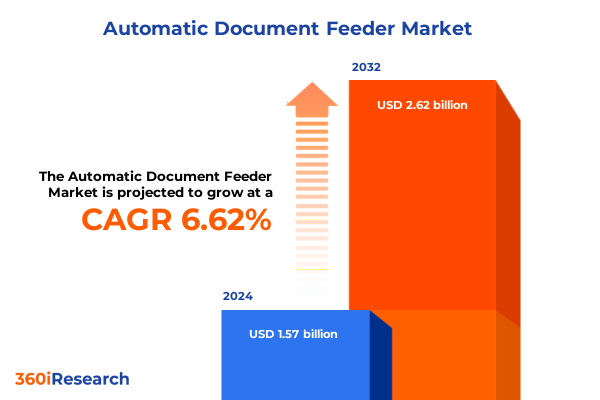

The Automatic Document Feeder Market size was estimated at USD 1.67 billion in 2025 and expected to reach USD 1.77 billion in 2026, at a CAGR of 6.68% to reach USD 2.62 billion by 2032.

Integrating the Power of Automatic Document Feeders to Revolutionize Document Management Workflows and Boost Operational Efficiency in Modern Enterprises

In an era defined by digital transformation and relentless demand for efficient information handling, automatic document feeders have emerged as indispensable assets for organizations across industries. These devices streamline the process of digitizing, copying, and managing high volumes of documents while minimizing manual intervention. By automating the feeding of multiple pages into scanners, copiers, and multifunction printers, automatic document feeders significantly boost productivity, reduce operational costs, and enhance accuracy in data capture workflows.

Moreover, the integration of advanced image processing algorithms and connectivity capabilities has expanded the scope of document management. Enterprises now leverage networked feeders to securely route scanned files directly to cloud repositories, enterprise content management systems, or collaborative platforms. In doing so, they fortify compliance with stringent data governance regulations and accelerate information sharing among distributed teams. As organizations navigate the complexities of hybrid work environments and digital archiving mandates, automatic document feeders stand as pivotal enablers of seamless document handling and secure data exchange.

Mapping the Transformative Technological and Market Shifts Reshaping the Automatic Document Feeder Landscape in a Digitally Driven Era

The landscape of automatic document feeders has undergone profound transformations fueled by innovations in imaging technologies, artificial intelligence, and connectivity solutions. Initially confined to rudimentary mechanical feed mechanisms, contemporary feeders now incorporate dual-pass and single-pass architectures that optimize throughput and image fidelity. Dual-pass systems enhance text clarity and color accuracy by scanning each side of a document separately, whereas single-pass systems prioritize speed by capturing both sides simultaneously-tailoring solutions to diverse user requirements.

Simultaneously, the advent of wireless feeders equipped with Bluetooth and Wi-Fi connectivity has liberated scanning stations from the constraints of physical cabling, fostering mobility and flexible deployment. Combined with robust software ecosystems offering real-time error correction and adaptive brightness adjustments, these technological shifts have democratized access to high-performance scanning, even in decentralized or remote office setups. As digital initiatives accelerate, the convergence of hardware advancements and intelligent software processing continues to redefine the benchmarks of speed, reliability, and security in document management.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Supply Chains and Cost Structures within the Automatic Document Feeder Market

Since the imposition of 25 percent Section 301 tariffs on certain electronic goods originating from specific countries, suppliers of automatic document feeders have navigated elevated input costs and disrupted supply chains. These duties, implemented in mid-2018 and persisting into 2025, have compelled manufacturers to reassess sourcing strategies and absorb parts of the tariff burden to maintain competitive pricing. Consequently, some vendors have localized component fabrication or diversified manufacturing bases to regions outside the tariff scope, thereby mitigating cost exposures and fortifying supply resilience.

In parallel, distributors and end users have adapted procurement practices by embracing longer-term purchasing agreements and bulk order consolidations to stabilize pricing under the prevailing tariff regime. Although the additional duty has imposed upward pressure on average selling prices, manufacturers’ push toward added-value features-such as enhanced paper handling capacities and integrated OCR software-has offset some cost sensitivities by justifying premium pricing through superior performance. Moving forward, continued dialogue between industry stakeholders and trade policymakers will be critical to balance domestic manufacturing incentives with customer affordability in an increasingly tariff-intensive environment.

Unveiling Deep Segment-Level Insights across Product Types Technologies and Applications Driving the Automatic Document Feeder Market Dynamics

An in-depth examination of automatic document feeder market segments reveals divergent growth trajectories driven by customer needs and operational contexts. Integrated units, embedded within multifunction printers, have gained traction among small to medium-sized enterprises seeking all-in-one document processing platforms. In contrast, standalone scanners equipped with dedicated feeders serve high-volume environments requiring specialized throughput and scanning quality. Across feed types, flatbed feeders accommodate delicate or oversized media, while roller-fed mechanisms excel in continuous batch processing scenarios. Sheetfed designs provide optimal balance for general office applications, delivering moderate speed and reliable media handling.

From a technological standpoint, dual-pass feeders appeal to archival and legal sectors where image fidelity and color accuracy are paramount, whereas single-pass variants satisfy high-speed transactional scanning in banking and logistics. Devices with high-capacity paper handling exceeding 200 sheets cater to centralized mailrooms and service bureaus, while low- and medium-capacity feeders support departmental use with varying workload demands. Speed ranges below 20 pages per minute address intermittent scanning tasks, mid-range speeds of 20–40 pages per minute align with office multipurpose needs, and above 40 pages per minute drive performance in enterprise scan centers.

Connectivity preferences also shape procurement decisions: wired feeders maintain consistent network throughput for secure environments, whereas wireless solutions-leveraging Bluetooth for direct device-to-scanner pairing or Wi-Fi for broader network access-enable flexible workstation setups. The application spectrum spans copying, faxing, printing, and advanced scanning functions, each requiring specific feeder configurations and software integrations. Finally, adoption varies significantly across end-use industries: banking, financial services, and insurance segments prioritize transaction speed and compliance; educational institutions emphasize ease of use and cost-effectiveness; government and healthcare entities demand robust security and HIPAA-compliant workflows; manufacturing, retail, and transportation enterprises focus on integration with enterprise resource planning and logistics platforms.

This comprehensive research report categorizes the Automatic Document Feeder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Feed Type

- Technology

- Paper Handling Capacity

- Speed Range

- Connectivity Type

- Application

- End-Use Industry

Decoding Regional Demand Patterns Highlighting Americas EMEA and Asia Pacific Dynamics in the Automatic Document Feeder Industry

Regional demand patterns for automatic document feeders underscore nuanced market drivers across the Americas, EMEA, and Asia-Pacific. In the Americas, large corporate enterprises and government agencies lead adoption, with buyers placing premium value on advanced security protocols, high throughput, and seamless integration into standardized IT infrastructures. North American organizations are particularly proactive in upgrading legacy scanning systems to support paperless initiatives and distributed work models.

Meanwhile, Europe, the Middle East, and Africa exhibit diverse purchasing behaviors influenced by regulatory mandates on data retention and cross-border trade requirements. Western Europe’s stringent privacy regulations have catalyzed the procurement of feeders with robust encryption and audit trail capabilities, whereas emerging markets in Africa prioritize cost-effective, multifunctional units that address both digital and analog document workflows. In the Middle East, vision for smart city and e-governance projects is accelerating demand for municipal and public service scanning solutions.

In Asia-Pacific, investment is driven by burgeoning small and medium enterprise segments, educational institutions, and expanding financial hubs. Chinese and Indian markets, in particular, demonstrate heightened interest in standalone high-capacity feeders to support rapid urbanization and digitization of public records. Concurrently, regional manufacturers are forging partnerships with global technology providers to introduce localized models featuring multilingual interfaces and regional compliance standards. These varied regional imperatives underscore the importance of tailoring product portfolios to match distinct market maturities, regulatory environments, and end-user priorities.

This comprehensive research report examines key regions that drive the evolution of the Automatic Document Feeder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Imperatives and Competitive Differentiators among Leading Automatic Document Feeder Manufacturers and Solution Providers

Leading manufacturers in the automatic document feeder space continue to differentiate through strategic investments in research and development, channel partnerships, and value-added services. Established office equipment providers are expanding feeder compatibility across multiple scanner and multifunction printer lines, ensuring customers benefit from streamlined maintenance and unified software ecosystems. At the same time, specialized scanning solution firms are carving niches by focusing on cloud-native workflows and advanced analytics that transform raw scanned data into actionable business insights.

Collaborations between hardware vendors and software developers have led to the emergence of intelligent feeder modules that automatically detect document anomalies, execute real-time image corrections, and synchronize with enterprise content management platforms. Additionally, several key players have bolstered their global service networks to offer rapid-response maintenance contracts, preventive diagnostics, and remote firmware updates, thereby minimizing downtime and protecting end-user productivity. Competitive positioning is further influenced by strategic alliances with IT resellers, system integrators, and value-added distributors who bundle feeders into broader digital transformation projects.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Document Feeder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avision Inc.

- Brother Industries, Ltd.

- BROTHER INTERNATIONAL PRIVATE LTD

- Canon Inc.

- Dell Technologies Inc.

- Dymo Corporation

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Kodak Alaris Inc.

- Konica Minolta, Inc.

- Kyocera Corporation

- Lexmark International Inc.

- Microtek International, Inc.

- Mustek Systems, Inc.

- Oki Electric Industry Co., Ltd.

- Panasonic Corporation

- Plustek Inc.

- Ricoh Company, Ltd.

- Seiko Epson Corporation

- Sharp Corporation by Hon Hai Precision Industry Co., Ltd

- Toshiba TEC Corporation

- UMAX Technologies, Inc.

- Visioneer, Inc.

- Xerox Corporation

Formulating Actionable Recommendations for Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Automatic Document Feeder Trends

To thrive in a rapidly evolving document management ecosystem, industry leaders must adopt a multifaceted strategy grounded in innovation, customer-centricity, and operational agility. First, expanding the development of wireless and hybrid connectivity options will address evolving workplace configurations and the demand for untethered scanning stations. Second, integrating artificial intelligence–powered image enhancement and document classification capabilities within feeder hardware can deliver substantial time savings and reduce the need for downstream manual processing.

Furthermore, cultivating partnerships with enterprise software providers will facilitate seamless integration with content management systems and robotic process automation platforms. This approach not only elevates the value proposition but also locks in customer loyalty through interoperable solutions. Leaders should also explore modular feeder designs that allow easy field upgrades to support evolving capacity and speed requirements, thus extending product lifecycles and maximizing return on investment. Finally, proactive engagement with trade authorities to mitigate tariff risk, coupled with diversified manufacturing footprints, will safeguard supply chains against geopolitical disruptions and sustain competitive cost structures.

Detailing Comprehensive Research Methodology Employed to Derive Robust Insights and Guarantee Data Integrity within the Automatic Document Feeder Study

This study harnessed a rigorous methodology combining secondary data analysis, expert interviews, and cross-verification to ensure comprehensive coverage and data integrity. Initially, publicly available sources such as industry journals, trade publications, patent filings, and regulatory filings were reviewed to map historical trends and competitive developments. Market participant annual reports and official trade statistics provided baseline insights into supply chain dynamics and pricing structures.

Subsequently, structured discussions with C-level executives, product managers, and channel partners were conducted to validate secondary findings and uncover nuanced perspectives on customer preferences, procurement cycles, and technological adoption barriers. Qualitative insights were synthesized with quantitative data through triangulation techniques, reconciling discrepancies and calibrating assumptions against real-world sampling. Finally, all information underwent iterative cross-checking and peer review to eliminate bias and reinforce the credibility of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Document Feeder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Document Feeder Market, by Product Type

- Automatic Document Feeder Market, by Feed Type

- Automatic Document Feeder Market, by Technology

- Automatic Document Feeder Market, by Paper Handling Capacity

- Automatic Document Feeder Market, by Speed Range

- Automatic Document Feeder Market, by Connectivity Type

- Automatic Document Feeder Market, by Application

- Automatic Document Feeder Market, by End-Use Industry

- Automatic Document Feeder Market, by Region

- Automatic Document Feeder Market, by Group

- Automatic Document Feeder Market, by Country

- United States Automatic Document Feeder Market

- China Automatic Document Feeder Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings to Illuminate Future Pathways and Strategic Imperatives for Stakeholders in the Automatic Document Feeder Ecosystem

In summary, automatic document feeders have evolved from mechanical accessories into critical enablers of digital transformation, addressing the escalating need for secure, high-throughput document management. Technological innovations-spanning dual-pass imaging, wireless connectivity, and AI-driven processing-are unlocking new levels of performance and usability. Meanwhile, tariff-induced cost pressures have been balanced by strategic sourcing adjustments and the bundling of advanced features to justify premium pricing.

Segment-specific preferences underscore the importance of a diversified product portfolio, with tailored solutions for integrated multifunction environments, dedicated scanning centers, and specialized industry applications. Regional variations in regulatory frameworks and digital maturity further emphasize the need for localized strategies and compliance-oriented features. As competition intensifies, vendors that emphasize interoperability, modular design, and service excellence will be best positioned to capture emerging opportunities. Ultimately, stakeholders that blend technological foresight with operational flexibility will shape the future contours of the automatic document feeder landscape.

Unlock Comprehensive Market Intelligence on Automatic Document Feeders by Collaborating with Ketan Rohom for Tailored Insights and Report Access

Unlock unparalleled insights into the automatic document feeder market’s competitive landscape and technological advancements by reaching out to Ketan Rohom, Associate Director, Sales & Marketing. By partnering directly, you will gain access to a comprehensive market research report that delves into transformative shifts, regional demand patterns, tariff impacts, and segmentation-driven dynamics shaping the industry. Ketan Rohom offers tailored consultation to align the findings with your business priorities, ensuring that decision-makers obtain actionable intelligence and strategic foresight. Elevate your market positioning with precise data and expert analysis on product innovations, connectivity trends, end-use applications, and competitive strategies. Engage now to secure this indispensable resource and empower your organization’s growth trajectory in the evolving automatic document feeder ecosystem.

- How big is the Automatic Document Feeder Market?

- What is the Automatic Document Feeder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?