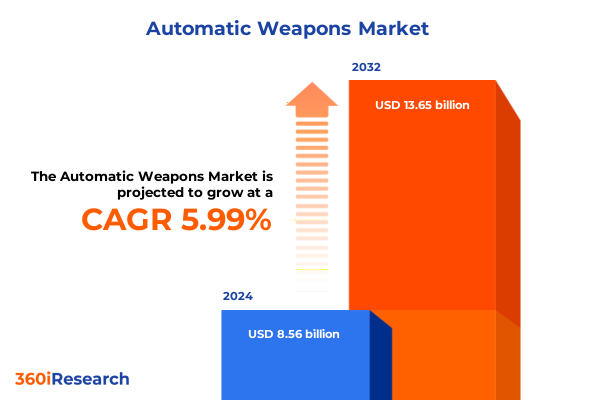

The Automatic Weapons Market size was estimated at USD 8.96 billion in 2025 and expected to reach USD 9.38 billion in 2026, at a CAGR of 6.19% to reach USD 13.65 billion by 2032.

Setting the Stage for an In-Depth Analysis of the Automatic Weapons Market’s Dynamic Trajectory Amid Mounting Geopolitical Pressures and Rapid Technological Innovation

The automatic weapons sector stands at a pivotal juncture, shaped by intersecting forces that will define its trajectory over the coming years. Against a backdrop of heightened geopolitical tensions, emerging defense doctrines and rapid technological breakthroughs, industry stakeholders are navigating an increasingly sophisticated competitive environment. From traditional military procurement to evolving civilian applications, the market is diversifying in ways that demand renewed strategic focus.

This report opens with a holistic overview of the macro drivers compelling growth and disruption in the automatic weapons space. It examines how shifting security priorities, both at national and alliance levels, are influencing procurement policies and funding allocations. Concurrently, rapid progress in materials science, digital integration and manufacturing techniques is accelerating product innovation, altering cost structures and redefining performance benchmarks. A thorough understanding of these dynamics is critical for decision-makers seeking to maintain operational readiness, capture emerging opportunities and mitigate regulatory and reputational risks.

By setting the stage with this comprehensive introduction, readers will gain clarity on the overarching trends molding industry direction, as well as the key challenges and inflection points that demand close attention.

Unveiling the Broad Technological and Geopolitical Forces Reshaping Weapon System Design and Procurement Strategies Globally

The landscape of automatic weapons has undergone transformative shifts driven by both the global security environment and technological maturation. Geopolitical hotspots around the world have prompted heightened defense budgets and an appetite for multi-role weapon systems capable of delivering precision, reliability and modularity. These demand patterns have accelerated research into advanced firing mechanisms, lightweight composite materials and systems integration that streamline maintenance and training.

Technological convergence has emerged as a defining theme, with autonomous targeting aids, low-signature barrel coatings and next-generation ammunition compatibility becoming standard considerations. Supply chains have adapted by forging closer ties between traditional ordnance manufacturers and cutting-edge technology firms specializing in electronics and data analytics. This fusion is producing weapon platforms that offer real-time diagnostics, predictive maintenance alerts and networked connectivity, forcing incumbents to re-evaluate legacy portfolios.

Meanwhile, evolving threat profiles-from asymmetric engagements to peer-level deterrence-are reshaping weapon specifications. The demand for versatile platforms capable of rapid role adaptation within the same system has led to the proliferation of configurable modules, ambidextrous ergonomics and scalable caliber options. These advances, coupled with the requirement for seamless integration into broader battlefield networks, have collectively redefined performance expectations.

Assessing the Broad Supply Chain Realignments Stemming from 2025 United States Tariff Policies on Imported Weapon Components

In 2025, the United States implemented a series of targeted tariffs affecting the importation of automatic weapons components, aiming to bolster domestic manufacturing and protect critical defense capabilities. These measures, applied to finished assemblies and key subcomponents sourced from select international partners, have introduced cost pressures along the supply chain, prompting a reconfiguration of sourcing strategies and production footprints.

Short-term disruptions have been inevitable, as manufacturers recalibrated their supplier base to mitigate the direct cost impact of increased duties. Companies with vertically integrated operations have found themselves at an advantage, leveraging existing in-country capabilities to absorb tariff-related expenses. Conversely, entities reliant on specialized foreign parts have accelerated partnership models with domestic enterprises to avoid margin erosion.

Looking ahead, the cumulative ramifications of these tariff adjustments are expected to drive further investment in onshore machining, coating and testing facilities. This shift will not only contribute to greater supply certainty but will also create opportunities for advanced manufacturing innovation, such as additive layering and automated finishing lines. Ultimately, the realignment prompted by United States tariffs in 2025 underscores the interplay between policy interventions and industrial agility in a complex global ecosystem.

Revealing Critical Market Dynamics by Integrating Product, End-Use, Mechanism, Operation Mode, and Channel Perspectives

Analyzing the automatic weapons market through multiple lenses reveals nuanced insights into demand drivers and competitive positioning. When segmented by product type, the landscape encompasses distinct categories such as assault rifles, general-purpose machine guns, light machine guns, sniper rifles, squad automatic weapons and submachine guns, each tailored to specific mission profiles and end-user requirements. This classification highlights how caliber, rate of fire and modularity considerations determine selection across diverse scenarios.

From an end-use perspective, demand patterns diverge significantly across civilian, law enforcement, military and private security applications. Within civilian circles, collecting, personal defense and sport shooting represent unique motivations driving purchasing decisions, underscoring different risk tolerances and regulatory interactions. In the law enforcement domain, federal agencies, local police departments and state-level units exhibit varied testing protocols and budget cycles, shaping procurement timelines. Military consumption is informed by branch-specific doctrine-air force, army and navy-each with its own set of environmental, range and interoperability benchmarks. Executive protection and corporate security teams, responsible for private security, prioritize concealability, reliability and logistical support.

The operation mechanism dimension further delineates the market, distinguishing between blowback, gas-operated and recoil-operated systems, with gas operation split into direct impingement and piston-driven variants. Operational preference hinges on factors such as maintenance complexity, heat dissipation and accuracy retention under sustained fire. Action type analysis separates fully automatic platforms from select fire configurations, reflecting end-user mandates for controlled engagements versus volume suppression. Finally, sales channel segmentation, encompassing offline retail and digital commerce pathways, maps consumer behavior shifts in distribution accessibility and purchasing convenience.

This comprehensive research report categorizes the Automatic Weapons market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Operation Mechanism

- Action

- End Use

- Sales Channel

Exploring How Varied Regional Mandates and Procurement Priorities Shape Demand Patterns across the Americas, EMEA, and Asia-Pacific

Regional nuances continue to dictate the strategic focus and growth trajectory of the automatic weapons sector. In the Americas, modernization initiatives across established military forces are intersecting with rising private security requirements, driving demand for modular platforms and advanced sighting systems. At the same time, civil liberties discourse and regulatory changes are shaping the contours of civilian ownership, prompting manufacturers to refine compliance and traceability processes.

Within Europe, Middle East and Africa, heterogeneous defense budgets and varied threat environments create a differentiated market fabric. Western European nations are emphasizing interoperability within NATO frameworks and upgrading legacy arsenals, while Middle Eastern states pursue high-capacity systems for border and asset protection. In sub-Saharan African zones, demand is more fragmented, often driven by peacekeeping needs and multinational training programs, necessitating adaptable solutions.

The Asia-Pacific region stands out for its rapid military expansion and domestic industry incentivization. Rising defense allocations in key markets are fueling large-scale procurement campaigns, while leading arms manufacturers in the region are investing heavily in research and development to capture both local and export markets. This mix of indigenous production goals and import dependencies produces a dynamic competitive landscape, characterized by joint ventures and technology transfer agreements.

Overall, regional strategies reflect a mosaic of doctrinal imperatives, procurement frameworks and regulatory climates that collectively shape market opportunity.

This comprehensive research report examines key regions that drive the evolution of the Automatic Weapons market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Understanding the Strategic Positioning of Established Defense Contractors and Agile Technology Innovators within the Automatic Weapons Ecosystem

The automatic weapons industry features a blend of traditional defense contractors and specialized technology firms, each vying for strategic partnerships and program awards. Leading players have leveraged extensive R&D capabilities to introduce next-generation modular systems, while newer entrants are carving niches by integrating digital targeting aids and lightweight composites into legacy platforms.

Established names with global footprints continue to secure multi-year contracts with national defense departments, enabling them to invest in advanced manufacturing processes that reduce cycle times and enhance quality control. Their expansive supply networks and legacy expertise in ballistics testing grant them a competitive edge when banks of validation data are required under stringent procurement protocols.

Meanwhile, smaller firms focused on component innovation-such as advanced gas systems, ergonomic chassis and variable-rate-of-fire triggers-are attracting partnerships with prime contractors and establishing themselves as indispensable collaborators. These technology-centric players often pilot disruptive features in pilot programs before scaling through broader platforms.

Collectively, the interplay between heritage contractors and agile innovators is fostering collaboration models that balance programmatic stability with rapid iteration. This ecosystem dynamic is essential for meeting evolving end-user demands and maintaining a resilient industrial base.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Weapons market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Barrett Firearms Manufacturing, Inc.

- China North Industries Corporation

- Colt’s Manufacturing Company, LLC

- Denel Land Systems

- FN Herstal S.A.

- General Dynamics Corporation

- Heckler & Koch GmbH & Co. KG

- Israel Weapon Industries Ltd.

- Kalashnikov Concern JSC

- KBP Instrument Design Bureau JSC

- Northrop Grumman Corporation

- Rheinmetall AG

- SIG Sauer, Inc.

- ST Engineering Ltd.

Crafting a Cohesive Strategy That Integrates Modular Innovation, Compliance Foresight, and Supply Chain Reinforcement to Sustain Competitive Advantage

Industry leaders must prioritize an integrated strategy that balances innovation, compliance and supply chain resilience to capture emerging opportunities. Investing in modular design platforms will enable rapid fielding of customized configurations, addressing diverse mission requirements while streamlining aftermarket support. Aligning these development objectives with proactive engagement on regulatory frameworks can mitigate approval delays and ensure readiness for potential policy shifts.

Securing onshore capabilities across critical manufacturing stages is equally imperative. By strengthening domestic partnerships in machining, coating and assembly, companies can reduce tariff exposure and build agility against geopolitical volatility. Complementing this, fostering collaborative ventures with electronics and software firms will expedite the integration of digital targeting, diagnostics and networked communications into future weapon systems.

From a commercial standpoint, diversifying go-to-market approaches by enhancing direct digital channels and augmenting traditional distribution networks can expand reach into emerging end-use segments. Tailored training and maintenance programs, underpinned by data analytics, will not only increase customer retention but also generate recurring revenue streams that align with performance-based contracting models.

Ultimately, leaders who execute a cohesive roadmap-one that marries technological foresight with robust risk management and market-centric agility-will secure enduring competitive advantage.

Implementing a Rigorous Mixed-Methods Approach Incorporating Primary Interviews, Facility Observations, and Secondary Data Triangulation for Comprehensive Insights

Our research methodology combined extensive primary and secondary data collection to ensure comprehensive, unbiased insights into the automatic weapons market. In the primary phase, we conducted structured interviews with senior defense procurement officers, end users in law enforcement and private security sectors, and R&D executives from leading arms manufacturers. Supplementary field visits to manufacturing and testing facilities provided direct observational data on production processes and quality assurance practices.

The secondary research component encompassed a thorough review of defense white papers, regulatory filings, press releases, technical journals and trade publications. We cross-referenced this information with import-export databases and government budget statements to validate procurement trends and tariff impacts. Advanced data analytics tools were then employed to normalize and interpret the collected datasets.

Qualitative insights were synthesized using thematic analysis, while quantitative findings underwent triangulation to minimize biases. The integrated approach allowed us to distill nuanced perspectives on technological adoption rates, regional procurement cycles and supply chain configurations, culminating in a robust, multi-dimensional market overview.

The resulting methodology provides stakeholders with a transparent framework that underpins the credibility and rigor of our findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Weapons market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Weapons Market, by Product Type

- Automatic Weapons Market, by Operation Mechanism

- Automatic Weapons Market, by Action

- Automatic Weapons Market, by End Use

- Automatic Weapons Market, by Sales Channel

- Automatic Weapons Market, by Region

- Automatic Weapons Market, by Group

- Automatic Weapons Market, by Country

- United States Automatic Weapons Market

- China Automatic Weapons Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Market Forces to Illuminate the Path Forward for Adaptive, High-Performance Automatic Weapons Solutions in an Evolving Security Landscape

As the automatic weapons landscape evolves, stakeholders face a confluence of challenges and opportunities that will define market direction. Technological advancements are enabling unprecedented levels of system modularity and digital integration, while geopolitical shifts and tariff regimes are exerting pressure on global supply chains and procurement timelines.

Industry resilience will hinge on the ability to adapt product portfolios to emerging mission profiles, maintain compliance across diverse regulatory environments and optimize manufacturing footprints in response to policy incentives. Collaboration between established contractors and specialized tech innovators will be instrumental in accelerating field-ready solutions that meet stringent performance criteria.

Looking forward, sustained success will require a forward-leaning posture: embracing additive manufacturing for rapid prototyping, deploying advanced analytics for predictive maintenance and cultivating strategic alliances that bridge domain expertise. By doing so, organizations can position themselves at the vanguard of innovation, ensuring readiness for both current security imperatives and future contingencies.

In sum, the market’s future will be shaped by those who adeptly navigate the interplay of technology, policy and end-user expectations to deliver responsive, high-performance automatic weapons systems.

Unlock Exclusive Expertise on the 2025 Automatic Weapons Market by Connecting with Our Associate Director to Access the Complete Research

For tailored insights and an in-depth walkthrough of the global automatic weapons landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report and position your organization at the forefront of this rapidly evolving industry

- How big is the Automatic Weapons Market?

- What is the Automatic Weapons Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?