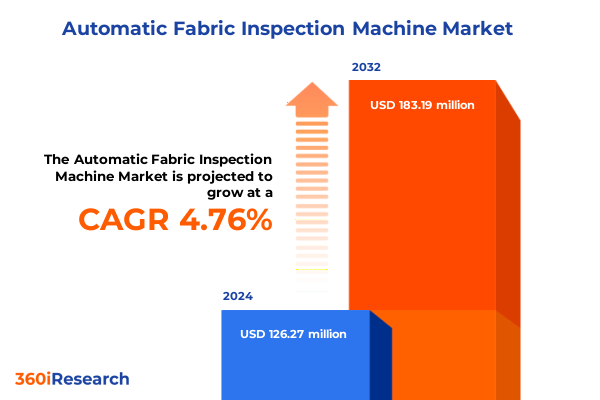

The Automatic Fabric Inspection Machine Market size was estimated at USD 131.91 million in 2025 and expected to reach USD 144.53 million in 2026, at a CAGR of 4.80% to reach USD 183.19 million by 2032.

Revolutionizing Textile Quality Control with Smart Automatic Fabric Inspection Machines for Enhanced Accuracy Speed and Operational Excellence

Automatic fabric inspection machines represent the next generation in textile quality control, automating the detection and classification of defects across diverse fabric types. These systems integrate high-resolution sensors and intelligent software to scan continuous fabric rolls at production speeds previously unattainable through manual inspection. Transitioning from manual methods to automated solutions, manufacturers have realized up to 50% reductions in lead times and over 80% decreases in material waste, underscoring the strategic value of rapid and reliable quality monitoring in competitive textile environments

Amid intensifying buyer specifications and regulatory standards that demand defect rates below 0.5%, the adoption of automated inspection has become essential for maintaining compliance and brand reputation. In regions such as Asia-Pacific, where exporters supply major global retailers, automated systems leveraging AI-driven visual algorithms deliver 99.3% recognition accuracy, a critical improvement over error-prone manual inspections whose accuracy often falls below 80% Moreover, as labor costs rise and skilled workforce shortages persist, automated inspection machines provide a stable alternative, aligning operational efficiency with cost optimization without compromising quality.

Technological convergence is further amplifying the capabilities of inspection systems. Cutting-edge solutions incorporate AI and machine learning to adaptively recognize novel defect patterns while advanced imaging modalities such as hyperspectral and near-infrared cameras enhance detection fidelity. Real-time data connectivity enabled by IoT platforms ensures continuous performance monitoring, predictive maintenance, and process insights that drive higher throughput and lower downtime across textile plants

Driving Industry Transformation through Integrated AI Robotics and Advanced Imaging Technologies in Fabric Inspection for Textile Manufacturing 4.0

Digital transformation is reshaping fabric inspection into an integral component of Industry 4.0 ecosystems. Modular AI cameras combined with robotic handlers now scan fabrics at line speeds exceeding 120 meters per minute, flagging micro-tears and pattern inconsistencies with 25% higher accuracy than manual review. Pioneering deployments in Turkish and Asian mills demonstrate that embedding AI inspections yields a 40% drop in defect-related waste while sustaining production targets, thereby driving capital investments in smart manufacturing platforms

Beyond mere defect detection, modern inspection solutions employ geospatial defect mapping and predictive analytics to uncover root-cause process inefficiencies. Platforms such as Robro’s KWIS automate alerts to maintenance teams, preventing downstream failures, while Uster Technologies and Loepfe Textile have collaborated with analytics partners to lift detection precision by up to 40% compared to conventional optical systems. This shift toward data-driven process control not only enhances fabric quality but also reduces unplanned downtime and extends equipment lifecycles

Integration with enterprise resource planning and manufacturing execution systems is enabling seamless compliance reporting and supply chain transparency. Emerging standards such as the European Union’s Digital Product Passport rely on automated inspection data to generate ISO-compliant quality certificates and digital defect repositories. As sustainability mandates intensify, brands leverage real-time inspection insights to quantify waste reduction metrics, aligning production practices with circular-economy goals while reinforcing traceability across global textile networks

Assessing the Cumulative Effects of United States Section 301 Tariffs on Imported Fabric Inspection Machinery and Supply Chain Dynamics through 2025

On January 1, 2025, the United States Trade Representative (USTR) implemented additional Section 301 duties, elevating tariffs on certain imported industrial machinery, including textile equipment under chapters 84 and 85 of the Harmonized Tariff Schedule (HTSUS), to 25%. This measure forms part of the four-year review of China-origin imports, aiming to recalibrate trade imbalances and address strategic industrial dependencies

Recognizing the operational impact, USTR has established an exclusion request process for eligible machinery, open from October 15, 2024 through March 31, 2025. Importers can petition for product-specific relief to exclude covered subheadings from the tariffs, with granted exclusions effective until May 31, 2025. The machinery exclusion list encompasses textile spinning and inspection machines, providing a critical window for manufacturers to mitigate increased duties through formal exemption filings

These tariff adjustments and the concurrent exclusion framework have prompted many textile manufacturers to reassess their supply chain strategies. As import costs rise, industry leaders are exploring localized production and alternative sourcing from third-country suppliers to preserve cost competitiveness. Concurrently, importers are accelerating exclusion petitions to reduce duty burdens, while domestic machinery producers are seizing opportunities to expand market share amid a shifting regulatory environment

Uncovering Critical Market Segmentation Perspectives Spanning Application Fabric Type Inspection Technology Production Stage and Installation Modes

Deep insights by application reveal that apparel stands at the forefront of automated fabric inspection adoption, driven by the rigid quality demands of children’s, men’s, and women’s wear. Within children’s wear, producers of infant clothing, school uniforms, and toddler garments leverage high-precision scanning to ensure safety standards and aesthetic uniformity. Men’s apparel manufacturers specializing in jackets, pants, and shirts depend on consistent defect detection to uphold brand integrity, while women’s bottom, dress, and top segments implement advanced vision systems to manage complex fabric blends and intricate pattern designs. These targeted applications underscore the critical role of intelligent inspection in meeting the fast-paced production cycles characteristic of modern fashion supply chains

Transitioning to automotive and industrial textiles, exterior components such as body panels and paint coatings, interior elements like carpets, headliners, and seat covers, and safety systems encompassing airbags, door panels, and seat belts, all benefit from in-line inspection systems capable of identifying micro-abrasions and material inconsistencies. Similarly, home textiles producers apply inspection solutions to bed linen sets-duvet covers, pillowcases, and sheets-as well as curtain ranges and furniture upholstery, ensuring durability and visual appeal. The medical segment, with its stringent regulatory oversight, employs automated inspection across protective garments, surgical drapes, and wound care materials, including caps, gloves, masks, gauze, gowns, bandages, and dressings, to guarantee patient safety and compliance

Moreover, the proliferation of knitted fabrics-particularly warp-knit and weft-knit constructions-has accelerated within athleisure and healthcare applications, fueled by consumer preferences for elasticity and comfort. TechSci Research reports robust growth in the knitted fabric market, emphasizing its versatility across both fashion and technical domains Concurrently, inspection technologies adapt to nonwoven subtypes like meltblown and spunbond materials used in medical and filtration applications, as well as woven blends and pure cotton or polyester textiles common in consumer goods. Integrated infrared, laser, ultrasonic, and vision systems engage at pre-production, in-process, and post-production stages, with installation modes ranging from fully automatic inline setups to handheld manual units and semi-automatic continuous platforms, reflecting the diverse requirements of global textile manufacturers.

This comprehensive research report categorizes the Automatic Fabric Inspection Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Fabric Type

- Technology Type

- Inspection Stage

- Application

- Sales Channel

Delving into Regional Market Dynamics across the Americas Europe Middle East Africa and Asia Pacific Revealing Growth Drivers and Adoption Trends

Throughout the Americas, leading fashion and automotive manufacturers have spearheaded the deployment of automated inspection technologies to bolster domestic production resilience and meet stringent North American free trade agreement requirements. Major textile hubs in the United States and Mexico integrate inline vision systems to uphold quality across denim, sportswear, and medical textiles, benefiting from incentive programs and state-level tax credits for advanced manufacturing. This regional emphasis on automation extends to Canada’s recycling and circular-economy initiatives, where inspection data underpins sustainable production and waste management strategies

In Europe, Middle East, and Africa, market maturity drives a focus on regulatory compliance and traceability. European mills proactively adopt AI-Enhanced inspection to generate ISO-compliant quality certificates and support the European Union’s Digital Product Passport framework, facilitating cross-border trade. Middle East manufacturers leverage high-speed camera arrays to satisfy the emerging demands of local automotive and luxury fashion sectors, while African textile clusters in Morocco and Egypt explore cost-effective semi-automatic systems to attract global brand partnerships through verified quality assurances.

Asia-Pacific remains the largest manufacturing hub, with China, India, and Bangladesh driving demand for scalable, cost-efficient inspection solutions. Investments in smart factory initiatives in Southeast Asia, supported by government-backed Industry 4.0 programs, have accelerated the integration of 3D cameras and ultrasonic sensors within weaving and finishing lines. This region increasingly dominates global exports by pairing high-volume production with automated quality control, sustaining competitive advantages in price and speed of delivery

This comprehensive research report examines key regions that drive the evolution of the Automatic Fabric Inspection Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Vendors and Strategic Collaborations Driving Innovation and Competitive Advantage in Automatic Fabric Inspection Solutions

Industry pioneers such as Germany-based Erhardt+Leimer continue to advance optical inspection technology through innovations like the ELSEAMTEX SI 1001 seam sensor, which uses AI-driven image analysis to detect cross-seams without physical contact and adapt to varying fabric thicknesses. The Elmeta MDA metal detector further optimizes production by identifying foreign inclusions, while integrated WLAN connectivity supports remote monitoring and app-based control

Leading Swiss developer Uster Technologies, in collaboration with analytics partner insight4ap, has enhanced defect-detection accuracy by 40% over legacy systems, leveraging cloud-enabled dashboards for real-time oversight across multiple sites. Parallel advances by Swiss firm Loepfe Textile, through Azure-based platforms, offer multinational textile groups consolidated defect maps, underscoring the move toward centralized quality intelligence. Robro’s KWIS exemplifies predictive maintenance integration, delivering automated alerts that preempt equipment failures and reduce scrap rates

Italy’s Testa Group S.r.l. and its SuperTestaRossa model illustrate how coupling inspection with automated cutting and packaging yields comprehensive roll mapping and optimized yield. Simultaneously, UK-based Shelton Machines Ltd. has refined template-matching techniques in its WebSpector platform to detect complex pattern deviations on printed textiles with over 97% accuracy, a marked improvement over traditional manual inspection rates below 65% Emerging suppliers such as Smartex and Course are also gaining traction by offering modular vision solutions and AI-based analytics tailored for niche fabric types, signaling a broader competitive landscape driven by specialization and software flexibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Fabric Inspection Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Brevetti Cea spa

- C-TEX NTX Ltd

- Caron Technology s.r.l.

- Chevalerin

- Comatex Textile Machinery

- Erhardt+Leimer GmbH

- GAYATRITEX ENGINEERS PVT. LTD.

- Juki Corporation

- Krögel Maschinenbau

- Mimaki La Meccanica Srl.

- OSHIMA Taiwan Co. Ltd.

- Suntech Textile Machinery

- Welco Garment Machinery P (LTD).

Actionable Strategic Recommendations for Textile Industry Leaders to Capitalize on Efficiency Sustainability and Technological Advancements in Fabric Inspection

To capitalize on automation benefits, textile manufacturers should pursue a dual strategy of technology integration and workforce development. By partnering with proven AI-vision providers and commissioning pilot programs, companies can validate system performance against specific fabric types and production stages before scaling. Concurrently, investing in cross-functional training ensures operators can manage both hardware and software aspects, maximizing uptime and defect-analysis productivity.

Given the imminent tariff increases and machinery exclusion deadlines, procurement and trade teams must prioritize submission of exclusion requests for HTS 84 and 85 subheadings by the March 31, 2025 cutoff. Establishing cross-departmental coordination between operations, legal, and finance functions will streamline documentation and expedite exemption approvals, safeguarding import cost structures Furthermore, cultivating local supplier relationships or diversifying sourcing to third-country machinery producers can reduce tariff exposure and secure supply continuity amid evolving trade policies.

Finally, aligning inspection data with sustainability objectives will fortify brand positioning. Integrating digital inspection outputs into environmental management systems enables quantification of waste reduction and energy savings, supporting circular-economy targets. Industry leaders should also engage in consortiums and standard-setting initiatives to shape the next generation of compliance frameworks and promote interoperable quality-data exchange across the global textile value chain.

Detailing the Rigorous Multi Stage Research Methodology Leveraging Primary and Secondary Data Expert Validation and Advanced Analytical Techniques

To develop these insights, the research combined comprehensive primary engagement with industry stakeholders and an extensive review of secondary sources. Expert interviews with machine builders, textile manufacturers, and trade association representatives provided qualitative perspectives on adoption barriers, technology roadmaps, and regional policy impacts. These discussions were complemented by an analysis of publicly available technical specifications, patent filings, and regulatory filings related to inspection machinery.

Secondary research included mapping HTSUS classifications and tariff notices to assess trade policy dynamics, while literature from peer-reviewed journals and trade publications informed technology trend evaluation. Data triangulation techniques were employed to reconcile divergent operational metrics such as defect-detection accuracy and throughput speeds across multiple vendor claims. Segmentation analyses leveraged the provided classification framework, organizing findings across application, fabric type, inspection technology, production stage, and installation mode. The resulting model underwent rigorous validation through stakeholder workshops, ensuring alignment with real-world manufacturing conditions and supporting actionable recommendations tailored to market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Fabric Inspection Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Fabric Inspection Machine Market, by Type

- Automatic Fabric Inspection Machine Market, by Fabric Type

- Automatic Fabric Inspection Machine Market, by Technology Type

- Automatic Fabric Inspection Machine Market, by Inspection Stage

- Automatic Fabric Inspection Machine Market, by Application

- Automatic Fabric Inspection Machine Market, by Sales Channel

- Automatic Fabric Inspection Machine Market, by Region

- Automatic Fabric Inspection Machine Market, by Group

- Automatic Fabric Inspection Machine Market, by Country

- United States Automatic Fabric Inspection Machine Market

- China Automatic Fabric Inspection Machine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Insights Emphasizing Quality Assurance Challenges Emerging Opportunities and the Strategic Imperatives for Fabric Inspection Stakeholders

Automated fabric inspection machines stand at the nexus of quality assurance, operational efficiency, and sustainability in today’s textile industry. As manufacturers navigate escalating quality standards and complex global supply chains, these systems deliver precision defect detection and data-driven process insights that traditional methods cannot match. The interplay between AI-driven vision, robotics, and enterprise integration defines the competitive frontier, with leading vendors and agile newcomers alike pushing the envelope of detection accuracy and throughput.

Regional dynamics underscore diverse adoption trajectories, from established mills in the Americas and EMEA to rapidly expanding hubs in Asia-Pacific. Simultaneously, US trade policies and Section 301 tariff schedules shape strategic sourcing decisions, accentuating the importance of exclusion filings and localized manufacturing partnerships. In this evolving environment, stakeholders who invest in robust inspection architectures and align their operations with Industry 4.0 principles will secure lasting advantages in product quality, compliance, and sustainability.

Connect with Ketan Rohom to Secure In-Depth Market Intelligence and Executive Briefings on Automatic Fabric Inspection Trends and Competitive Landscape

To explore in-depth market analysis, actionable insights, and detailed vendor profiles for automatic fabric inspection machines, engage Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide tailored executive briefings, facilitate access to proprietary data sets, and guide strategic planning initiatives. Reach out today to secure your comprehensive market research report and position your organization at the forefront of textile quality innovation.

- How big is the Automatic Fabric Inspection Machine Market?

- What is the Automatic Fabric Inspection Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?