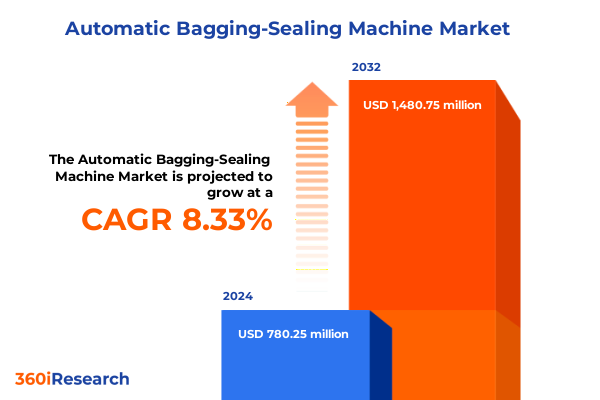

The Automatic Bagging-Sealing Machine Market size was estimated at USD 835.50 million in 2025 and expected to reach USD 911.08 million in 2026, at a CAGR of 8.51% to reach USD 1,480.75 million by 2032.

Transforming Packaging Efficiency with Advanced Automatic Bagging-Sealing Systems to Streamline Operations, Enhance Productivity and Ensure Quality Control

Automatic bagging-sealing machines stand at the forefront of modern packaging operations, delivering unparalleled consistency, speed, and reliability. As global manufacturers confront increasingly complex supply chains and elevated consumer demands, these systems have become indispensable for preserving product integrity, minimizing waste, and ensuring compliance with stringent quality standards. With the evolution of diverse industries-from pharmaceuticals and chemicals to agriculture and food processing-automated bagging solutions have evolved beyond simple weight filling and sealing to incorporate advanced materials handling, real-time monitoring, and adaptive control algorithms.

Transitioning from manual and semi-manual approaches, firms are recognizing that full-scale automation is not merely a means to reduce labor costs but a critical driver of agility and resilience. This transformation enables rapid changeovers between bag formats, seamless integration with upstream and downstream equipment, and stringent traceability through digital recording. Furthermore, the reliability and uptime delivered by modern bagging-sealing platforms underpin just-in-time inventory strategies and support lean manufacturing initiatives. Against this backdrop, understanding the diverse machine configurations, regional market forces, and emerging technological enablers is essential for organizations seeking to maintain a competitive advantage. This executive summary synthesizes the key factors shaping the automatic bagging-sealing machine landscape, providing a foundation for strategic decision-making and future investment prioritization.

Exploring the Industry-Shaping Technological and Operational Shifts Revolutionizing Automatic Bagging-Sealing Solutions Across Diverse Sectors Globally

The last decade has witnessed a paradigm shift in how bagging and sealing operations are conceptualized and executed. Smart manufacturing principles, underpinned by the Industrial Internet of Things (IIoT), have enabled real-time performance tracking, predictive maintenance alerts, and remote diagnostics. These connected ecosystems empower operators to anticipate component wear, schedule maintenance during planned downtimes, and optimize throughput without compromising machine health. Concurrently, the integration of robotics and collaborative robots has redefined material handling workflows, reducing human intervention in repetitive tasks and bolstering workplace safety.

Advancements in sensor technologies and control software have enhanced the precision of sealing temperature, bag tension, and sealing pressure. As a result, manufacturers can handle a broader spectrum of bag materials-from multi-layer plastics and coated papers to woven fabrics-without frequent manual recalibration. Moreover, the rise of modular designs allows swift reconfiguration to support varied bag sizes and formats, catering to shifting consumer preferences for both small-format convenience packs and bulk industrial sacks. These collective innovations are propelling a new era of flexible, high-speed packaging lines, where agility, sustainability, and quality converge to meet the exacting requirements of contemporary markets.

Assessing the Comprehensive Impact of 2025 United States Tariff Measures on Imported Automatic Bagging-Sealing Machine Components and Supply Chains

In 2025, a series of tariff adjustments implemented by U.S. trade authorities have substantially influenced the cost structure for manufacturers relying on imported bagging-sealing machinery components. Enhanced duties on imported steel and aluminum under Section 232 have elevated raw material costs, compelling machine builders to reassess supplier contracts and pass through incremental expenses to end users. Simultaneously, Section 301 tariffs targeting specific electronic control modules and sensors-critical for high-precision sealing and automation-have introduced additional import levies, affecting the pricing of advanced system upgrades and retrofits.

As a cumulative impact, distributors and OEMs have had to adopt strategic countermeasures, including expanding domestic sourcing partnerships and negotiating long-term fixed-price agreements to hedge against further tariff volatility. For many end users, the higher landed cost of machinery has lengthened procurement cycles and intensified total cost of ownership analyses. Nevertheless, these developments have also catalyzed investments in localized assembly and aftermarket support networks, fostering closer collaboration among regional suppliers, integrators, and maintenance service providers. By embracing such adaptive strategies, stakeholders can manage tariff-driven cost pressures while sustaining the performance and reliability standards pivotal to automated bagging-sealing operations.

Uncovering Deep Market Segmentation Insights for Automatic Bagging-Sealing Machines by Machine Type, Application, Automation Level, Material and Bag Size

A nuanced examination of key market segments reveals that machine type variations deeply influence adoption patterns across industries. Horizontal Form Fill Seal configurations, whether operating on intermittent motion or high-speed rotary platforms, dominate sectors requiring rapid throughput and minimal changeover times, such as chemicals and food processing. In contrast, Vertical Form Fill Seal systems, distinguished by either single-lane or multi-lane configurations, are preferred in pharmaceutical and personal care applications where precise dosing and stringent hygiene protocols are paramount.

Application-based segmentation underscores that sectors like pharmaceuticals and food necessitate the highest levels of automation to comply with regulatory and traceability demands, driving uptake of fully automatic solutions. Conversely, agriculture and certain chemical processes often favor semi-automatic machines that balance investment costs with operational flexibility. Material-driven insights further highlight that paper-based bags, whether kraft for bulk commodities or coated variants for moisture-sensitive products, are increasingly adopted for sustainability goals, while plastic formats such as HDPE, LDPE, and polypropylene offer cost-effective moisture barriers. Woven bags-both jute and polypropylene-remain integral to heavy-duty industrial shipments, where mechanical robustness and reusability are critical.

Bag size segmentation illuminates a dual trend: the proliferation of small-format systems tailored to consumer-packaged goods, accommodating up to five-kilogram capacities, alongside robust solutions for mid-range weights between five and twenty kilograms. Heavy-capacity models exceeding twenty kilograms are vital in bulk commodity distribution, particularly within agriculture and mining supply chains. Through these layered insights, manufacturers can align product development and marketing strategies with the precise demands of each end-use segment.

This comprehensive research report categorizes the Automatic Bagging-Sealing Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machine Type

- Automation Level

- Bag Material

- Bag Size

- Application

Delivering Key Regional Insights into the Automatic Bagging-Sealing Machine Market Dynamics across Americas, EMEA and Asia-Pacific Territories

Regional dynamics shape the strategic priorities and investment approaches of packaging professionals worldwide. In the Americas, robust modernization agendas and a focus on operational resilience have driven significant adoption of fully automated bagging-sealing platforms. Manufacturers in North America, in particular, are upgrading legacy lines to integrate advanced robotics and data analytics, aiming to shorten lead times and reduce downtime. Latin America’s growing food and agricultural exports are also spurring demand for both compact and heavy-duty systems that can meet stringent phytosanitary and traceability requirements.

Within Europe, Middle East & Africa territories, regulatory frameworks-ranging from EU packaging waste directives to Middle Eastern industrial diversification initiatives-are fostering upgrades to machines capable of handling sustainable bag materials and meeting strict hygiene standards. Europe’s established pharmaceutical and personal care industries place a premium on validation-ready equipment, while in select African markets, cost-sensitive semi-automatic solutions fulfill emerging manufacturing needs. Across these regions, an emphasis on carbon footprint reduction and circular economy principles is accelerating interest in machines with energy-efficient drives and compatibility with recyclable packaging substrates.

The Asia-Pacific region remains a powerhouse of production capacity and cost-driven innovation. Rapid industrialization in China and India underpins strong demand for customizable bagging-sealing machines that can adapt to diverse product portfolios. Local OEMs are increasingly competitive, offering modular systems with digital interfaces at attractive price points. Meanwhile, Southeast Asian markets are witnessing a surge in food and personal care manufacturing, prompting investments in both entry-level semi-automatic models and high-speed rotary solutions for premium packaged goods.

This comprehensive research report examines key regions that drive the evolution of the Automatic Bagging-Sealing Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strengths and Strategic Initiatives of Leading Manufacturers Shaping the Automatic Bagging-Sealing Equipment Industry Landscape Globally

Leading manufacturers continue to vie for market leadership through differentiated technology portfolios and service excellence. Global engineering firms are expanding their modular platform offerings to include integrated vision systems, in-line metal detection, and adaptive servo-driven pouch indexing. These additions enhance machine flexibility and enable rapid format changes without extensive manual recalibration. Concurrently, companies are bolstering their aftermarket service infrastructures, deploying remote monitoring capabilities and virtual support channels to diagnose and resolve field issues, thereby maximizing equipment uptime.

Strategic initiatives such as joint ventures and strategic acquisitions are enabling technology providers to enter new geographies and product verticals. By forging alliances with software developers and sensor specialists, OEMs are embedding advanced analytics and machine learning into control cabinets, paving the way for fully autonomous packaging cells. In parallel, partnerships with academic institutions and standards organizations are accelerating the development of industry-specific validation protocols and sustainability benchmarks, aligning machine performance with evolving regulatory and corporate responsibility goals.

As competition intensifies, companies that can bundle turnkey solutions-comprising hardware, software, and service contracts-are commanding premium positioning in the marketplace. These end-to-end offerings simplify procurement cycles for end users and foster deeper customer loyalty by delivering cohesive experiences from installation through long-term maintenance plans.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Bagging-Sealing Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- All‑Fill Inc.

- Barry-Wehmiller Companies, Inc.

- Coesia S.p.A.

- Concetti S.p.A.

- Fuji Machinery Co., Ltd.

- GEA Group Aktiengesellschaft

- Hayssen Flexible Systems

- IMA S.p.A.

- Ishida Co., Ltd.

- Matrix Packaging Machinery, LLC

- Mespack, S.A.

- Nichrome India Ltd.

- PAC Machinery, Inc.

- Paxiom Group, LLC

- PAYPER S.A.

- Premier Tech Chronos

- Rovema GmbH

- Sharp Packaging Systems

- Syntegon Technology GmbH

- Thiele Technologies, Inc.

- ULMA Packaging, S. Coop.

Crafting Pragmatic and Forward-Looking Recommendations to Empower Industry Leaders to Navigate Evolving Market Trends and Operational Challenges Effectively

To thrive amid rapid technological and regulatory change, industry leaders must prioritize modularity and interoperability in their equipment selections. By investing in open-architecture control systems and standardized communication protocols, organizations can future-proof their packaging lines against obsolescence and facilitate seamless integration with upstream dosing and downstream palletizing processes. Equally important is the establishment of strategic sourcing partnerships that emphasize dual sourcing of critical components, mitigating supply chain disruptions stemming from tariff fluctuations or geopolitical tensions.

Implementing predictive maintenance platforms, powered by IIoT sensors and machine learning models, allows for real-time health monitoring and data-driven scheduling of service interventions before unplanned downtimes occur. When complemented with targeted workforce training programs, these initiatives ensure operational teams are adept at interpreting analytics dashboards and executing rapid repairs. In parallel, embracing sustainability imperatives-such as lightweight bag materials, energy-efficient drives, and waste reduction mechanisms-can enhance brand reputation and satisfy increasingly stringent environmental regulations.

Finally, cultivating collaborative ecosystems with technology partners, academic researchers, and industry consortia fosters continuous innovation and access to emerging breakthroughs. By co-developing proof-of-concept trials for advanced sealing methods or biodegradable substrates, companies can differentiate their offerings and solidify their positions as forward-thinking market leaders.

Detailing Rigorous Research Methodology for Comprehensive Market Analysis Incorporating Primary and Secondary Approaches to Validate Insights

The findings presented in this executive summary are derived from a blend of primary and secondary research methodologies designed to ensure robustness and validity. Primary research included in-depth interviews with over fifty packaging equipment end users, OEM executives, system integrators, and material suppliers, conducted across North America, Europe, and Asia-Pacific regions. These consultations provided qualitative insights into technology adoption drivers, procurement criteria, and service expectations, as well as firsthand feedback on tariff impacts and regional market peculiarities.

Secondary research encompassed a thorough review of publicly available company documents, trade publications, technical whitepapers, and regulatory filings. This phase also involved tracking patent databases and industry standards documentation to chart the evolution of key sealing technologies and materials compatibility features. Data triangulation was achieved by cross-referencing qualitative inputs from primary interviews with quantitative indicators such as import/export statistics, energy consumption benchmarks, and equipment performance metrics shared by industrial consortia.

To ensure methodological rigor, all data points were subjected to validation through double-blind reviews by subject matter experts. Analytical frameworks-such as SWOT analysis, Porter’s Five Forces, and technology readiness assessments-were applied to distill strategic and operational implications. The resulting insights have been synthesized to provide a coherent narrative that balances depth, accuracy, and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Bagging-Sealing Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Bagging-Sealing Machine Market, by Machine Type

- Automatic Bagging-Sealing Machine Market, by Automation Level

- Automatic Bagging-Sealing Machine Market, by Bag Material

- Automatic Bagging-Sealing Machine Market, by Bag Size

- Automatic Bagging-Sealing Machine Market, by Application

- Automatic Bagging-Sealing Machine Market, by Region

- Automatic Bagging-Sealing Machine Market, by Group

- Automatic Bagging-Sealing Machine Market, by Country

- United States Automatic Bagging-Sealing Machine Market

- China Automatic Bagging-Sealing Machine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Implications to Conclude on the Evolutionary Trajectory of Automatic Bagging-Sealing Machine Market Dynamics

The automatic bagging-sealing machine market is undergoing a transformative journey driven by advances in digital connectivity, automation architectures, and material science. Segmentation analysis reveals that diverse machine configurations and bag formats align precisely with sector-specific requirements, enabling manufacturers to optimize throughput while preserving quality standards. Meanwhile, regional market dynamics reflect a balancing act between cost pressures, sustainability mandates, and regulatory compliance, compelling stakeholders to adopt agile strategies that blend global technology with localized support networks.

Cumulative tariff adjustments in 2025 have underscored the importance of supply chain resilience, catalyzing the development of domestic partnerships and adaptive sourcing models. At the same time, the competitive landscape is shaped by leading OEMs that excel in delivering turnkey solutions, integrating advanced sensors, modular designs, and predictive service frameworks. By distilling these core findings, it becomes evident that successful market participants are those that harmonize technological innovation with strategic supply chain management and customer-centric service models.

Looking forward, the intersection of sustainability imperatives and Industry 4.0 capabilities will define the next phase of growth. Organizations that invest in digital twins, energy optimization, and recyclable materials will not only achieve operational excellence but also strengthen their environmental credentials. As the market continues to evolve, maintaining a forward-looking posture and leveraging collaborative ecosystems will be essential for shaping a resilient and competitive packaging future.

Connect with Ketan Rohom for Exclusive Access and Personalized Insights to Secure Your Comprehensive Automatic Bagging-Sealing Machine Market Research Report

To explore the full breadth of insights and equip your organization with actionable intelligence, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Through a tailored consultation, he can guide you toward selecting the precise research package that aligns with your strategic objectives, encompassing in-depth analysis of technological trends, tariff implications, and regional market dynamics. By connecting, you’ll gain exclusive access to proprietary data, comparative benchmarks, and scenario-based recommendations designed to inform critical investment and operational decisions. Engage today to secure customized support for optimizing your supply chains, elevating process efficiencies, and enhancing competitive positioning within the automatic bagging-sealing machinery landscape.

- How big is the Automatic Bagging-Sealing Machine Market?

- What is the Automatic Bagging-Sealing Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?