomous navigation modules, the total landed cost of turn-key solutions has increased, prompting buyers to seek alternative sourcing strategies.

Vendors and integrators have responded by accelerating localization of key hardware assembly. Partnerships with domestic electronics manufacturers have proliferated, and some providers have shifted to modular designs that allow the substitution of in-scope items with tariff-exempt equivalents. Despite these mitigation efforts, lead times have extended, and project timelines have adjusted, reflecting the complex interdependencies within the global supply chain.

These tariff-driven shifts have also reinforced the importance of software subscription models. By decoupling recurring revenue from one-time hardware sales, suppliers can better absorb cost fluctuations and protect margins. Moreover, buyers are increasingly open to cloud-native management services, which reduce upfront capital requirements and provide continuous innovation through iterative updates. Collectively, these trends underscore how 2025’s tariff environment has reshaped procurement strategies, making flexibility and local partnerships essential for sustained growth.

Uncovering How Componentry, Facility, Platform, Automation, Vehicle, and End-Use Variables Shape Adoption Patterns

An analysis of the market by component reveals that hardware solutions remain fundamental, encompassing mechanical retrieval units, electric motor drives, and environmental sensors. The hardware segment commands significant attention as facility owners prioritize robust, reliable platforms capable of continuous operation. Software platforms, by contrast, deliver the intelligent orchestration layer, integrating reservation interfaces, remote monitoring dashboards, and AI-driven optimization routines.

Evaluating facility type unveils that off-street parking environments, such as purpose-built garages and subterranean structures, are early adopters. These controlled settings facilitate integration of rail guided cart systems, shuttle modules, and tower-based storage, delivering high throughput and efficient land use. On-street deployments, though more nascent, leverage mobile robot fleets and dynamic curbside platforms to maximize underutilized road frontage in dense urban corridors.

Platform type considerations distinguish non-palleted configurations-where vehicles are parked directly on floors or platforms-from palleted systems that rely on mobile trays to transport cars. Structural choices also play a pivotal role, from automated guided vehicle (AGV) systems best suited for surface applications to silo and puzzle systems optimized for extreme space constraints.

Automation levels range from fully automated, offering end-to-end orchestration with minimal human intervention, to semi-automated models that retain manual oversight for critical maneuvers. Vehicle type segmentation underscores distinct workflows for commercial fleets-where heavy and light commercial vehicles demand tailored handling-and passenger segments, which span hatchbacks, sedans, and SUVs with varying dimensions and charge profiles. In terms of end use, solutions tailored for commercial venues prioritize throughput, mixed-use developments seek integration with retail and hospitality offerings, and residential projects focus on convenience, security, and aesthetic integration.

This comprehensive research report categorizes the Automated Valet Parking System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Facility Type

- Platform Type

- Structure Type

- Automation Level

- Vehicle Type

- End Use

Regional Dynamics Revealing Divergent Adoption Trajectories Across Americas, EMEA Landscapes and Asia-Pacific Megacities

When surveying the Americas, the region stands out for early pilot programs in major metropolitan markets, driven by real estate cost pressures and environmental mandates. Cities across North America have witnessed demonstration projects in high-density business districts, where seamless integration with ride-hailing services enhances last-mile connectivity. Meanwhile, Latin American governments are exploring public-private partnerships to deploy cost-effective off-street automated garages that alleviate chronic congestion in urban centers.

Shifting focus to Europe, Middle East & Africa, the EMEA region exhibits a mosaic of regulatory environments and infrastructural maturity. Western European markets, particularly those with stringent emission reduction targets, have accelerated adoption of energy-efficient, fully automated parking towers. Gulf Cooperation Council member states leverage large-scale mixed-use developments to showcase cutting-edge technology, often incorporating smart building energy management. In contrast, select African hubs are evaluating more modular, scalable systems to address rapidly growing vehicle ownership with limited new construction capacity.

In Asia-Pacific, demand has soared as urban centers contend with skyrocketing real estate costs. Nations such as Japan, South Korea, and China have advanced both pallet and non-pallet systems, integrating them into major transportation nodes and commercial complexes. Emerging economies within the region are also piloting semi-automated models to balance cost and capability, laying the foundation for long-term expansion of automated parking infrastructure.

This comprehensive research report examines key regions that drive the evolution of the Automated Valet Parking System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Terrain of Robotics Manufacturers, Software Innovators, and Construction Powerhouses

The competitive arena features a blend of robotics specialists, building systems integrators, and emerging software disruptors. Leading global robotics firms offer modular retrieval hardware and sensor kits, which are increasingly bundled with proprietary AI platforms to deliver turnkey solutions. Traditional elevator and crane manufacturers have pivoted to parking-specific applications, repurposing decades of vertical transport expertise into silo and tower systems.

At the same time, upstart software companies are capitalizing on API-driven architectures, enabling seamless interoperability with third-party mobility services and facility management suites. These providers emphasize agile development methodologies, releasing frequent updates that refine vehicle routing logic and predictive maintenance capabilities. Large construction conglomerates are also entering the space through strategic joint ventures, embedding automation elements into mixed-use and residential projects from the ground up.

Furthermore, several regional champions maintain a strong foothold in local markets by customizing solutions to comply with domestic regulations and climate conditions. Partnerships between academic research institutions and private vendors have spawned pilot rows of proof-of-concept builds, informing product roadmaps with localized data. This competitive diversity underscores the importance of collaboration across the ecosystem to accelerate adoption and drive continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Valet Parking System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- Aptiv PLC

- AUDI AG

- BMW Group

- City lift India Ltd.

- Continental AG

- E Star Engineers Private Limited

- Ficosa Internacional SA

- GIKEN LTD.

- Klaus Multiparking Systems Pvt. Ltd.

- Lödige Industries

- Mercedes-Benz Group AG

- Mitsubishi Heavy Industries, Ltd.

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Robotic Parking Systems, Inc.

- Siemens AG

- SOTEFIN SA

- Stanley Robotics

- The Ford Motor Company

- Unitronics Ltd.

- Valeo SA

- Volkswagen AG

- Westfalia Mobil GmbH

- Wipro Ltd.

- Wohr Parking Systems Pvt. Ltd.

- WÖHR Autoparksysteme GmbH

- ZF Friedrichshafen AG

Strategic Playbook for Executives to Navigate Supply, Regulation, and Partnerships While Driving Operational Excellence

As automated valet parking systems transition from pilot demonstrations to large-scale rollouts, industry leaders must adopt a multifaceted strategy that aligns technology, partnerships, and process innovation. First, they should cultivate relationships with domestic component suppliers to mitigate tariff volatility and accelerate local content certification. Simultaneously, forging alliances with software developers enables rapid integration of emerging AI and analytics modules, ensuring the platform evolves in lockstep with user expectations.

In parallel, operators must engage with urban planners and municipal authorities to address zoning, safety, and accessibility requirements. By proactively participating in code-making bodies and standardization initiatives, stakeholders can influence an environment that supports streamlined permitting and deployment. Moreover, cross-sector collaborations with ride-hailing, fleet management, and electric vehicle charging providers will unlock network effects, broadening use cases beyond static parking lots and into real-time mobility orchestration.

Finally, executives should institute robust change management frameworks that combine targeted training programs with data-driven performance metrics. Emphasizing human-machine collaboration at the facility level ensures staff can adapt quickly to new workflows, thereby reducing downtime and maximizing operational efficiency. Taken together, these actionable steps will position industry leaders to seize market share and deliver superior end-user experiences.

Combining Executive Interviews, Regulatory Analysis, and Statistical Modeling to Forge a Robust Automated Parking Market Framework

This research utilizes a synergistic approach combining primary interviews, secondary data analysis, and scenario planning to deliver comprehensive market insights. We engaged senior executives from equipment manufacturers, technology providers, and facility operators to collect firsthand perspectives on deployment challenges, cost structures, and performance benchmarks. Supplementing this, we examined regulatory documents, tariff notices, and patent filings to validate emerging product capabilities and localization trends.

Quantitative data was gathered from public infrastructure reports, urban mobility white papers, and academic publications, enabling us to identify usage patterns across diverse facility types and geographic regions. Advanced statistical models were then applied to test correlations between automation levels and operational metrics such as throughput, energy consumption, and maintenance frequency. Scenario analysis further projected how evolving trade policies and technological breakthroughs could reshape capital expenditure strategies over the medium term.

Finally, iterative validation sessions with industry experts ensured that our findings were grounded in real-world applicability. By triangulating across data sources and stakeholder inputs, this methodology produces a nuanced narrative that reflects the complex interplay of technology, regulation, and market dynamics in the automated valet parking ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Valet Parking System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Valet Parking System Market, by Component

- Automated Valet Parking System Market, by Facility Type

- Automated Valet Parking System Market, by Platform Type

- Automated Valet Parking System Market, by Structure Type

- Automated Valet Parking System Market, by Automation Level

- Automated Valet Parking System Market, by Vehicle Type

- Automated Valet Parking System Market, by End Use

- Automated Valet Parking System Market, by Region

- Automated Valet Parking System Market, by Group

- Automated Valet Parking System Market, by Country

- United States Automated Valet Parking System Market

- China Automated Valet Parking System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Why Adaptability in Sourcing, Partnership Ecosystems, and Modular Innovation Will Shape the Future of Automated Urban Parking Solutions

The Automated Valet Parking System market is at a crossroads where technological prowess, regulatory shifts, and strategic partnerships converge to define the next iteration of urban mobility. As tariffs reshape supply chains, and sustainability mandates tighten, the ability to adapt through modular architectures and flexible business models will differentiate market leaders from followers.

Investment in localized manufacturing and software-driven service offerings will be critical to mitigate geopolitical and economic headwinds. At the same time, deep collaboration with municipal authorities and mobility ecosystems will expand use cases and foster wider acceptance. Executives who balance aggressive innovation with operational rigor and stakeholder engagement will unlock the greatest value and secure long-term competitive advantage.

In summary, the coming years will see automated parking transcend its initial novelty to become an integral component of smart city infrastructure. Those who harness these insights to optimize procurement, deployment, and partnership strategies will catalyze the transformation of the parking landscape into a driver of efficiency, sustainability, and enhanced user experience.

Engage With Our Senior Sales Leadership Today to Unlock Exclusive Automated Valet Parking System Insights and Drive Strategic Growth

Elevate your strategic decision-making with a customized deep dive into Automated Valet Parking System insights. Speak directly with Ketan Rohom, Associate Director for Sales & Marketing, to discover how this transformative study can inform your next move. His expertise will guide you through tailored data and synthesis to ensure that your organization capitalizes on emerging trends and seizes opportunities in this rapidly evolving market. Connect today to secure exclusive access, accelerate your competitive advantage, and drive tangible results with this premier research offering.

- How big is the Automated Valet Parking System Market?

- What is the Automated Valet Parking System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?