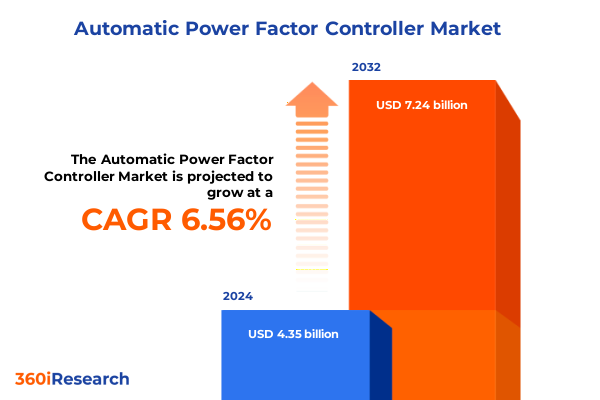

The Automatic Power Factor Controller Market size was estimated at USD 4.63 billion in 2025 and expected to reach USD 4.93 billion in 2026, at a CAGR of 6.58% to reach USD 7.24 billion by 2032.

Unveiling the Role of Automatic Power Factor Controllers in Optimizing Energy Efficiency Across Industrial and Commercial Applications

Across industrial and commercial operations, the imperative to optimize energy utilization has never been more pronounced. Automatic power factor controllers have emerged as a cornerstone in achieving energy efficiency, ensuring that reactive power imbalances are actively managed to enhance overall system performance. By continuously monitoring and adjusting the power factor, these controllers mitigate wasted energy, reduce utility penalties, and promote sustainable consumption practices. As organizations navigate tightening regulatory mandates and rising energy costs, the deployment of adaptive control systems represents a decisive step toward operational excellence.

The introduction of intelligent automation has revolutionized traditional power management approaches. Unlike legacy manual or semi-automated systems, modern solutions integrate advanced sensing and real-time analytics, allowing for instantaneous compensation of reactive loads. This evolution reflects broader industry trends toward digitalization and connectivity, where data-driven decision-making transforms how enterprises monitor power quality and reliability. Consequently, the role of automatic power factor controllers extends beyond simple correction; it becomes a strategic enabler for businesses pursuing resilience and competitiveness in demanding market environments.

Building on this foundation, this executive summary presents a comprehensive exploration of pivotal market shifts, regulatory influences, segmentation insights, and regional dynamics. By examining the factors driving adoption and innovation, decision-makers can better align technology investments with organizational goals and emerging sustainability imperatives.

Charting the Evolution of Automatic Power Factor Controllers Amid Digitalization and Sustainability Demands in Modern Energy Systems

Over the past decade, the landscape for automatic power factor controllers has undergone a profound transformation driven by digital technology integration and heightened sustainability objectives. Traditional correction methods have given way to smart solutions powered by microcontrollers, programmable logic controllers, and advanced relay designs, each offering varying degrees of precision and scalability. These technological leaps have enabled more granular monitoring and control, allowing systems to adapt dynamically to fluctuating load conditions and maintain optimal power factors with minimal manual intervention.

Moreover, the convergence of the Industrial Internet of Things and cloud-based analytics has unlocked new possibilities for remote monitoring and predictive maintenance. Controllers now transmit real-time performance metrics to centralized platforms, where machine learning algorithms analyze patterns and forecast maintenance needs. This shift from reactive servicing to proactive upkeep not only reduces downtime but also extends the lifespan of critical assets. As a result, stakeholders are realizing significant reductions in operational costs and unplanned outages while enhancing overall system reliability.

Furthermore, stringent environmental regulations and corporate sustainability targets are shaping product roadmaps and adoption strategies. Stakeholders increasingly prioritize solutions that demonstrate verifiable carbon footprint reductions and compliance with emerging standards. Coupled with the rise of renewable energy integration, where automated power factor correction is vital to managing variable generation profiles, these trends underscore the pivotal role of advanced control systems in driving the next wave of energy optimization and resilience.

Examining the Far-Reaching Consequences of 2025 United States Tariff Measures on Automatic Power Factor Controller Market Dynamics

In 2025, a new suite of United States tariffs targeting electrical components and ancillary equipment has introduced notable dynamics into the global supply chain for power factor correction technologies. These tariffs have led to increased import costs for certain microcontroller and relay imports, prompting manufacturers to reassess sourcing strategies and production footprints. Consequently, stakeholders are exploring localized assembly and component procurement to buffer against price volatility and maintain competitive pricing structures.

The ripple effects of these measures extend beyond procurement. Distributors and end users have experienced temporary disruptions as supply lead times adjusted to new trade flows. This environment has stimulated strategic partnerships between component suppliers and system integrators, fostering collaborative approaches to inventory management and co-development initiatives. Furthermore, cost pressures have accelerated the adoption of alternative product configurations that leverage domestically available materials without compromising performance standards.

As a result of the cumulative impact of tariffs, industry players are prioritizing transparency and agility in their operations. Companies investing in flexible manufacturing platforms are better positioned to pivot quickly in response to shifting trade policies. In addition, the heightened focus on supply chain resilience underscores the importance of robust risk assessment frameworks and diversified sourcing to safeguard continuity amid evolving geopolitical landscapes. These developments collectively reinforce the critical need for strategic foresight and adaptive capabilities in navigating the complexities introduced by recent tariff measures.

Deriving Strategic Insights from End User, Voltage Rating, Product Type, Connection Type, and Installation Mode Classifications

Segmentation analysis reveals that end users across chemicals, energy and power, manufacturing, and oil and gas sectors each demand unique characteristics from their correction solutions. Within the chemicals domain, bulk operations require high-capacity, robust designs capable of withstanding continuous heavy loads, whereas specialty chemical facilities prioritize precision in compensation to protect sensitive processes. Energy and power stakeholders, split between generation and transmission and distribution, seek controllers that either optimize output under fluctuating generation schedules or maintain power quality across extensive grid networks.

In manufacturing environments, divergent requirements emerge among automotive lines focused on high-speed production, food and beverage facilities emphasizing hygiene and uptime, and metals and mining sectors demanding rugged devices capable of addressing extreme operating conditions. Meanwhile, upstream and downstream oil and gas operations balance the need for reliable monitoring in remote extraction sites with robust protection mechanisms in refining and distribution facilities. Understanding these nuanced demands is essential for tailoring solutions that align with specific operational priorities and environmental constraints.

Voltage rating classifications further inform product selection, as high voltage systems necessitate specialized insulation and safety protocols, medium voltage networks demand scalable modules to balance performance and cost, and low voltage applications call for compact, cost-effective devices. Likewise, choices between microcontroller-based, programmable logic controller–based, and relay-based product types reflect trade-offs among precision, programmability, and simplicity. Deployment models then diverge according to connection preferences, ranging from centralized architectures that offer consolidated oversight to decentralized and hybrid configurations that distribute control points and enhance system flexibility. Finally, installation considerations differentiate indoor units designed for climate-controlled environments from outdoor variants engineered to withstand harsh weather and environmental fluctuations.

This comprehensive research report categorizes the Automatic Power Factor Controller market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Voltage Rating

- Product Type

- Connection Type

- Installation Mode

- End User

Analyzing Regional Drivers and Challenges Shaping Automatic Power Factor Controller Adoption Across Americas, EMEA, and Asia-Pacific Markets

Geographic analysis highlights distinctive drivers and constraints across the Americas, Europe Middle East and Africa, and Asia-Pacific regions. In the Americas, strong regulatory emphasis on energy efficiency coupled with established infrastructure fosters widespread adoption of automated solutions. North American markets, in particular, showcase growing interest in retrofitting legacy systems as organizations strive to meet ambitious environmental targets. Latin American economies, while progressing more gradually, present opportunities tied to grid modernization initiatives and industrial expansion.

Across Europe Middle East and Africa, stringent emissions regulations and incentive programs propel uptake, especially in Western Europe, where carbon taxation schemes and energy audits have become commonplace. The Middle Eastern focus on diversifying economies and investing in smart grid projects is catalyzing demand for advanced correction equipment, whereas Africa’s burgeoning industrial sectors underscore the need for cost-effective, scalable solutions that can thrive amid infrastructure development challenges.

Asia-Pacific exhibits the fastest growth rates, driven by rapid industrialization in markets such as India and Southeast Asia, alongside technology upgrades in mature economies like Japan and South Korea. Government incentives for renewable integration and grid resilience further stimulate demand, as stakeholders incorporate advanced controllers to manage reactive power imbalances associated with solar, wind, and hybrid energy installations. These varied regional landscapes demand tailored strategies that consider local regulations, infrastructure maturity, and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Automatic Power Factor Controller market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants and Their Innovations in Advancing Automatic Power Factor Controller Technologies and Solutions

Leading industry participants have intensified their focus on innovation and strategic collaborations to solidify market positions. Global electrical equipment manufacturers have expanded their offerings by integrating sophisticated analytics platforms with correction hardware, enabling end users to visualize power factor trends and derive actionable insights. Such initiatives often involve cross-sector partnerships, combining electronic component expertise with software development capabilities to deliver end-to-end solutions.

In addition, a segment of emerging technology firms is differentiating through niche capabilities, such as AI-driven predictive control algorithms and modular hardware designs that simplify scalability. These companies are forging alliances with academic institutions and research centers to validate performance under real-world conditions and accelerate product certification processes across multiple regions. Established players, in turn, are acquiring or investing in these agile innovators to bolster their digital portfolios and accelerate time-to-market for next-generation control systems.

Service providers have also enhanced their value propositions by offering comprehensive lifecycle support, encompassing installation, commissioning, and ongoing remote monitoring services. By bundling hardware solutions with maintenance contracts and performance guarantees, they enable end users to mitigate operational risk and secure predictable outcomes. This evolving competitive landscape underscores the importance of strategic alignment across product development, value-added services, and partner networks to achieve sustainable differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Power Factor Controller market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Ducati Energia S.p.A.

- Eaton Corporation

- General Electric Company

- Hitachi Energy Ltd.

- Larsen & Toubro Limited

- Legrand S.A.

- Mitsubishi Electric Corporation

- Neptune India Limited

- Nissin Electric Co., Ltd.

- Schneider Electric

- Schneider Electric SE

- Selec Controls Pvt. Ltd.

- Siemens AG

- Socomec Groupe SAS

- TDK Electronics AG

- Wikipedia

Presenting Targeted Strategic Recommendations to Empower Industry Leaders in Optimizing Deployment and Development of Control Systems

Industry leaders should prioritize investment in digital integration capabilities to unlock the full potential of automated power factor control. By deploying cloud-enabled platforms and leveraging advanced analytics, organizations can shift from reactive maintenance to predictive strategies, reducing downtime and optimizing asset utilization. Consequently, stakeholders are advised to develop clear roadmaps for phased digital transformation that align with existing operational technologies and IT frameworks.

Supply chain resilience must remain at the forefront of strategic planning. In light of recent trade policy shifts, companies should diversify supplier portfolios and explore localized assembly options to buffer against tariff-related cost fluctuations. Engaging in collaborative partnerships with key component manufacturers can further secure preferential access and facilitate mutual development of customized solutions tailored to regional demand profiles.

Finally, deepening regulatory engagement and advocacy is vital for shaping favorable policy environments. Industry consortia and trade associations offer avenues to influence emerging standards and incentive programs, ensuring that the unique value of advanced control systems is recognized in governmental energy efficiency initiatives. By combining technical expertise with proactive dialogue, businesses can help sculpt frameworks that drive wider adoption and bolster long-term market growth.

Detailing Rigorous Research Methodology and Analytical Framework Employed to Ensure Comprehensive Coverage and Reliability of Findings

This research employs a multi-tiered methodology combining qualitative and quantitative data collection to ensure robust and actionable insights. Primary research included in-depth interviews with industry executives, system integrators, and end users to capture firsthand perspectives on technology adoption, operational challenges, and future requirements. These qualitative inputs were supplemented by surveys gathering technical specifications, purchase criteria, and implementation feedback from a representative cross-section of market participants.

Secondary research encompassed an extensive review of regulatory documentation, technical standards publications, and academic journals, providing a comprehensive baseline of the industry’s regulatory landscape and technological evolution. Information from leading trade associations and government agencies was analyzed to validate key trends and contextualize regional nuances. Data triangulation techniques were applied to reconcile disparities between primary and secondary findings, ensuring consistency and reliability of conclusions.

Finally, an analytical framework integrating SWOT analysis, Porter’s Five Forces, and value chain mapping was utilized to identify strategic imperatives and competitive dynamics. Findings were further refined through expert panel reviews, leveraging the insights of seasoned professionals in power quality management and energy efficiency to validate interpretations and recommendations. This rigorous approach guarantees that the resulting analysis reflects the complexities of the market and provides a credible foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Power Factor Controller market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Power Factor Controller Market, by Voltage Rating

- Automatic Power Factor Controller Market, by Product Type

- Automatic Power Factor Controller Market, by Connection Type

- Automatic Power Factor Controller Market, by Installation Mode

- Automatic Power Factor Controller Market, by End User

- Automatic Power Factor Controller Market, by Region

- Automatic Power Factor Controller Market, by Group

- Automatic Power Factor Controller Market, by Country

- United States Automatic Power Factor Controller Market

- China Automatic Power Factor Controller Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthetizing Key Takeaways and Underscoring the Strategic Significance of Automatic Power Factor Controllers for Energy Efficiency and Cost Mitigation

The insights presented throughout this summary underscore the pivotal role of automatic power factor controllers in driving energy efficiency and operational excellence. By examining technological advancements, regulatory drivers, market segmentation nuances, and regional dynamics, the critical value propositions of these systems become clear. Organizations that embrace smart control solutions will not only realize cost savings but also strengthen their resilience and sustainability credentials.

Stakeholders must remain vigilant amid evolving trade policies and technological disruptions, deploying adaptive strategies that balance digital adoption, supply chain robustness, and regulatory advocacy. Collaborative innovation, underpinned by strategic partnerships and targeted investments, will be essential to navigate competitive pressures and capitalize on emerging opportunities.

In conclusion, automatic power factor controllers are more than corrective devices; they represent a strategic investment in energy optimization and operational continuity. As markets mature and technologies converge, the ability to integrate advanced analytics, modular hardware, and responsive maintenance models will distinguish leaders from followers. By leveraging the insights and recommendations detailed herein, decision-makers can chart a clear path toward enhanced performance and long-term success.

Engage with Sales and Marketing Leadership to Secure Expert Guidance and Unlock Strategic Advantages with Our Comprehensive Market Research

We invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing, to explore how this comprehensive research can empower your organization to make informed decisions and achieve strategic objectives. Ketan possesses in-depth knowledge of power factor correction technologies and market dynamics, ensuring that you receive personalized guidance tailored to your specific needs. By securing this detailed report, you gain access to invaluable insights that will enable you to optimize operational efficiency and stay ahead of emerging trends in control system solutions.

Reach out today to discuss report access, customization options, and next steps for leveraging these insights to drive performance improvements and innovation within your enterprise. Our team is committed to providing exceptional support and will collaborate with you to address any questions or special requirements. Don’t miss the opportunity to equip your leadership with the critical data needed to outperform competitors and maximize return on investment.

Take action now to schedule a consultation and secure your copy of the in-depth analysis covering market developments, tariff implications, segmentation intelligence, regional outlooks, and strategic recommendations. Engage with Ketan Rohom to unlock the full potential of this authoritative research and propel your organization toward sustained growth and energy efficiency excellence

- How big is the Automatic Power Factor Controller Market?

- What is the Automatic Power Factor Controller Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?