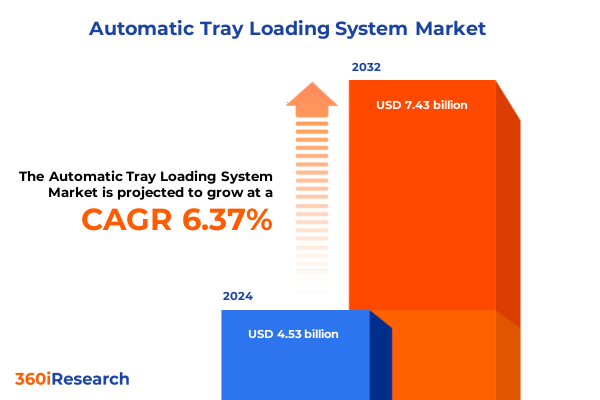

The Automatic Tray Loading System Market size was estimated at USD 4.80 billion in 2025 and expected to reach USD 5.09 billion in 2026, at a CAGR of 6.44% to reach USD 7.43 billion by 2032.

Shifting Manufacturing Priorities and Rising Throughput Demands Highlight the Critical Role of Automated Tray Loading Solutions in Modern Factories

The manufacturing world is undergoing a profound transformation spurred by an insatiable demand for higher throughput, tighter process integration, and more reliable material handling. As production cycles accelerate, traditional manual loading processes become bottlenecks that compromise efficiency and increase operational costs. Consequently, automated tray loading systems have emerged as critical enablers of lean manufacturing, seamlessly integrating with assembly lines, ovens, freezers, and inspection stations to maintain continuous production flow.

Moreover, the advent of Industry 4.0 and smart factory initiatives has elevated the importance of data-driven decision making. Automated tray loaders not only reduce labor dependencies but also provide rich performance analytics, enabling plant managers to track cycle times, detect anomalies, and optimize workflows. In addition, growing labor shortages and the increasing cost of skilled labor have underscored the need for systems that can operate autonomously over extended shifts with minimal human intervention.

Furthermore, the rapid shift toward smaller production batches and customized products demands flexible automation capable of handling a variety of tray sizes, shapes, and payloads with minimal changeover time. As a result, modern tray loading solutions feature modular designs, quick-change tooling, and adaptive control algorithms that respond in real time to production variances. Ultimately, this confluence of efficiency pressures, labor dynamics, and customization imperatives is propelling the widespread adoption of automated tray loading in high-volume, precision-oriented manufacturing environments.

Emerging Technological Breakthroughs and Shifting Economic Forces Redefine Tray Loading Automation Across Industry Verticals and Supply Chains

The landscape of tray loading automation is being reshaped by breakthroughs in robotics, vision systems, and artificial intelligence. Collaborative robots equipped with advanced force sensors now perform delicate tray placements previously deemed too complex for automation. Consequently, manufacturers across industries are deploying cobots alongside traditional industrial robots to achieve both precision and safety in mixed-human workspaces.

In parallel, the integration of machine learning into control software is driving self-optimizing systems that adjust pick-and-place strategies on the fly. As product variants proliferate, these intelligent systems learn from every cycle, continually refining motion paths, grip forces, and alignment tolerances. Moreover, the convergence of edge computing and cloud analytics ensures that performance data is aggregated at scale, providing actionable insights for network-wide optimization.

Additionally, economic pressures such as tariff volatility, supply chain disruptions, and currency fluctuations are prompting companies to seek automation platforms that can be rapidly adapted to new locations or reconfigured for alternative products. This resilience imperative has given rise to modular, plug-and-play tray loaders that can be relocated or repurposed with minimal engineering overhead. Taken together, these technological advancements and economic forces are forging a transformative shift in how manufacturers approach tray loading, fostering agility, scalability, and data-driven efficiency across global operations.

Comprehensive Assessment of Recent United States Tariff Measures and Their Ripple Effects on Automated Tray Loading Equipment Procurement Costs

In 2025, a series of U.S. tariff measures targeting industrial machinery components and raw materials has added complexity to procurement strategies for tray loading systems. Tariffs imposed on steel and aluminum under national security provisions have increased the cost basis of frame structures, while additional duties on electronic controls and servo motors have impacted the price of integrated robot cells.

As OEMs and integrators grapple with these duties, many are responding by localizing component sourcing and redesigning load-bearing structures to reduce reliance on tariff-exposed materials. Furthermore, some suppliers are exploring alternative alloys and composite materials that deliver comparable performance without triggering punitive duties. Consequently, buyers must now evaluate total landed cost, including duty mitigation tactics, freight expenses, and potential delays at customs.

Moreover, the uncertainty surrounding prospective renewals or expansions of tariff schedules has underscored the need for flexible procurement frameworks. Manufacturers are increasingly negotiating clauses that allow for renegotiation or supplier substitution should new duties be enacted. Taken together, these tariff dynamics are reshaping capital planning for automated tray loading systems, compelling stakeholders to incorporate risk mitigation, supply chain transparency, and alternative material strategies into their sourcing decisions.

In-Depth Segmentation Uncovers How End Use Demands System Types Automation Levels Enterprise Sizes and Distribution Approaches Influence Tray Loading Solutions

A granular look at market segmentation underscores the multifaceted drivers shaping tray loading adoption. End use requirements vary drastically from heavy-duty automotive lines handling stamping components and chassis assemblies to delicate consumer electronics and semiconductor wafer trays that demand sub-millimeter precision. Similarly, food and beverage processors handling baked goods, beverages, confectionery items, and dairy products impose hygiene and cleanliness standards that differ markedly from pharmaceutical producers managing injectable vials, liquid dosage pumps, or solid dosage blister packs.

Beyond end use, system typologies such as floor-mounted units excel in stability for high-capacity operations, whereas overhead loaders offer superior flexibility and floor space efficiency in compact facilities. In parallel, automation levels span fully automatic systems with integrated vision guidance to manual loading stations that retain human oversight, as well as hybrid semi-automatic configurations that balance speed with operator control. Equally important, enterprise scale influences adoption patterns: large multinational manufacturers typically invest in turnkey, enterprise-grade solutions with global service contracts, while small and medium enterprises often favor more modular, pay-as-you-grow systems to manage capital expenditure risks.

Lastly, distribution channels play a pivotal role in shaping the purchase journey. Direct sales channels enable customized engineering support and tighter alignment with corporate standards. Distribution partners provide localized support networks that accelerate lead times and streamline spare parts logistics. Online platforms cater to smaller buyers seeking rapid procurement and minimal customization. Collectively, these segmentation lenses reveal the complexity of decision making and highlight the necessity for suppliers to offer a spectrum of solutions tailored to distinct operational, financial, and strategic priorities.

This comprehensive research report categorizes the Automatic Tray Loading System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Automation Level

- Tray Type

- Technology

- Component

- End Use Industry

- Distribution Channel

Regional Market Dynamics Uncovered Highlighting Key Growth Drivers and Adoption Patterns for Automated Tray Loading in Americas EMEA and Asia-Pacific

Regional nuances significantly influence the adoption and evolution of tray loading systems. In the Americas, the mix of advanced automotive plants, food processing hubs, and burgeoning pharma production centers drives sustained investment in high-speed, robust loading solutions. Additionally, reshoring initiatives have prompted renewed capital deployment in domestic facilities, amplifying demand for automated material handling and reducing reliance on overseas manufacturing.

By contrast, Europe, the Middle East, and Africa present a diverse tapestry of regulations and infrastructure maturity. Western European manufacturers emphasize energy efficiency and compliance with stringent safety and hygiene standards, while emerging economies in Eastern Europe and the Middle East prioritize cost-effective automation to boost competitiveness. Across the region, service networks and support ecosystems are evolving to meet growing maintenance and spare parts requirements, reflecting an increasing focus on lifecycle performance.

Meanwhile, the Asia-Pacific region remains the largest volume market by virtue of its expansive consumer electronics, food and beverage, and pharmaceutical production corridors. China, Japan, South Korea, and Southeast Asian nations continue to invest in smart factory frameworks, integrating tray loading automation into broader digitalization roadmaps. Concurrently, rising wages and labor constraints in key manufacturing zones are accelerating the replacement of manual processes, positioning Asia-Pacific as both a leader in adoption and a hotbed for supplier innovation.

This comprehensive research report examines key regions that drive the evolution of the Automatic Tray Loading System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Forge Strategic Partnerships Technological Innovations and Market Expansions to Enhance Automated Tray Loading Capabilities

Major equipment manufacturers and system integrators are intensifying their focus on delivering turnkey tray loading solutions that blend robotics, vision systems, and advanced controls. Leading robotics providers have forged collaborative alliances with specialty automation integrators to develop industry-specific loading modules, targeting applications in automotive stamping lines, pharmaceutical filling operations, and consumer electronics assembly.

In addition, some players are differentiating through the integration of predictive maintenance services, utilizing embedded sensors and cloud analytics to forecast component wear and schedule maintenance before unplanned downtime occurs. Others are expanding their global footprint by establishing regional centers of excellence, ensuring that local customers receive faster deployment, training, and support.

Meanwhile, technology startups are entering the fray with innovative end-effector designs that offer rapid tooling changeovers and universal gripper compatibility, challenging incumbents to evolve their product portfolios. As competition intensifies, the ability to deliver integrated software platforms that unify machine control, performance monitoring, and remote diagnostics is becoming a critical success factor. Taken together, these strategic moves underscore a broader industry shift toward comprehensive, service-oriented offerings that extend beyond hardware.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Tray Loading System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambica Pharma Machines Pvt. Ltd

- ATS Automation Tooling Systems

- BEUMER Group

- BluePrint Automation

- Brenton, LLC.

- Cama North America

- Daifuku Co., Ltd

- Direct Conveyors

- FlexLink

- Forte Automation Systems

- FOTH

- Fritz SchäFer GmbH

- Gleason Automation Systems

- Hirata Corporation

- IMA Group

- JEL Corporation

- Kardex Holding AG

- KION GROUP AG

- Krones Group

- Körber AG

- Life Scientific Inc.

- Marchesini Group

- MG2 s.r.l

- MK Group

- MULTIVAC Group

- Murata Machinery, Ltd.

- OMORI HOLDINGS CO., LTD.

- QUPAQ A/S

- R.A. Pearson Company

- Rhein-Nadel Automation group

- Romaco Group

- ROVEMA GmbH

- Syntegon Technology GmbH.

- Tesi Industrial Europa, S.L

- TGW Logistics Group

- viastore SYSTEMS

- Werner & Pfleiderer Lebensmitteltechnik GmbH

- WITRON Logistik + Informatik GmbH.

- Wrabacon, Inc

Actionable Strategic Recommendations Empower Industry Leaders to Enhance Operational Efficiency Embrace Flexibility and Mitigate Tariff Challenges in Tray Loading

Industry leaders should prioritize the development of flexible automation ecosystems that can adapt to evolving production requirements and regulatory environments. To this end, architects of tray loading solutions must design modular platforms that allow for rapid reconfiguration of tray sizes, payload capacities, and integration points. Furthermore, cultivating partnerships with local system integrators and service providers will strengthen deployment agility and ensure consistent post-sales support across regions.

Additionally, executives are advised to establish strategic sourcing agreements that include tariff-contingent clauses, enabling swift material substitutions or price renegotiations in response to shifting trade policies. Concurrently, incorporating alternative material frameworks-such as composite alloys for structural components-can mitigate exposure to metal tariff fluctuations. On the technology front, embedding machine learning capabilities into control software will empower self-optimizing systems that continually refine cycle efficiency and error detection, thereby enhancing uptime and throughput.

Finally, companies should invest in workforce development programs that upskill technicians in advanced robotics maintenance, programming, and data analysis. By fostering multidisciplinary expertise, organizations can maximize the value of their tray loading investments and maintain operational resilience in the face of evolving labor and regulatory landscapes.

Rigorous Multi-Method Research Methodology Integrates Expert Interviews Primary Surveys and Secondary Analysis to Deliver Robust Tray Loading Insights

This analysis is founded on a rigorous, multi-method research framework that combines primary insights from over 50 in-depth interviews with manufacturing executives, automation engineers, and supply chain specialists. These conversations provided granular perspectives on adoption drivers, technology preferences, and tariff mitigation strategies directly from end users across automotive, food and beverage, electronics, and pharmaceutical sectors.

Complementing primary research, an extensive review of secondary sources-including industry whitepapers, technical standards publications, and regulatory filings-offered contextual grounding on the implications of recent tariff measures, material innovations, and emerging control architectures. Data triangulation was employed to validate key themes, ensuring consistency between interview findings and documented technological developments.

Throughout the research process, analytical rigor was maintained by cross-referencing supplier case studies, patent filings, and trade association reports to identify actionable trends and benchmark best practices. The result is a comprehensive, evidence-based assessment of the automatic tray loading systems landscape, designed to support informed decision making among technology buyers, integrators, and equipment manufacturers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Tray Loading System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Tray Loading System Market, by Automation Level

- Automatic Tray Loading System Market, by Tray Type

- Automatic Tray Loading System Market, by Technology

- Automatic Tray Loading System Market, by Component

- Automatic Tray Loading System Market, by End Use Industry

- Automatic Tray Loading System Market, by Distribution Channel

- Automatic Tray Loading System Market, by Region

- Automatic Tray Loading System Market, by Group

- Automatic Tray Loading System Market, by Country

- United States Automatic Tray Loading System Market

- China Automatic Tray Loading System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Conclusive Perspectives on the Future Trajectory of Automated Tray Loading Highlighting Strategic Imperatives for Sustained Operational Excellence and Innovation

Automated tray loading systems have transitioned from niche installations to strategic enablers of high-throughput, quality-driven manufacturing processes. As throughput demands accelerate and labor constraints tighten, the integration of intelligent robotics, adaptive controls, and modular designs becomes indispensable. Moreover, the dual pressures of customization and compliance amplify the need for versatile solutions capable of addressing distinct end use requirements and regional regulatory mandates.

Looking ahead, the interplay between tariff uncertainties and material engineering innovations will shape procurement strategies and system architectures. Manufacturers that proactively embed flexibility into both hardware and supply chains will be best positioned to maintain cost efficiency and minimize exposure to geopolitical shifts. Equally important, the maturation of digital twins, edge analytics, and autonomous error correction promises to further elevate the performance and resilience of tray loading deployments.

Ultimately, the future trajectory of automated material handling will be defined by a holistic approach that marries cutting-edge technology with agile supply chain practices and targeted workforce development. By embracing these strategic imperatives, organizations can secure sustained operational excellence and competitive differentiation in an increasingly complex manufacturing landscape.

Contact the Associate Director of Sales and Marketing to Secure Comprehensive Insights and Drive Competitive Advantage with the Tray Loading Systems Report

To gain a competitive edge and leverage in-depth insights on automatic tray loading trends, technologies, and strategic imperatives, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing). He will guide you through the report’s key benefits, customization options, and integration pathways. Secure your copy of the comprehensive market research report and unlock actionable intelligence that will inform capital investments, operational planning, and long-term growth strategies.

- How big is the Automatic Tray Loading System Market?

- What is the Automatic Tray Loading System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?