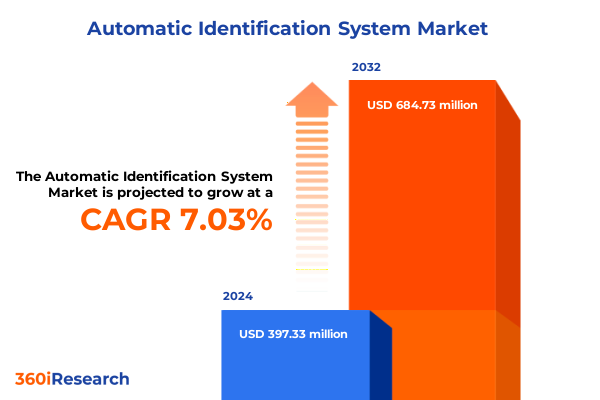

The Automatic Identification System Market size was estimated at USD 423.28 million in 2025 and expected to reach USD 457.02 million in 2026, at a CAGR of 7.11% to reach USD 684.72 million by 2032.

Navigating the Future of Vessel Tracking and Safety with Comprehensive Automatic Identification System Insights and Strategic Overview

The maritime industry’s increasing reliance on digital technologies has thrust the Automatic Identification System into the spotlight as an essential cornerstone of vessel safety and operational efficiency. Initially designed to enhance real-time vessel tracking and collision avoidance, this automated network now encompasses a sophisticated ecosystem of hardware, software, and services. International mandates from regulatory bodies have catalyzed widespread AIS deployment, creating an interconnected global network that underpins critical navigation functions and port traffic management operations.

In recent years, the evolution of high-precision analytics platforms and advanced transceiver solutions has revolutionized situational awareness at sea and in coastal zones. Innovations in antenna design and receiver sensitivity are enabling vessels to transmit and capture detailed voyage data over greater distances, while software providers are integrating machine learning algorithms to forecast traffic patterns and anticipate collision risks. Concurrently, service providers specializing in consulting, installation, and lifecycle support are positioning themselves as indispensable partners for fleet operators seeking seamless AIS integration and regulatory adherence.

This executive summary outlines the strategic landscape surrounding the AIS market, examining transformative technological shifts, the cumulative effects of recent tariff adjustments in the United States, and segmentation insights across components, vessel types, communication classes, and applications. Additionally, it presents regional dynamics, competitive analysis of leading manufacturers, actionable recommendations for industry leaders, and the rigorous research methodology underpinning these findings. Together, these elements offer a comprehensive overview designed to guide informed decision-making in the fast-evolving world of Automatic Identification Systems.

Uncovering the Critical Technological and Regulatory Transformations Reshaping the Automatic Identification System Ecosystem Worldwide

The AIS market is undergoing a profound metamorphosis driven by both technological breakthroughs and shifting regulatory frameworks. On the technology front, the advent of next-generation transceivers equipped with adaptive frequency selection and enhanced encryption measures is elevating security standards and operational resilience. These devices leverage software-defined radio architectures to dynamically optimize communication channels, effectively mitigating signal congestion in high-traffic corridors. Meanwhile, the integration of cloud-native analytics platforms and edge computing modules is enabling real-time data processing and predictive modeling of maritime traffic flows.

Regulatory agencies worldwide are also reshaping the competitive landscape through updated compliance requirements and expanded implementation mandates. Recent amendments to regional safety directives now require all vessels above specified tonnage thresholds to adopt dual-class communication capabilities, ensuring continuous coverage even in remote oceanic regions. Port authorities are likewise implementing stricter shore-side AIS monitoring protocols, demanding higher data fidelity and more frequent positional updates to enhance coastal traffic management and search and rescue operations.

These converging forces are driving market participants to reorient their product roadmaps and service portfolios toward integrated solutions that balance cutting-edge performance with regulatory compliance. As a result, collaboration between hardware manufacturers, software developers, and service specialists has intensified, spawning joint ventures and strategic alliances aimed at delivering cohesive, end-to-end AIS ecosystems that meet the complex demands of modern maritime operations.

Analyzing the Aggregate Consequences of 2025 United States Tariff Measures on Automatic Identification System Supply Chains and Operations

In 2025, the United States government implemented revised tariff structures that significantly affect the supply chains for Automatic Identification System hardware and related components. These measures, aimed at bolstering domestic manufacturing, have introduced additional duties on imported antennas, receivers, and transceivers sourced from key Asian and European suppliers. Consequently, equipment providers face elevated input costs, which in turn exert upward pressure on system pricing for commercial fleet operators and port authorities.

The cumulative impact of these tariffs has reverberated across distribution channels and service engagements. Consulting firms and installation specialists report extended lead times as suppliers navigate increased customs inspections and quarantine processes. Service and maintenance providers have adjusted contractual pricing to account for higher logistic expenditures and inventory carrying costs. Moreover, downstream software vendors are reassessing deployment strategies for analytics and monitoring platforms, given the potential slowdown in hardware roll-out schedules.

Despite these headwinds, the tariff policy has also stimulated renewed investment in domestic component production and assembly facilities. Several manufacturers have announced expansions of U.S.-based operations for antenna and receiver assembly lines, aiming to localize production and mitigate exposure to import levies. This shift fosters closer proximity to major shipbuilding hubs and port complexes, which may, over time, offset short-term pricing challenges by reducing transportation expenses and improving supply chain resilience. As industry stakeholders adapt, the balance between cost management and innovation investment will be pivotal in shaping the AIS market trajectory.

Revealing Critical Insights from Comprehensive Component Vessel Communication and Application Segmentation within the Automatic Identification System Market

A nuanced analysis of the AIS market reveals that components, vessel categories, communication tiers, and operational applications each possess distinct drivers and adoption curves. Within hardware, antenna systems have evolved toward multi-band designs optimized for Class A transmissions, while receiver modules leverage digital signal processing to enhance sensitivity under congested maritime conditions. Transceiver units now often incorporate modular firmware upgrade paths, enabling seamless support for future Class B communication protocols. The services segment sees growth in specialized consulting engagements focused on regulatory compliance, followed by installation projects that integrate bespoke support and maintenance contracts to sustain vessel uptime.

Divergent needs across vessel types further shape market dynamics. Cargo ships and tankers prioritize robust, long-range Class A solutions to maintain constant connectivity in open oceans, whereas leisure and passenger vessels, along with smaller fishing fleets, increasingly adopt cost-efficient Class B transceiver packages that deliver adequate coverage in coastal and port operations. Software platforms addressing analytics and monitoring provide vessel traffic management centers with unprecedented visibility into traffic flows, while specialized modules for collision avoidance leverage anti-collision and bridge collision subsystems to issue intelligent navigational alerts. Search and rescue applications draw on alert notification and distress tracking capabilities to streamline emergency response coordination in both inland waterways and offshore search zones.

This segmentation insight underscores the importance of modular, scalable solutions that can address the full spectrum of maritime requirements. Vendors are therefore prioritizing flexible product architectures that accommodate diverse hardware configurations and software integrations, ensuring that system integrators and end-users alike can tailor AIS deployments to their unique operational and regulatory contexts.

This comprehensive research report categorizes the Automatic Identification System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Vessel Type

- Communication Type

- Application

Mapping Regional Dynamics and Emerging Opportunities across the Americas Europe Middle East Africa and AsiaPacific for Automatic Identification Systems

Regional market dynamics in the Americas are heavily influenced by extensive commercial shipping lanes and a thriving offshore energy sector. In North America, regulatory pressure to modernize port traffic management systems has catalyzed investments in advanced AIS monitoring stations along the Atlantic and Pacific coasts. Central and South American maritime authorities are likewise pursuing upgrades to fishing vessel fleets, prioritizing affordable transceiver packages that meet minimum safety standards while accommodating fragmented operational budgets.

Across Europe, the Middle East, and Africa, the confluence of dense coastal traffic and expansive offshore installations creates a distinct demand profile. European Union directives emphasizing cross-border maritime safety have accelerated the rollout of next-generation hardware with enhanced encryption and spectrum management features. Meanwhile, emerging markets in the Gulf region and West Africa are adopting search and rescue solutions that integrate alert notification and distress tracking to reinforce offshore oil and gas operations. Port traffic management remains a key focus in Mediterranean and North Sea shipping hubs, where real-time analytics platforms are employed to mitigate congestion and environmental impact.

In the Asia-Pacific region, the world’s busiest shipping corridors drive fierce competition among AIS solution providers. China and Southeast Asian economies are directing substantial resources toward domestic transceiver development and deployment, often paired with comprehensive installation services to expedite adoption. Australia and New Zealand, with their extensive coastal monitoring requirements, are early adopters of integrated vessel traffic management systems combining coastal and port traffic modules. Across the region, the proliferation of leisure craft and fishing fleets continues to expand the market for software-driven monitoring platforms, further diversifying the AIS ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Automatic Identification System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positions and Portfolio Strengths of Leading Manufacturers in the Automatic Identification System Industry

Leading participants in the AIS arena have strategically diversified their portfolios to encompass hardware engineering, service delivery, and software innovation. Key manufacturers of antenna, receiver, and transceiver hardware have invested heavily in research and development to introduce multi-protocol capabilities, enhancing compatibility with evolving Class A and Class B communication standards. These firms leverage proprietary signal-processing technologies to differentiate their product lines and deliver superior performance in congested maritime environments.

Complementing hardware strengths, specialized consulting and installation enterprises have scaled operations to provide turnkey AIS solutions. From site assessment and regulatory compliance consulting to hands-on installation and ongoing support and maintenance, these service providers are essential in bridging technological advancements with operational realities. By bundling hardware procurement with comprehensive lifecycle support, they have cultivated recurring revenue streams and fortified customer relationships.

On the software front, analytics platform developers focus on advanced data visualization, machine learning-driven threat detection, and seamless integration with coastal traffic management centers. Monitoring platform vendors prioritize intuitive dashboards and alerting systems that align with port authority workflows and search and rescue protocols. This synergy between hardware manufacturers, service firms, and software developers underscores a collaborative ecosystem where combined expertise accelerates market adoption and delivers cohesive AIS solutions tailored to diverse maritime applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Identification System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. S. Moloobhoy Pvt. Ltd.

- Aqua Marine Automation

- Comar Systems Ltd.

- FURUNO ELECTRIC CO.,LTD.

- Garmin Ltd.

- Honeywell International Inc.

- Navico Group

- Recktronic Devices & Systems Pvt. Ltd.

- RPS Group

- Teledyne Technologies Incorporated

- Wärtsilä Corporation

Driving Impactful Industry Advancements with Targeted Strategic Recommendations for Stakeholders in the Automatic Identification System Domain

To navigate the complex AIS landscape, industry leaders should prioritize end-to-end solution frameworks that integrate advanced hardware, specialized services, and AI-enabled software platforms. First, aligning product development roadmaps with impending regulatory changes ensures that Class A and Class B communication capabilities remain compliant while capitalizing on emerging safety directives. By anticipating mandatory encryption updates and dual-band frequency requirements, hardware manufacturers can secure a competitive edge in prequalification processes for major fleet retrofits.

Second, establishing strategic partnerships across the value chain accelerates market penetration. Collaborations between antenna and transceiver engineers with analytics platform providers enable rapid prototyping of integrated offerings that address vessel traffic management and collision avoidance in a single, cohesive package. Service providers should explore co-development initiatives to embed predictive maintenance algorithms into installation and support contracts, thereby transforming traditional after-sales programs into proactive service models.

Finally, investing in regional supply chain resilience will mitigate exposure to tariff fluctuations and logistical disruptions. Expanding assembly facilities closer to key maritime hubs and cultivating diversified sourcing agreements for critical components can reduce lead times and stabilize pricing. By adopting these actionable strategies, stakeholders will be positioned to drive innovation, enhance operational reliability, and capture growth across all segments of the Automatic Identification System market.

Detailing the Comprehensive Research Framework Techniques and Analytical Processes Employed to Assess the Automatic Identification System Market

This research adopts a multi-method approach, combining primary stakeholder engagements with secondary data aggregation and rigorous analytical techniques. In the primary phase, in-depth interviews and structured questionnaires were conducted with vessel operators, port authority representatives, hardware engineers, and software developers. These qualitative insights provided a nuanced understanding of evolving use cases, deployment challenges, and technology preferences across different vessel classes and geographic regions.

The secondary phase involved systematic review of maritime safety regulations, technology white papers, and trade association reports. Proprietary data on import-export flows and tariff classifications was analyzed to quantify the impact of 2025 U.S. duties on component supply chains. Technical specifications for antenna, receiver, and transceiver products were evaluated to map performance differentials and integration capabilities.

Analytically, the study employed cross-segmentation correlation analysis to identify deployment patterns across components, vessel types, communication classes, and applications. Additionally, regional growth potential was assessed through a combination of port traffic density metrics and offshore activity indices. Competitive benchmarking was executed using a strategic positioning matrix that contrasted portfolio breadth, innovation investment, and service coverage. Together, these methodologies underpin a robust framework for assessing the current state and future trajectory of the Automatic Identification System market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Identification System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Identification System Market, by Component

- Automatic Identification System Market, by Vessel Type

- Automatic Identification System Market, by Communication Type

- Automatic Identification System Market, by Application

- Automatic Identification System Market, by Region

- Automatic Identification System Market, by Group

- Automatic Identification System Market, by Country

- United States Automatic Identification System Market

- China Automatic Identification System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Strategic Takeaways to Consolidate Understanding of Automatic Identification System Market Developments

The analysis affirms that the Automatic Identification System market is at a strategic inflection point, driven by rapid technological advancements and evolving regulatory mandates. Convergent innovations in hardware modularity, software intelligence, and service orchestration are expanding the range of AIS applications, from traditional collision avoidance to expansive coastal and port traffic management networks.

Regional insights reveal that while the Americas and Europe drive adoption through regulatory modernization and port infrastructure upgrades, the Asia-Pacific region leads in volume deployment across diverse vessel classes. The impact of U.S. tariffs, although introducing short-term cost pressures, is catalyzing domestic production capabilities and reinforcing supply chain resilience. Segmentation analysis highlights that demand is strongest for Class A long-range solutions in commercial fleets, yet there is a burgeoning market for Class B systems among leisure and smaller fishing vessels seeking cost-effective safety enhancements.

Ultimately, the interplay between component innovation, service excellence, and software sophistication will dictate competitive positioning. Stakeholders that integrate predictive analytics into installation and maintenance offerings, while aligning hardware roadmaps with forthcoming regulatory requirements, stand to secure the most significant market share and long-term profitability. These strategic takeaways consolidate a comprehensive understanding of current developments and pave the way for sustained growth in the Automatic Identification System ecosystem.

Secure Access to the InDepth Automatic Identification System Market Research Report with Expertise Driven Engagement from Associate Director Sales Marketing

Engaging with this research represents an invaluable step toward unlocking strategic maritime safety and compliance excellence. By securing the full market research report, stakeholders gain access to in-depth analysis of the Automatic Identification System ecosystem, informed by rigorous methodology and expert interpretation. Direct collaboration with Ketan Rohom, Associate Director of Sales & Marketing, ensures personalized guidance on leveraging these insights to bolster procurement strategies, navigate emerging regulations, and align investment decisions with evolving technological trends. This tailored engagement facilitates accelerated decision making and confidence in adopting critical components, services, and software platforms. Whether evaluating advanced antenna and transceiver solutions for offshore applications or integrating comprehensive analytics and monitoring platforms, this report serves as the definitive resource for navigating 2025 and beyond. Reach out today to initiate a consultative dialogue and transform data into actionable growth opportunities.

- How big is the Automatic Identification System Market?

- What is the Automatic Identification System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?