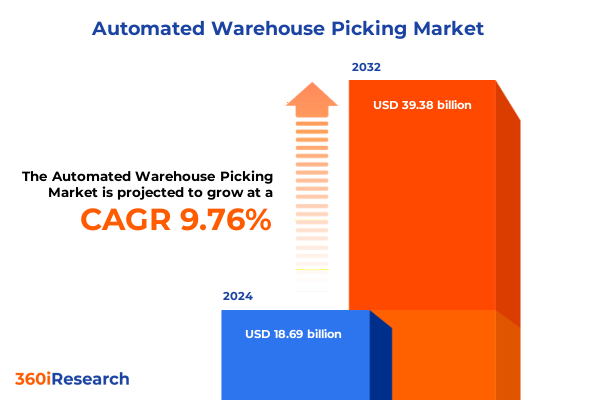

The Automated Warehouse Picking Market size was estimated at USD 20.29 billion in 2025 and expected to reach USD 22.04 billion in 2026, at a CAGR of 9.93% to reach USD 39.38 billion by 2032.

Revolutionizing Order Fulfillment with Cutting-Edge Automation Technologies to Enhance Efficiency, Accuracy, and Resilience Across Warehouse Operations

Surging consumer demand, driven by the continued shift toward online channels, is fundamentally reshaping order fulfillment strategies. According to the U.S. Census Bureau, retail e-commerce sales reached $352.9 billion in the fourth quarter of 2024, marking a 22.1 percent increase quarter-on-quarter and accounting for 17.9 percent of total retail sales. This data underscores the permanence of digital commerce and the pressing need for supply chains to support accelerated fulfillment cycles.

Simultaneously, warehouse labor markets are tightening as businesses grapple with workforce shortages and rising labor costs. Major logistics operators are increasingly turning to autonomous and AI-driven robotics; the adoption of over one million AMRs and picking robots across leading fulfillment networks has boosted per-employee delivery volumes from 175 in 2015 to nearly 3,870 today, illustrating the profound productivity gains made possible by automation.

Moreover, advancements in sensor technologies, real-time analytics, and collaborative robotics have matured to a point where integrated picking solutions are commercially viable for operations of all scales. Autonomous mobile robots now navigate dynamic environments via LiDAR and computer vision, while voice-directed and vision-picking systems enhance accuracy and free workers from manual data entry. As a result, warehousing operations are entering a new era characterized by agility, precision, and resilience in meeting unpredictable market demands.

Embracing Workforce Redefinition and Advanced Robotics to Navigate Labor Challenges and Scale Order Fulfillment with Data-Driven Insights

The warehouse automation landscape is experiencing fundamental shifts driven by converging technological and operational factors. At the forefront, artificial intelligence and machine learning are enabling robots to perform increasingly complex picking tasks without rigid programming. Vision-picking technologies equipped with deep-learning algorithms now discern product variations and guide robotic arms with millimeter precision, leading to over 40 percent reductions in picking errors in early deployments.

Concurrently, autonomous mobile robots (AMRs) are supplanting traditional AGVs by navigating freely without fixed guidance paths. Ships of AMRs equipped with simultaneous localization and mapping (SLAM) capabilities dynamically reroute around obstacles, improving throughput by 20 percent in pilot programs across distribution centers. This flexibility reduces infrastructure dependency, enabling rapid reconfiguration of warehouse layouts to accommodate seasonal or promotional surges.

In parallel, collaborative robotics, or “cobots,” are emerging as vital partners to human operators for tasks that require tactile dexterity or complex decision-making. Cobots equipped with force-sensing joints and compliant grippers safely assist in mixed-item picking, alleviating worker fatigue and minimizing workplace injuries. Their growth underscores a broader trend toward human-robot teaming, which balances cognitive oversight with autonomous execution to achieve operational excellence.

Unpacking the Cumulative Consequences of Escalating U.S. Tariffs on Warehouse Automation Supply Chains and Capital Investments through 2025

Beginning in 2018, the United States progressively escalated tariff rates, culminating in an average applied rate that peaked near 27 percent by April 2025 before adjustments lowered it to approximately 15.8 percent as of June 2025. This surge, underpinned by universal duties and sector-specific levies on steel, aluminum, automobiles, and electronics, represents the highest tariff levels in over a century, reshaping supply chain economics across industries.

For automated warehouse equipment, the 25 percent tariff on steel constitutes a particularly acute challenge, as most robotics, conveyor systems, and storage infrastructure are steel-intensive. Increased raw material costs have driven up equipment prices and delayed project timelines, forcing many operations to downscale planned automation footprints or pivot toward less steel-dependent mobile solutions. In one industry survey, roughly 45 percent of automation buyers reported project postponements due to steel price volatility and tariff-related uncertainty.

Meanwhile, heightened economic uncertainty has extended sales cycles for new automation investments. Decision-makers are delaying capital commitments while alternative sourcing strategies and nearshoring models are evaluated. As companies build inventory buffers to mitigate further disruptions, warehouse occupancy rates have climbed, generating short-term demand for additional storage capacity but impeding long-term automation throughput expansion. Outsourced logistics via specialized 3PLs has also gained traction, as these providers offer tariff-savvy supply chain management and advanced automation expertise under a risk-sharing model.

Leveraging Multi-Dimensional Segmentation to Reveal Opportunities Across Technologies, Industries, Systems, and Deployment Models in Automated Picking

When examining the market through a technology lens, automated guided vehicles have given way to more sophisticated AMRs that navigate dynamically, yet legacy pick-to-light and pick-to-cart systems remain relevant in high-throughput, low-variety operations. Voice-directed picking has evolved into enterprise-grade solutions integrated seamlessly with WMS platforms, delivering hands-free accuracy improvements of up to 25 percent in complex picking environments.

End user industries also exhibit divergent automation profiles. E-commerce and third-party logistics providers lead in deploying end-to-end robotics and data analytics, while sectors such as food and beverage and pharmaceuticals prioritize specialized ASRS implementations to meet stringent quality and traceability regulations. Automotive and manufacturing environments leverage put-walls and carousel systems to process high-volume, repetitive orders, whereas retail and healthcare increasingly adopt mobile robotic picking for smaller batch requirements and rapid replenishment cycles.

In terms of system architecture, automated storage and retrieval systems spanning unit, mini, and mid-load configurations dominate bulk storage, complemented by shuttle systems and vertical lift modules for dense, capacity-optimized warehousing. Shuttles paired with intelligent sorting options enable wave and cluster picking strategies, reducing travel time and boosting pick rates. Mid-sized enterprises are gravitating toward cloud-based deployment models for elastic scalability, while large enterprises often favor on-premise, integrated solutions to manage peak-volume events while preserving control over sensitive operations.

This comprehensive research report categorizes the Automated Warehouse Picking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- System Type

- Picking Method

- End User Industry

- Deployment Model

- Organization Size

Highlighting Distinct Growth Drivers and Adoption Patterns across Americas, EMEA, and Asia-Pacific Warehousing Automation Ecosystems

In the Americas, particularly the U.S., automation adoption is propelled by e-commerce growth, labor cost pressures, and robust government incentives for domestic manufacturing. North American fulfillment centers frequently lead in integrating AI-powered vision systems and collaborative robots, supported by tax credits and reshoring grants targeting advanced manufacturing and logistics infrastructure.

Europe, Middle East & Africa presents a heterogeneous landscape; Western Europe emphasizes sustainability and ESG compliance, driving interest in energy-efficient ASRS cranes and renewable-powered AMRs, while Eastern European markets attract investments through cost-competitive labor and strategic nearshoring of automotive and electronics assembly. Regulatory frameworks fostering carbon-neutral warehousing have catalyzed pilots of emissions-monitoring IoT networks and green battery swap stations for autonomous fleets.

Asia-Pacific is the fastest-growing region, fueled by rapid digitalization, urbanization, and government-led smart city initiatives. China’s refrigerated logistics sector, surpassing CNY 5.17 trillion in 2023, underscores the region’s appetite for cold-chain automation. Additionally, India and Southeast Asian economies are witnessing accelerated uptake of AMRs to offset growing labor shortages, while Japan and South Korea drive innovation in high-density shuttle systems and robotic picking arms.

This comprehensive research report examines key regions that drive the evolution of the Automated Warehouse Picking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automation Innovators and Established Industry Titans Shaping the Future of Warehouse Picking Solutions

Amazon Robotics continues to innovate at scale, deploying over a million proprietary robots across its global fulfillment network and pioneering AI-enabled tactile gripping systems that expand handling capabilities beyond standard tote-based workflows. Symbotic has likewise secured a transformative acquisition of Walmart’s robotics division, combining assets to streamline fulfillment center automation and expand its commercial backlog by several billion dollars.

Traditional automation leaders such as Dematic and Swisslog maintain strong market positions through modular intralogistics platforms that integrate ASRS, conveyor solutions, and warehouse control systems. Dematic’s global footprint, bolstered by its inclusion in the KION Group, underpins large-scale implementations across automotive, retail, and food & beverage sectors, while Swisslog leverages its Kuka-backed robotics expertise to deliver agile, data-driven solutions.

Innovative entrants like GreyOrange, Covariant, and Fetch Robotics (now part of Zebra Technologies) are redefining picking with AI-driven autonomy and cloud-native orchestration, targeting mid-market deployments and 3PL partnerships. Their collaborative robots, machine vision systems, and multi-modal grippers tackle diverse SKU assortments, enabling faster cycle times and flexible order configurations that meet evolving customer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Warehouse Picking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AutoStore AS

- Daifuku Co., Ltd.

- GreyOrange Pte. Ltd.

- Honeywell International Inc.

- JR Automation by HItachi Ltd.

- KION Group AG

- KNAPP AG

- Locus Robotics

- Murata Machinery, Ltd.

- SSI Schaefer Group

- Swisslog AG

- ULMA Handling Systems

- Zebra Technologies Corporation

Strategic Roadmap for Industry Leaders to Accelerate Adoption, Drive ROI, and Mitigate Risk in Warehouse Picking Automation Deployments

To maximize the returns on automation investments, industry leaders should begin with data-driven opportunity assessments that align picking strategies with SKU velocity, order profiles, and labor cost benchmarks. Employing digital twin simulations enables rapid scenario testing and optimizes equipment mix before capital deployment. A phased rollout that combines high-impact pilot zones with scalable expansion plans ensures early ROI and organizational buy-in.

Furthermore, integrating automation with warehouse execution systems and real-time analytics platforms delivers actionable insights on throughput, OEE, and resource utilization. By adopting cloud-native architectures and open APIs, companies can future-proof their infrastructure and accommodate emergent innovations such as 5G-enabled robotics and blockchain-backed traceability without extensive reconfiguration.

Finally, forging strategic partnerships with automation integrators and 3PL providers mitigates execution risk and leverages external expertise. Collaborative supplier relationships, coupled with flexible financing models and performance-based service agreements, allow organizations to share upside, reduce project timelines, and adapt swiftly to regulatory or market shifts.

Outlining the Comprehensive Research Design Incorporating Primary Interviews, Secondary Data, and Rigorous Analytical Frameworks Delivering Reliable Insights

Our research methodology combined in-depth primary interviews with decision-makers across e-commerce, manufacturing, retail, and logistics sectors to capture first-hand insights on automation objectives, adoption barriers, and performance metrics. Over 40 executive and operational stakeholders participated in this phase, ensuring a holistic view of strategic priorities and real-world constraints.

Secondary data sources included publicly disclosed financials, regulatory filings, patent databases, and technical whitepapers to map technology roadmaps and investment trends. Market activity was triangulated with supply chain analytics, trade data, and macroeconomic indicators to contextualize regional growth drivers and policy impacts.

A rigorous analytical framework, featuring scenario simulation, trend extrapolation, and benchmarking against industry standards, was applied to ensure the robustness of findings. Cross-validation techniques were used to reconcile disparate datasets, while sensitivity analyses tested the resilience of key conclusions against shifts in trade policy, labor rates, and macroeconomic variables.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Warehouse Picking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Warehouse Picking Market, by Technology

- Automated Warehouse Picking Market, by System Type

- Automated Warehouse Picking Market, by Picking Method

- Automated Warehouse Picking Market, by End User Industry

- Automated Warehouse Picking Market, by Deployment Model

- Automated Warehouse Picking Market, by Organization Size

- Automated Warehouse Picking Market, by Region

- Automated Warehouse Picking Market, by Group

- Automated Warehouse Picking Market, by Country

- United States Automated Warehouse Picking Market

- China Automated Warehouse Picking Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Insights on the Evolutionary Trajectory of Automated Picking and Its Role in Shaping Future Supply Chain Excellence

Automated picking has evolved from a niche capability to a cornerstone of modern logistics strategy, driven by technological advances, shifting consumer expectations, and supply chain disruptions. The iterative integration of AI, robotics, and data analytics has unlocked new levels of speed and accuracy, positioning automation as a strategic imperative rather than a cost-saving tactic.

Looking ahead, the interplay between human expertise and robotic precision will define warehouse excellence. As AI-enhanced cobots and multi-modal picking frameworks mature, organizations will be able to orchestrate complex fulfillment workflows with minimal manual intervention, driving service level improvements and labor sustainability.

In sum, the trajectory of automated picking underscores the broader transformation of supply chains into adaptive, intelligence-driven ecosystems. Companies that invest strategically and remain agile in their automation approach will be best positioned to capture the benefits of this paradigm shift.

Connect with Ketan Rohom to Unlock Strategic Insights and Secure Your Definitive Market Research Report on Automated Warehouse Picking Today

To capitalize on the transformative potential of automated warehouse picking and secure a competitive edge, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan offers in-depth guidance and can provide immediate access to a comprehensive market research report tailored to your organization’s strategic needs. Engage today to explore customized insights, understand emerging opportunities, and implement best-in-class automation solutions that drive operational excellence. Reach out to kick-start your journey toward efficient, resilient, and future-ready warehousing.

- How big is the Automated Warehouse Picking Market?

- What is the Automated Warehouse Picking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?