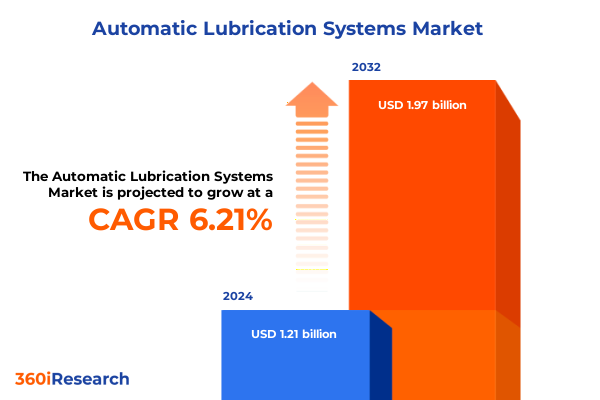

The Automatic Lubrication Systems Market size was estimated at USD 1.29 billion in 2025 and expected to reach USD 1.37 billion in 2026, at a CAGR of 6.23% to reach USD 1.97 billion by 2032.

Pioneering the Future of Lubrication with Automated Solutions to Drive Operational Excellence and Resilient Industrial Performance

Automated lubrication systems have emerged as a pivotal force in transforming industrial maintenance by minimizing manual intervention and optimizing machine performance. Their precision delivery of lubricants to critical components reduces friction and wear, enhancing equipment longevity while simultaneously lowering operational costs. As industries such as automotive, mining, and energy intensify their focus on uptime and reliability, the adoption of automated lubrication has shifted from a niche optimization to a core requirement for competitive facility management.

Furthermore, the integration of these systems supports stringent sustainability goals by ensuring proper lubricant usage and reducing waste. By leveraging time-based, condition-based, and demand-based lubrication strategies, facilities can tailor maintenance schedules to actual operating conditions, thereby extending service intervals and conserving resources. This capability aligns with corporate environmental commitments and regulatory pressures, reflecting a broader shift towards smarter, greener industrial processes.

In addition, the scalability of automated lubrication solutions has accelerated their deployment from single-machine applications to networked, plant-wide implementations. Networked controllers and centralized dashboards now allow maintenance teams to monitor and manage lubrication events remotely, turning data into actionable insights. This enhanced visibility fosters proactive maintenance strategies, reduces unplanned downtime, and ultimately drives higher throughput and profitability. As a result, stakeholders across manufacturing, construction, and power generation are increasingly prioritizing the integration of automated lubrication systems as a strategic investment in operational resilience.

Harnessing Digital Transformation and Smart Maintenance Protocols to Revolutionize Lubrication Precision Efficiency and Predictive Operational Control

The landscape of industrial lubrication is undergoing a seismic shift driven by digital transformation and intelligent maintenance protocols. Automated lubrication systems now integrate IoT-enabled smart sensors to monitor temperature, pressure, and lubricant quality in real time, enabling continuous optimization of lubrication intervals. By leveraging cloud connectivity and edge computing, these systems provide immediate feedback on equipment health, reducing latency and ensuring timely interventions. This advanced connectivity lays the groundwork for a proactive maintenance culture that moves beyond scheduled routines to responsive, data-driven lubrication management.

Moreover, manufacturers increasingly deploy AI-driven predictive maintenance platforms that analyze sensor data to forecast equipment health and schedule lubrication interventions before failures occur. Machine learning algorithms identify subtle patterns and anomalies in vibration, flow, and pressure signals to predict potential points of wear and plan maintenance activities with unprecedented precision. As a result, unplanned downtime and emergency repairs decline, while the overall maintenance budget becomes more predictable and efficient.

Additionally, environmental regulations and sustainability commitments are accelerating the shift toward PFAS-free and bio-based lubricants, which reduce ecological risk while meeting rigorous performance standards. Advanced formulations based on biodegradable synthetic esters and polymeric additives achieve high-temperature stability and anti-wear properties without persistent environmental contaminants. This regulatory-driven innovation is fostering collaborations among OEMs, chemical suppliers, and facility operators to co-develop next-generation lubrication solutions that align with circular economy principles and lower total cost of ownership.

Assessing the Far-Reaching Consequences of Reinforced Section 232 Steel and Aluminum Tariffs on Lubrication System Supply Chains and Costs

In early 2025, the United States reinstated a 25% tariff on all steel imports and elevated aluminum tariffs to the same rate under Section 232 of the Trade Expansion Act. The proclamation, effective March 12, 2025, closed existing exemptions and applied strict “melted and poured” standards, significantly affecting downstream products such as tubing, fittings, and fasteners used in automated lubrication systems. By extending the tariff to derivative steel and aluminum articles, the policy aimed to bolster domestic metal production but inadvertently increased input costs for equipment manufacturers.

Just months later, on June 4, 2025, the tariff rates doubled to 50% for steel and aluminum products and their derivatives, with Canada and Mexico explicitly targeted by the higher rate. This move reflected the administration’s intensified approach to securing national supply chains but further strained global sourcing strategies. The abrupt increase to 50% ad valorem disrupted procurement contracts and led to renegotiation of material prices for components such as vacuum pumps, solenoid valves, and precision tubing.

The expanded derivative scope of the tariffs proved particularly disruptive for small and mid-sized manufacturers. Components once exempt, including stamped brackets and machined tubes, suddenly incurred significant duties, leading to immediate cost escalations. Small metal fabricators reported double-digit increases in material expenses, extended lead times, and difficulty in absorbing these unanticipated tariffs. Many faced operational bottlenecks as domestic producers struggled to scale quickly enough to meet demand, causing project delays and higher system prices for end users.

A concurrent survey of vehicle suppliers revealed that 78% of respondents were exposed to steel tariffs, while 63% faced aluminum duties, with over 80% impacted by derivative levies. Nearly all suppliers expressed concern over distress among sub-tier vendors and noted insufficient domestic capacity to offset reliance on global supply chains. As equipment manufacturers grapple with these rising costs, strategic adjustments-such as re-evaluating supplier networks and redesigning components for alternative materials-are becoming essential to maintain competitiveness.

Unveiling Critical Segmentation Insights to Unlock Tailored Strategies Across Industries System Types Applications and Distribution Channels

A nuanced understanding of market segmentation reveals critical pathways to tailored growth and innovation. By mapping end-user industries-including automotive, construction, energy and power, manufacturing, and mining-stakeholders can identify where automated lubrication systems deliver the greatest operational gains and ROI. In automotive, both aftermarket and OEM channels call for precision solutions that support stringent performance and downtime targets, whereas construction demands durable, easy-to-maintain systems for non-residential and residential projects alike. Energy and power applications split between conventional and renewable sectors, each requiring flexible lubricant types and distribution strategies to address unique equipment cycles and environmental standards. Manufacturing environments further diverge between discrete and process operations, necessitating distinct lubrication profiles that protect high-speed bearings in assembly lines or corrosion-resistant coatings in chemical processing. Surface and underground mining present yet another set of challenges, where harsh conditions and remote locations demand robust, autonomous systems capable of long maintenance intervals.

In parallel, system type segmentation-grease, oil, and oil mist-underscores the importance of matching lubricant delivery methods to equipment design and operational parameters. Grease systems excel in high-load, low-speed applications, while oil mist solutions provide uniform lubrication across complex, multi-bearing shafts. Application-based segmentation spans automotive manufacturing, energy production, food processing, metalworking, and mining, each with specialized sub-segments from chassis assembly to hydropower turbines and from beverage processing lines to underground drilling rigs. The intricacies of distribution channels-direct sales, distributors, and online platforms-determine how manufacturers engage with end users, balancing personalized service with scalability. Moreover, lubricant types such as calcium- and lithium-based greases or mineral and synthetic oils influence system performance and lifecycle costs. Finally, component segmentation-covering fittings, pumps, sensors, and valves-highlights opportunities for integrated solutions, as gear, piston, and vacuum pumps, alongside flow and pressure sensors, merge with connectors, tubing, and various valve types to form complete automation packages. This comprehensive segmentation framework empowers decision-makers to optimize product portfolios and align market strategies with precise customer needs.

This comprehensive research report categorizes the Automatic Lubrication Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Lubricant Type

- Component

- End User Industry

- Application

- Distribution Channel

Deciphering Regional Dynamics and Growth Drivers in the Americas Europe Middle East Africa and Asia Pacific Lubrication Markets

Regional dynamics play a pivotal role in shaping the global automated lubrication systems market. In the Americas, mature infrastructure and ongoing investments in manufacturing modernization drive steady demand. The United States leads with stringent maintenance standards and widespread digitalization initiatives, while Brazil and Mexico exhibit growing adoption in automotive and mining sectors as they pursue operational efficiency.

Europe, the Middle East, and Africa represent a diverse landscape. Western Europe’s advanced regulatory framework and sustainability directives encourage the integration of eco-friendly lubrication technologies. Central and Eastern European nations, with their expanding manufacturing base, are increasingly receptive to automation investments that enhance competitiveness. In the Middle East, energy and petrochemical industries seek reliable lubrication solutions for critical operations, whereas Africa’s infrastructure projects are progressively adopting automated systems to address resource and maintenance challenges.

Asia-Pacific stands out as the fastest-growing region, propelled by rapid industrialization and government initiatives supporting Industry 4.0 adoption. China’s manufacturing hubs are early adopters of predictive maintenance and smart lubrication, while India’s construction and power generation sectors are investing heavily in automation. Southeast Asian markets, including Thailand and Malaysia, benefit from foreign direct investment in electronics and automotive assembly, leading to surging demand for precision lubrication infrastructure.

Collectively, these regional insights underscore the necessity of localized strategies. Tailoring product offerings to meet regulatory environments, infrastructure maturity, and industry priorities ensures that solutions address the unique needs and growth trajectories of each geography.

This comprehensive research report examines key regions that drive the evolution of the Automatic Lubrication Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leaders and Innovative Approaches That Are Shaping the Automatic Lubrication System Industry’s Competitive Landscape

The competitive landscape of automatic lubrication systems is marked by a blend of global leaders and specialized innovators. Industry veterans have bolstered their positions through continuous technology enhancements and strategic collaborations. Companies are integrating digital platforms with traditional mechanical expertise to offer turnkey solutions that span system design, installation, and lifecycle support.

Strategic acquisitions and partnerships have expanded product portfolios and geographic reach. Leading equipment manufacturers are collaborating with sensor and software developers to deliver predictive analytics and remote monitoring capabilities. At the same time, specialized component suppliers are focusing on niche markets-such as high-pressure hydraulic equipment-where deep domain knowledge and customization are key differentiators.

Innovation in service models is also reshaping the competitive scene. Several market leaders provide subscription-based maintenance and data analytics services, enabling clients to shift from capital-intensive investments toward operational expenditure models. This approach aligns vendor incentives with performance outcomes, promoting long-term customer relationships and recurring revenue streams.

R&D efforts continue to emphasize modular system architectures and multi-fluid compatibility, addressing the evolving needs of industries from food processing to offshore energy. By offering scalable platforms that accommodate grease, oil, and oil mist systems, leading firms maintain agility across diverse applications. In this context, the ability to deliver end-to-end integrated solutions remains a critical success factor, ensuring that companies can meet the holistic demands of a digital, sustainability-focused market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Lubrication Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.T.S. Electro-Lube International Inc

- AB SKF

- Bijur Delimon International

- Cenlub Systems

- Dropsa S.p.A.

- Eugen WOERNER GmbH & Co. KG

- Graco Inc.

- I.L.C. Srl

- KLÜBER LUBRICATION

- KRS Multilub Private Limited

- KWS Manufacturing Company Ltd.

- Luberr

- Lubrication Engineers

- Oil-Rite Corporation

- perma-tec GmbH & Co. KG

- REDEX SAS

- SAMOA Ltd.

- Simatec AG

- Systematrix Engineering Services

- The Timken Company

- The Weir Group PLC

Implementing Actionable Strategic Recommendations to Enhance Operational Performance Adapt to Regulatory Challenges and Drive Sustainable Growth

Industry leaders must prioritize digital integration to stay ahead. Implementing IoT-enabled sensors and centralized monitoring dashboards will facilitate real-time lubrication management and predictive maintenance, reducing unplanned downtime and maintenance costs. Coupling these investments with cloud-based analytics platforms ensures that data from multiple sites can be aggregated, analyzed, and leveraged for continuous improvement.

Diversification of supply chains is essential to mitigate the risks posed by geopolitical uncertainties and tariff fluctuations. Developing relationships with multiple steel and aluminum suppliers, as well as exploring alternative materials and component redesigns, will help maintain cost stability and production continuity. Establishing strategic alliances with local manufacturers can also reduce lead times and import dependencies.

Sustainability initiatives should be integrated into product development roadmaps. Advancing biodegradable and PFAS-free lubricant formulations, while securing eco-certifications, will align solutions with emerging environmental regulations and corporate ESG goals. Concurrently, investing in closed-loop lubricant recycling programs and optimizing lubrication delivery to minimize waste will enhance both environmental and economic performance.

Finally, fostering partnerships across the value chain-including OEMs, distributors, and maintenance service providers-will expand market reach and support turnkey solution offerings. Collaborative training programs and co-development projects can accelerate technology adoption, equipping engineering teams with the skills needed to champion automated lubrication systems and drive long-term operational excellence.

Detailing Robust Research Methodologies Combining Primary and Secondary Data with Quantitative and Qualitative Analyses to Ensure Comprehensive Market Insights

Our research methodology combines rigorous primary and secondary data collection to ensure comprehensive market insights. Primary research included in-depth interviews with key industry stakeholders-such as lubrication system manufacturers, OEMs, distributors, and end-users-to gather firsthand perspectives on technology adoption, procurement strategies, and operational challenges. These qualitative insights were supplemented by quantitative data from industry associations, trade publications, and government reports.

Secondary research involved a systematic review of publicly available information, including company annual reports, patent filings, regulatory disclosures, and relevant academic literature. This approach enabled the identification of historical trends, competitive dynamics, and emerging technologies within the automated lubrication systems market.

Data triangulation was applied to validate findings, cross-referencing multiple sources to reconcile discrepancies and enhance accuracy. Market sizing and growth factors were analyzed through bottom-up and top-down approaches, while scenario analysis assessed potential impacts of regulatory changes and technological disruptions.

Finally, expert advisory panels-comprising senior engineers, procurement directors, and supply chain specialists-provided iterative feedback on draft findings, ensuring that conclusions and recommendations align with real-world operational considerations. This robust methodology underpins the reliability and actionable value of our market research report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Lubrication Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Lubrication Systems Market, by System Type

- Automatic Lubrication Systems Market, by Lubricant Type

- Automatic Lubrication Systems Market, by Component

- Automatic Lubrication Systems Market, by End User Industry

- Automatic Lubrication Systems Market, by Application

- Automatic Lubrication Systems Market, by Distribution Channel

- Automatic Lubrication Systems Market, by Region

- Automatic Lubrication Systems Market, by Group

- Automatic Lubrication Systems Market, by Country

- United States Automatic Lubrication Systems Market

- China Automatic Lubrication Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3657 ]

Concluding Reflections on Evolving Market Dynamics Technological Advancements and Strategic Imperatives for the Future of Automated Lubrication Solutions

Automated lubrication systems are poised to redefine maintenance paradigms across heavy industries, blending mechanical reliability with digital intelligence. As organizations embrace IoT connectivity and predictive analytics, these systems will become integral to proactive asset management, driving higher equipment availability and lower lifecycle costs.

Technological advancements-such as edge computing, AI-driven analytics, and sensor miniaturization-will deepen the integration of lubrication data within broader Industry 4.0 strategies. This convergence will enable real-time adjustments, autonomous control loops, and self-optimizing maintenance workflows that anticipate and adapt to evolving operational demands.

Meanwhile, regulatory pressures and sustainability imperatives will continue to stimulate innovation in lubricant chemistry and delivery technologies. The shift toward PFAS-free, biodegradable, and low-viscosity formulations will further enhance environmental performance, aligning maintenance practices with corporate ESG objectives.

Looking ahead, the ability to orchestrate end-to-end lubrication ecosystems-from lubricant selection and component design to data analytics and service support-will distinguish market leaders. Organizations that leverage holistic solutions and cultivate strategic partnerships will unlock the full potential of automated lubrication, securing competitive advantage in a dynamic industrial landscape.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure the In-Depth Automatic Lubrication Systems Market Research Report Today

Engage with Ketan Rohom, Associate Director of Sales and Marketing, to secure your comprehensive market research report on automatic lubrication systems today. Gain unparalleled insights into industry trends, segmentation strategies, tariff impacts, and regional dynamics to make data-driven decisions that enhance operational efficiency and competitiveness. Reach out now to unlock detailed analysis, company profiles, and actionable recommendations that will empower your organization to stay ahead in a rapidly evolving market.

- How big is the Automatic Lubrication Systems Market?

- What is the Automatic Lubrication Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?