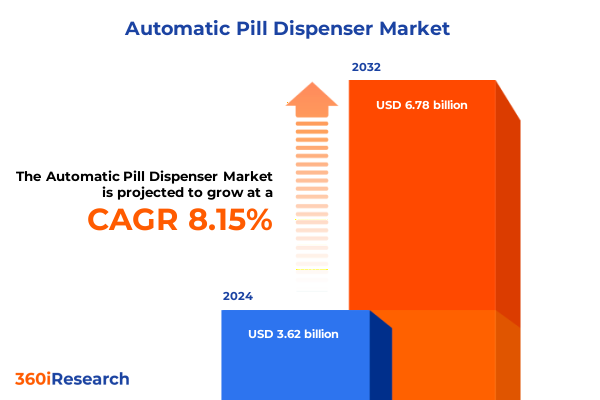

The Automatic Pill Dispenser Market size was estimated at USD 3.22 billion in 2025 and expected to reach USD 3.42 billion in 2026, at a CAGR of 6.45% to reach USD 4.99 billion by 2032.

Revolutionizing Medication Management by Deploying Smart, Connected Dispensers That Elevate Patient Safety and Foster Consistent Treatment Compliance

The landscape of medication management is being reshaped by a confluence of demographic pressures and technological innovation. With nearly half of patients with chronic conditions failing to adhere to prescribed regimens in developed countries, the human and economic toll of non-adherence has never been higher. This widespread challenge translates into avoidable complications, hospitalizations, and in the United States alone, more than 125,000 annual fatalities linked to improper medication use. Against this backdrop, healthcare providers and technology firms are accelerating efforts to deploy automated dispensing solutions that mitigate human error and foster consistent therapeutic adherence.

As populations around the globe age at an unprecedented pace, the demand for solutions that support independent living and reduce caregiver burden is intensifying. Automatic pill dispensers are emerging as pivotal tools in home-based care, assisted living, and clinical settings, offering programmable dispensing, real-time alerts, and data-driven adherence tracking. Transitional care models are evolving to integrate these devices within broader telehealth and remote monitoring ecosystems, enabling clinicians to intervene proactively and patients to maintain confidence in their daily treatment routines.

Convergence of IoT Connectivity and AI Innovations Is Transforming Automatic Dispensers into Proactive Pill Management Solutions with Holistic Patient Engagement

A transformative shift is underway as connectivity standards and artificial intelligence coalesce to create pill dispensers that do far more than schedule doses. Modern devices harness Bluetooth Low Energy and cellular networks to transmit adherence data instantly to caregivers and providers, while embedded AI algorithms analyze usage patterns to predict and prevent lapses in regimen compliance. This convergence of real-time data streams and predictive analytics empowers healthcare teams to tailor interventions, driving a shift from reactive to proactive adherence support.

Furthermore, integration with cloud-based platforms and interoperability frameworks is enabling seamless connectivity across disparate healthcare systems. Strategic alliances, such as the collaboration between Philips and AWS on HealthSuite cloud services, are streamlining the deployment of generative AI workflows and unified device ecosystems in hospital environments. As 5G networks expand and edge computing capacities mature, the automatic pill dispenser is positioned to become a central node within a holistic patient monitoring architecture, bridging in-home care with institutional oversight.

Navigating Escalating Section 301 Duties and Their Compounded Impact on Imported Medical Device Components in Pill Dispenser Supply Chains

Recent policy actions under Section 301 have significantly altered the cost dynamics for components integral to automatic pill dispensers. New duty hikes effective as of late 2024 impose a 100% tariff on syringes and needles, a 50% duty on rubber medical gloves beginning in 2025, and stepped increases for respirators and surgical facemasks, escalating to 50% tariffs by 2026. These measures, designed to counteract perceived unfair trade practices, have compounded supply chain pressures for manufacturers reliant on Chinese imports.

In parallel, temporary exclusions extended through mid-2025 have offered brief reprieves for essential medical equipment, but their scheduled expiration underscores the urgency for supply chain diversification and tariff mitigation strategies. Companies are responding by exploring alternate sourcing partnerships in Southeast Asia and Latin America, adjusting component specifications to comply with less-targeted HS codes, and optimizing inventory buffers to absorb duty fluctuations. Navigating this complex tariff landscape is now a critical component of any sustainable production and distribution plan for automatic dispensers.

Uncovering Nuanced Patient Needs Across Delivery, Connectivity Options, and Pricing Tiers That Shape Automatic Pill Dispenser Market Strategies

The design and commercial success of automatic pill dispensers hinge on a nuanced understanding of end-user environments. Dispensers deployed in assisted living facilities must integrate seamlessly with nursing workflows and electronic health records, whereas devices for homecare settings prioritize user-friendly interfaces, secure locking mechanisms, and caregiver alerts. Clinic-based systems emphasize rapid refill cycles and multi-chamber capacity for diverse medication regimens, while hospital implementations demand integration with pharmacy automation suites and compliance with stringent clinical protocols.

Equally important is the connectivity matrix that underpins these devices. Bluetooth-enabled dispensers leverage classic and low-energy profiles to balance battery life and data throughput, whereas cellular models operating on 2G/3G and 4G/5G networks ensure broad geographic coverage. Wi-Fi options, spanning 2.4 GHz and 5 GHz bands, support higher bandwidth applications, including video-enabled adherence checks. Decisions around single versus multi-chamber configurations, automatic versus manual scheduling, and electronic versus mechanical actuation further inform product roadmaps. Price-tier positioning-from low-cost, basic models to premium, AI-driven platforms-dictates feature sets and channel strategies across medical stores, online portals, retail pharmacies, and specialty outlets.

This comprehensive research report categorizes the Automatic Pill Dispenser market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Connectivity

- Pill Form

- Dispensing Technology

- Chamber Count

- End User

- Distribution Channel

Examining Regional Dynamics in Aging Demographics, Reimbursement Policies, and Technological Readiness Driving Automatic Pill Dispenser Adoption Worldwide

Regional adoption of automatic pill dispensers is heavily influenced by demographic profiles, reimbursement frameworks, and the maturity of healthcare infrastructure. In the Americas, robust national reimbursement programs and widespread telehealth integration have created fertile ground for device proliferation, particularly in the United States and Canada. Meanwhile, Europe, the Middle East, and Africa exhibit diverse regulatory landscapes; advanced economies are piloting cross-border interoperability initiatives, while emerging markets focus on cost-effective, low-power solutions suited to variable connectivity and resource constraints.

Asia-Pacific offers a unique juxtaposition of high-volume manufacturing hubs and rapidly aging populations, with countries like Japan and South Korea pioneering advanced automation in geriatric care. Growth in China, India, and Southeast Asia is driven by expanding healthcare access programs and rising digital literacy, yet tariff policies and local content requirements necessitate tailored go-to-market approaches. Across all regions, strategic sovereignty goals are prompting governments to incentivize domestic production of critical medical devices, reshaping global supply networks in the process.

This comprehensive research report examines key regions that drive the evolution of the Automatic Pill Dispenser market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Innovations and Strategic Partnerships Shaping the Competitive Landscape of Smart Medication Dispensing Solutions

Leading technology providers are forging innovative partnerships and advancing device functionalities to capture market share. Philips’ recent collaboration with major infusion pump and critical care manufacturers demonstrates a commitment to open interoperability through Service-Oriented Device Connectivity standards, creating a cohesive hospital ecosystem for patient monitoring and medication management. Simultaneously, MedMinder has secured high-profile deployments within specialized care settings, from the New England Center for Children’s autism programs to the Kahlert Institute for Addiction Medicine’s clinical trials, underscoring the versatility of connected adherence platforms in diverse clinical environments.

Emerging players are differentiating through AI-driven adherence algorithms and remote monitoring capabilities. Hero Health’s consumer-centric model, delivering scheduled doses and personalized reminders backed by a subscription service, has garnered mixed user feedback regarding reliability and cost but highlights the growing consumer appetite for direct-to-home dispensers. As established medical device companies expand their portfolios-integrating multi-chamber robotics, advanced sensor arrays, and cloud-based analytics-the competitive landscape continues to intensify, driving ongoing innovation and strategic consolidation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Pill Dispenser market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Omnicell, Inc.

- McKesson Corporation

- Baxter International Inc.

- Becton, Dickinson and Company

- Yuyama Co., Ltd.

- Dose Health LLC.

- ARxIUM Inc.

- Hero Health, Inc.

- Ōmcare Inc.

- Accu-Chart Plus Healthcare Systems, Inc.

- AceAge Inc.

- AdhereTech, LLC

- Algocare Co., Ltd.

- Capsa Solutions, LLC

- e-pill, LLC.

- Impruvon Health, Inc.

- InstyMeds Corporation

- LiveFine, Inc.

- MedMinder Systems, Inc.

- MedReady, Inc.

- NewIcon Oy

- PharmAdva, LLC

- ScriptPro LLC

Implementing Agile Supply Chain, Interoperability, and Product Customization Measures to Strengthen Pill Dispenser Market Positioning

Industry leaders are advised to pursue agile supply chain architectures that incorporate regional manufacturing nodes and dual-sourcing strategies, enabling rapid response to tariff shifts and logistical disruptions. Cultivating interoperability through adherence to universally accepted connectivity standards ensures seamless integration with emerging hospital and telehealth platforms. Investing in versatile device configurations-ranging from basic mechanical dispensers to fully automated, AI-driven multi-chamber systems-allows product lines to address a spectrum of patient needs and price sensitivities.

Strategic forays into healthcare payers and value-based care initiatives can unlock reimbursement pathways, while collaborations with homecare and long-term care providers expand device penetration beyond acute care settings. Prioritizing cybersecurity in product development safeguards patient data and fosters trust, particularly in connected environments. By aligning technology roadmaps with evolving regulatory frameworks, industry players can position themselves at the forefront of next-generation medication management solutions.

Detailing a Robust Mixed-Method Research Framework Integrating Primary Insights and Comprehensive Data Validation for Pill Dispenser Analysis

This research leverages a mixed-method framework integrating primary interviews with healthcare professionals, caregivers, and product developers alongside secondary data from regulatory filings, patent databases, and trade publications. Quantitative analysis was conducted to assess tariff schedules and connectivity standards, while qualitative insights derived from workshops and focus groups informed provider workflow integration considerations.

Data triangulation and peer review processes ensured the validity of findings, and adherence to ethical research guidelines was maintained across all stages. Geographic representation was prioritized to reflect regional policy nuances and user demographics, while iterative validation with stakeholder panels refined actionable insights. The methodology provides a robust foundation for understanding the multi-dimensional factors shaping automatic pill dispenser innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Pill Dispenser market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Pill Dispenser Market, by Connectivity

- Automatic Pill Dispenser Market, by Pill Form

- Automatic Pill Dispenser Market, by Dispensing Technology

- Automatic Pill Dispenser Market, by Chamber Count

- Automatic Pill Dispenser Market, by End User

- Automatic Pill Dispenser Market, by Distribution Channel

- Automatic Pill Dispenser Market, by Region

- Automatic Pill Dispenser Market, by Group

- Automatic Pill Dispenser Market, by Country

- United States Automatic Pill Dispenser Market

- China Automatic Pill Dispenser Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Insights on Technological Advancements and Policy Dynamics to Inform Future Pill Dispenser Innovation and Adoption Pathways

In summary, the automatic pill dispenser market stands at the nexus of demographic imperatives, technological evolution, and shifting policy landscapes. Devices that blend reliable mechanical designs with advanced connectivity and AI-driven insights are proving essential for improving medication adherence and optimizing care delivery. Navigating the complexities of tariffs, regional regulations, and reimbursement pathways requires strategic agility and collaborative partnerships.

As healthcare systems continue to prioritize patient-centric, data-driven care models, automatic dispensers will play an increasingly prominent role within integrated care pathways. Stakeholders who proactively align their product portfolios with interoperability standards, diversify their supply chains, and engage payer ecosystems will be best positioned to drive sustained growth and deliver meaningful clinical outcomes.

Connect with Ketan Rohom to Secure Exclusive Access to a Comprehensive Market Research Report on Automatic Pill Dispensers and Propel Your Strategic Decisions

To explore how detailed data and strategic insights can inform your next moves, reach out directly with Ketan Rohom, Associate Director of Sales & Marketing. Discuss bespoke research packages that address your organization’s specific objectives and gain access to in-depth analyses tailored to your needs. Ketan’s expertise will guide you through the report’s findings and demonstrate how these insights can translate into measurable improvements in patient adherence, operational efficiency, and market positioning.

Contact Ketan to secure an exclusive copy of the full market research report on automatic pill dispensers. Position your team to capitalize on emerging technological opportunities, navigate evolving policy landscapes, and differentiate your offerings in a competitive marketplace. Empower your strategic decision-making with authoritative data and actionable recommendations that propel your growth trajectory.

- How big is the Automatic Pill Dispenser Market?

- What is the Automatic Pill Dispenser Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?