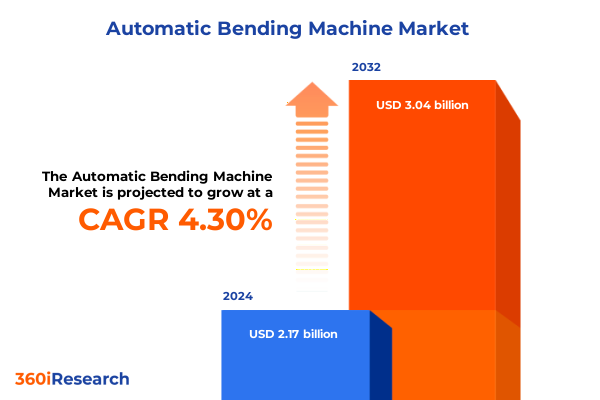

The Automatic Bending Machine Market size was estimated at USD 2.22 billion in 2025 and expected to reach USD 2.28 billion in 2026, at a CAGR of 4.55% to reach USD 3.04 billion by 2032.

Unveiling the Strategic Importance and Operational Efficiency of Automatic Bending Machines in Evolving Manufacturing Environments Globally

The landscape of modern manufacturing is undergoing a profound evolution driven by the need for higher precision, increased throughput, and sustainable operations. Automatic bending machines are at the forefront of this transformation, enabling manufacturers to meet stringent design requirements while optimizing production efficiency. As product life cycles shorten and customization demands intensify, these machines deliver the repeatability and agility that legacy equipment cannot match. Moreover, the integration of advanced control systems and real-time monitoring capabilities has shifted the role of bending equipment from a stand-alone resource to a connected node within smart factory ecosystems, reinforcing their strategic importance.

In addition to their operational benefits, automatic bending machines also support sustainability objectives by minimizing material waste and reducing energy consumption through optimized bending sequences. This aligns with broader corporate commitments to environmental stewardship and regulatory compliance, making these machines vital assets in green manufacturing strategies. As digitalization advances, manufacturers that leverage data-driven insights from bending operations are poised to unlock further cost savings and product quality improvements. Overall, the adoption of automatic bending solutions represents a critical step for organizations aiming to sustain competitiveness in an increasingly complex market environment.

Exploring the Rapid Technological and Operational Shifts Redefining Automatic Bending Machine Capabilities and Industry Applications Over the Past Decade

Technological innovation and shifting market demands have catalyzed a series of transformative shifts in how automatic bending machines are designed and deployed. The transition from purely hydraulic systems to hybrid electric architectures has resulted in machines that offer faster cycle times and enhanced precision. Moreover, embedding servo-electric actuators has granted manufacturers unprecedented control over bending angles, enabling complex geometries that were previously unattainable. These advancements have been accompanied by the integration of machine learning algorithms that optimize bend sequences in real time, reducing set-up times and improving throughput.

Concurrently, software platforms designed for remote diagnostics and predictive maintenance have emerged as essential tools for maintaining machine uptime. This shift toward connectivity is redefining maintenance paradigms, allowing service teams to anticipate component wear and schedule interventions proactively. Furthermore, the rise of modular machine designs has empowered manufacturers to reconfigure production lines swiftly in response to product mix changes. This flexibility has become increasingly vital as customer expectations for rapid delivery and personalized products intensify across sectors such as automotive and aerospace.

Taken together, these operational and technological shifts are creating a new standard for automatic bending equipment-one that prioritizes agility, connectivity, and precision. As the industry continues to embrace Industry 4.0 principles, these machines will serve as critical enablers of smart manufacturing environments, facilitating seamless integration with robotics and advanced material handling systems.

Assessing the Cumulative Impact of United States 2025 Tariffs on Supply Chains and Competitiveness in Automatic Bending Equipment Sector

The imposition of United States tariffs in 2025 has exerted a far-reaching impact on supply chain dynamics and competitive positioning within the automatic bending equipment sector. By increasing import costs for raw materials such as high-strength steels and specialized alloys, manufacturers have been compelled to reassess sourcing strategies. Consequently, many have sought domestic steel suppliers or negotiated longer-term contracts to mitigate price volatility. These strategic adjustments have ripple effects across production schedules and capital expenditure planning, as equipment manufacturers pass on a portion of these increased costs through price adjustments to end-users.

In response to these tariff-induced pressures, some machine builders have localized component production or diversified their vendor base to maintain cost competitiveness. This shift has led to the development of new supplier relationships and the reconfiguration of global procurement networks. At the same time, companies with established domestic manufacturing footprints have gained a strategic advantage, enabling them to shield operations from the full impact of tariff increases. As a result, regional players have strengthened their market positions, while global exporters face heightened headwinds in price-sensitive applications.

Ultimately, the cumulative impact of the 2025 tariff regime underscores the importance of agility in procurement and supply chain resilience. Manufacturers that proactively adapt sourcing strategies and invest in local partnerships are better positioned to sustain profitability and meet evolving customer demands under a shifting regulatory landscape.

Unearthing Critical Insights from End Use Industry Technology Bending Capacity and Automation Level Segmentation Frameworks for Strategic Market Positioning

Decoding the market through the lens of end use industries reveals distinct patterns of adoption and growth opportunities. In aerospace applications, precision and material traceability drive the need for automated bending technologies that can accommodate specialty alloys while ensuring stringent quality standards. Within the automotive sector, original equipment manufacturers prioritize high-volume cycle times and repeatability, while aftermarket suppliers value versatility for smaller batch runs. Construction end users focus on durability and the ability to handle thick structural components, whereas consumer goods producers seek machines that can bend decorative metals with minimal manual intervention. Meanwhile, shipbuilding operations require robust systems capable of shaping large plates with consistent force distribution.

From a technological standpoint, the market is segmented between CNC-driven platforms that offer multiple axis control for intricate bend sequences and purely electric or hydraulic models that balance precision and power. CNC systems with three-axis configurations serve standard bending tasks, while four and higher axis machines enable compound bending in fewer operations. Two-axis models maintain relevance for simple profiles due to their reliability and lower entry cost. Electric systems deliver quieter operations and reduced energy consumption, whereas hydraulic machines excel in high-force tasks. Meanwhile, servo-electric solutions bridge the gap by offering dynamic force modulation with minimal hydraulic fluid usage.

Evaluating bending capacity provides further granularity, distinguishing machines by their maximum tonnage. Units designed for lighter loads up to 100 tons cater to precision components, while mid-range models between 101 and 300 tons support a broader array of industrial parts. Heavy-duty systems above 300 tons underpin large-scale structural bending tasks. Finally, the level of automation differentiates standalone machines from integrated production lines. Conveyor-integrated systems ensure seamless part transfer and processing, whereas robotic cell configurations offer scalable automation for high-mix, low-volume operations.

This comprehensive research report categorizes the Automatic Bending Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Automation Level

- Technology

- Bending Capacity

- End Use Industry

Illuminating Distinct Regional Dynamics Shaping Adoption and Innovation of Automatic Bending Machines Across Key Global Markets

Regional dynamics exert a powerful influence on the trajectory of automatic bending machine adoption. In the Americas, manufacturers benefit from well-established supply chains and a growing emphasis on reshoring initiatives. Domestic policies encouraging investment in advanced manufacturing have spurred demand for automated bending solutions that can underpin localized production. Conversely, Europe, the Middle East, and Africa exhibit a mosaic of regulatory environments and infrastructure maturity. Western European countries emphasize energy efficiency and digital integration, pushing vendors to innovate in machine connectivity. In contrast, Middle Eastern markets focus on heavy fabrication for construction and oil and gas projects, demanding machines capable of handling large sections, while parts of Africa are characterized by emerging manufacturing capacities that require cost-effective automation solutions.

The Asia-Pacific region presents a diverse landscape ranging from highly advanced manufacturing hubs to rapidly industrializing economies. Nations with established automotive and electronics sectors drive strong demand for high-precision, high-speed bending systems, often paired with Industry 4.0 technologies. Meanwhile, developing markets in Southeast Asia are embracing automation to overcome rising labor costs and to boost quality standards. Across APAC, government incentives for smart manufacturing and local content requirements have accelerated investments in automated bending equipment, fostering partnerships between global machinery providers and regional integrators.

These regional characteristics underscore the need for tailored strategies that account for local regulatory incentives, supply chain configurations, and industry maturity. Companies that align product development and go-to-market approaches with these regional nuances will be best positioned to capture emerging growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Automatic Bending Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves Competitive Strengths and Collaborative Innovations Among Leading Automatic Bending Machine Manufacturers

Leading manufacturers in the automatic bending machine sector are executing a variety of strategic initiatives to maintain forward momentum. Some have prioritized the launch of modular platforms that facilitate rapid retooling and scalability, enabling customers to expand capacity incrementally. Others have intensified investments in digital services, offering cloud-based performance analytics and remote maintenance packages that enhance machine reliability. Collaborative partnerships between machine builders and control system providers have driven the integration of advanced human-machine interfaces, reducing operator training time and error rates.

Competitive strengths are also being reshaped by the ability to deliver turnkey solutions that combine bending equipment with downstream processes such as part handling and robotic loading. Companies that can orchestrate these end-to-end offerings not only streamline installation for clients but also create high entry barriers for new market entrants. In addition, joint ventures and strategic alliances with local integrators have enabled certain vendors to penetrate emerging markets more effectively, leveraging regional insights to align product features with customer needs. This collaborative model is particularly impactful in regions with nascent automation ecosystems, where implementation support is critical.

Innovation pipelines are bolstered through in-house R&D and acquisitions of niche technology firms specializing in sensor development and AI-driven process optimization. By augmenting core machine designs with intelligent monitoring and adaptive control algorithms, these manufacturers are forging a competitive advantage in operational efficiency and product quality. Overall, the competitive landscape is defined by a dual focus on product innovation and service-oriented business models that drive recurring value for end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Bending Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amada Co., Ltd.

- AMOB S.r.l.

- Baileigh Industrial, LLC

- BLM Group S.p.A.

- Bystronic Laser AG

- Durma Makina Sanayi ve Ticaret A.Ş.

- GA-MOR Machine Tools Pvt. Ltd.

- Highmach CTL India Pvt. Ltd.

- Hines Bending Systems Inc

- Jeet Machine Tools Corporation Pvt. Ltd.

- Joe Machinery Pvt. Ltd.

- Komatsu Industries Corp.

- LVD Company nv

- Murata Machinery, Ltd.

- Parrytech Hydraulics Pvt. Ltd.

- Prima Industrie S.p.A.

- Salvagnini S.p.A.

- Schlebach Maschinen GmbH

- Technex Machines India LLP

- TRUMPF GmbH + Co. KG

- Unison Ltd.

- Weldor CNC Machines Pvt. Ltd.

Delivering Actionable Strategic Recommendations to Drive Efficiency Innovation and Competitive Advantage in Automatic Bending Machine Operations

Industry leaders can capitalize on market momentum by adopting a series of targeted actions. First, accelerating the integration of predictive maintenance tools will enhance machine availability and reduce unplanned downtime. By embedding sensors and analytics within bending equipment, organizations can transition from reactive to proactive servicing, unlocking efficiency gains and lowering lifecycle costs. Furthermore, aligning R&D efforts with emerging digital factory initiatives will ensure new machine models are designed for seamless interoperability with MES and ERP systems.

Another critical action is to cultivate strategic partnerships with software and robotics providers. This collaborative approach can yield turnkey solutions that address complex production requirements while simplifying the purchase decision for end users. Simultaneously, expanding local service footprints in growth regions will build customer confidence and facilitate faster response times. Investing in comprehensive training programs for operators will also drive adoption, as user proficiency directly influences throughput and quality outcomes.

Finally, embedding sustainability considerations into machine design-such as energy-recovery systems and eco-friendly hydraulic fluids-will resonate with corporate environmental goals and regulatory mandates. By leading with innovation that balances performance and environmental impact, equipment manufacturers can differentiate their offerings and position themselves as trusted partners in customers’ digital transformation journeys.

Detailing Robust Research Methodology Data Collection and Analytical Approaches Underpinning Comprehensive Market Insights

The research methodology underpinning this analysis combines rigorous primary and secondary data collection with advanced analytical techniques. Primary research involved in-depth interviews with industry experts, equipment manufacturers, system integrators, and end users, ensuring a holistic perspective on market dynamics. These insights were supplemented by technical workshops and site visits to major production facilities, providing direct observation of machine performance and application contexts.

Secondary research encompassed a thorough review of trade publications, technical whitepapers, and patent filings to track emerging technologies and identify competitive developments. Regulatory frameworks and tariff schedules were analyzed to assess their impact on supply chain configurations and cost structures. Data triangulation techniques were employed to validate findings across multiple sources, enhancing the robustness and reliability of the conclusions.

Analytical tools such as SWOT and Porter’s Five Forces were applied to evaluate market attractiveness and competitive pressures, while scenario planning exercises facilitated the exploration of potential future developments. This multi-layered approach ensures that the insights presented are grounded in empirical evidence and reflect the nuanced realities of the automatic bending machine landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Bending Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Bending Machine Market, by Automation Level

- Automatic Bending Machine Market, by Technology

- Automatic Bending Machine Market, by Bending Capacity

- Automatic Bending Machine Market, by End Use Industry

- Automatic Bending Machine Market, by Region

- Automatic Bending Machine Market, by Group

- Automatic Bending Machine Market, by Country

- United States Automatic Bending Machine Market

- China Automatic Bending Machine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Imperatives to Chart the Future Direction of Automatic Bending Machine Adoption Pathways

Drawing together the core findings, it is evident that automatic bending machines are central to advancing manufacturing productivity, quality, and sustainability. Technological innovations, including servo-electric actuators and advanced control software, have raised the bar for precision and operational flexibility. The 2025 tariff adjustments have further highlighted the need for resilient supply chains and local sourcing strategies to safeguard profitability.

Segment analysis has revealed that diverse end use industries demand tailored machine capabilities, while technology choices and automation levels influence both operational outcomes and total cost of ownership. Regional variations underscore the importance of localized market strategies, particularly in emerging economies where infrastructure maturity and regulatory incentives shape adoption patterns. Leading vendors differentiate themselves through integrated solutions, service-oriented models, and strategic alliances, positioning them to capture growth across multiple sectors.

Looking ahead, organizations that embrace predictive maintenance, deepen digital integration, and prioritize sustainability will be best equipped to harness the full potential of automatic bending technology. By aligning product development with customer requirements and regional nuances, equipment builders can unlock new revenue streams and drive industry innovation.

Engage Directly with Ketan Rohom to Secure Comprehensive Market Research Insights and Drive Strategic Growth Initiatives in Automatic Bending Solutions

To obtain a detailed understanding of market dynamics and gain a competitive edge, readers are encouraged to engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings deep expertise in market intelligence and can guide potential subscribers through key insights tailored to their strategic objectives. By establishing this dialogue, organizations can secure a bespoke overview of the automatic bending machine landscape and identify the most impactful levers for growth.

This direct engagement offers more than a transactional report purchase; it facilitates a collaborative exploration of emerging trends, technological advancements, and regulatory influences shaping the industry. By partnering with Ketan, stakeholders can ensure they are investing in high-value research that aligns with their operational priorities and long-term goals. This partnership underscores a commitment to data-driven decision making and positions companies to capitalize on market opportunities with confidence.

Schedule a conversation with Ketan today to explore customized market intelligence solutions and unlock actionable recommendations that will drive transformative outcomes in your organization.

- How big is the Automatic Bending Machine Market?

- What is the Automatic Bending Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?