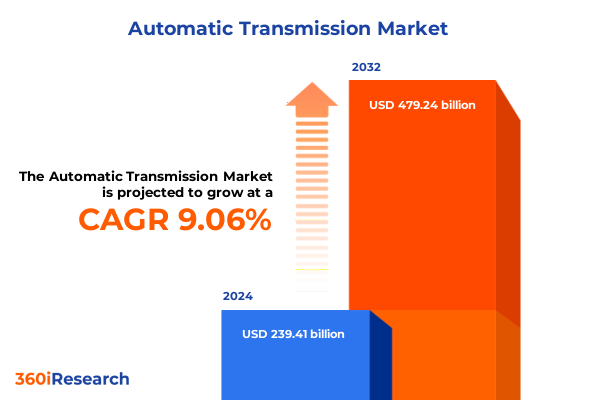

The Automatic Transmission Market size was estimated at USD 260.67 billion in 2025 and expected to reach USD 283.83 billion in 2026, at a CAGR of 9.08% to reach USD 479.24 billion by 2032.

Unveiling the pivotal evolution of automatic transmission technology reshaping vehicle efficiency performance and strategic industry dynamics

The automatic transmission landscape has undergone remarkable transformation in recent years, emerging as a critical focal point for automotive performance, fuel efficiency, and overall vehicle appeal. As consumer preferences shift toward smoother gear changes, lower emissions, and enhanced driving dynamics, manufacturers are investing heavily in advanced transmission architecture and control systems to meet these evolving demands. From precision-engineered torque converters to sophisticated electro-hydraulic control units, the interplay of mechanical design and digital intelligence has never been more pronounced.

Against this backdrop, the strategic imperatives for industry stakeholders are clear: adopt cutting-edge technologies, streamline production processes, and build flexible supply chains that can respond to geopolitical and regulatory shifts. Meanwhile, reliability and durability remain non-negotiable benchmarks that underpin consumer confidence and brand reputation. This introduction sets the stage for a deeper exploration of the drivers, trends, and market forces shaping the next generation of automatic transmissions. By examining the forces that influence research and development priorities, procurement strategies, and aftersales support, the ensuing sections will illustrate how the automatic transmission segment is both a barometer and a catalyst for broader powertrain transformation.

Mapping the transformative shifts redefining automatic transmissions through digitalization electrification and manufacturing innovation across global markets

The current era of automatic transmissions is defined by transformative shifts that extend well beyond incremental gear ratio enhancements. At the core lies digitalization, where embedded sensors and real-time data analytics enable predictive maintenance and adaptive shift strategies tailored to individual driving habits. These smart systems not only optimize shift timing for fuel economy but also enhance driver engagement by reducing lag and eliminating unwanted gear hunting. Simultaneously, electrification has inserted a new layer of complexity and opportunity, as hybrid and full-electric powertrains require seamless integration of electric motor assistance with traditional torque converter operations. This synthesis of mechanical and electrical propulsion demands novel control algorithms and robust thermal management solutions.

Moreover, manufacturing innovation has emerged as a key enabler for scalable transmission production. Additive manufacturing is being trialed for prototyping intricate valve bodies and clutch components, while modular assembly lines support rapid reconfiguration to accommodate multiple transmission platforms. Lean and agile practices are being reinforced by digital thread connectivity that links design, production, and quality assurance, accelerating time to market without compromising precision. Together, these forces are redefining what automatic transmissions can achieve, setting new benchmarks for performance, sustainability, and customization across a diverse automotive ecosystem.

Assessing the cascading effects of 2025 United States automotive tariffs on transmission supply chains cost structures and domestic industry competitiveness

In early 2025, the United States government enacted sweeping measures under section 232 of the Trade Expansion Act to bolster domestic automotive security by imposing new import duties on vehicles and key components. Effective April 3, 2025, all imported automobiles became subject to a 25 percent tariff, followed by a corresponding tariff on certain parts including transmissions and powertrain assemblies no later than May 3, 2025. These actions aimed to incentivize local production and mitigate vulnerabilities revealed during supply chain disruptions in the pandemic era. However, stakeholders across the supply chain have experienced cascading cost pressures as international suppliers reevaluate sourcing strategies and domestic assemblers face higher input prices.

Recognizing the potential for overburdening domestic manufacturers, an amendment issued on April 29, 2025, introduced an import adjustment offset mechanism. This provision allows a tiered reduction in duties for parts accounting for a defined percentage of vehicle value, offering relief to manufacturers in exchange for maintaining assembly volumes in the United States. While the offset framework reduces immediate financial impact, transmission suppliers and OEMs continue to navigate complex administrative processes to claim benefits. Consequently, the cumulative effect has been a reevaluation of cross-border partnerships and renewed emphasis on reshoring critical component production to balance compliance with cost efficiency.

Uncovering critical segmentation insights revealing how transmission type vehicle type fuel type and sales channel dynamics drive market differentiation

Insight into segmentation reveals the nuanced dynamics that drive strategy and product positioning. Examining the market through the lens of transmission type clarifies how Automated Manual systems are carving out niches in commercial applications, while Continuously Variable solutions deliver seamless performance in economy-focused passenger vehicles. Dual Clutch offerings continue to bridge the gap between manual responsiveness and automatic convenience, and Traditional Automatic architectures remain foundational in a broad spectrum of mid-tier to luxury segments.

When vehicle type is considered, Heavy Commercial Vehicles demand transmissions engineered for high torque and longevity, contrasted with Light Commercial Vehicles where weight reduction and fuel economy predominate. In off-highway contexts, Agricultural Machinery benefits from torque multiplication and durability under extreme loads, while Construction Equipment prioritizes shock absorption and serviceability. Passenger Cars, spanning subcompact to premium sedan classes, leverage varied transmission architectures to align with brand positioning and customer preferences.

Fuel type introduces another layer of differentiation: Diesel applications often require transmission designs robust enough to handle higher torque output, whereas Petrol configurations can optimize shift algorithms for responsiveness and smoother transitions. Finally, the channel through which transmissions reach end users shapes aftermarket support models and original equipment planning. Aftermarket channels focus on retrofit compatibility and service kits, while OEM supply chains emphasize just-in-time delivery and integration with broader vehicle assembly workflows. Together, these segmentation insights illuminate pathways for targeted innovation and resource allocation.

This comprehensive research report categorizes the Automatic Transmission market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Transmission Type

- Vehicle Type

- Fuel Type

- Sales Channel

Exploring regional variations in automatic transmission adoption highlighting the Americas Europe Middle East Africa and Asia Pacific market dynamics

Regional perspectives underscore the multifaceted evolution of automatic transmissions and highlight divergent growth trajectories. In the Americas, stringent emissions standards and consumer appetite for SUVs have fueled demand for multi-ratio automatics that maximize fuel efficiency. North America’s advanced manufacturing ecosystem continues to attract investments in smart transmission assembly lines, while Latin American markets are gradually adopting higher-efficiency systems amid rising fuel costs and urbanization trends.

Across Europe, Middle East & Africa, regulatory emphasis on CO₂ reduction has accelerated deployment of hybrid-compatible transmissions. Partnerships between OEMs and local component specialists have given rise to modular transmission platforms adaptable to both traditional and electrified powertrains. In the Middle East, evolving urban mobility plans are steering demand toward transmissions that support start-stop operation and enhanced durability in high-temperature environments, whereas African markets prioritize low-maintenance designs suited to less developed road infrastructure.

Asia-Pacific remains a powerhouse of both production and innovation. In China and India, domestic manufacturers are rapidly scaling factories for dual clutch and CVT solutions to satisfy burgeoning passenger and commercial vehicle demand. Meanwhile, Japan and South Korea continue to advance precision engineering, integrating AI-driven shift logic and low-friction materials. The region’s complex supply chain network fosters collaborative R&D models, positioning Asia-Pacific as a leading hub for next-generation transmission technology.

This comprehensive research report examines key regions that drive the evolution of the Automatic Transmission market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing leading players in the automatic transmission sector focusing on technological innovation strategic collaborations and competitive positioning

The competitive environment in the automatic transmission sphere is shaped by a mix of established legacy players and agile challengers. ZF Friedrichshafen consistently ranks among the leaders with its 8- and 9-speed automatic platforms, underpinned by extensive IP in torque converter technology and centralized software development centers across Europe and North America. Aisin Seiki, with its close ties to major OEMs, has pioneered integrated hybrid transmission solutions, leveraging proprietary clutch actuation systems to optimize energy recuperation.

BorgWarner has differentiated itself through its e-GearDrive and bi-clutch technologies, catering to both passenger and light commercial segments with a focus on electrification readiness. Meanwhile, Jatco’s leadership in CVT systems, supported by aggressive capacity expansions in Southeast Asia, underscores the growing importance of continuously variable solutions in fuel-focused markets. Emerging regional suppliers are also gaining traction by offering cost-optimized transmission modules for off-highway applications, capitalizing on lean manufacturing and localized sourcing.

Collaborative ventures and joint development agreements have become essential to maintain technological leadership. Cross-industry partnerships are enabling shared investment in advanced materials, sensor fusion, and machine learning-driven shift control, while strategic acquisitions are consolidating specialized expertise in mechatronic units. These competitive strategies emphasize the importance of scale, innovation, and strategic alliances in securing long-term market positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Transmission market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Allison Transmission Holdings, Inc.

- Bonfiglioli Riduttori S.p.A.

- BorgWarner Inc.

- Carraro S.p.A.

- Continental AG

- Denso Corporation

- Eaton Corporation plc

- GKN plc

- Hyundai Transys Inc.

- Jatco Ltd.

- KATE LLC

- Magna International Inc.

- Marelli Holdings Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Schaeffler AG

- SKF AB

- Tremec Group Holdings, Inc.

- Voith GmbH & Co. KGaA

- ZF Friedrichshafen AG

Defining actionable recommendations enabling industry leaders to optimize transmission strategies enhance supply chain resilience and leverage emerging roadmaps

To harness the opportunities presented by advancing transmission technologies and evolving market conditions, industry leaders should prioritize the development of adaptive control systems that integrate machine learning with existing electronic control units. By embedding predictive algorithms, manufacturers can deliver tailored shift profiles that reduce wear and improve fuel economy. Furthermore, establishing regional centers of excellence for transmission prototyping and validation will shorten development cycles and align product offerings with local regulatory and operational requirements.

Supply chain resilience can be fortified by diversifying the supplier base for critical components such as clutch plates, valve bodies, and hydraulic pumps. Engaging in long-term agreements with multiple tier-two suppliers reduces the risk of single-source dependencies and supports rapid response to tariff or trade policy shifts. Simultaneously, investing in digital twins and advanced analytics across the production line enables real-time quality monitoring and predictive maintenance, minimizing downtime and material waste.

Finally, fostering open innovation through strategic alliances with software firms and materials research institutes will accelerate the integration of lightweight polymers and AI-driven control modules. These partnerships can yield breakthroughs in thermal management and friction reduction, further elevating transmission efficiency. By executing these recommendations, organizations can position themselves at the forefront of a dynamic market, ready to capitalize on the next wave of powertrain innovation.

Detailing the robust research methodology encompassing data collection expert interviews data triangulation and rigorous statistical validation

The research methodology underpinning this analysis integrates diverse data sources to ensure both breadth and depth of insight. Primary research included in-depth interviews with senior executives at OEMs, transmission suppliers, and aftermarket distributors, capturing firsthand perspectives on technology adoption and strategic priorities. Complementing these interviews, site visits to manufacturing facilities in North America, Europe, and Asia provided direct observations of production workflows, quality protocols, and process automation.

Secondary research involved systematic reviews of technical journals, patent filings, regulatory filings, and government proclamations related to automotive trade and tariff measures. Proprietary databases supplied transaction-level data on aftermarket sales and OEM procurement, while industry associations furnished macroeconomic and regulatory context. Data triangulation was achieved by cross-referencing qualitative findings with quantitative indicators such as import duty schedules and production capacity statistics.

Rigorous statistical validation was conducted using standard segmentation analyses, variance testing, and scenario modeling to identify key drivers and potential inflection points. This multi-layered approach ensures that the resulting insights are robust, actionable, and reflective of the rapidly evolving automatic transmission domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Transmission market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Transmission Market, by Transmission Type

- Automatic Transmission Market, by Vehicle Type

- Automatic Transmission Market, by Fuel Type

- Automatic Transmission Market, by Sales Channel

- Automatic Transmission Market, by Region

- Automatic Transmission Market, by Group

- Automatic Transmission Market, by Country

- United States Automatic Transmission Market

- China Automatic Transmission Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing the strategic significance of evolving automatic transmission technologies and market shifts influencing the future of global powertrain landscapes

In conclusion, the automatic transmission sector stands at a critical juncture where technological innovation, regulatory action, and shifting consumer expectations converge. The integration of digital control systems and electrified power trains is redefining performance benchmarks, even as geopolitical considerations and trade policies reshape supply chain strategies. Segmentation insights reveal how distinct transmission architectures and vehicle categories demand tailored approaches, while regional analysis highlights the importance of local market dynamics and regulatory landscapes.

Competitive pressures are intensifying, prompting leading suppliers to pursue strategic collaborations and invest in next-generation materials and software capabilities. At the same time, actionable recommendations underscore the need for agile supply chains, predictive analytics, and open innovation to maintain resilience and drive value creation. By aligning technology roadmaps with evolving legislation and consumer priorities, stakeholders can secure a sustainable growth path. Ultimately, the future of automatic transmissions will be determined by those who can seamlessly integrate mechanical ingenuity with digital intelligence, delivering compelling performance, efficiency, and reliability in a rapidly transforming automotive ecosystem.

Connect directly with Ketan Rohom to obtain your detailed automatic transmission market research report and accelerate your strategic market initiatives

Connect directly with Ketan Rohom to obtain your detailed automatic transmission market research report and accelerate your strategic market initiatives

- How big is the Automatic Transmission Market?

- What is the Automatic Transmission Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?